How Tokenized U.S. Treasuries on Ethereum Are Reshaping Institutional Liquidity

In the past year, the tokenization of U. S. Treasuries on Ethereum has moved from a speculative concept to a cornerstone of institutional liquidity management. With Ethereum (ETH) currently priced at $4,129.18, the network now serves as the primary settlement layer for a new generation of onchain treasury funds, boasting approximately $5.3 billion in tokenized U. S. Treasuries, about 72% of the global total. This rapid evolution is not only reshaping how institutions access and deploy capital but also redefining the very nature of fixed-income markets.

Ethereum Treasury Tokens: Institutional Adoption Accelerates

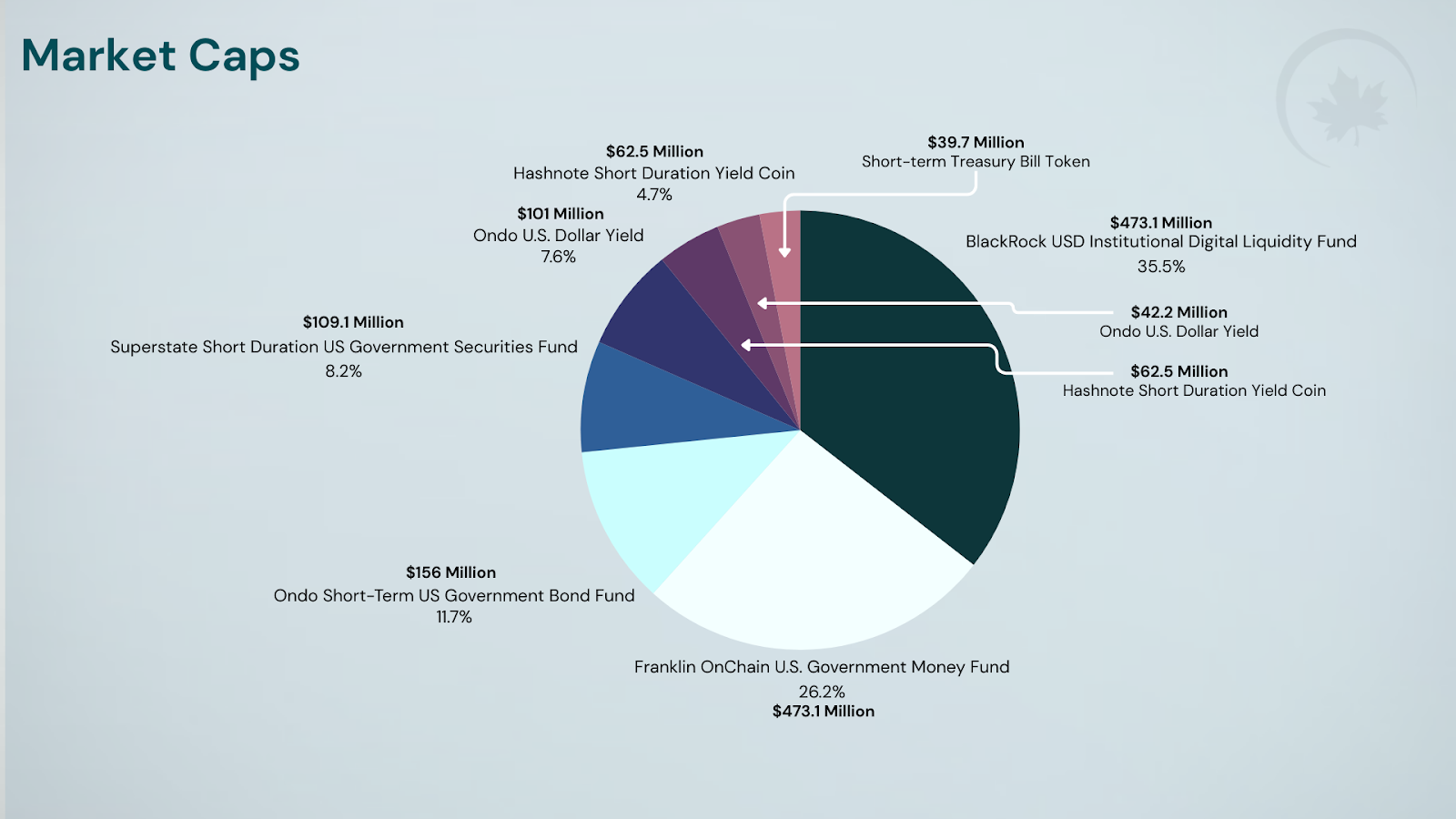

The current landscape is defined by heavyweight entrants and surging demand for programmable yield treasuries. BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) leads with over $2.83 billion in assets under management, while Franklin Templeton and innovative platforms like Ondo Finance have carved out significant market share. The recent debut of Fidelity’s Digital Interest Token (FDIT), launched as an ERC20 on Ethereum, underscores this trend, bringing $200 million in U. S. Treasuries onchain and signaling that institutional capital is no longer just testing the waters but actively participating.

These developments are not occurring in isolation. Regulatory clarity from both the SEC in the United States and MiCA in Europe has provided a foundation for risk-managed adoption, encouraging asset managers, hedge funds, and even traditional banks to integrate tokenized treasuries into their liquidity stacks.

How Onchain Treasury Funds Transform Liquidity Models

The appeal of tokenized U. S. treasuries goes beyond simple digitization. By leveraging Ethereum’s 24/7 settlement capabilities, institutions can now trade treasury tokens globally at any hour, eliminating legacy frictions such as cut-off times and cross-border delays. For example, Ondo Finance’s Short-Term U. S. Government Bond Fund (OUSG) allows daily accrual of yield with no lockups, enabling real-time portfolio rebalancing and collateral optimization within DeFi protocols like Aave.

This shift is particularly relevant as stable yields between 4% and 8% have made treasury tokens an attractive alternative to traditional stablecoins for managing cash reserves or providing liquidity in decentralized finance ecosystems.

Programmable Yield: The New Standard for Institutional Cash Management

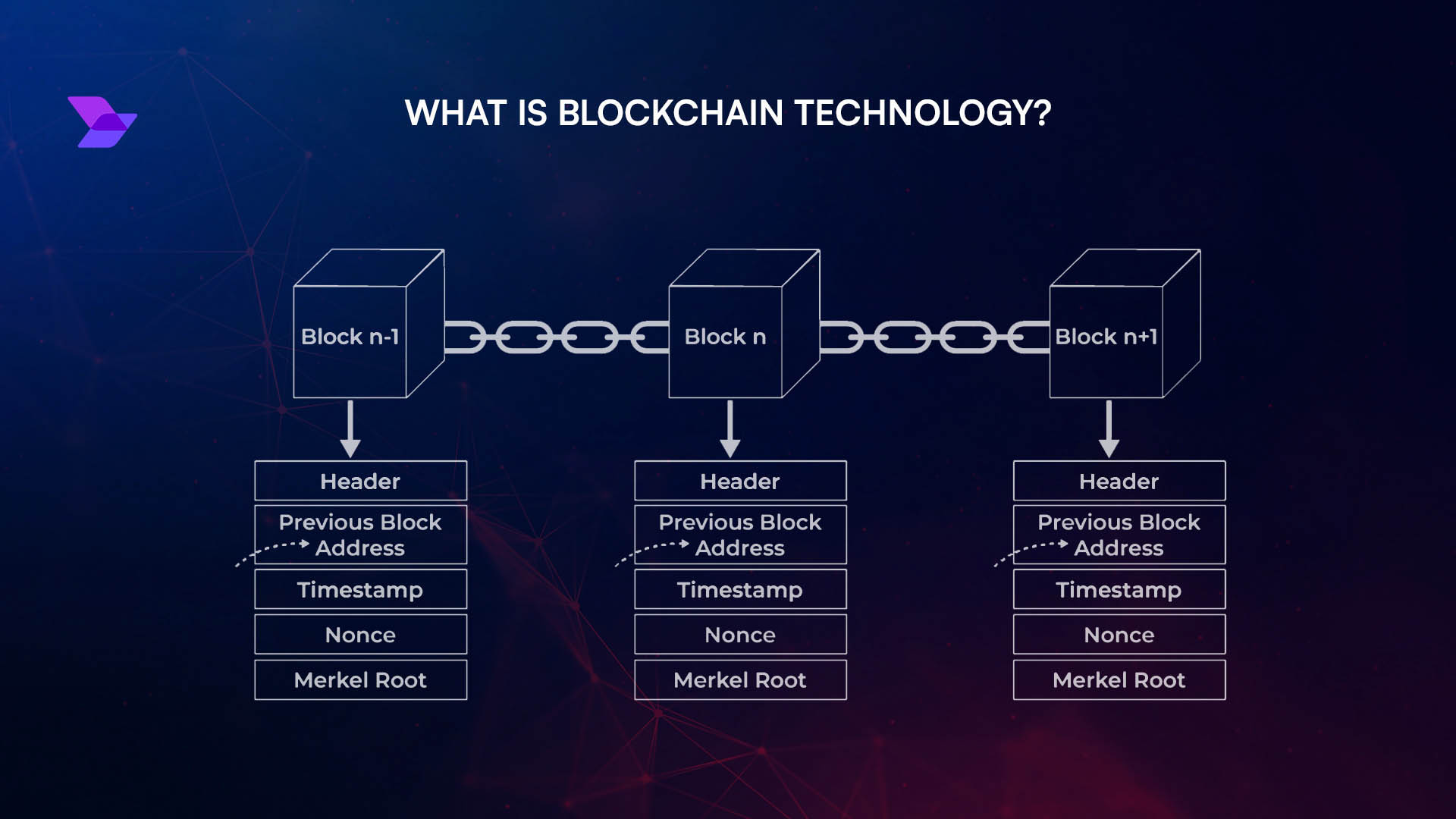

The programmability of Ethereum-based treasury tokens opens new frontiers for institutional investors seeking both security and flexibility. Smart contracts automate interest accruals, enable customizable payout schedules, and facilitate seamless integration with DeFi lending markets, all while maintaining full transparency over underlying assets.

Ethereum (ETH) Price Prediction Table: 2026–2031

Scenarios Based on Continued Adoption of Tokenized U.S. Treasuries and Institutional Liquidity Growth on Ethereum

| Year | Minimum Price | Average Price | Maximum Price | YoY Change (Avg %) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,750 | $4,650 | $6,200 | +12.6% | Post-ETF growth consolidates, tokenized treasuries drive steady institutional inflows. Regulatory clarity supports stability. |

| 2027 | $4,100 | $5,350 | $7,800 | +15.1% | DeFi integrations with tokenized treasuries expand; Ethereum upgrades enhance scalability. Global institutions increase allocation. |

| 2028 | $4,500 | $6,200 | $9,400 | +15.9% | Bullish cycle as real-world asset tokenization gains traction; ETH benefits from dominant market share. |

| 2029 | $4,800 | $7,050 | $11,200 | +13.7% | Market matures, competition emerges (e.g., alternative L1s), but Ethereum maintains lead in tokenized finance. |

| 2030 | $5,200 | $7,850 | $12,900 | +11.4% | Tokenized bond market exceeds $20B; ETH adoption grows in both DeFi and traditional finance. Regulation remains favorable. |

| 2031 | $5,600 | $8,500 | $14,500 | +8.3% | Growth moderates as market matures. ETH remains core infrastructure for on-chain finance; volatility tapers. |

Price Prediction Summary

Ethereum is poised for sustained growth through 2031, driven by its leading role in the tokenized U.S. Treasuries market and increasing integration with institutional liquidity solutions. Price projections reflect both the upside of further adoption and the potential for increased competition and market maturation. Regulatory clarity, technological upgrades, and expanding use cases underpin ETH’s long-term value proposition, though market cycles and macroeconomic factors will influence volatility.

Key Factors Affecting Ethereum Price

- Continued growth and adoption of tokenized U.S. Treasuries on Ethereum, driving institutional demand.

- Ongoing integration of Ethereum-based assets into DeFi protocols and traditional finance.

- Advancements in Ethereum scalability (e.g., EIP-4844, Layer 2 rollups) improving transaction efficiency.

- Market cycles, including potential bullish surges and consolidation phases.

- Global regulatory clarity from the SEC and MiCA, supporting institutional participation.

- Potential competition from alternative blockchains offering tokenization solutions.

- Macro factors such as interest rates, global liquidity, and digital asset market sentiment.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As programmable yield becomes standard practice among leading funds like BlackRock’s BUIDL and Fidelity’s FDIT, we are witnessing a fundamental transformation in how cash management products are delivered to global investors.

Beyond yield and efficiency, the transparency inherent to Ethereum’s public ledger is proving invaluable for institutional compliance and reporting. Every transaction, asset transfer, and interest payment is immutably recorded, providing auditors and risk managers with real-time visibility into fund activity. This level of transparency reduces operational risks and can streamline everything from NAV calculations to regulatory disclosures.

Another major advantage is the composability of onchain treasury funds. Institutions can use treasury tokens as collateral within DeFi protocols, creating new liquidity pathways that were previously unavailable in traditional finance. For example, a hedge fund might pledge BlackRock’s BUIDL tokens on Aave to borrow against their holdings, or deploy Franklin Templeton’s OnChain Money Fund tokens in automated liquidity pools for additional yield. This interoperability between regulated assets and open financial protocols is driving a new wave of financial innovation.

Risks and Regulatory Considerations

Despite the rapid growth, tokenized U. S. treasuries are not without challenges. Regulatory frameworks are evolving but still fragmented across jurisdictions. Custody solutions must meet both digital asset security standards and traditional compliance requirements. Additionally, while Ethereum’s $4,129.18 price supports robust network security and developer activity, gas fees and network congestion remain operational concerns during periods of high activity.

Key Benefits & Risks of Tokenized U.S. Treasuries on Ethereum

-

Enhanced Liquidity & 24/7 Access: Tokenized U.S. Treasuries on Ethereum, such as BlackRock’s BUIDL and Franklin Templeton’s OnChain U.S. Government Money Fund, provide institutional investors with round-the-clock trading and instant settlement, eliminating traditional market hour constraints.

-

Stable Yields with Lower Volatility: These funds offer yields between 4% and 8%, providing a stable, low-risk alternative to traditional stablecoins and volatile crypto assets. As of October 1, 2025, the total value of tokenized U.S. Treasuries on Ethereum reached $5.3 billion.

-

Integration with DeFi Platforms: Products like Ondo Finance’s OUSG enable institutions to use tokenized Treasuries as collateral or liquidity in decentralized finance protocols, unlocking new yield and liquidity strategies.

-

Regulatory Clarity & Institutional Confidence: The U.S. SEC and EU MiCA frameworks have provided greater regulatory certainty, encouraging adoption by major institutions such as Fidelity, BlackRock, and Franklin Templeton.

-

Counterparty & Custody Risks: Despite blockchain transparency, institutions face risks related to smart contract vulnerabilities, third-party custodians, and potential regulatory shifts that could impact asset security or accessibility.

-

Market & Liquidity Risks: While Ethereum offers deep liquidity, periods of network congestion or market stress can affect the ability to redeem or transfer large positions quickly, potentially leading to slippage or illiquidity.

-

Technology & Integration Challenges: Integrating tokenized assets with legacy systems remains complex, requiring robust technical infrastructure and ongoing compliance monitoring for institutional adoption.

Market participants must also consider counterparty risk associated with smart contracts and the underlying trust in issuers’ ability to redeem tokens for real-world assets. However, ongoing collaboration between asset managers, blockchain developers, and regulators continues to address these concerns through improved standards for audits, disclosures, and token design.

What’s Next? The Future of Institutional Liquidity on Ethereum

The trajectory is clear: as more institutions embrace onchain treasury funds like Fidelity FDIT, BlackRock BUIDL, and Franklin Templeton’s OnChain Money Fund, the ecosystem will continue to expand beyond $7.4 billion in tokenized U. S. Treasuries. We’re likely to see further integration with global settlement networks and more sophisticated programmable yield products tailored for specific institutional use cases.

For those seeking a deeper dive into the mechanics or regulatory implications of this shift in fixed-income investing, explore our comprehensive guide.

The bottom line: Ethereum-based treasury tokens are not just a technical upgrade, they represent a structural evolution in institutional liquidity management that blends the best of blockchain transparency with the stability of U. S. government debt.