Ondo USDY Tokenized Treasuries Live on Sei Network: Unlocking High-Speed DeFi Lending and Collateral

In a world where traditional finance meets blockchain’s relentless pace, Ondo Finance’s USDY tokenized treasuries have gone live on the Sei Network, blending short-term U. S. Treasuries and bank deposits into a yield-bearing powerhouse for DeFi. Priced at a steady $1.10, this launch isn’t just another token drop; it’s a gateway to high-speed lending and collateral that could redefine how global investors park and deploy capital. Sei’s ultra-fast infrastructure turns what was once a slow-burn yield play into a composable asset ready for the frontlines of decentralized finance.

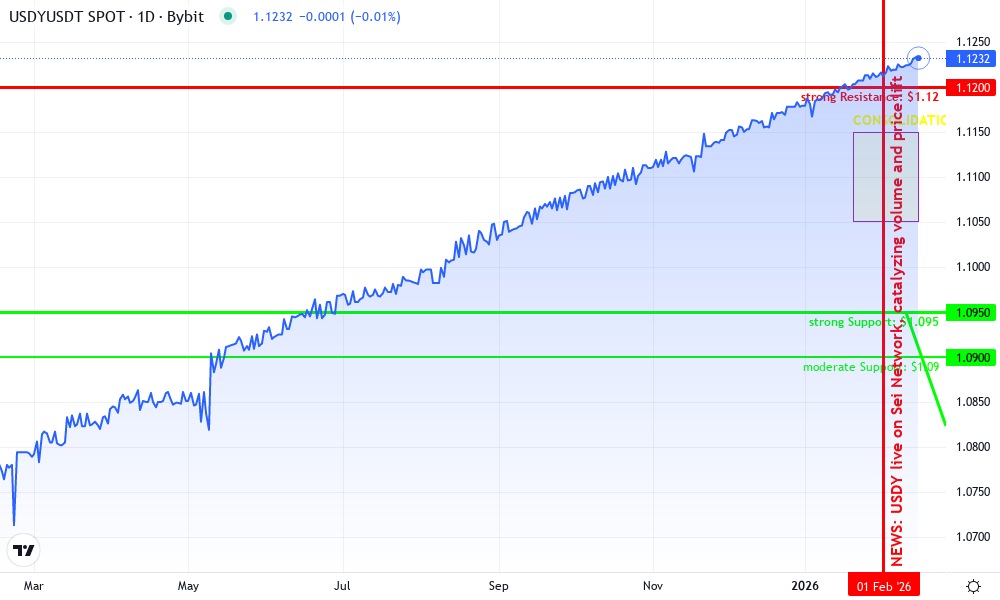

Ondo USDY Technical Analysis Chart

Analysis by Holly Madison | Symbol: BYBIT:USDYUSDT | Interval: 1W | Drawings: 6

Technical Analysis Summary

As Holly Madison, with my macro lens on tokenized treasuries, start by drawing a strong uptrend line (trend_line) connecting swing lows from 2026-05-15 at $1.02 to the recent support test on 2026-02-10 at $1.095, highlighting the steady appreciation driven by RWA adoption. Add horizontal lines (horizontal_line) at key support $1.09 and resistance $1.12. Use fib_retracement from the recent swing high $1.12 (2026-02-14) to low $1.09 (2026-02-15) to mark 50% retracement at $1.105 for potential entry. Place a long_position marker near $1.095. Mark a vertical_line at 2026-02-01 for the Sei Network integration news. Add callouts (callout) for volume spikes and MACD bullish crossover. Rectangle the recent consolidation range from 2026-01-20 $1.105-$1.115 to 2026-02-15. Arrow up at MACD signal and text for insights like ‘Yield accrual + DeFi demand’.

Risk Assessment: medium

Analysis: Tokenized Treasury stability tempers crypto swings, but short-term volatility from DeFi integration; medium tolerance suits scaled longs

Holly Madison’s Recommendation: Accumulate on dips to $1.095, target $1.15; big picture favors holding for yield + macro tailwinds

Key Support & Resistance Levels

📈 Support Levels:

-

$1.09 – Recent 24h low and swing support, aligns with 38.2% fib

moderate -

$1.095 – Trendline confluence and prior consolidation base

strong

📉 Resistance Levels:

-

$1.12 – 24h high and recent peak, psychological barrier

strong -

$1.115 – Minor resistance from early Feb consolidation high

weak

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$1.095 – Trendline support bounce post-Sei news digestion, medium risk aligns with tolerance

medium risk

🚪 Exit Zones:

-

$1.15 – Measured move target from range expansion, yield-enhanced upside

💰 profit target -

$1.085 – Below key support invalidates uptrend

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Rising on advances, contracting on pullbacks

Confirms uptrend strength, spikes align with news catalysts

📈 MACD Analysis:

Signal: Bullish crossover holding above zero

Momentum intact despite minor divergence on dip

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Holly Madison is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

USDY stands out because it accrues yield through gradual price appreciation, sidestepping the complexities of rebasing tokens while delivering dollar-denominated returns to non-U. S. users. Backed by assets yielding around traditional Treasury rates, it offers a taste of stability in crypto’s wild ride. Now on Sei, users can swap it seamlessly on platforms like Saphyre, borrow against it on Takara Lend and Yei Finance, or bridge it via LayerZero. This isn’t hype; it’s the big-picture convergence of real-world assets (RWAs) with layer-1 performance that handles thousands of transactions per second at pennies per pop.

Sei’s High-Octane Edge Powers USDY’s DeFi Potential

Sei Network isn’t your average chain. Engineered for trading and DeFi from the ground up, it boasts sub-second finality and throughput that leaves Ethereum L2s in the dust. Pair that with USDY’s institutional pedigree, and you get Ondo USDY Sei Network integration that’s tailor-made for tokenized US treasuries lending Sei. Imagine collateralizing high-quality liquid assets (HQLA) in lending markets without the drag of high gas fees or sluggish confirmations. For macro watchers like me, this aligns perfectly with persistent high interest rates; Treasuries remain a haven, and tokenization unlocks them for on-chain economies.

Institutional-grade yield meets full DeFi composability on Sei.

The tokenized treasuries market has ballooned past $10 billion, and USDY’s arrival on Sei accelerates that growth. Ondo Finance smartly targets ecosystems where speed matters most, enabling protocols to offer competitive lending rates backed by real yields. At $1.10, USDY’s 24-hour range from $1.09 to $1.12 reflects measured appreciation, underscoring its role as a stable store of value amid volatility.

Unlocking Yield-Bearing Collateral in High-Speed DeFi

Collateral has long been DeFi’s Achilles’ heel: too volatile or too illiquid. Enter USDY tokenized treasuries Sei, now live as prime collateral on Sei’s lending platforms. Borrowers can leverage USDY’s backing for loans, while lenders earn yields compounded by Sei’s efficiency. This setup lowers risk profiles across the board, drawing in institutions wary of pure crypto plays. From a macroeconomic lens, as Fed rates hover, tokenized Treasuries like USDY bridge TradFi liquidity to DeFi, potentially injecting billions into lending pools.

Platforms like Takara Lend and Yei Finance are already integrating, allowing users to deposit USDY for borrowing other assets or earning enhanced APYs. It’s not just lending; swaps on Saphyre mean instant liquidity, and LayerZero bridging expands its reach cross-chain. For Ondo Finance USDY DeFi enthusiasts, this means global access without U. S. regulatory hurdles, fostering a truly borderless yield market.

Market Snapshot: USDY’s Steady Climb on Sei

With USDY at $1.10 after a slight 24-hour dip of -0.91%, the token shows resilience. Its low of $1.09 and high of $1.12 capture the subtle accrual mechanism at work. This stability is gold for Sei Network treasury tokens, positioning USDY as the go-to for cash management in volatile times. Looking ahead, as RWA adoption surges, expect deeper liquidity and tighter spreads.

Ondo USDY Tokenized Treasuries Price Prediction 2027-2032

Forecasts based on current $1.10 price (2026), Treasury yield trends (~4.25% APY), Sei Network DeFi adoption, and RWA market growth. Min/Max reflect bearish/bullish scenarios.

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $1.08 | $1.14 | $1.22 | +3.6% |

| 2028 | $1.12 | $1.21 | $1.35 | +6.1% |

| 2029 | $1.16 | $1.29 | $1.50 | +6.6% |

| 2030 | $1.20 | $1.38 | $1.70 | +6.9% |

| 2031 | $1.25 | $1.48 | $1.95 | +7.2% |

| 2032 | $1.30 | $1.60 | $2.25 | +8.1% |

Price Prediction Summary

USDY is poised for gradual appreciation driven by consistent Treasury yields and expanding DeFi utility on Sei Network. Average prices could compound to $1.60 by 2032 in base case, with upside to $2.25 in bullish adoption scenarios amid RWA tokenization boom, though mins account for potential yield drops or regulatory hurdles.

Key Factors Affecting Ondo USDY Tokenized Treasuries Price

- Treasury yield persistence (4-5% APY) fueling price accrual

- Sei Network integration boosting DeFi lending/collateral use cases

- RWA sector growth and tokenized asset adoption ($10B+ market)

- Regulatory clarity for non-U.S. tokenized Treasuries

- Crypto market cycles and competition from yield-bearing stables

- Technical stability and bridging via LayerZero

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

USDY’s integration across Sei’s ecosystem isn’t theoretical, it’s operational today. On Saphyre, traders swap USDY with minimal slippage thanks to Sei’s parallelized execution, turning tokenized Treasuries into everyday liquidity. Takara Lend lets users collateralize USDY for borrowing stablecoins or blue-chip tokens, while Yei Finance layers on competitive borrow rates backed by real-world yields. This composability elevates Ondo USDY Sei Network from a passive holding to an active DeFi engine, where high-speed infrastructure meets institutional-grade backing.

Why Speed and Stability Win in Tokenized Lending

DeFi lending thrives on two pillars: velocity and trust. Sei delivers the former with block times under 400 milliseconds, outpacing most competitors and slashing latency risks in leveraged positions. USDY supplies the latter, its $1.10 price reflecting steady accrual from underlying Treasuries and deposits. For protocols, this means healthier loan-to-value ratios and reduced liquidation cascades during market dips. Macro trends amplify this: with global rates elevated, tokenized US treasuries lending Sei captures excess liquidity seeking yield without equity volatility.

Tokenized Treasuries are a $10B and market, and growing, USDY on Sei fuels the expansion.

Institutional players, long sidelined by compliance and speed barriers, now eye Sei for treasury management. Ondo’s design ensures non-U. S. accessibility, aligning with regulatory realities while unlocking dollar yields globally. Picture pension funds or family offices deploying capital on-chain, earning 4-5% APY through appreciation, all composable with DeFi primitives. That’s the big-picture shift: RWAs aren’t fringe anymore; they’re infrastructure.

Ecosystem Breakdown: USDY’s Live Integrations on Sei

Sei’s DeFi suite positions USDY as a cornerstone asset. Here’s how it’s playing out across key protocols:

USDY Features on Sei Network DeFi Platforms (Current Price: $1.10)

| Platform | Key Function | Liquidity 💧 | Speed ⚡ | Yield 📈 |

|---|---|---|---|---|

| Saphyre | Swaps | High 💧💧💧 | Ultra-fast ⚡⚡⚡ | Market-driven |

| Takara Lend | Borrowing/Collateral | High 💧💧💧 | Ultra-fast ⚡⚡⚡ | Competitive 📈📈 |

| Yei Finance | Lending APYs | High 💧💧💧 | Ultra-fast ⚡⚡⚡ | 4.25% 📈📈📈 |

These integrations highlight USDY tokenized treasuries Sei‘s edge: low costs, instant execution, and yield that compounds without rebase headaches. LayerZero bridging further extends reach, letting USDY flow to Ethereum or Solana ecosystems seamlessly. For developers, this opens doors to build exotic strategies, like automated yield vaults or cross-chain collateral swaps.

From my vantage as a macro strategist, USDY on Sei underscores a pivotal trend. Persistent inflation and rate hikes keep Treasuries attractive, while blockchain tokenization democratizes access. The 24-hour low of $1.09 and high of $1.12 at $1.10 current price signal reliability, even with a -0.91% daily change. As adoption deepens, expect tighter bid-ask spreads and volume spikes, mirroring the $10 billion tokenized treasury surge.

Big-Picture Implications for Ondo Finance USDY DeFi

Ondo’s move to Sei isn’t isolated; it’s part of a broader RWA renaissance. Sei Network treasury tokens like USDY lower the bar for institutional entry, blending TradFi safety with DeFi innovation. Lenders benefit from overcollateralized positions backed by HQLA, borrowers from cheap capital, and traders from liquid pairs. Risks remain, smart contract vulnerabilities or oracle dependencies, but Sei’s battle-tested design and Ondo’s audits mitigate them.

Looking forward, this launch could catalyze similar expansions. Imagine USDY powering perpetuals, options, or even tokenized money markets at scale. For global investors, it means dollar yields without banks, borders, or bureaucracy. In high-interest eras, such assets anchor portfolios, and Sei’s performance supercharges deployment. USDY at $1.10 isn’t just a token; it’s a blueprint for finance’s next chapter, where speed, yield, and stability converge on-chain.