How Tokenized U.S. Treasury Funds Became the Digital Safe Haven for Institutional Investors

What happens when the world’s most trusted government securities meet the speed and transparency of blockchain? You get tokenized U. S. Treasury funds: the digital safe haven that’s captivating institutional investors and rewriting the rules of fixed-income investing in 2025.

Let’s pull back the curtain on this quiet revolution. In just a few short years, tokenized treasuries have leaped from niche experiment to a $7.4 billion market, as of mid-2025. Heavyweights like BlackRock, Franklin Templeton, and Fidelity now anchor this space, offering digital tokens backed 1: 1 by U. S. Treasuries, making it possible to gain exposure to government debt with all the efficiency and programmability of blockchain.

Why Institutions Are Flocking to Tokenized Treasuries

The appeal is simple but powerful. In an era where crypto volatility keeps even seasoned traders on their toes, institutions crave stability without sacrificing liquidity or operational efficiency. Tokenized U. S. Treasury funds deliver:

Key Benefits of Tokenized Treasury Funds for Institutions

-

Stable, Competitive Yields: Tokenized U.S. Treasury funds offer institutional investors attractive yields ranging from 4% to 8%, providing a low-risk alternative to traditional stablecoins and cash holdings.

-

24/7 Liquidity and Instant Settlement: These digital funds can be traded around the clock on blockchain platforms, enabling immediate settlement and continuous market access—unlike traditional markets with limited trading hours.

-

Seamless Integration with Digital Asset Ecosystems: Major funds like BlackRock’s BUIDL are now accepted as collateral on leading crypto platforms such as Crypto.com and Deribit, allowing institutions to leverage their holdings for trading and lending.

-

Operational Efficiency & Transparency: Blockchain technology streamlines processes like subscription, redemption, and transfer, reducing operational costs and increasing transparency for compliance and auditing.

-

Global Accessibility & Regulatory Clarity: With launches like Franklin Templeton’s tokenized U.S. Treasury fund in Luxembourg, institutions worldwide can access these products, backed by improving regulatory frameworks in major financial centers.

-

Enhanced Security & Compliance: Digital tokens are recorded on secure blockchains (e.g., Stellar), providing robust security and transparent audit trails, which are essential for institutional compliance.

Stable Yields: With yields ranging from 4% to 8%, these digital assets offer a compelling alternative to traditional stablecoins, less risk, more transparency, and real-world backing via U. S. government bonds. According to Tokenization News, this yield advantage is drawing capital away from legacy money market funds and into blockchain-native options.

24/7 Liquidity: Forget about T and 2 settlement delays or weekend downtime. On-chain treasuries can be traded at any hour, with instant settlement, a game-changer for funds that need to move quickly or rebalance portfolios outside traditional market hours.

Operational Efficiency: Blockchain rails automate subscriptions, redemptions, and transfers, slashing costs tied up in paperwork and intermediaries. And because every transaction is recorded immutably on-chain, audits become faster and more reliable.

The Rise of Digital Safe Haven Assets

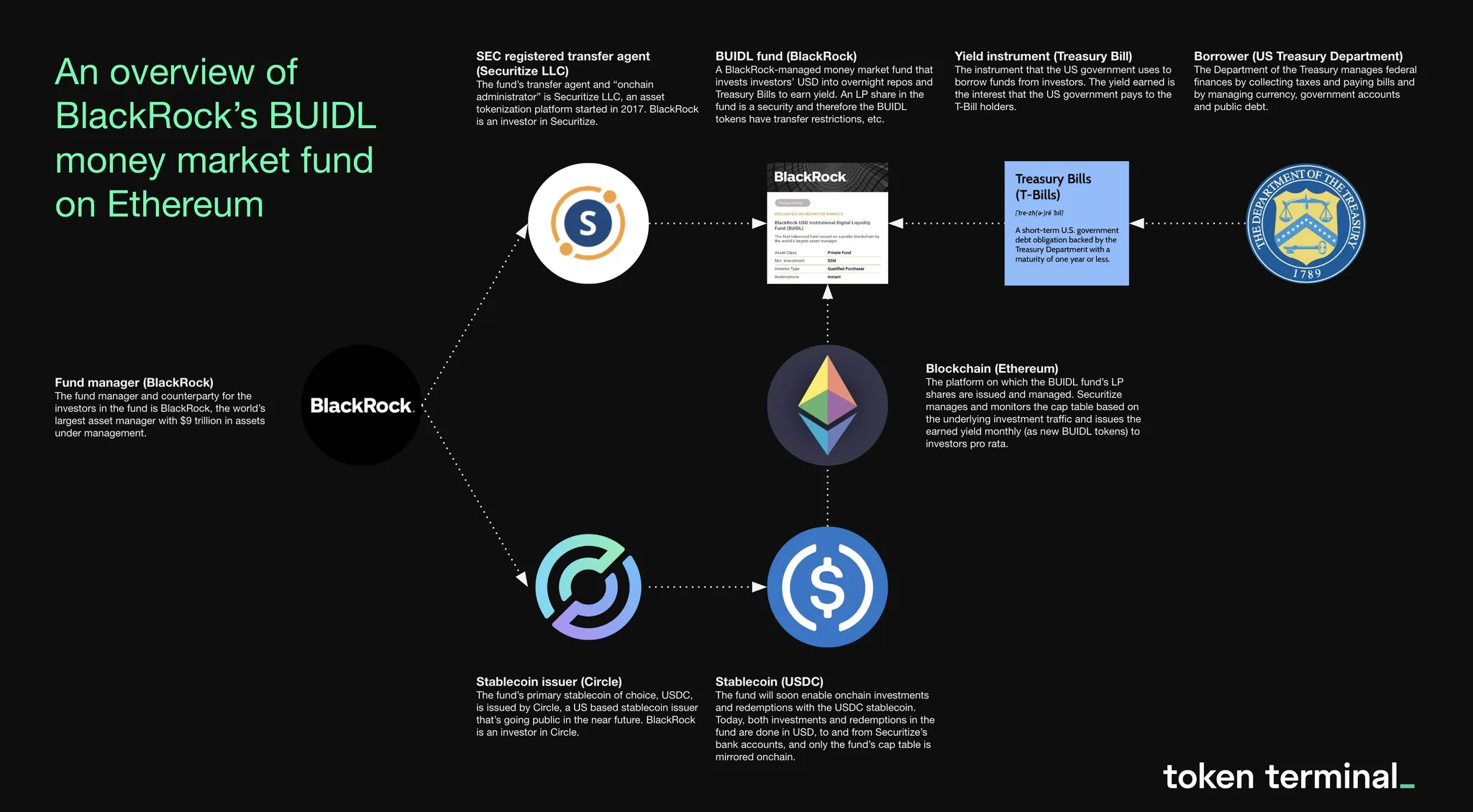

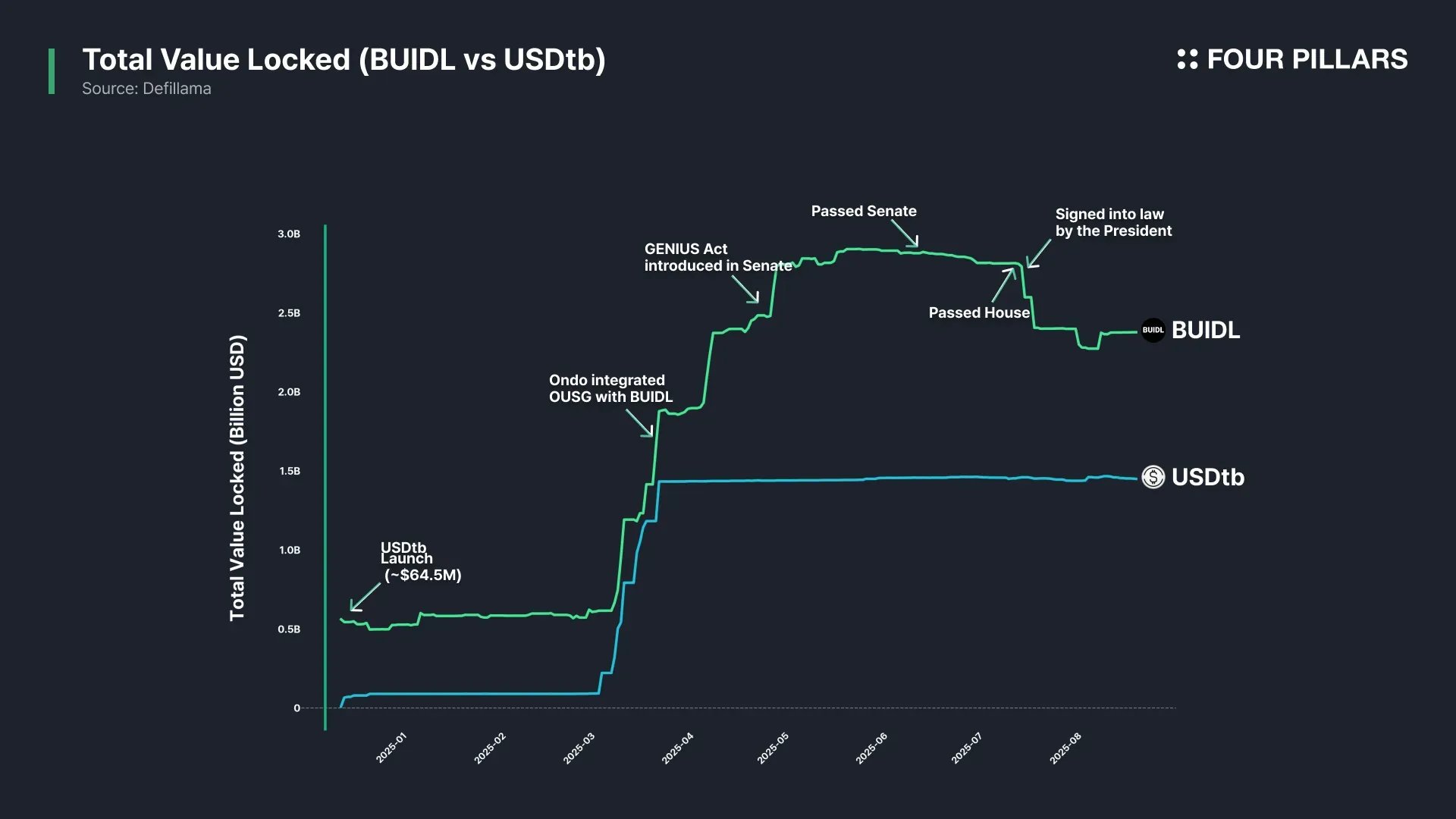

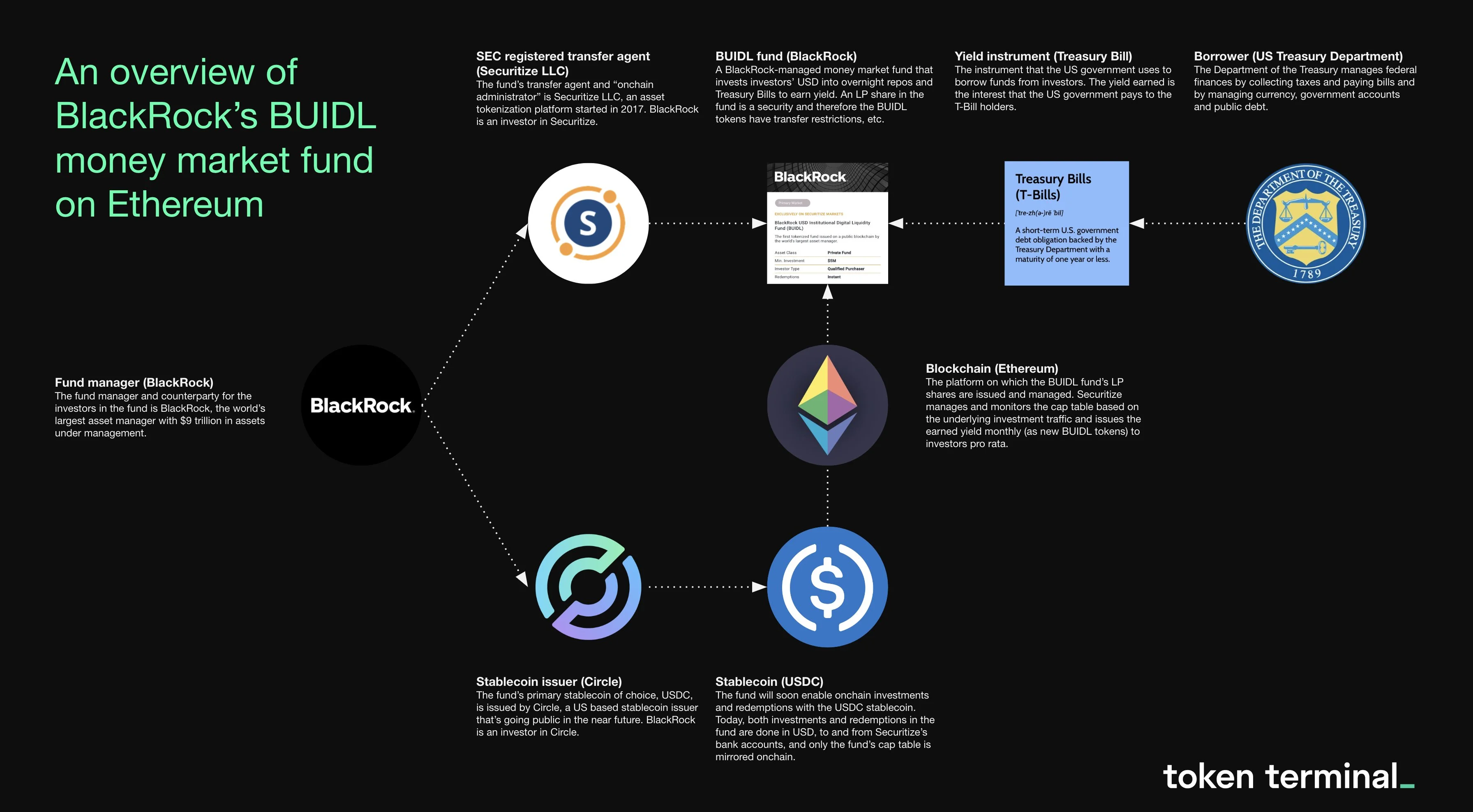

This migration isn’t just about chasing yield, it’s about finding a new kind of safety net in a world where macro instability is the norm. The largest player so far? BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), which has amassed $2.9 billion in assets under management by mid-2025 and is now accepted as collateral on major crypto trading venues like Crypto. com and Deribit.

BUIDL isn’t just a product, it’s infrastructure for a new era where digital asset markets demand both trust and real-time flexibility.

This acceptance as collateral signals something profound: tokenized treasuries aren’t just passive investments, they’re becoming foundational building blocks for decentralized finance (DeFi) strategies, cross-exchange arbitrage, and even stablecoin reserves.

Regulatory Green Lights and Global Expansion

The regulatory landscape is catching up fast, sometimes even leading the way. Franklin Templeton’s launch of its tokenized U. S. Treasury fund in Luxembourg made headlines earlier this year by opening access to European institutions through Stellar blockchain infrastructure (Coindesk). Meanwhile, Goldman Sachs and BNY Mellon have teamed up to digitize shares of money market funds, modernizing collateral management for everything from repo trades to margining (Reuters).

- Diversified Access: Funds are now available across multiple blockchains (Ethereum, Stellar), each catering to different compliance needs.

- Smoother Cross-Border Flows: Tokenization removes friction for global investors seeking dollar-denominated security without navigating legacy banking delays.

- Stronger Regulatory Clarity: As lawmakers recognize the legitimacy, and systemic importance, of tokenized treasuries, adoption accelerates even further.

But the story doesn’t stop at regulatory wins and institutional adoption. The ripple effects are already reshaping how capital moves in both crypto and traditional markets. As tokenized treasuries become a core asset, we’re seeing new patterns of risk management, portfolio construction, and even geopolitical positioning.

Tokenized Treasuries: The Institutional Response to Crypto Volatility

2025 has been a year of wild swings in digital asset prices. Bitcoin’s meteoric rise past $100,000 captured headlines, but it also underscored the appetite for low-volatility assets that can serve as ballast in turbulent times. Tokenized U. S. Treasury funds are answering that call, offering a programmable safe haven with yields that outpace most stablecoins.

This isn’t just theory, major crypto-native funds and trading desks now regularly park idle capital in on-chain treasuries between high-risk trades or during periods of uncertainty. The result? A new liquidity layer that sits at the intersection of TradFi and DeFi, ready to be mobilized instantly as market conditions shift.

How Tokenized Treasuries Are Rewiring Market Structure

The impact on market structure is profound. By integrating with smart contracts and on-chain lending protocols, tokenized treasuries unlock use cases that go far beyond passive holding:

Real-World Tokenized Treasury Funds Powering DeFi

-

BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) is the largest tokenized U.S. Treasury fund, with $2.9 billion in assets as of mid-2025. BUIDL is now accepted as collateral on major crypto platforms like Crypto.com and Deribit, enabling institutional investors to unlock liquidity for DeFi trading and lending strategies while earning stable Treasury yields.

-

Franklin Templeton’s OnChain U.S. Government Money Fund brought tokenized Treasuries to Europe by launching on the Stellar blockchain. With $580 million in assets, this fund allows European institutions to tap into U.S. Treasury yields and integrate these assets into DeFi protocols for enhanced liquidity and cross-border settlement.

-

Goldman Sachs and BNY Mellon’s Digital Money Market Tokens represent a new wave of tokenized money market funds. These tokens are used by institutions as collateral in digital asset markets, streamlining repo transactions and enabling instant settlement on blockchain-based DeFi platforms.

-

Ondo Finance’s OUSG Token is a blockchain-based token fully backed by U.S. Treasuries. It is widely used in DeFi protocols to provide yield-bearing, low-risk collateral for lending, liquidity pools, and stablecoin reserves, making it a popular choice for institutional DeFi strategies.

-

Maple Finance’s Cash Management Pools leverage tokenized U.S. Treasuries to offer on-chain yield opportunities for institutional investors. These pools provide transparent, blockchain-native access to Treasury yields, powering DeFi lending and liquidity solutions with real-world assets.

Collateralization: Funds like BUIDL are now accepted as pristine collateral on centralized exchanges and DeFi lending markets alike. This bridges liquidity between previously siloed ecosystems.

Instant Settlement: 24/7 trading means institutional players can rebalance portfolios or meet margin calls without waiting for the next business day, a critical edge during volatile events.

Programmable Compliance: Smart contracts enforce whitelisting, transfer restrictions, and reporting requirements automatically, streamlining regulatory workflows for global investors.

What’s Next? Portfolio Transformation Through Tokenization

The future looks even bolder. According to Tokenization News, some analysts expect tokenized assets could comprise up to a quarter of institutional portfolios by 2030 as more asset classes migrate on-chain. With over $7.4 billion already locked in tokenized U. S. Treasury funds (mid-2025), the flywheel is spinning faster every quarter.

This shift isn’t just about efficiency, it’s about democratizing access to the world’s safest assets while inviting a new generation of programmable finance products built atop them.

Would you allocate part of your portfolio to tokenized U.S. Treasury funds?

Tokenized U.S. Treasury funds have surged to $7.4 billion in assets by mid-2025, offering stable yields (4%-8%), 24/7 liquidity, and blockchain efficiency. With major players like BlackRock and Franklin Templeton leading the way, would you consider adding these digital safe haven assets to your investment mix?

The Bottom Line: Digital Safe Havens Are Here to Stay

The digital transformation of U. S. Treasuries is more than a trend, it’s a structural evolution in how institutions manage risk, optimize returns, and interact with global financial infrastructure. For investors navigating an era defined by both opportunity and uncertainty, tokenized treasury funds offer a rare combination: government-backed security with all the agility and programmability of blockchain technology.

If you’re an institution looking for yield without drama, or simply want your safe haven assets to work harder for you, the time to explore this new frontier is now.