How Fidelity’s Tokenized U.S. Treasuries Fund on Ethereum Is Reshaping Institutional Fixed-Income in 2025

2025 has become a watershed year for institutional fixed-income, with Fidelity’s launch of the Fidelity Digital Interest Token (FDIT) on Ethereum signaling a new era for on-chain U. S. Treasuries. In August, Fidelity Investments quietly rolled out FDIT, a tokenized share class of its flagship Treasury money market fund (FYOXX), now live as an ERC-20 asset on Ethereum. The implications are profound: by bridging the $7.3 billion tokenized Treasury market with the world’s most established blockchain, Fidelity is not simply following a trend but actively shaping the future of digital securities.

Why Fidelity’s FDIT Is a Game Changer for Institutional Investors

The arrival of FDIT is more than just another product launch – it marks a tipping point in how institutions access and manage fixed-income exposure. For decades, U. S. Treasuries have been the bedrock of institutional portfolios, prized for liquidity and safety but hampered by legacy infrastructure and settlement friction. With FDIT, each token represents fractional ownership in Fidelity’s Treasury MMF, offering 24/7 transferability and real-time settlement – all without intermediaries.

This model slashes operational bottlenecks and opens up new liquidity pathways for asset managers, hedge funds, DAOs, and even crypto-native treasuries seeking yield with reduced counterparty risk. The fund charges a competitive 0.20% management fee and is custodied by Bank of New York Mellon, ensuring robust compliance and trust while leveraging blockchain rails.

The Numbers: Tokenized Treasuries Surge Past $7 Billion

Context is key: as of November 2025, tokenized U. S. Treasuries have exploded past $7.3 billion, with Ethereum hosting roughly 70% of these assets according to ethnews. com. Fidelity’s FDIT alone amassed over $200 million in assets within weeks – an impressive feat underscoring pent-up demand among large institutional players.

Interestingly, two investors currently dominate the fund’s cap table (one holding the vast majority), reflecting how early-stage adoption often concentrates among sophisticated players before broadening out to a wider base as operational confidence grows.

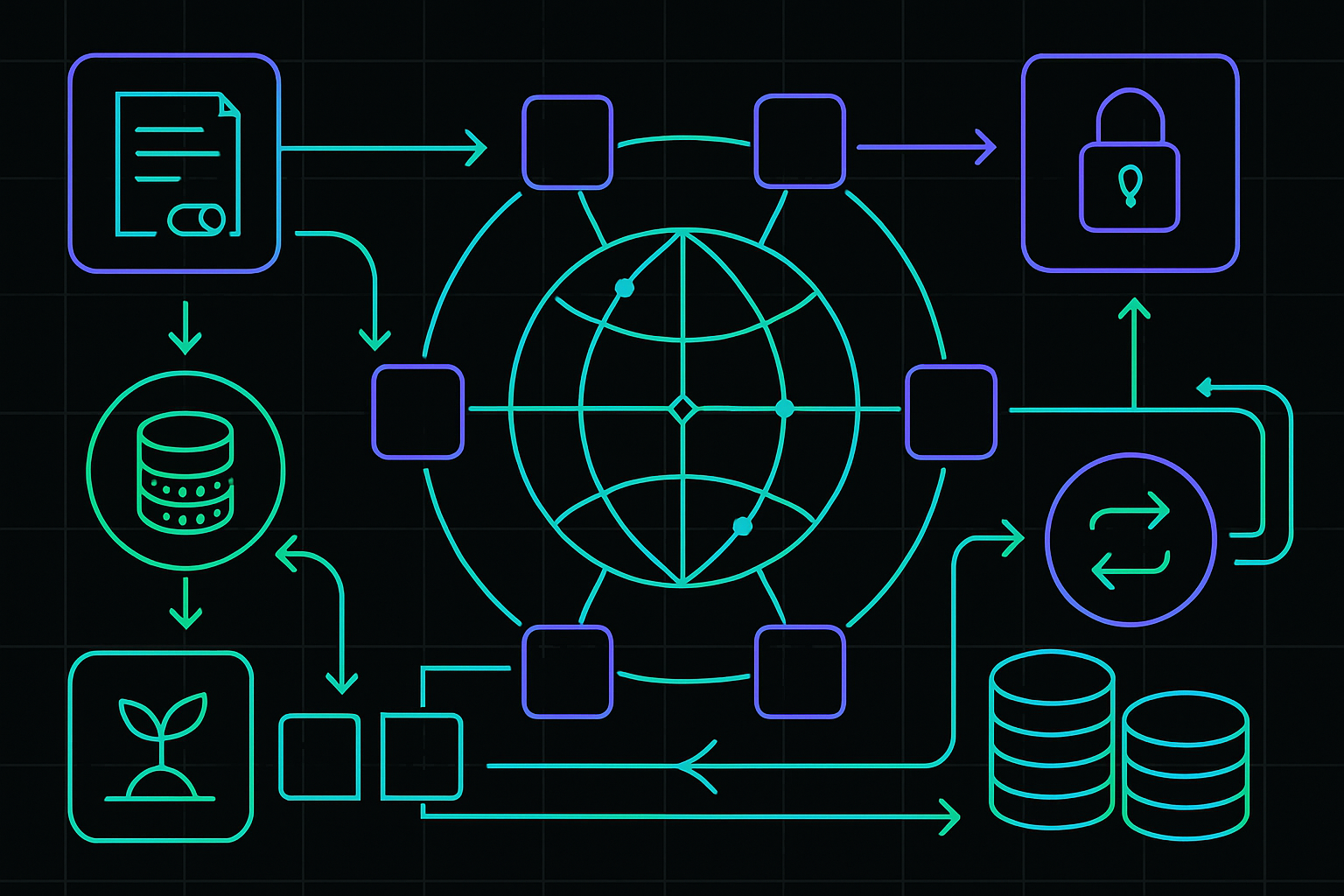

How Does On-Chain Treasury Tokenization Work?

The mechanics behind FDIT are elegantly simple yet transformative. Investors subscribe to shares in Fidelity’s Treasury MMF through traditional onboarding but receive ERC-20 tokens representing their stake. These tokens are then freely transferable on Ethereum between whitelisted wallets, enabling secondary market activity at unprecedented speed and efficiency compared to legacy transfer agent models.

This structure enables seamless integration with DeFi protocols for collateralization or automated treasury management – while still adhering to regulatory KYC/AML requirements thanks to permissioned wallet lists maintained by Fidelity.

If you’re curious about what this means for institutional investors specifically, check out our deep dive here: What Institutional Investors Need to Know About Fidelity’s Tokenized U. S. Treasuries Fund.

With the operational rails in place, FDIT’s early traction is forcing a rethink of what fixed-income can look like in a digitally native era. The speed and transparency of on-chain settlement are already attracting not just crypto-native treasuries but also traditional asset managers seeking to streamline back-office operations. By eliminating legacy friction, tokenized Treasuries like FDIT make it possible to rebalance portfolios or respond to market events 24/7, a sharp contrast to the 9-to-5 cycles that have long defined bond markets.

For compliance-minded institutions, the fact that FDIT is custodied by Bank of New York Mellon and issued by Fidelity brings a level of trust and operational rigor that has often been missing from earlier experiments in DeFi-based fixed income. The ERC-20 structure ensures interoperability with the broader Ethereum ecosystem, opening doors for composability with lending protocols, automated cash management, and even programmable payout schedules for structured products.

Competition Heats Up: BlackRock, Franklin Templeton, and WisdomTree Follow Suit

Fidelity’s move didn’t happen in a vacuum. In 2025, other asset management giants like BlackRock and Franklin Templeton also expanded their on-chain Treasury offerings. This competitive surge is driving innovation across the sector, lower fees, improved user interfaces, and better on-chain analytics are now table stakes as institutional clients demand more sophisticated tools for managing digital securities.

The result? A rapidly maturing market where tokenized fixed-income products are no longer an experiment but a core allocation tool. As more funds launch on Ethereum (and potentially other blockchains), interoperability standards and regulatory clarity will be crucial for mainstream adoption.

Risks, Hurdles and What Comes Next

Despite its promise, tokenized Treasuries aren’t without risks. Liquidity remains concentrated among a handful of large players, at least for now, which could limit price discovery or secondary trading depth. Regulatory frameworks continue to evolve as authorities weigh how best to oversee blockchain-based securities; any shift in guidance could impact fund structures or transferability rules overnight.

Technical risks also persist: smart contract vulnerabilities or blockchain congestion could disrupt transfers or settlements at scale. However, with major custodians involved and ongoing audits by leading security firms, these risks are being actively managed.

Why This Matters for Institutional Portfolios

The big picture? Tokenization is pushing fixed-income into the digital age, making U. S. Treasuries programmable assets that can be integrated into everything from DAO treasuries to global asset manager strategies. For institutions willing to embrace this shift early, there’s an opportunity not only for operational alpha but also for shaping the standards that will define digital securities for decades.

If you’re interested in how these developments reshape institutional access to fixed income, and what comes next as adoption broadens, explore our related coverage at How Fidelity’s Tokenized U. S. Treasuries Fund Changes Institutional Access.

The bottom line: With $7.3 billion now locked in tokenized U. S. Treasuries (and growing), Fidelity’s FDIT isn’t just a milestone, it’s a signal flare for where institutional finance is heading next.