thBILL as DeFi Collateral: Borrowing Against Tokenized T-Bills on Morpho and Stable

In the evolving landscape of decentralized finance, tokenized U. S. Treasury bills like thBILL are reshaping how investors approach collateral. Trading at $1.01 with a 24-hour change of $-0.001000 (-0.0990%), thBILL offers a stable, yield-bearing option backed by institutional-grade assets from regulated issuers such as tULTRA. This positions it perfectly for borrowing on platforms like Morpho and Stable, blending the security of traditional treasuries with DeFi’s flexibility. As tokenized T-bills DeFi integrations mature, thBILL collateral unlocks leverage without sacrificing the low-risk profile that draws global institutions.

thBILL’s rapid ascent underscores a pivotal shift. Surpassing $200 million in assets under management, it ranks among the fastest-growing tokenized Treasury offerings. Commitments from Stable and Theo exceeding $100 million to Ultra highlight converging TradFi and DeFi forces. Now leveraging Solana for collateral backing, thBILL alters its risk profile positively, enhancing on-chain composability while maintaining exposure to short-duration U. S. Treasuries.

thBILL’s Core Appeal as RWA Collateral

What sets thBILL apart in the thBILL collateral arena is its design as a basket of tokenized T-bills. Issued by entities like Wellington Management’s ULTRA via Theo, it delivers built-in yield and liquidity. Holders benefit from seamless on-chain access, with the token hovering steadily at $1.01 amid minor fluctuations; its 24-hour high reached $1.02, low $1.01. This stability makes it ideal for tokenized T-bills DeFi strategies, where borrowers tap equity-like leverage against fixed-income safety.

[price_widget: Real-time price display for Theo Short Duration US Treasury Fund (thBILL) at $1.01]

From a global markets perspective, thBILL bridges forex and commodities volatility with predictable Treasury yields. Its integration into Theo Network’s ecosystem fosters a stable core asset, appealing to those diversifying beyond crypto natives. Platforms like Morpho and Euler Labs already embrace similar RWAs, such as BlackRock’s BUIDL, signaling thBILL’s timely entry into lending markets.

Morpho V2: Empowering thBILL Morpho Borrowing

Morpho’s V2 update marks a game-changer for thBILL Morpho borrowing. By supporting real-world assets as collateral, the protocol introduces market-driven fixed-rate, fixed-term loans tailored for institutions. Users can now deposit thBILL at $1.01 valuation to borrow assets like USDC, mirroring Coinbase’s Bitcoin-backed loans up to $100,000 on the same platform. This enhances liquidity for tokenized treasuries, allowing holders to unlock capital without selling yield-generating positions.

Consider the mechanics: supply thBILL to Morpho’s vaults, where market dynamics set borrow rates. With thBILL’s low volatility, collateral factors remain conservative, minimizing liquidation risks. This setup suits enterprise users seeking customizable terms, from short-term bridges to longer hedges against currency flows. In my view, Morpho’s RWA pivot accelerates Theo Network thBILL adoption, positioning it as a cornerstone for on-chain fixed income.

thBILL Tokenized T-Bills Price Prediction 2027-2032

Forecast incorporating DeFi TVL growth, Treasury yields, RWA adoption, and market cycles (baseline 2026: $1.01)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.97 | $1.01 | $1.04 | 0.0% |

| 2028 | $0.98 | $1.02 | $1.05 | +0.99% |

| 2029 | $0.99 | $1.025 | $1.06 | +0.49% |

| 2030 | $1.00 | $1.03 | $1.07 | +0.49% |

| 2031 | $1.00 | $1.035 | $1.08 | +0.49% |

| 2032 | $1.01 | $1.04 | $1.10 | +0.48% |

Price Prediction Summary

thBILL is projected to exhibit strong price stability near $1.00 parity due to its backing by U.S. Treasury bills, with average prices gradually appreciating to $1.04 by 2032 amid DeFi integrations and RWA growth. Minimums account for bearish scenarios like regulatory hurdles or yield spikes; maximums reflect bullish adoption and TVL expansion.

Key Factors Affecting thBILL Tokenized T-Bills Price

- DeFi TVL and RWA sector expansion driving demand

- Fluctuations in U.S. Treasury yields impacting NAV

- Regulatory developments for tokenized real-world assets

- Platform integrations (e.g., Morpho, Stable, Solana)

- Competition from other tokenized Treasury products

- Broader crypto market cycles and institutional adoption

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Stable Protocol’s Role in Treasury Leverage

Complementing Morpho, Stable protocol integrates Stable protocol treasuries like thBILL for borrowing against tokenized T-bills. Over $100 million anchored in Libeara-backed products underscores confidence in this convergence. On Stable, thBILL serves as premium collateral, enabling users to borrow stablecoins while earning underlying Treasury yields. The protocol’s focus on RWA treasury yield optimization means depositors capture spreads between lending rates and T-bill returns.

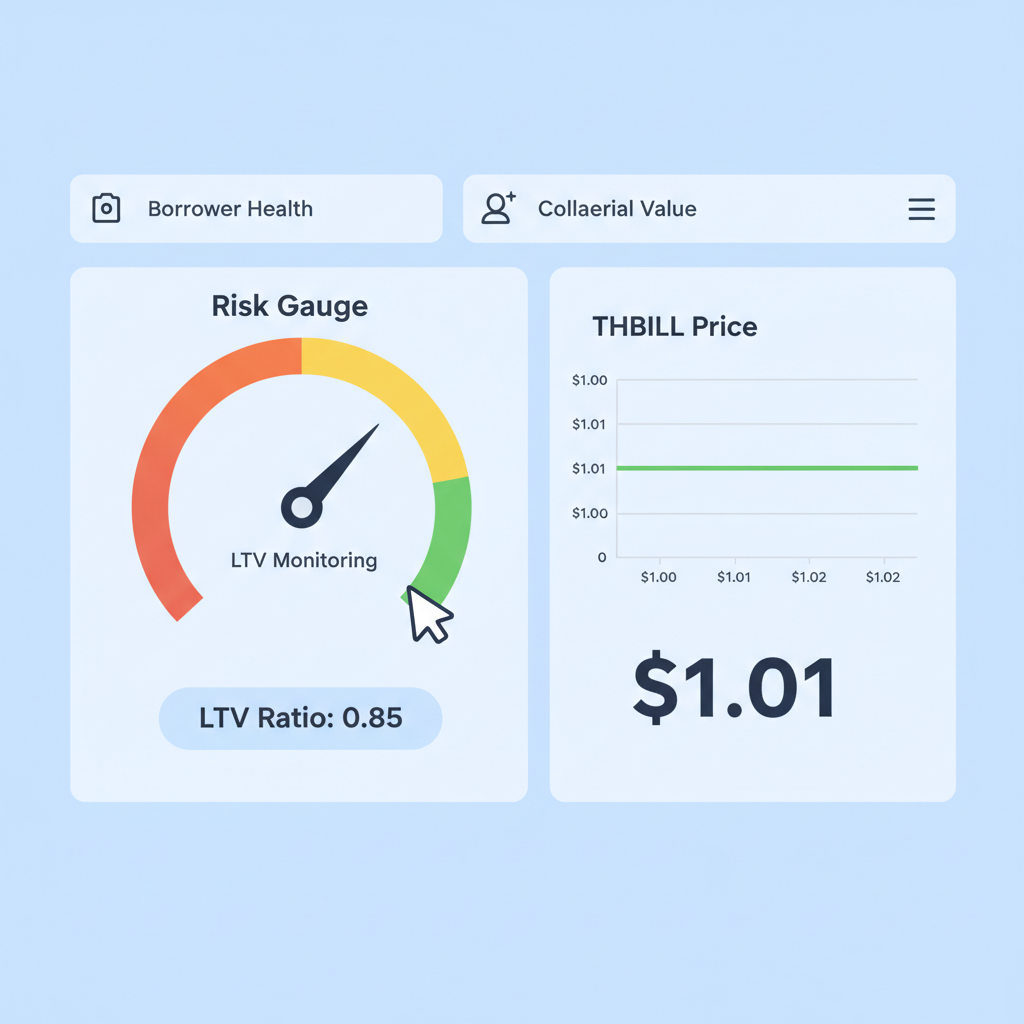

Solana’s recent backing for thBILL further bolsters Stable’s efficiency, reducing gas costs and boosting throughput for high-volume borrowing. At current $1.01 pricing, a hypothetical $1 million thBILL position might collateralize $800,000 in borrows at 80% LTV, depending on market conditions. This leverage amplifies returns for sophisticated players, yet thBILL’s regulated underpinnings keep systemic risks in check. Globally, this model resonates in regions eyeing dollar-pegged assets amid fiat instability.

thBILL’s Solana integration sharpens its edge on Stable, where high-speed transactions support frequent rebalancing of leveraged positions. This setup appeals to forex traders hedging against currency swings, using RWA treasury yield as a ballast. In emerging markets, where dollar access is prized, thBILL collateral democratizes leverage once reserved for offshore banks.

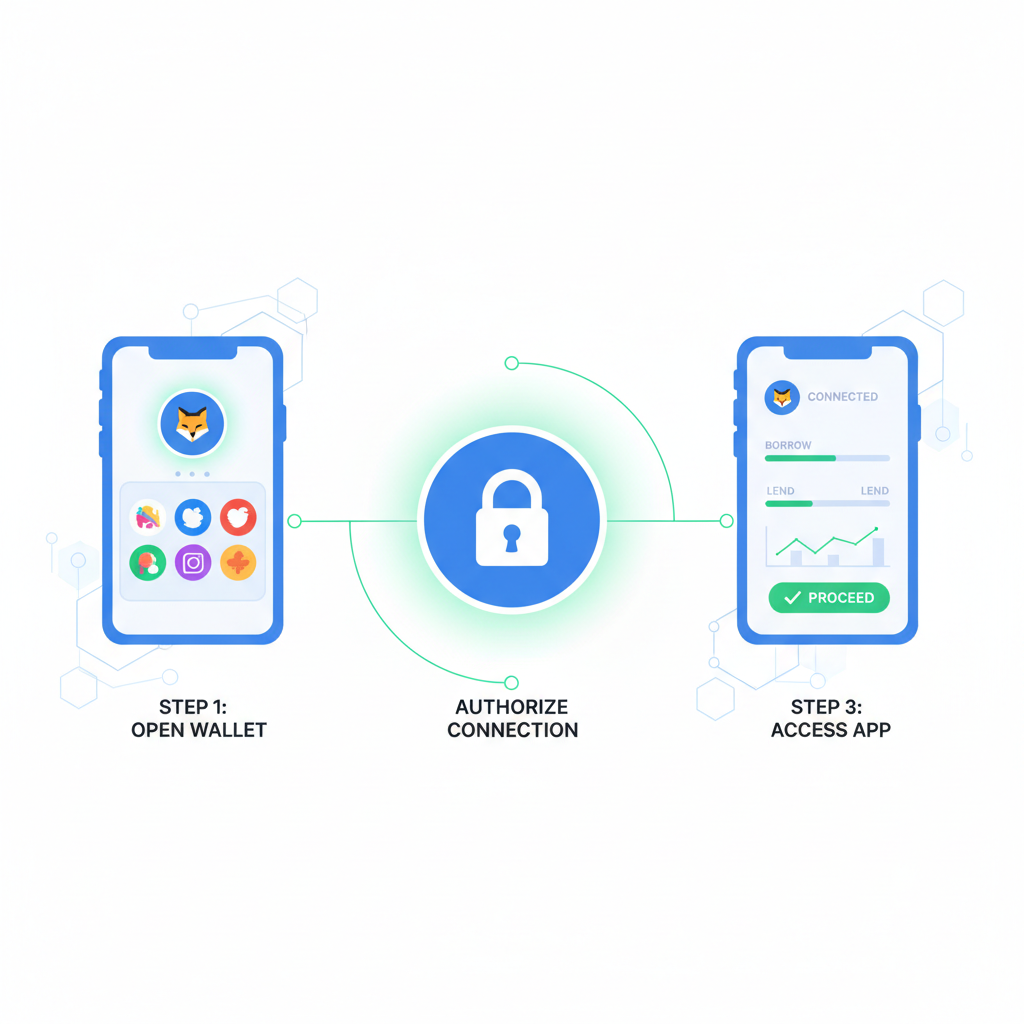

Step-by-Step: Leveraging thBILL on Morpho and Stable

Navigating these platforms requires precision. First, acquire thBILL through Theo Network at its stable $1.01 peg. Bridge to the relevant chain, whether Ethereum for Morpho or Solana for enhanced Stable operations. Deposit into vaults, monitor health factors, and borrow conservatively. Advanced users layer strategies, pairing thBILL with perps for amplified on-chain T-bill leverage. My experience trading across markets suggests starting small; thBILL’s predictability rewards patience over aggression.

Beyond mechanics, thBILL Morpho borrowing and Stable integrations signal DeFi’s maturation. Morpho’s fixed-term loans echo TradFi repos, yet with blockchain transparency. Stable’s yield optimization captures alpha from Treasury spreads, vital as rates hover near multi-year lows. With thBILL at $1.01, down slightly by $-0.001000 (-0.0990%) over 24 hours, its resilience shines amid crypto volatility.

Risks vs. Rewards in thBILL Collateral Strategies

No collateral is risk-free, even one backed by U. S. Treasuries. thBILL holders face smart contract vulnerabilities, though Morpho and Stable’s audits mitigate this. Oracle discrepancies could trigger premature liquidations, a concern in fast markets. Yet, rewards dominate: earn yield on collateral while borrowing for higher-upside plays. At 80-90% LTVs typical for RWAs, a $1.01 thBILL deposit yields borrowing power with minimal upkeep.

Globally, this model influences capital flows. European institutions, navigating MiCA regulations, view tokenized T-bills DeFi as compliant gateways. In Asia, where commodities dominate, thBILL hedges inflation without forex exposure. Theo Network thBILL’s $200 million AUM milestone, fueled by $100 million commitments, validates this trajectory. Solana’s collateral backing adds redundancy, diversifying from Ethereum congestion.

Looking ahead, expect deeper composability. Pair thBILL with lending on Aave or perps on Hyperliquid for turbocharged returns. Regulatory nods, like potential SEC clarity on tokenized funds, could propel AUM past $500 million. For investors, thBILL at $1.01 remains a low-volatility anchor in stormy seas, blending TradFi safety with DeFi innovation.

Key Considerations for thBILL Users

Institutional appetite grows as platforms like Euler follow Morpho’s lead. thBILL’s basket structure, drawing from tULTRA and peers, ensures diversification within Treasuries. Its 24-hour range ($1.02 high, $1.01 low) underscores appeal for conservative leverage. From my vantage in global markets, thBILL collateral heralds a fixed-income renaissance on-chain, where yield meets velocity without borders.