Fidelity’s Tokenized U.S. Treasuries Fund on Ethereum: What Institutional Investors Need to Know

Fidelity’s quiet but decisive entrance into the on-chain fixed income market is sending ripples through institutional corridors. With the launch of the Fidelity Digital Interest Token (FDIT): a tokenized share class of its Treasury fund on Ethereum, Fidelity has not only staked its claim in the rapidly maturing world of tokenized government bonds but also signaled a strategic shift for institutional treasury management. The FDIT, which debuted in August 2025, has already amassed $203.7 million in assets as of September 8,2025, cementing Ethereum’s status as the platform of choice for digital fixed-income products.

Fidelity’s Tokenized Treasuries: A New Standard for On-Chain Fixed Income

Let’s cut through the noise: institutional investors have watched tokenized assets go from speculative experiments to regulated, scalable products. Fidelity’s FDIT isn’t just another digital asset, it’s a fully compliant, blockchain-enabled share class of the Fidelity Treasury Digital Fund (FYOXX), with each token representing a direct claim on U. S. Treasuries and cash held in traditional custody by Bank of New York Mellon. This hybrid structure delivers the best of both worlds: the transparency, programmability, and 24/7 accessibility of Ethereum, paired with the regulatory safeguards and operational rigor of legacy finance.

The tokenized US treasury fund on Ethereum is not an abstract concept anymore. FDIT’s on-chain design enables near-instant settlement and continuous transferability, features that traditional T-bill markets simply can’t match. For asset allocators, this means faster liquidity management, reduced counterparty risk, and lower operational friction. The annual fee stands at a competitive 0.20%, keeping costs firmly in check even as the product delivers novel utility.

How FDIT Works: Institutional-Grade Security Meets Blockchain Efficiency

Unlike synthetic or wrapped tokens, FDIT is a true tokenized share class. Here’s what institutional investors need to know:

Key Features of Fidelity’s Tokenized U.S. Treasuries Fund (FDIT)

-

Real-World Asset Backing: Each FDIT token represents a share in the Fidelity Treasury Digital Fund (FYOXX), backed exclusively by U.S. Treasury securities and cash.

-

Ethereum-Based Settlement: FDIT is issued and settled on the Ethereum blockchain, enabling near-instant transactions, 24/7 access, and reduced reliance on intermediaries.

-

Institutional-Grade Custody: The underlying assets are held with Bank of New York Mellon (BNY Mellon), ensuring robust security and compliance with traditional finance standards.

-

Regulatory Compliance: FDIT maintains compliance with existing regulatory frameworks, combining blockchain innovation with conventional oversight for institutional investors.

-

Competitive Annual Fee: The fund charges a 0.20% annual management fee, offering cost-effective exposure to tokenized U.S. Treasuries.

-

Significant Market Presence: As of September 8, 2025, FDIT has amassed approximately $203.7 million in assets, highlighting strong institutional demand and Ethereum’s dominance in tokenized Treasuries.

-

Enhanced Transparency and Efficiency: Blockchain-based ownership and transfer provide greater transparency, auditability, and operational efficiency for institutional investors.

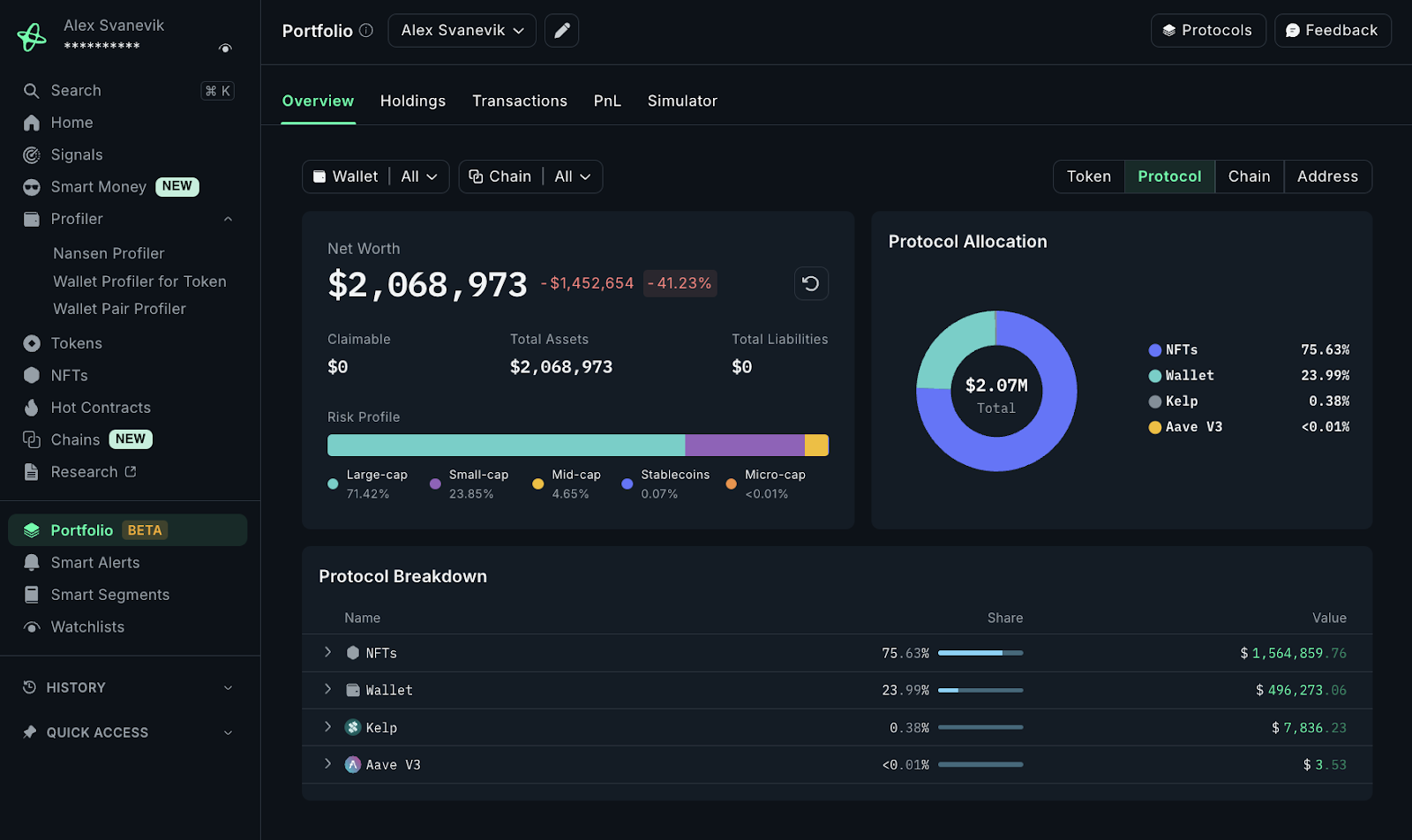

Each FDIT token is minted on Ethereum and can be transferred peer-to-peer or via smart contract-based protocols, subject to whitelisting and KYC controls. Underlying assets, exclusively U. S. Treasuries and cash, remain off-chain but are reconciled daily against the on-chain ledger, ensuring full transparency and auditability. This structure addresses a core concern for institutions: operational risk. By leveraging Ethereum’s security and programmability while keeping assets under the watchful eye of a top-tier custodian, FDIT bridges the gap between DeFi innovation and institutional-grade oversight.

Market Impact: Ethereum Dominance and the $203.7 Million Milestone

The numbers matter. As of September 2025, Ethereum hosts about 70% of the $7.46 billion tokenized U. S. Treasury market, a figure that will only grow as more asset managers follow Fidelity’s lead. FDIT’s rapid accumulation of $203.7 million is not just a headline; it’s a signal that institutional demand for on-chain T-bill tokens is real and accelerating. For context, the market share captured by Ethereum is a direct result of its robust smart contract infrastructure, deep liquidity, and proven security model.

Asset tokenization is no longer a theoretical value proposition, it’s a live market with real capital at stake. Fidelity’s move validates the thesis that blockchain government bonds are not just viable but strategically advantageous for institutional portfolios seeking agility and transparency.

Why Institutions Are Paying Attention: The Strategic Case for Treasury Tokenization

The operational advantages of FDIT extend well beyond cost savings. With 24/7 availability and programmable settlement, institutional treasurers can optimize cash management cycles, respond to market events in real time, and streamline compliance reporting through automated on-chain records. Regulatory alignment is critical: FDIT’s underlying assets are held by BNY Mellon and remain within established legal frameworks, offering peace of mind that newer DeFi-native tokens cannot match.

The bottom line? Fidelity’s tokenized treasury fund on Ethereum is not just a product launch, it’s a marker of how institutional treasury tokenization is evolving from vision to reality. As the market digests this development, expect more sophisticated capital to flow into digital fixed-income products that combine regulatory discipline with technological edge.

Looking ahead, the competitive landscape for on-chain t-bill tokens is poised for rapid evolution. Fidelity’s scale, brand trust, and regulatory rigor have set a high bar for future entrants. Yet, the open architecture of Ethereum means that interoperability with DeFi protocols, secondary liquidity venues, and innovative yield strategies will be crucial for ongoing adoption. Institutions are not just seeking digital wrappers on old products, they want composability, transparency, and operational flexibility that legacy systems can’t deliver.

“The institutional embrace of tokenized US Treasuries marks a pivotal shift in fixed income. Fidelity’s FDIT is the first domino, expect a wave of capital to follow. “

From Proof-of-Concept to Portfolio Core: The Roadmap for Institutional Adoption

For CIOs and portfolio managers, the question is no longer “if” but “how” to integrate tokenized fixed-income products. The FDIT fund provides a playbook: start with compliant, asset-backed tokens, leverage established custodians for risk mitigation, and use programmable infrastructure for operational efficiency. The result is an agile portfolio that can respond instantly to macro shifts, without sacrificing compliance or transparency. This is not just about chasing yield; it’s about building resilient, future-proof treasury operations.

How Institutions Can Evaluate & Adopt FDIT

-

Assess Regulatory Compliance and Custody Arrangements: Confirm that the Fidelity Digital Interest Token (FDIT) is managed in accordance with existing financial regulations. Note that underlying U.S. Treasury assets are held by Bank of New York Mellon, providing institutional-grade custody and oversight.

-

Evaluate Blockchain Infrastructure and Security: Understand that FDIT operates on the Ethereum blockchain, which enables near-instant settlement and 24/7 operational access. Review Ethereum’s security track record and the smart contract audit status of FDIT before onboarding.

-

Analyze Fund Structure, Fees, and Liquidity: Review the Fidelity Treasury Digital Fund (FYOXX) details, including its annual fee of 0.20% and current asset base of $203.7 million as of September 2025. Assess the liquidity profile and on-chain transfer mechanisms for FDIT tokens.

-

Integrate with Existing Portfolio Management Systems: Ensure your institution’s operational infrastructure can support digital asset custody, on-chain transaction monitoring, and reporting for tokenized securities like FDIT.

-

Conduct Counterparty and Platform Due Diligence: Vet Fidelity Investments as the fund manager and assess the reliability of on-chain platforms and intermediaries used for FDIT transactions.

-

Establish Internal Policies and Risk Controls: Develop or update digital asset policies, including procedures for wallet management, private key security, and compliance reporting specific to tokenized funds.

-

Engage with Industry Partners and Service Providers: Collaborate with established entities such as Ondo Finance and leading custodians to stay informed about best practices and evolving standards in tokenized treasury markets.

As more asset managers tokenize government bonds, expect to see a proliferation of on-chain products with varying risk profiles, durations, and yield enhancement strategies. The coming quarters will likely bring enhanced liquidity pools, real-time NAV oracles, and deeper integration with on-chain collateral frameworks. For early adopters, the opportunity is clear: gain exposure to the next generation of digital fixed-income products while setting new standards for transparency and efficiency.

Fidelity’s FDIT also demonstrates how regulatory clarity can coexist with technological innovation. By keeping underlying assets in traditional custody while issuing tokens on Ethereum, the fund sidesteps many of the legal uncertainties that have hampered DeFi-native products. This hybrid approach is likely to become the industry blueprint as regulators, auditors, and institutional allocators converge on best practices for institutional treasury tokenization.

What’s Next: The Institutional Playbook for Digital Treasuries

With $203.7 million already locked in FDIT and Ethereum controlling 70% of a $7.46 billion market, the momentum is undeniable. The next wave will be defined by interoperability, on-chain analytics, and integration with global settlement networks. Institutional investors who adapt early will be best positioned to capitalize on liquidity, cost, and compliance advantages as tokenized treasuries move from niche to mainstream.

Will your institution allocate to tokenized U.S. Treasury funds like Fidelity’s FDIT on Ethereum in the next 12 months?

Fidelity has launched the Digital Interest Token (FDIT), a tokenized share class of its Treasury fund on Ethereum, offering blockchain-enabled access to U.S. Treasuries. With over $203 million in assets and growing institutional interest, are you considering this new avenue for portfolio diversification?

Ultimately, Fidelity’s tokenized US treasury fund on Ethereum is not just a milestone, it’s a catalyst. As capital markets re-architect around programmable money and digital securities, those who embrace this shift will define the future of fixed income. The message is clear: adapt, or be left behind.