How Fidelity’s Tokenized U.S. Treasuries Fund on Ethereum Is Reshaping Institutional Fixed-Income Investing

Institutional fixed-income investing is undergoing a radical transformation as blockchain technology moves from the periphery to the core of capital markets. Fidelity’s launch of its tokenized U. S. Treasuries fund on Ethereum, known as the Fidelity Digital Interest Token (FDIT), is not just a technical experiment – it represents a pivotal shift in how major financial institutions are reimagining access, efficiency, and transparency in traditional assets.

Fidelity’s Tokenized Treasuries Fund: A Milestone for Onchain Capital Markets

With over $200 million in assets under management as of September 2025, FDIT offers institutional investors direct exposure to U. S. Treasury securities through an ERC-20 token on Ethereum. This move is part of a broader trend that has seen the tokenized U. S. Treasuries market triple in size over the past year, now standing at $7.5 billion. By leveraging blockchain, Fidelity enables fractional ownership, near-instant settlements, and reduced counterparty risk – all while maintaining regulatory oversight and robust compliance frameworks.

The FDIT token is more than just a digital wrapper for government bonds. It serves as an accessible bridge between traditional finance and decentralized protocols. For example, Ondo Finance holds significant reserves of FDIT to back its own OUSG yield-generating tokens, demonstrating how tokenized treasuries can power new forms of onchain liquidity while meeting strict institutional requirements.

Why Tokenization Resonates with Institutional Investors

Tokenization addresses longstanding pain points in the fixed-income world:

- Fractionalization: Lower minimums make high-quality assets like Treasuries available to a wider range of investors.

- Real-Time Settlement: Onchain transactions clear within minutes rather than days – freeing up capital and reducing operational risk.

- Transparency and Auditability: Blockchain records all transfers immutably, allowing for real-time monitoring and easier reconciliation.

- 24/7 Access: Unlike legacy markets with restrictive hours, investors can interact with their holdings anytime via smart contracts.

This evolution comes at a time when institutional demand for efficient treasury products exceeds $2 trillion globally. BlackRock and Franklin Templeton have also entered the space, but Fidelity’s scale and reputation make this launch especially significant for mainstream adoption.

The Mechanics: How FDIT Works on Ethereum

The FDIT token operates as an ERC-20 asset on Ethereum’s mainnet – currently priced at $4,498.78. Each token represents a share in Fidelity’s Treasury money market fund (FYHXX), which holds short-term U. S. Treasury securities and cash equivalents. With a competitive 0.2% management fee and robust onchain transfer capabilities, FDIT enables seamless integration with DeFi protocols while preserving investor protections expected by institutions.

This approach also introduces new operational efficiencies: settlement cycles are compressed from T and 1 or T and 2 down to near-instantaneous finality; custodial risks are minimized; and reporting becomes more automated thanks to blockchain-native transparency tools.

Ethereum (ETH) Price Prediction Table Post-Fidelity Tokenized Treasuries Launch (2026-2031)

Forecasting ETH price trends in the context of institutional adoption and real-world asset tokenization via major players like Fidelity (Baseline price as of Sep 2025: $4,498.78)

| Year | Minimum Price (Bearish Scenario) | Average Price (Base Case) | Maximum Price (Bullish Scenario) | Year-over-Year Change (Avg) |

|---|---|---|---|---|

| 2026 | $3,950 | $5,150 | $6,500 | +14.5% |

| 2027 | $4,400 | $6,200 | $8,000 | +20.4% |

| 2028 | $5,000 | $7,350 | $10,200 | +18.5% |

| 2029 | $5,600 | $8,500 | $12,700 | +15.6% |

| 2030 | $6,100 | $9,850 | $15,000 | +15.9% |

| 2031 | $6,700 | $11,300 | $18,000 | +14.7% |

Price Prediction Summary

Ethereum’s price outlook from 2026 to 2031 is bullish, driven by the surging institutional adoption of on-chain assets, such as Fidelity’s tokenized U.S. Treasuries, and the broader trend of real-world asset tokenization. The average price is projected to rise steadily, with the base case reaching $11,300 by 2031. However, volatility remains, with minimum prices reflecting potential regulatory or macro setbacks and maximum prices capturing the upside of mass institutional integration and global adoption.

Key Factors Affecting Ethereum Price

- Institutional adoption of Ethereum for real-world asset tokenization (e.g., treasuries, ETFs)

- Broader DeFi and on-chain finance growth, increasing ETH demand for transaction fees and collateral

- Potential for Ethereum network upgrades (scalability, security, staking rewards)

- Macro-economic climate, including U.S. monetary policy and global risk appetite

- Regulatory clarity or constraints in the U.S. and globally for tokenized assets and DeFi

- Competition from other smart contract platforms (e.g., Solana, Avalanche, emerging L1s)

- Sustained network activity and developer innovation on Ethereum, including Layer 2 integrations

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Ripple Effect Across Fixed-Income Markets

The emergence of products like FDIT signals that institutional fixed-income blockchain adoption is no longer theoretical but actively reshaping market structure. As more asset managers tokenize their offerings, we’re likely to see increased competition around fees, access models, and integration with both centralized finance (CeFi) and decentralized finance (DeFi) ecosystems.

One of the most compelling aspects of Fidelity’s tokenized U. S. Treasuries fund is its impact on liquidity and market access. By bringing Treasury securities onchain, FDIT allows for fractional trading and 24/7 secondary market activity, features that were previously unimaginable in the traditional fixed-income world. This means institutional investors can now manage cash positions, rebalance portfolios, or tap into short-term yield opportunities with unprecedented agility.

Moreover, the interoperability of ERC-20 tokens enables seamless composability with DeFi primitives such as lending protocols, automated market makers, and collateralized stablecoins. For example, FDIT can be integrated into decentralized lending pools or used as high-quality collateral within onchain repo markets. This not only enhances capital efficiency but also opens up innovative strategies for treasury managers and crypto-native funds alike.

Risks and Considerations for Institutional Adoption

While the advantages are clear, institutional investors must also navigate new risks unique to blockchain-based assets. Smart contract vulnerabilities, regulatory uncertainty around digital securities, and the operational learning curve all require careful risk management. However, Fidelity’s rigorous compliance infrastructure and commitment to investor protection set a standard that others in the space will likely emulate.

Key Benefits and Risks of Tokenized Treasuries on Ethereum

-

Fractional Ownership & Accessibility: Tokenized treasuries like Fidelity’s FDIT on Ethereum enable fractional investment in U.S. Treasury securities, allowing institutional investors to access high-quality assets with lower minimums and improved liquidity.

-

Faster Settlement & 24/7 Access: Blockchain infrastructure provides real-time settlement and 24/7 operational capability, reducing delays and allowing investors to transact outside of traditional market hours.

-

Enhanced Transparency & Reduced Intermediaries: On-chain records offer greater transparency into fund operations and holdings, while reducing reliance on intermediaries, which can lower operational risks and costs.

-

Integration with DeFi Ecosystem: As an ERC-20 asset, FDIT can be integrated with DeFi protocols, enabling new yield strategies and composability with other on-chain financial products.

-

Regulatory & Counterparty Risks: While tokenization offers benefits, investors face regulatory uncertainties and must assess the security and compliance of both the blockchain platform and the tokenized fund provider.

-

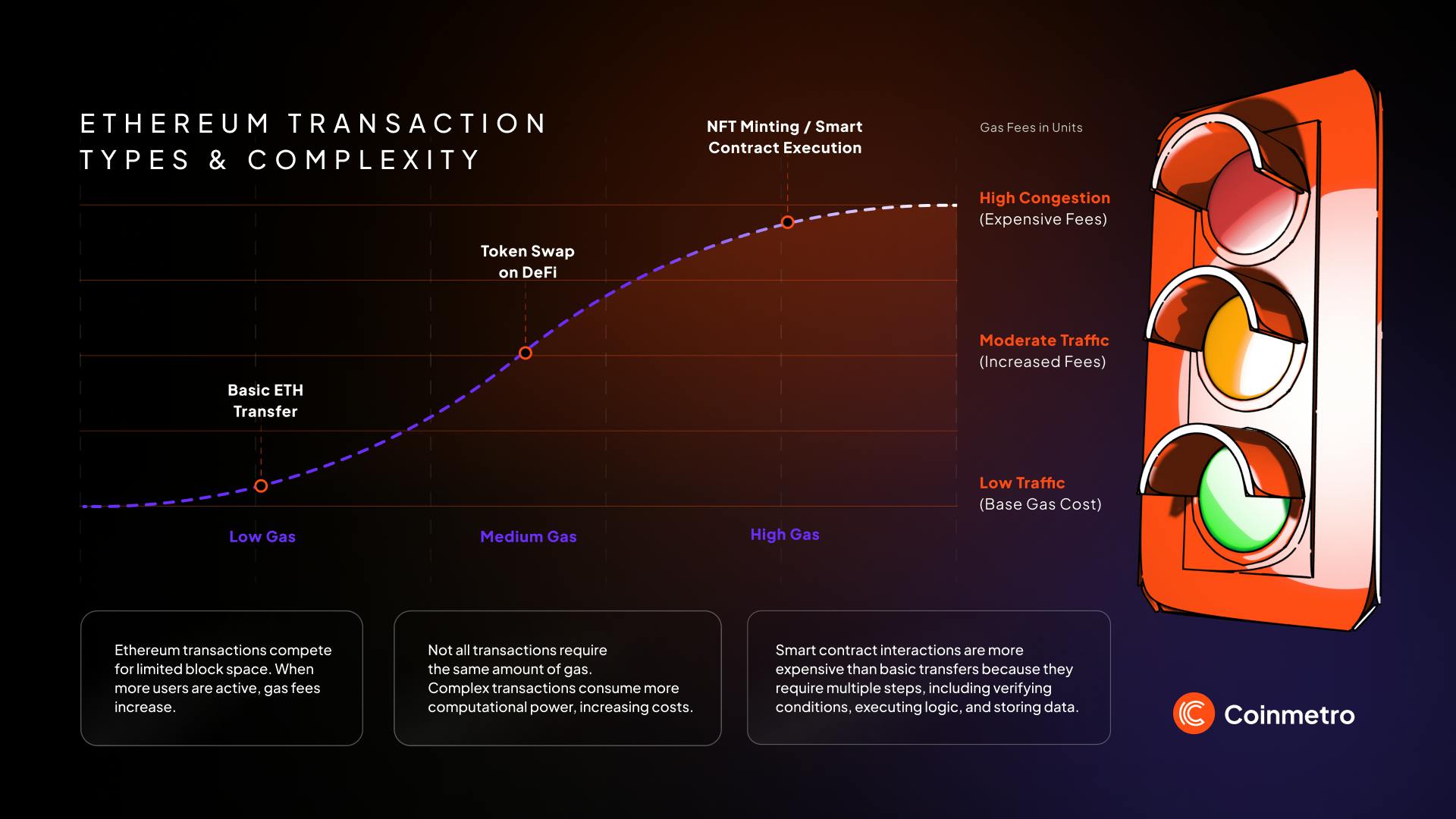

Ethereum Network Risks & Fees: Usage of Ethereum exposes investors to network congestion and fluctuating transaction fees (gas), which can impact cost efficiency, especially during periods of high network activity.

-

Smart Contract & Custody Risks: Tokenized funds depend on smart contract security and robust custody solutions; vulnerabilities or exploits could lead to loss of assets or disruptions.

Another consideration is Ethereum’s network performance. With ETH currently priced at $4,498.78, transaction fees remain a factor, especially during periods of high network congestion. Yet ongoing improvements such as rollups and Layer 2 scaling solutions are expected to mitigate these costs over time, making large-scale institutional participation more practical.

A Glimpse Into the Future: Onchain Capital Markets at Scale

The growth trajectory for tokenized U. S. Treasuries is unmistakable, surpassing $7.5 billion in 2025 alone, and Fidelity’s entry has set a new benchmark for credibility and scale in this emerging asset class. As more institutions seek transparency, efficiency, and global access to fixed-income products, blockchain rails are poised to become an essential part of financial infrastructure.

For investors tracking the evolution of institutional fixed-income blockchain, Fidelity’s move is more than just a headline, it’s an inflection point that could redefine what it means to manage risk and optimize returns in the digital age.

“Tokenization is not just about digitizing existing assets, ” says one industry analyst, “it’s about unlocking entirely new ways to interact with value. ”

If you’re interested in deeper analysis or want to explore how these developments might affect your portfolio strategy, our dedicated guide offers a comprehensive breakdown: How Fidelity’s Tokenized U. S. Treasuries Fund on Ethereum Is Reshaping Institutional Fixed-Income Access.