Risks and Security Best Practices for Investing in Tokenized Bonds

Tokenized bonds are rapidly redefining fixed-income investing, offering a blend of blockchain transparency and traditional yield. But as with any innovation in finance, new opportunities bring new risks. If you’re considering digital bond investment, understanding the unique risk landscape and applying proven security best practices is essential for protecting your capital in this evolving market.

The Dual Nature of Tokenized Bond Risks

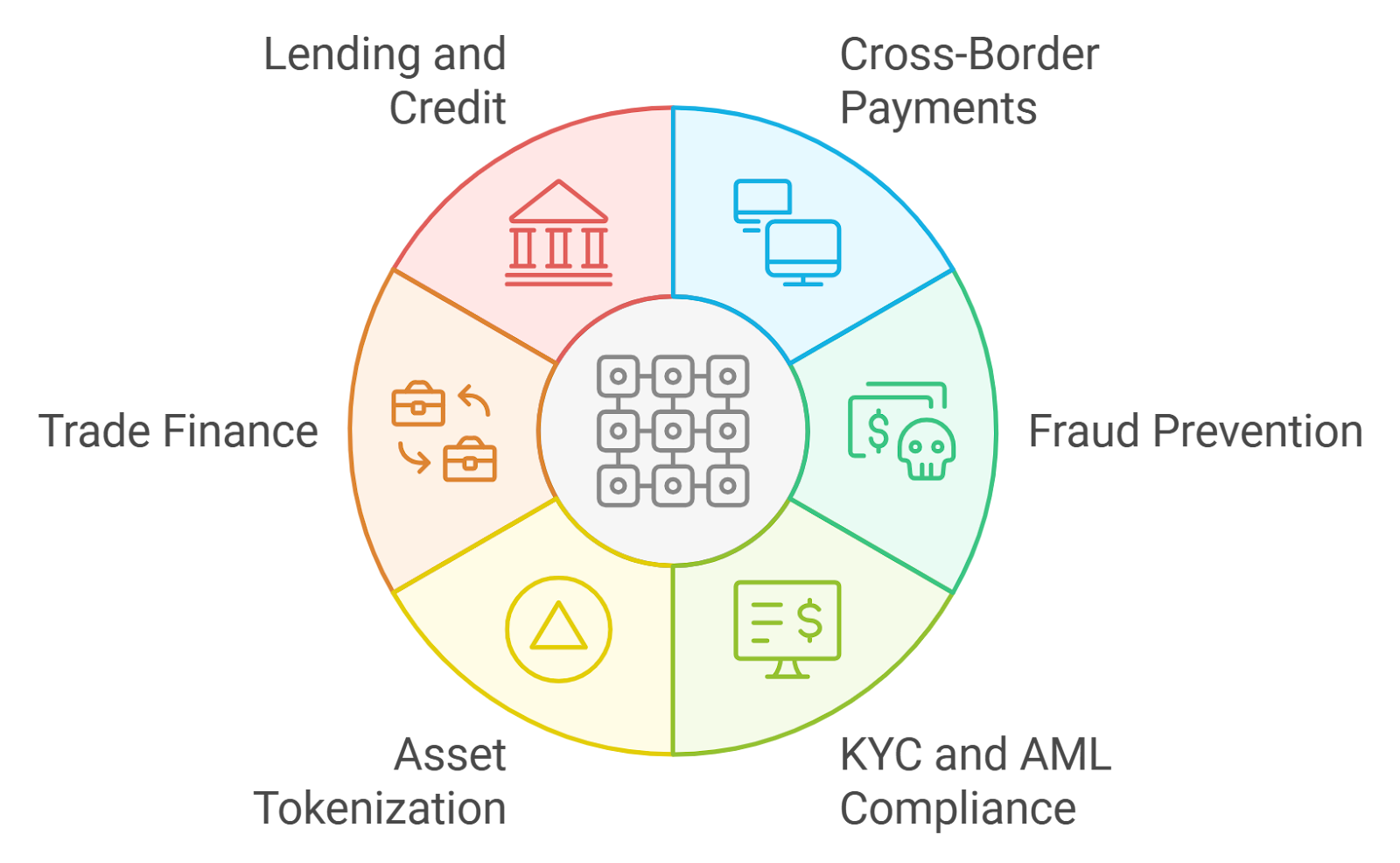

At their core, tokenized bonds are digital representations of real-world debt securities issued on blockchain platforms. This structure introduces two critical risk vectors that every investor must scrutinize: counterparty and smart contract risk, and regulatory compliance with KYC/AML enforcement.

Counterparty and Smart Contract Risk: More Than Just Code

In the world of tokenized bonds, your exposure isn’t limited to the issuer’s creditworthiness, it also includes the technical integrity of the smart contracts underpinning each bond. A well-structured smart contract automates coupon payments and redemptions, but a single bug or vulnerability can lead to catastrophic loss or improper execution. High-profile exploits in DeFi have shown how devastating a single overlooked flaw can be.

Best Practice: Always conduct due diligence not just on the issuer’s reputation but also on the platform’s technical backbone. Look for independent code audits, transparent disclosures about audit findings, and active bug bounty programs. Don’t hesitate to ask platforms for their most recent audit reports or details about their security partners.

Regulatory Compliance and KYC/AML Enforcement: Navigating Uncertainty

The regulatory environment for tokenized securities is still a moving target. While some jurisdictions have embraced digital securities frameworks, others lag behind or impose patchwork rules. The U. S. , for example, requires that all tokenized securities comply with existing SEC regulations, including rigorous Know Your Customer (KYC) and Anti-Money Laundering (AML) checks.

This means investors face both legal uncertainty and operational friction if platforms fail to enforce compliance standards. Non-compliance could result in frozen assets or even forced unwinding of positions, not to mention potential legal penalties.

Best Practice: Before investing, verify that the issuing platform has robust KYC/AML processes in place. Look for clear evidence that they adhere to local securities laws, regularly update compliance protocols, and maintain transparent reporting practices. When in doubt, consult legal counsel familiar with digital asset regulation in your jurisdiction.

Top Risks & Best Practices for Tokenized Bond Investors

-

Counterparty and Smart Contract Risk: Tokenized bonds rely on both the underlying issuer’s creditworthiness and the integrity of smart contracts. Bugs or vulnerabilities in smart contract code can lead to loss of funds or improper execution. Best Practice: Conduct thorough due diligence on both the issuer (e.g., Onchain, Société Générale) and the technical audit status of the tokenization platform. Look for platforms that have undergone independent security audits by firms like Halborn or CertiK.

-

Regulatory Compliance and KYC/AML Enforcement: Regulatory uncertainty remains a key risk, as tokenized bonds must comply with securities laws, including KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements.Best Practice: Ensure that platforms such as Tokeny and Polymesh adhere to regional regulations and maintain robust compliance processes. Engage with legal experts and monitor updates from authorities like the U.S. SEC to avoid legal or financial penalties.

Why These Risks Matter Right Now

The promise of enhanced liquidity and 24/7 markets is alluring, but without attention to these foundational risks, investors could find themselves exposed to losses that would be unthinkable in traditional bond markets. As adoption accelerates into 2025, regulators are sharpening their focus while hackers continue probing for weak points across blockchain ecosystems.

If you want more detail on how these risks compare with conventional fixed-income products, including accessibility differences, check out our deep dive at /comparing-tokenized-bonds-vs-traditional-bonds-risks-returns-and-accessibility.

It’s easy to be dazzled by the speed and transparency of blockchain-based bonds, but prudent investors know that security and compliance are not optional, they’re fundamental. In this landscape, even seasoned institutions are learning new playbooks for digital asset due diligence.

How to Protect Yourself: Security Best Practices in Action

Let’s get tactical. When it comes to counterparty and smart contract risk, don’t just rely on glossy marketing or a big-name issuer. Dig deeper:

- Request smart contract audit documentation. Reputable platforms will share independent audit reports, if they hesitate, consider it a red flag.

- Monitor bug bounty programs. Platforms that incentivize ethical hacking are more likely to discover and fix vulnerabilities before they become investor headaches.

- Diversify across issuers and platforms. Don’t put all your capital into one protocol, especially if it’s untested or lacks a public audit trail.

On the compliance front, KYC/AML enforcement is about more than ticking boxes. It’s your first line of defense against regulatory blowback:

- Choose platforms with transparent onboarding processes. If KYC is perfunctory or absent, walk away, these shortcuts can lead to costly legal entanglements down the road.

- Check for regular regulatory updates. The best platforms communicate openly about how they adapt to changing laws and audits from authorities. Silence is not golden in this context.

What Institutional Investors Are Watching For

This isn’t just retail advice, institutions are setting the tone by demanding higher standards from tokenization providers. Expect more pressure for real-time transparency dashboards, automated compliance checks, and cross-chain interoperability testing as the market matures. If you’re allocating significant capital, ask about insurance coverage against smart contract exploits or counterparty defaults; some leading custodians now offer these protections as part of their service stack.

Checklist: Are You Ready for Tokenized Bonds?

The bottom line? Treat every digital bond like you would any high-stakes investment, question everything, demand transparency, and never underestimate the importance of both technical audits and regulatory clarity. As blockchain bonds gain traction in global portfolios, those who blend innovation with caution will be best positioned to benefit from this new era of fixed-income investing.