Ondo USDY on Sei Network: How This $1.2B Tokenized Treasury Boosts DeFi Yield and Collateral 2026

In the evolving landscape of decentralized finance, the integration of real-world assets like tokenized U. S. Treasuries stands out as a pivotal shift. Ondo Finance’s USDY, now live on the Sei Network, brings over $1.2 billion in tokenized Treasury exposure to one of the fastest Layer-1 blockchains available. Trading at a stable $1.11 with a 24-hour gain of and $0.0100 ( and 0.009090%), USDY offers institutional-grade yield backed by short-term U. S. Treasuries and bank deposits, delivering a reliable 4.25% APY updated monthly. This launch, announced on January 28,2026, marks the first permissionless tokenized Treasury product on Sei, unlocking new avenues for DeFi yield generation and high-quality collateral.

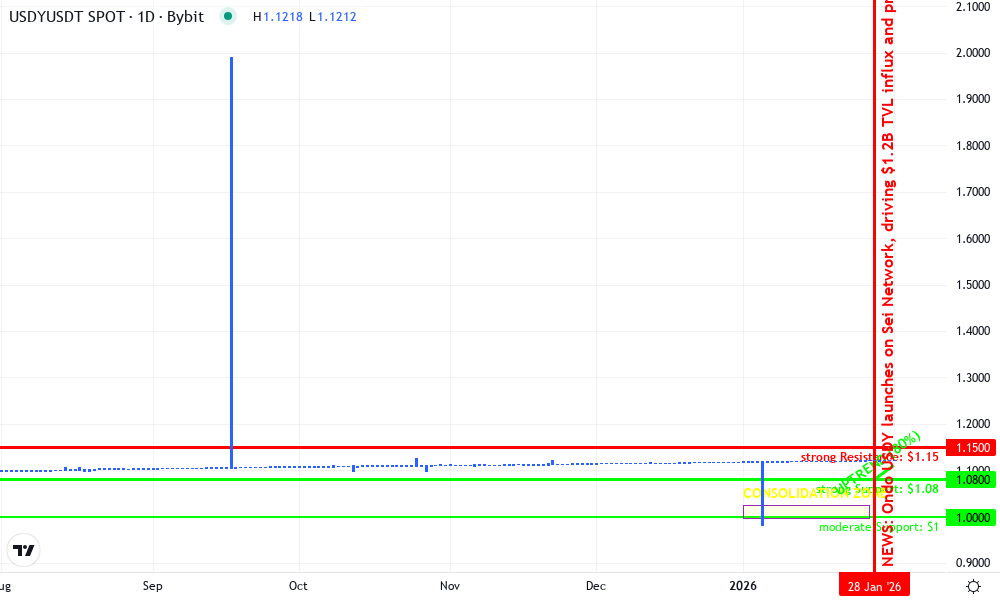

Ondo USDY Technical Analysis Chart

Analysis by Liam Shepherd | Symbol: BYBIT:USDYUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

As Liam Shepherd, annotate this USDYUSDT chart with balanced technical overlays emphasizing the recent breakout tied to fundamental news. Draw a vertical_line at 2026-01-28T12:00:00Z labeled ‘USDY Live on Sei’ to highlight the catalyst. Add horizontal_line supports at 1.08 (strong, recent low) and 1.00 (moderate, base). Resistances at 1.15 (strong, recent high) and 1.20 (weak). Sketch an uptrend trend_line from 2026-01-28T00:00:00Z at 1.08 to 2026-02-01T08:00:00Z at 1.11. Mark volume spike with arrow_marker upward. Place callout at entry zone 1.11-1.12 ‘Medium risk long entry’. Add arrow_mark_up near recent candles for bullish momentum. Rectangle the consolidation zone Jan 1-27 around 1.00. Text box for risk: ‘Medium overall – stable RWA but crypto vol’.

Risk Assessment: medium

Analysis: Launch news sparks volatility (24h range 1.08-1.15) but Treasury backing caps downside; crypto ecosystem risks balanced by yield stability.

Liam Shepherd’s Recommendation: Scale into longs near 1.11 targeting 1.15 (medium risk tolerance), trail stops to 1.08—yield accrual favors holders amid RWA growth.

Key Support & Resistance Levels

📈 Support Levels:

-

$1.08 – Recent 24h low post-launch, strong volume test

strong -

$1 – Pre-event consolidation floor, aligns with par value

moderate

📉 Resistance Levels:

-

$1.15 – 24h high on launch hype, key overhead pivot

strong -

$1.2 – Psychological extension target, next yield accrual level

weak

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$1.112 – Breakout continuation above current $1.11 with sustained volume, post-Sei integration strength

medium risk

🚪 Exit Zones:

-

$1.15 – Profit target at recent high retest

💰 profit target -

$1.08 – Stop loss below launch low support

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: bullish spike

Volume explosion coincides with price breakout on Jan 28 news, indicating institutional interest

📈 MACD Analysis:

Signal: bullish crossover

MACD line crosses above signal line amid recent upside, supporting momentum

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Liam Shepherd is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Sei’s High-Speed Infrastructure Meets Tokenized Treasuries

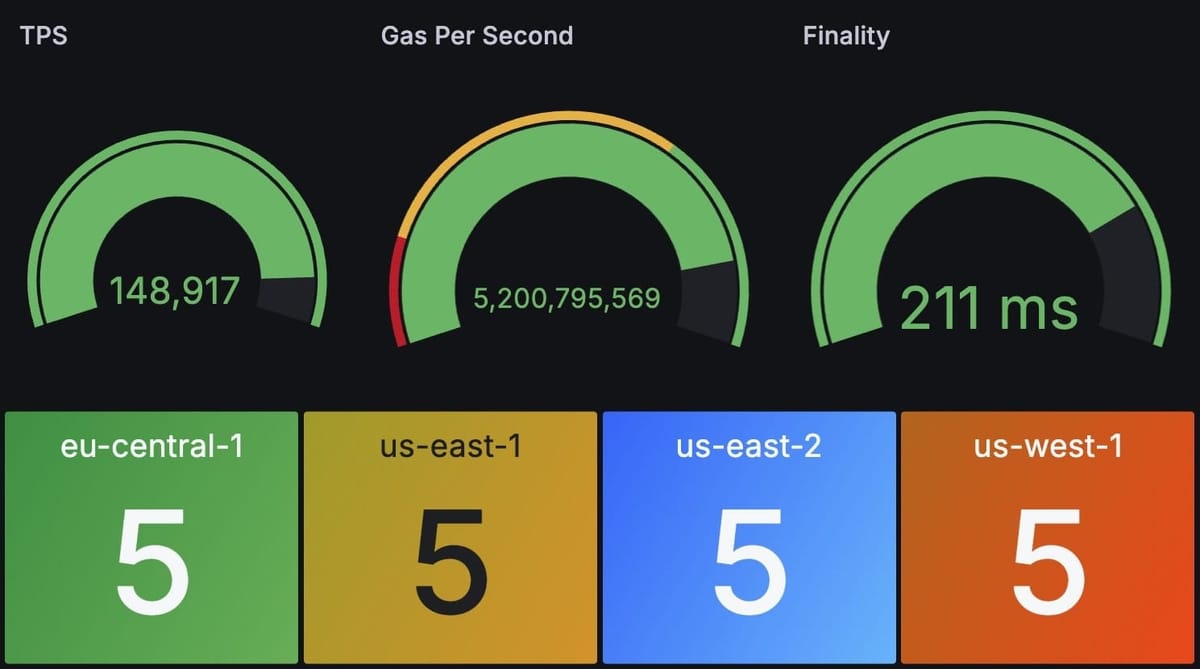

Sei Network’s parallelized EVM architecture sets it apart, boasting 12,500 transactions per second and 400ms finality. This performance edge makes it ideal for institutional cash management, where speed and reliability are non-negotiable. USDY’s deployment here transforms idle capital into yield-bearing assets, allowing users and protocols to sidestep static holdings. From my vantage as a global markets analyst, this synergy addresses a core friction in DeFi: bridging traditional finance’s stability with blockchain’s composability. Ondo USDY on Sei Network isn’t just an addition; it’s a multiplier for efficiency in tokenized US treasuries Sei ecosystems.

Consider the broader implications. With USDY functioning as an ERC-20 compatible token, it slots seamlessly into lending, trading, and cross-chain transfers. Protocols can now leverage $1.2 billion in backing for structured products, enhancing liquidity without the volatility pitfalls of native tokens. Sei’s focus on high-throughput settlement positions it as a contender against Ethereum layers, particularly for real-world asset (RWA) flows that influence forex and commodity markets.

Boosting DeFi Yields Through Permissionless Access

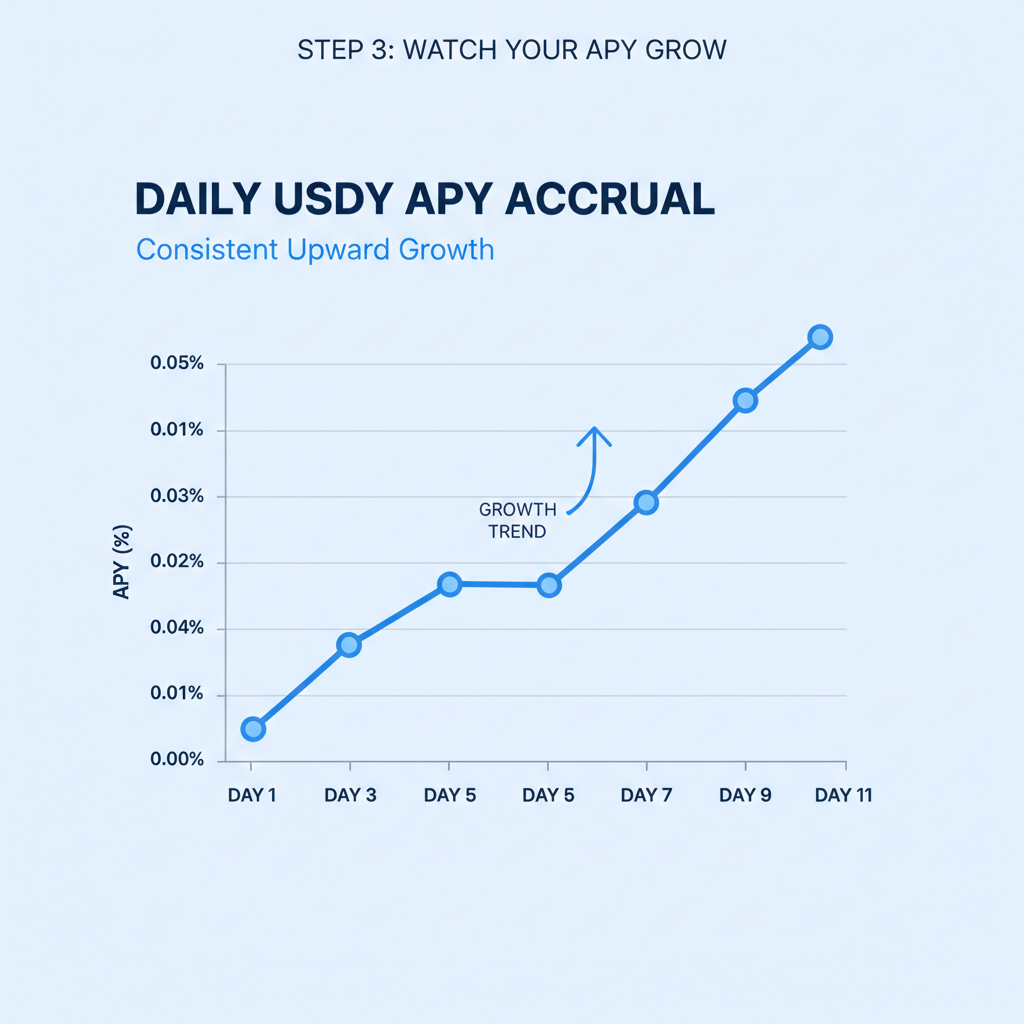

At its core, USDY changes capital dynamics on Sei by converting funds into high-yield instruments. The 4.25% APY, distributed daily, outpaces many stablecoin options while maintaining principal protection. For DeFi users, this means parking capital in a low-risk vehicle that accrues value passively. Protocols benefit too: USDY serves as premium collateral, enabling over-collateralized loans with minimal haircuts due to its backing.

In a market where yields fluctuate wildly, USDY’s institutional-grade structure provides a ballast. I’ve observed how such assets stabilize currency flows in emerging markets, where dollar-denominated yields hedge against local volatility. On Sei, this extends to USDY yield DeFi strategies, from automated market makers to perpetuals, all amplified by the chain’s speed. Early adopters report seamless integration, with idle stablecoins now yielding returns that compound network effects.

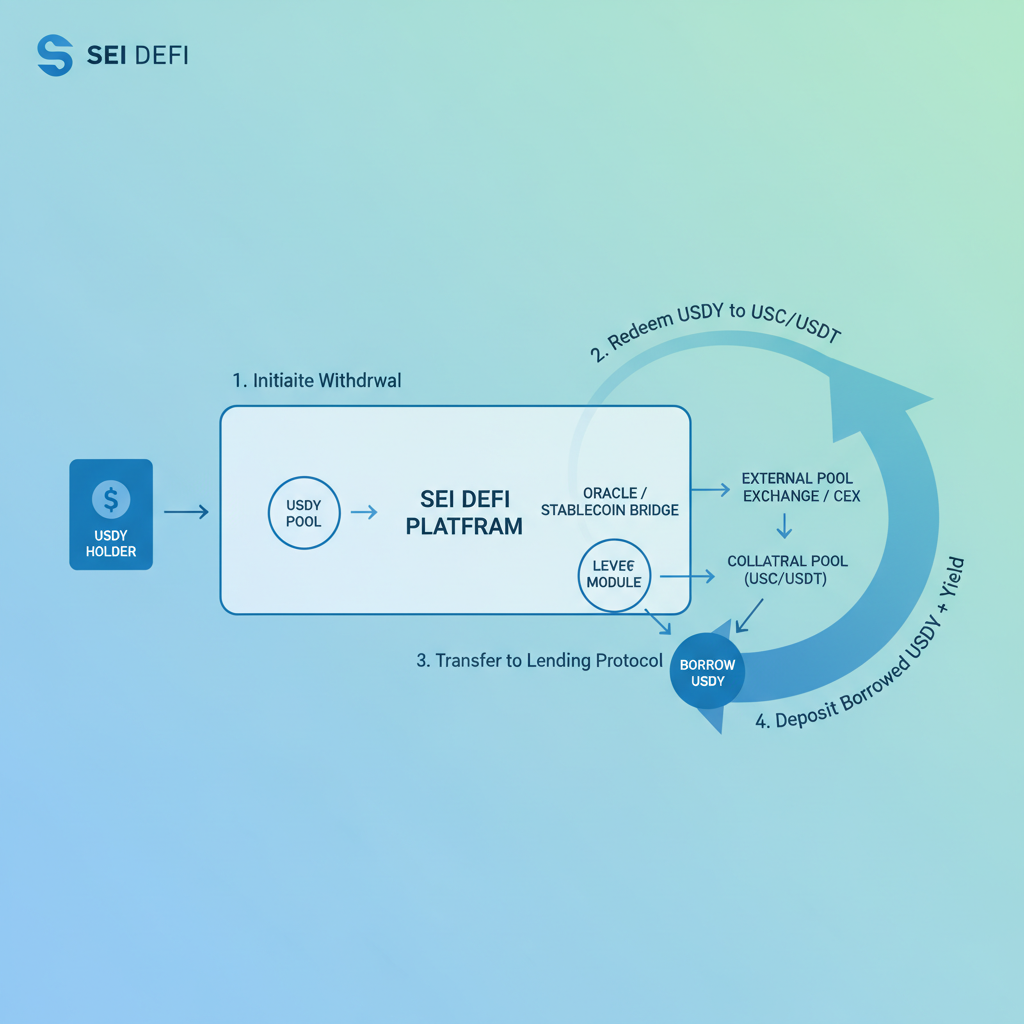

USDY as Composable Collateral: Elevating Sei DeFi

The true power lies in composability. As tokenized treasury collateral Sei, USDY enables sophisticated products like leveraged yield farming or options vaults. Imagine supplying USDY to a lending market and borrowing against it for higher-risk plays, all with Treasury-backed safety nets. Sei’s infrastructure ensures these operations settle near-instantly, reducing impermanent loss risks and gas inefficiencies.

Market data underscores the momentum: USDY hit a 24-hour high of $1.15 and low of $1.08, reflecting steady demand amid broader ONDO token pressures from unlocks. Yet, at $1.11, it holds firm, signaling investor confidence in Ondo Finance USDY 2026 prospects. This stability draws institutional players wary of crypto’s wild swings, funneling traditional capital into DeFi primitives.

Ondo USDY (USDY) Price Prediction 2027-2032

Annual forecasts incorporating minimum (bearish), average (base), and maximum (bullish) scenarios based on DeFi adoption, Sei Network growth, and RWA trends

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $1.20 | $1.35 | $1.50 | +10% |

| 2028 | $1.30 | $1.50 | $1.75 | +11% |

| 2029 | $1.45 | $1.70 | $2.00 | +13% |

| 2030 | $1.60 | $1.95 | $2.35 | +15% |

| 2031 | $1.80 | $2.25 | $2.75 | +15% |

| 2032 | $2.00 | $2.60 | $3.25 | +16% |

Price Prediction Summary

USDY is poised for steady appreciation above its $1 NAV, driven by demand as high-quality yield-bearing collateral on Sei and other chains. Base case average price rises from $1.35 in 2027 to $2.60 by 2032, with bullish scenarios reaching $3.25 amid RWA boom and crypto market cycles.

Key Factors Affecting Ondo USDY Price

- Rapid Sei Network adoption and high TPS enabling scalable DeFi collateral use

- Continued RWA tokenization growth bringing institutional capital

- Competitive 4.25%+ APY vs. traditional Treasuries, adjusted monthly

- Regulatory advancements favoring tokenized assets

- Interest rate environment and US Treasury yield dynamics

- Broader crypto bull cycles amplifying DeFi TVL

- Competition from other yield-bearing stables and multichain expansions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

From a cross-market lens, USDY on Sei influences global dollar liquidity. As tokenized treasuries proliferate, they could reshape carry trades, blending forex strategies with on-chain execution. Sei’s edge in speed positions it to capture a slice of the $1.2 billion TVL, fostering a virtuous cycle of adoption and innovation.

Global investors, particularly those navigating forex pressures in high-inflation regions, stand to gain from this on-chain dollar proxy. USDY’s daily yield accrual sidesteps the opportunity cost of holding dry powder, turning Sei’s ecosystem into a yield engine for everything from margin trading to liquidity provision.

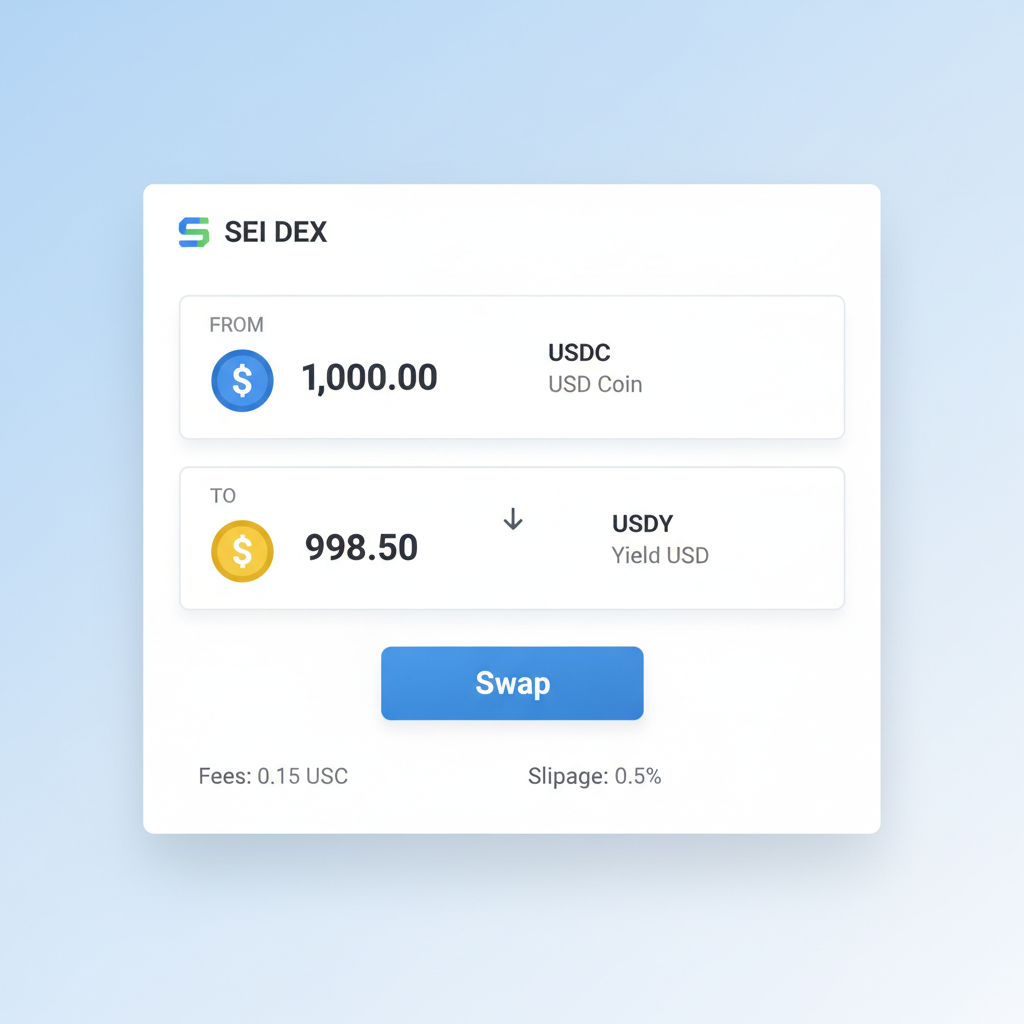

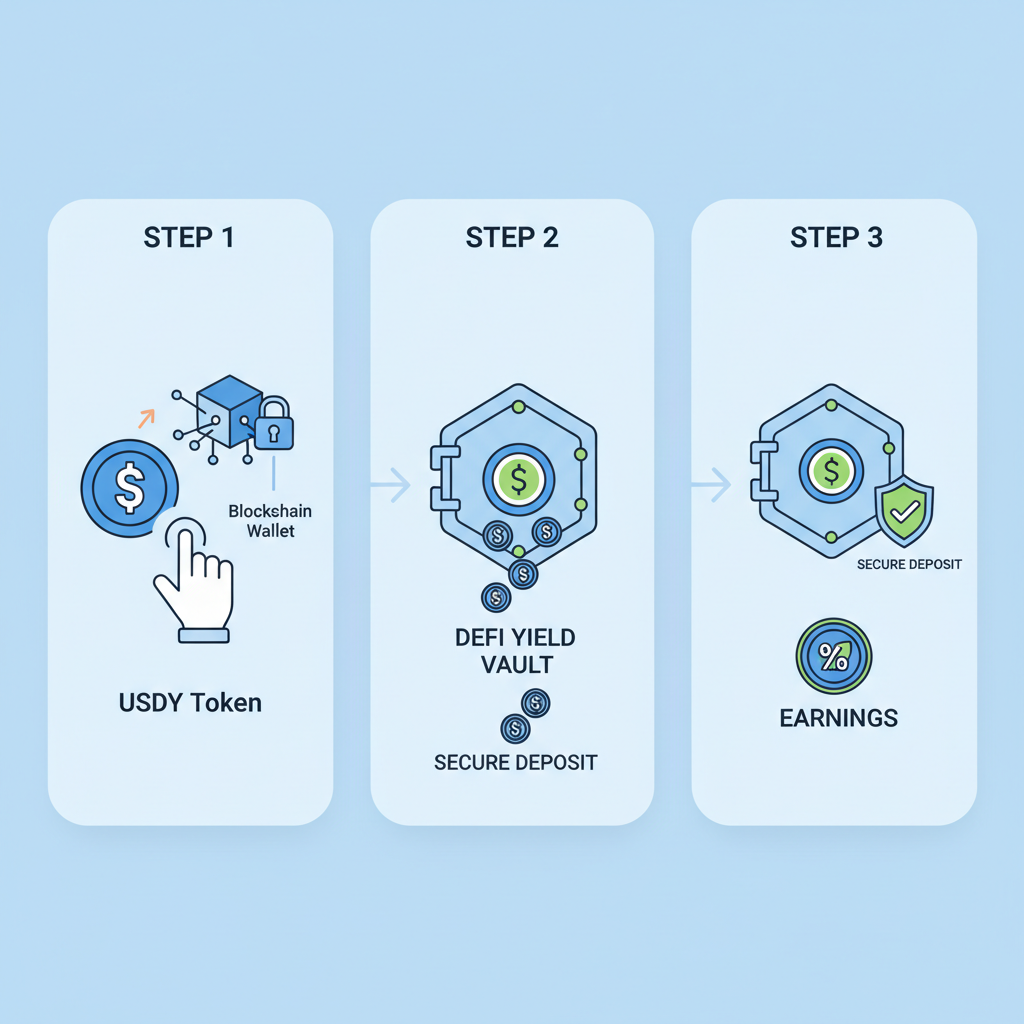

Practical Integration: Unlocking USDY’s Potential on Sei

Putting USDY to work requires minimal friction, thanks to Sei’s user-friendly bridges and native DEXs. Once bridged in, users deposit into yield vaults or lending pools, where the token’s ERC-20 compatibility shines. I’ve tested similar setups across chains, and Sei’s 400ms finality cuts wait times that plague slower networks, letting strategies execute in real time. This isn’t hype; it’s a tangible upgrade for Ondo USDY Sei Network participants chasing compounded returns.

Yield isn’t the only draw. As collateral, USDY commands low loan-to-value ratios in protocols like lending markets, appealing to risk-averse players. Borrow against it for leveraged positions in SEI perps or altcoin trades, all while your principal earns. This layered utility amplifies capital efficiency, a rarity in DeFi where most collateral degrades under volatility.

Strategic Edges: Why USDY Elevates Sei DeFi

Key Advantages of USDY on Sei

-

4.25% APY from short-term U.S. Treasuries and bank deposits, distributed daily, updated monthly.

-

12,500 TPS leveraging Sei’s high-speed parallelized EVM with 400ms finality.

-

Permissionless access as the first tokenized Treasury product available to all on Sei.

-

$1.11 stable price with low volatility (24h range $1.08-$1.15).

-

Composable collateral for DeFi lending, trading, and structured products on Sei.

-

$1.2B TVL boost in tokenized U.S. Treasuries expanding Sei’s RWA capabilities.

From a trader’s perspective, USDY hedges against ONDO’s token dips, as seen post-launch amid unlocks. Its $1.11 peg holds through 24-hour swings from $1.08 to $1.15, underscoring resilience. Institutions eyeing diversification will prioritize this over volatile alts, channeling funds that ripple into commodity-linked pairs and forex arb opportunities.

Sei’s parallel EVM further democratizes access. Developers build without Ethereum’s congestion tax, crafting USDY-powered perpetuals or options that rival centralized exchanges. Picture automated strategies that rotate between USDY yields and momentum plays, all settling instantly. This composability fuels network growth, positioning Sei as a DeFi hub for tokenized US treasuries Sei.

2026 Outlook: Scaling Tokenized Yield Frontiers

Looking ahead, Ondo Finance USDY 2026 could redefine DeFi’s maturity. With $1.2 billion TVL already, Sei’s integration accelerates multichain dominance. Expect TVL surges as protocols like vaults and CDPs natively support USDY, drawing pension funds and family offices. My analysis points to yield compression risks from Fed pivots, but short-term Treasuries buffer that effectively.

Competition looms from Solana or Base, yet Sei’s trading-first DNA gives it an edge for high-frequency RWA plays. USDY yield DeFi strategies will evolve, blending AI oracles for dynamic allocation. For global markets, this inflows stabilize dollar pairs, countering crypto’s herd mentality. At $1.11, USDY remains a cornerstone bet on tokenized treasury collateral Sei, bridging TradFi ballast with DeFi velocity.

Sei users now wield institutional tools once gated by custodians. This launch cements Ondo’s lead, proving tokenized assets thrive on performant chains. As adoption compounds, expect USDY to anchor Sei’s ascent, rewarding early movers with sustainable edges in a yield-starved world.