How Tokenized U.S. Treasuries on Ethereum Are Reshaping Institutional Yield Strategies in 2024

The landscape of institutional yield strategies has undergone a dramatic transformation in 2024, as tokenized U. S. Treasuries on Ethereum have moved from experimental concept to mainstream portfolio component. With the market for on-chain U. S. Treasuries reaching $2.4 billion by October 2024, institutional investors are now leveraging blockchain rails to access programmable yield and unprecedented liquidity. This shift is not only technical but also strategic, as institutions seek to enhance returns, reduce operational friction, and unlock new collateral pathways in decentralized finance (DeFi).

Major Players Fuel Growth: Fidelity, BlackRock, Franklin Templeton

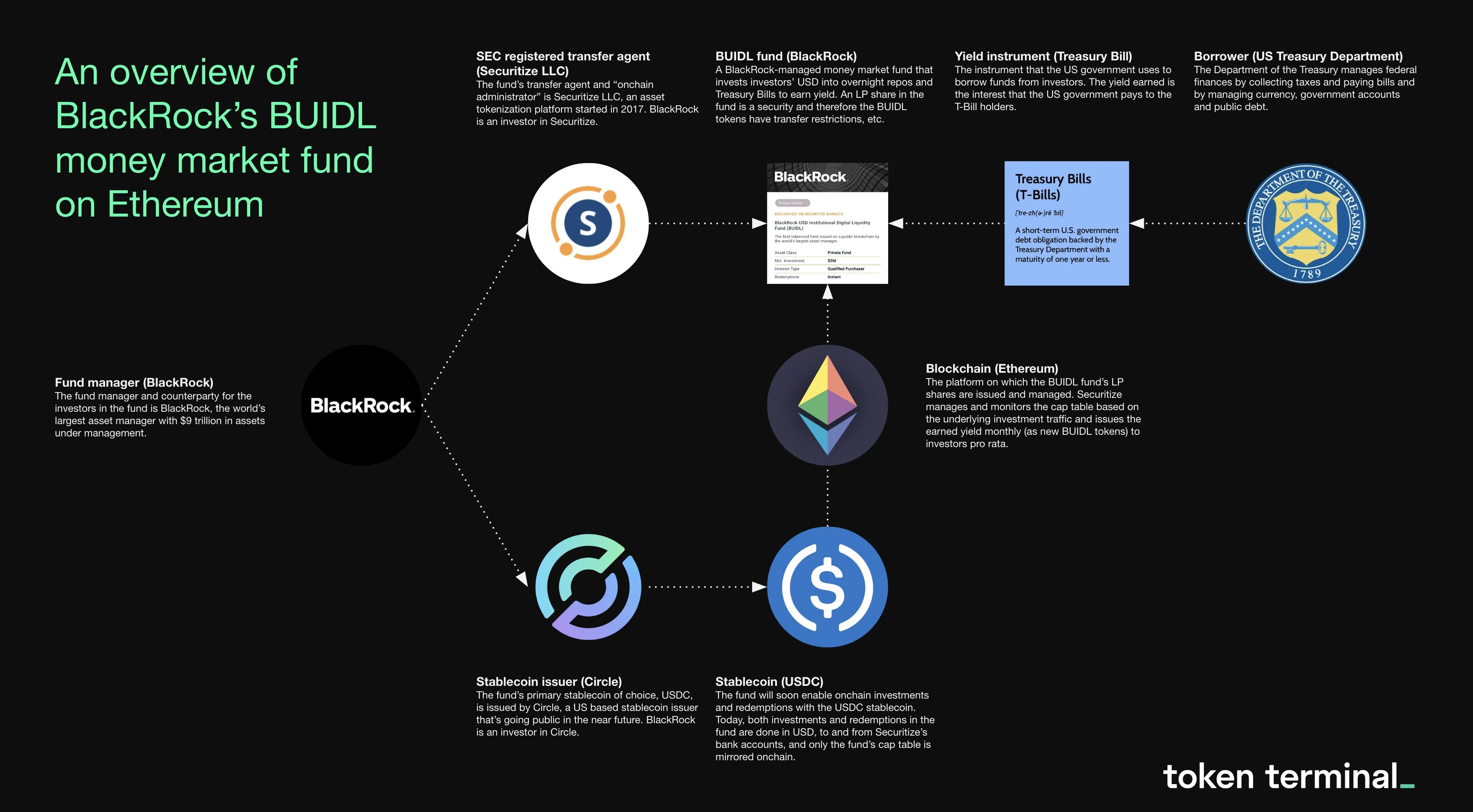

The surge in adoption is being driven by heavyweight asset managers. Fidelity’s Tokenized Treasury Fund (FDIT) debuted on Ethereum and rapidly amassed over $203 million in assets, signaling deepening institutional confidence in digital securities. BlackRock’s BUIDL fund set an even more ambitious pace, with its market capitalization soaring to $530 million by March 2024. Meanwhile, Franklin Templeton’s OnChain U. S. Government Money Fund achieved UCITS authorization in Luxembourg, paving the way for European pension funds and insurers to allocate capital into tokenized treasuries without regulatory headaches.

This competitive momentum has established Ethereum as the preferred settlement layer for tokenized fixed income products, even as multi-chain support (such as Stellar and IOTA) expands cross-border liquidity options.

How Tokenization Works: From T-Bills to Tradable Tokens

Tokenization is fundamentally about converting traditional securities, like Treasury bills or money market fund shares, into digital tokens that represent real-world value on a blockchain ledger. For example, Abu Dhabi-based Realize launched its T-BILLS Fund by investing in U. S. Treasury ETFs from BlackRock and State Street, then issuing corresponding tokens tradable 24/7 on Ethereum and IOTA networks.

This process delivers several benefits:

Top Advantages of Tokenized Treasuries for Institutions

-

Enhanced Liquidity and 24/7 Trading: Tokenized U.S. Treasuries on Ethereum, such as those in BlackRock’s BUIDL Fund and Fidelity’s FDIT, enable institutions to trade assets continuously, beyond traditional market hours, with near-instant settlement.

-

Reduced Transaction Costs: By utilizing tokenized Treasury-focused ETFs, like the Realize T-BILLS Fund, institutions can minimize fees and operational expenses associated with reinvestment and settlement, resulting in more efficient portfolio management.

-

Direct Integration with DeFi Platforms: Tokenized Treasuries can be used as collateral in decentralized finance protocols, allowing institutions to unlock additional yield opportunities. For example, BlackRock BUIDL tokens can be utilized in DeFi, providing new avenues for capital efficiency.

-

Improved Cross-Border Accessibility: Funds like Franklin Templeton’s OnChain U.S. Government Money Fund leverage both Ethereum and Stellar blockchains, enabling seamless access for global investors and simplifying compliance for European pension funds and insurers.

-

Regulatory Progress and Institutional Trust: The adoption of tokenized Treasuries is underpinned by evolving regulatory frameworks, such as the SEC’s 2024 roundtable on tokenization and the EU’s MiCA framework, which foster greater institutional confidence and participation.

- Continuous Liquidity: Unlike legacy markets with limited hours, these tokens can be traded globally around the clock with near-instant settlement.

- Reduced Transaction Costs: By wrapping ETFs instead of buying individual T-bills directly, funds minimize costs linked to reinvestment cycles.

- DeFi Integration: Token holders can use their assets as collateral across DeFi protocols, unlocking programmable yield strategies previously unavailable with traditional bonds or cash equivalents.

The ability to deploy tokenized treasury bill strategies within DeFi is particularly compelling for institutions searching for safe yield enhancements without sacrificing liquidity or compliance standards. To explore more about these opportunities and risks, see our dedicated guide: Yield Strategies Using Tokenized US Treasuries: Opportunities and Risks.

The Regulatory Landscape: Building Trust in On-Chain Fixed Income

This rapid evolution has not gone unnoticed by regulators. In 2024, the U. S. Securities and Exchange Commission (SEC) convened a roundtable on tokenization, signaling growing regulatory engagement with blockchain-based financial products. Across the Atlantic, Europe’s MiCA framework provided much-needed clarity for digital asset issuers and institutional allocators alike.

The result? Increased trust among risk-averse institutions who now view tokenized treasuries as viable complements, or even alternatives, to legacy money market instruments. As programmable yield fixed income becomes a reality, expect further harmonization between traditional finance (TradFi) practices and blockchain-native innovation.

As the market matures, risk management and operational due diligence have become essential for institutions considering tokenized treasuries on Ethereum. Custody solutions are adapting, with providers like BitGo offering institutional-grade safekeeping and multi-signature wallets to address counterparty and technical risks. Auditability is also enhanced by blockchain’s transparent ledger, every token movement and smart contract action is recorded and verifiable in real time, a significant leap from the opaque processes of legacy custodians.

Another key benefit is the ability to automate compliance. Smart contracts can enforce transfer restrictions, whitelisting, and regulatory checks programmatically. This reduces manual errors and ensures that only eligible investors can access specific classes of tokenized treasury assets. For global asset managers operating across jurisdictions, this automation streamlines onboarding while maintaining robust compliance standards.

Yield Strategies Unlocked: Programmable Income and Collateralization

The programmable nature of these digital assets is transforming yield generation. Institutions are now able to design bespoke strategies, such as auto-reinvesting maturing tokens into new issues, or deploying idle treasury tokens as collateral in DeFi lending protocols for incremental return. This flexibility was previously impossible with traditional custody chains or bank intermediaries.

For example, BlackRock’s BUIDL fund enables on-chain collateralization for stablecoin issuers and DeFi platforms seeking high-quality backing. Similarly, Fidelity’s FDIT offers programmable settlement features that allow for automated dividend distributions, reinvestment schedules, or even time-locked escrow arrangements tailored to institutional mandates. If you’re interested in how these approaches fit into broader liquidity management frameworks, explore our analysis: How Tokenized U. S. Treasuries on Ethereum Are Reshaping Institutional Liquidity.

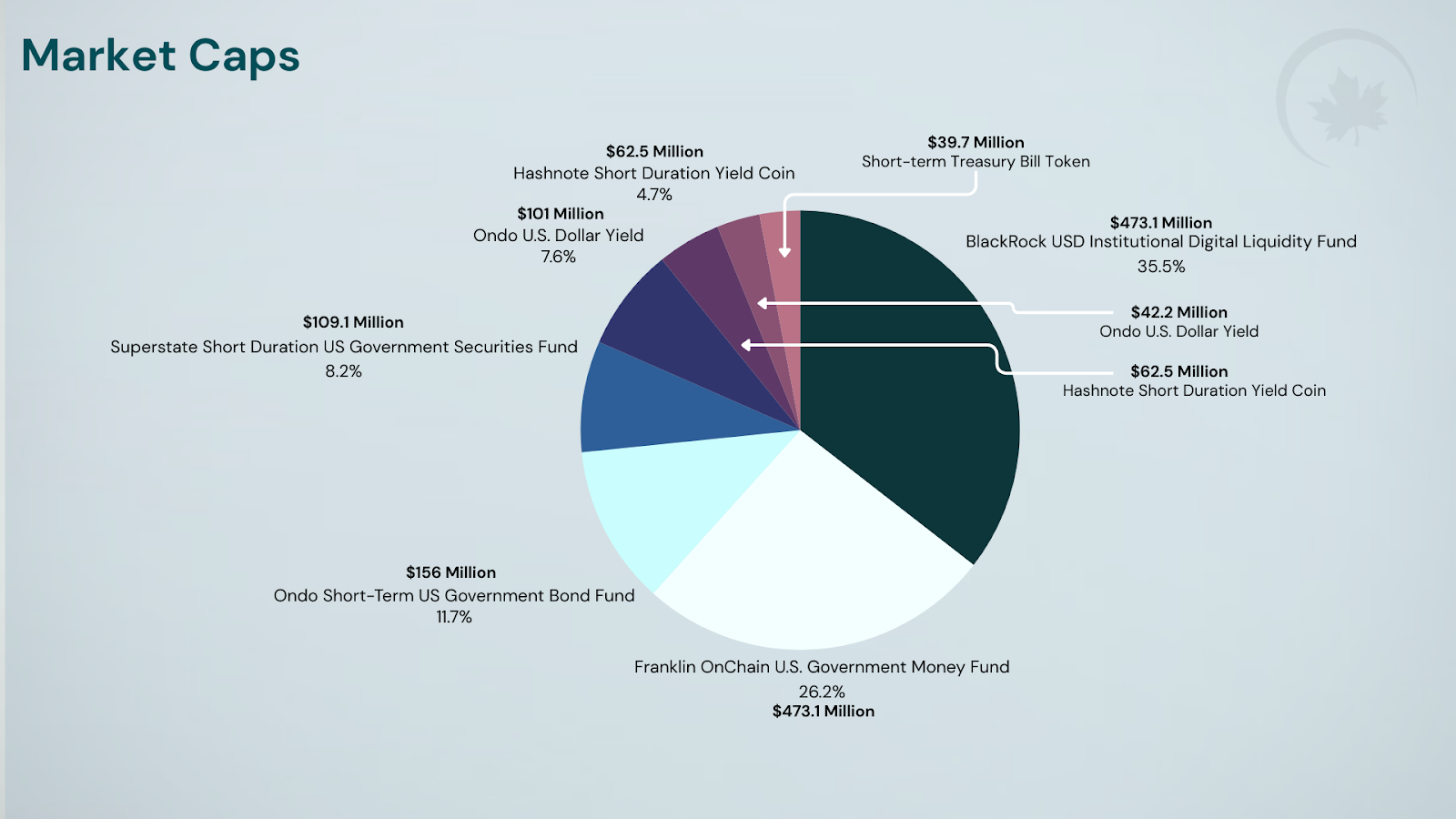

Top Tokenized U.S. Treasury Funds on Ethereum (2024)

| Fund Name | Issuer | Blockchain(s) | Current TVL / AUM | Yield (%) | On-Chain Activity / Integration |

|---|---|---|---|---|---|

| BlackRock BUIDL | BlackRock | Ethereum | $530 million | ~5.0% | DeFi collateral, 24/7 trading |

| Fidelity Digital Interest Token (FDIT) | Fidelity | Ethereum | $203.7 million | ~4.9% | DeFi integration, institutional-grade custody |

| Franklin OnChain U.S. Govt Money Fund | Franklin Templeton | Ethereum, Stellar | Not disclosed | ~4.8% | UCITS authorized, cross-border liquidity |

| Realize T-BILLS Fund | Realize (Abu Dhabi) | Ethereum, IOTA | Not disclosed | ~4.7% | Tokenizes ETFs, reduced reinvestment costs |

This evolution isn’t just theoretical, real capital is flowing in at record pace. The total value of on-chain U. S. Treasuries hit $2.4 billion in October 2024, with Fidelity FDIT alone crossing $203 million and BlackRock BUIDL reaching $530 million earlier in the year. These figures underscore a clear migration from proof-of-concept pilots to large-scale portfolio allocations by institutions seeking secure yield in a volatile macro environment.

Challenges Ahead: Scalability and Interoperability

Despite the momentum, challenges remain around blockchain scalability and cross-chain interoperability. Gas fees on Ethereum can spike during periods of network congestion, a concern for high-frequency trading of treasury tokens or large-scale redemptions. However, rollup solutions and layer-2 integrations are actively being explored by both asset managers and infrastructure providers to mitigate these costs.

The rise of multi-chain support (notably Stellar and IOTA) signals a future where tokenized treasuries move fluidly between blockchains, optimizing for cost, speed, or regulatory preference without sacrificing security or transparency.

Looking Forward: Digital Bonds as Core Portfolio Holdings

The events of 2024 have set a new standard: tokenized treasuries on Ethereum are now a credible core holding for institutional fixed income portfolios worldwide. As regulatory clarity improves and infrastructure matures further, expect deeper integration between programmable yield fixed income products and both TradFi systems and DeFi protocols.

This convergence empowers CIOs, risk managers, and allocators to pursue more agile strategies, balancing safety with innovation while maintaining full transparency over their holdings at all times. To see how leading asset managers are putting these ideas into practice today, review our case studies: Real World Adoption of Tokenized Treasuries by Asset Managers.