Fidelity’s Tokenized U.S. Treasuries Fund on Ethereum: What It Means for Institutional Investors

Fidelity’s quiet but decisive entry into the blockchain-based fixed income market has sent ripples across institutional finance. With the launch of the Fidelity Digital Interest Token (FDIT), a tokenized share class of its Treasury fund now live on Ethereum, the asset management giant has put $200 million in U. S. Treasuries directly on-chain. For institutional investors, this is more than a headline – it’s a strategic signal that blockchain rails are no longer experimental but are maturing into critical infrastructure for capital markets.

Fidelity’s FDIT: A Pragmatic Leap into Tokenized Treasuries

The FDIT fund isn’t just another crypto experiment. Each token represents a share of the Fidelity Treasury Digital Fund (FYOXX), giving holders direct blockchain-enabled access to U. S. Treasuries and cash. The Bank of New York Mellon, acting as custodian, ensures institutional-grade security and compliance. With a competitive 0.20% management fee, FDIT is engineered for scale, transparency, and operational efficiency.

Why does this matter? Until now, most tokenized treasury products were dominated by crypto-native startups or niche fintechs. Fidelity’s move brings blue-chip credibility and regulatory rigor, making tokenized treasuries palatable for pension funds, endowments, and asset allocators who previously sat on the sidelines. The $200 million already allocated to FDIT is not just seed capital – it’s a benchmark for institutional confidence and a harbinger of broader adoption.

Ethereum at $3,923.82: Why Blockchain Rails Matter for Institutions

Fidelity’s choice of Ethereum as its settlement layer is strategic. Ethereum, currently priced at $3,923.82, has evolved into the institutional blockchain of choice for tokenized real-world assets. Its robust security, developer ecosystem, and interoperability make it an attractive foundation for regulated financial products.

For institutional investors, on-chain settlement means T and 0 liquidity, atomic swaps, and programmable compliance – a seismic improvement over legacy clearing systems. The transparency and auditability of public blockchains also mitigate counterparty and operational risk, a key consideration for fiduciaries managing billions in client assets.

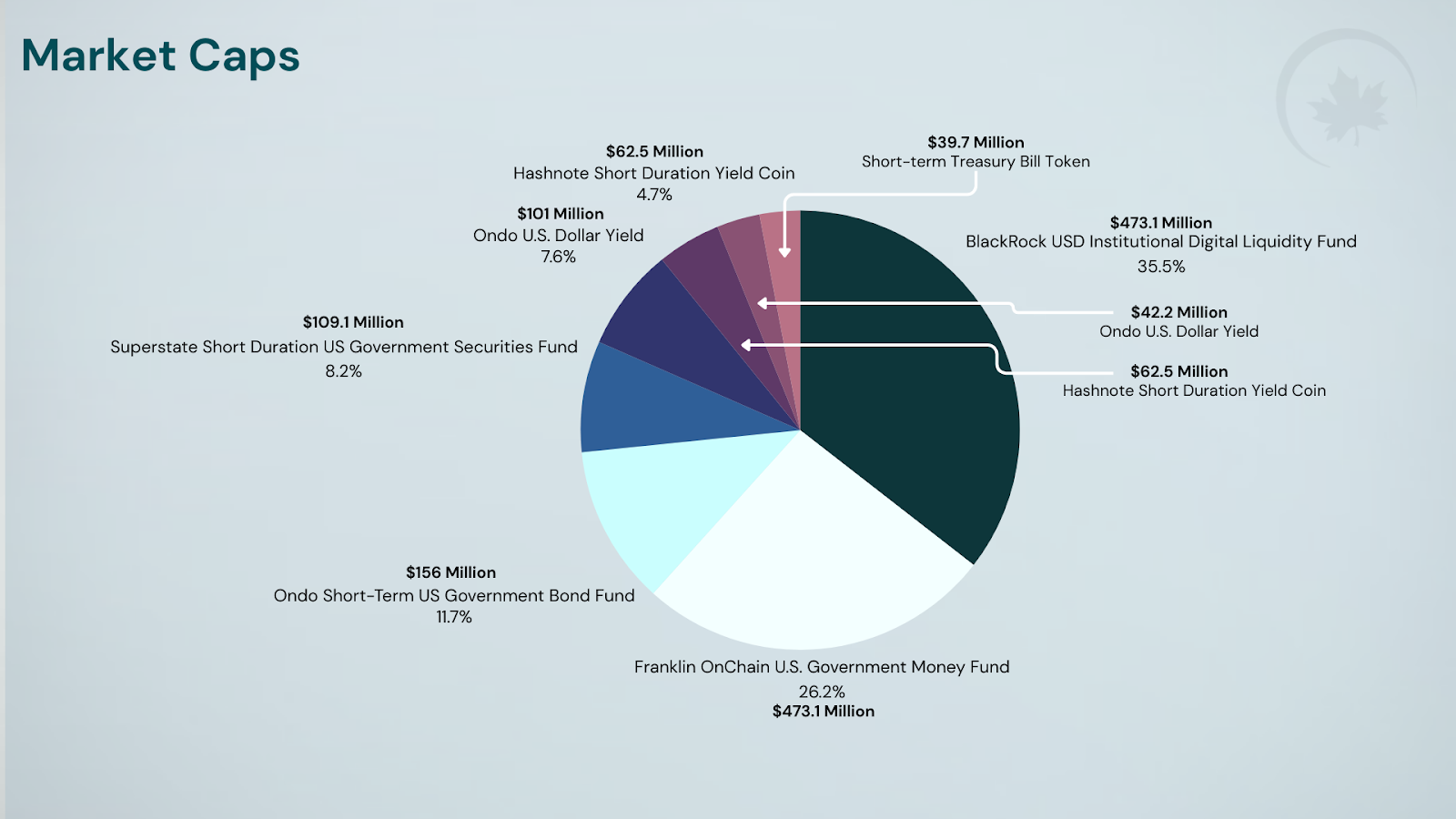

Tokenized Treasuries: From Niche to $7 Billion Market

The market for tokenized U. S. Treasuries has exploded to $7 billion, with Fidelity joining a cohort that includes BlackRock (BUIDL), Franklin Templeton, and WisdomTree. This is no longer a theoretical market; it’s a rapidly scaling sector with real assets and real inflows. Fidelity’s $200 million FDIT debut positions Ethereum-based treasury tokens on a $10 billion trajectory by 2025, according to industry analysts.

What’s driving this growth? Institutional demand for 24/7 liquidity, efficient collateral management, and global access to U. S. government debt is converging with blockchain’s technical advantages. The FDIT fund’s design – transparent, auditable, and instantly transferable – aligns perfectly with these evolving requirements.

Ethereum (ETH) Price Prediction 2026-2031: Impact of Institutional Tokenization

Professional outlook considering Fidelity’s tokenized U.S. Treasuries fund, institutional adoption, and blockchain-based asset growth

| Year | Minimum Price (Bearish Scenario) | Average Price (Baseline) | Maximum Price (Bullish Scenario) | YoY % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,200 | $4,600 | $6,800 | +17% | Institutional inflows accelerate; regulatory clarity improves |

| 2027 | $3,000 | $5,100 | $8,500 | +11% | Sustained adoption; tokenized asset market exceeds $15B |

| 2028 | $2,900 | $5,800 | $11,200 | +13% | DeFi & RWAs grow; ETH upgrades enhance scalability |

| 2029 | $3,500 | $6,900 | $13,900 | +19% | Major institutions onboard; ETH ecosystem matures |

| 2030 | $4,400 | $8,200 | $16,400 | +19% | Tokenized US Treasuries $30B+; ETH as institutional settlement layer |

| 2031 | $4,800 | $9,500 | $20,000 | +16% | Global regulatory frameworks; mainstream adoption of on-chain assets |

Price Prediction Summary

Ethereum is positioned to benefit from the rapid expansion of tokenized real-world assets (RWAs) and increasing institutional adoption, as exemplified by Fidelity’s $200M tokenized U.S. Treasuries fund. Over the next six years, ETH’s price trajectory is expected to be shaped by its role as the backbone for institutional-grade financial products, ongoing technology upgrades, and global regulatory trends. While volatility and macroeconomic factors may cause significant price swings, the overall outlook is bullish with progressive growth year over year.

Key Factors Affecting Ethereum Price

- Institutional adoption of Ethereum for RWAs and financial products (e.g., tokenized Treasuries)

- Growth of the tokenized Treasury market (projected to exceed $30B by 2030)

- Ethereum network upgrades (scalability, security, and efficiency improvements)

- Macro-economic environment and interest rate cycles

- Global regulatory clarity and frameworks for digital assets

- Competition from other layer-1 blockchains and tokenization platforms

- Potential integration of ETH as a settlement layer for mainstream finance

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Competitive Landscape: FDIT vs. BlackRock’s BUIDL and JPMorgan’s JPMD

Fidelity’s FDIT enters a competitive but expanding arena. BlackRock’s BUIDL and JPMorgan’s JPMD have set early standards for tokenized fixed income products, but Fidelity’s brand strength and operational scale could accelerate mainstream adoption. The presence of multiple heavyweight asset managers validates the sector and offers institutional allocators genuine choice in on-chain treasury exposure.

For a deeper dive into how Fidelity’s offering compares with its peers and what this means for institutional access, see our detailed analysis.

Yet, the real story is not just about competition, it’s about the rapid normalization of blockchain rails in institutional finance. With FDIT, BlackRock’s BUIDL, and JPMorgan’s JPMD all live on public chains, asset managers are no longer asking ‘if’ but ‘how fast’ they can integrate tokenized treasuries into their portfolios. This dynamic is pushing service providers, custodians, and compliance vendors to adapt at breakneck speed. The result? A more liquid, interoperable, and transparent fixed-income ecosystem that blurs the lines between traditional and digital markets.

Operational Advantages: Why Tokenization Resonates with Institutions

Institutions are not chasing blockchain for novelty’s sake. The operational lift is tangible: 24/7 settlement, atomic swaps for collateral, and real-time NAV reporting are now possible. For treasury managers, this means less friction, lower costs, and faster cycles for repo and securities lending. The programmable nature of smart contracts also enables automated compliance, KYC, whitelisting, and transfer restrictions can be coded directly into the token itself.

Key Operational Advantages of Tokenized Treasuries

-

Enhanced Liquidity: Tokenized U.S. Treasuries like Fidelity’s FDIT on Ethereum offer 24/7 trading and fractional ownership, enabling institutional investors to enter and exit positions with greater flexibility compared to traditional markets.

-

Real-Time Settlement: Blockchain-based platforms enable instantaneous settlement of transactions, reducing counterparty risk and eliminating the delays associated with legacy clearing systems.

-

Increased Transparency: The use of Ethereum’s public ledger ensures auditable, tamper-resistant records of all transactions, giving institutions greater confidence in asset provenance and fund operations.

-

Operational Efficiency: Smart contracts automate processes such as interest payments and compliance checks, minimizing manual intervention and lowering administrative costs for institutional investors.

-

Broader Market Access: Tokenization allows for global participation in U.S. Treasury markets, enabling institutions worldwide to access high-quality collateral without traditional geographic or banking barriers.

-

Collateral Integration: Tokenized treasuries can be seamlessly integrated into DeFi protocols and on-chain lending platforms, expanding collateral options and unlocking new liquidity avenues for institutional strategies.

These efficiencies translate into measurable alpha. For example, a pension fund can now rebalance exposures globally in minutes, not days. Asset allocators can tap into U. S. Treasuries from anywhere in the world without intermediaries or settlement bottlenecks. And for risk officers, blockchain’s transparency provides a new level of auditability and real-time oversight that legacy systems simply cannot match.

What’s Next: Roadmap for Institutional Blockchain Adoption

The market is watching how quickly secondary liquidity develops for FDIT and its peers. As more trading venues and DeFi protocols integrate these tokens as collateral, expect tighter spreads and deeper order books. Regulatory clarity will be critical, Fidelity’s partnership with Bank of New York Mellon signals that compliance and investor protection remain paramount even as technology evolves.

Institutional investors should also monitor how tokenized treasuries fit into broader portfolio construction. With on-chain yields, composability with DeFi protocols, and instant settlement, these instruments are poised to become core building blocks for modern fixed-income strategies. For a strategic overview on how FDIT is reshaping institutional fixed income, read our feature analysis.

Strategic Takeaways: Adapt or Be Left Behind

Fidelity’s $200 million tokenized Treasury fund on Ethereum is not just a milestone; it’s a strategic inflection point for institutional finance. As tokenized bonds and treasuries cross into the mainstream, asset managers who fail to adapt risk obsolescence. The operational, liquidity, and transparency advantages of blockchain-based fixed income are now too significant to ignore.

For those ready to lead rather than follow, the roadmap is clear: embrace on-chain infrastructure, demand institutional-grade products like FDIT, and build teams with both traditional and digital expertise. The future of fixed income will not be decided by legacy systems, but by those willing to innovate at the intersection of blockchain and capital markets.