BounceBit Tokenized Treasuries Integration: BENJI as Collateral for Yield Strategies

In the fast-evolving intersection of traditional finance and DeFi, BounceBit’s latest move stands out: integrating Franklin Templeton’s BENJI token as collateral on its BB Prime platform. This isn’t just another listing; it’s a gateway for investors to harness tokenized treasuries yield strategies while maintaining exposure to real-world asset stability. With BENJI currently trading at $0.001756, up and $0.000020 ( and 0.0117%) in the last 24 hours, this integration signals growing confidence in BENJI collateral for productive margin plays.

[price_widget: Real-time Basenji (BENJI) price with 24h change, high/low from latest data]

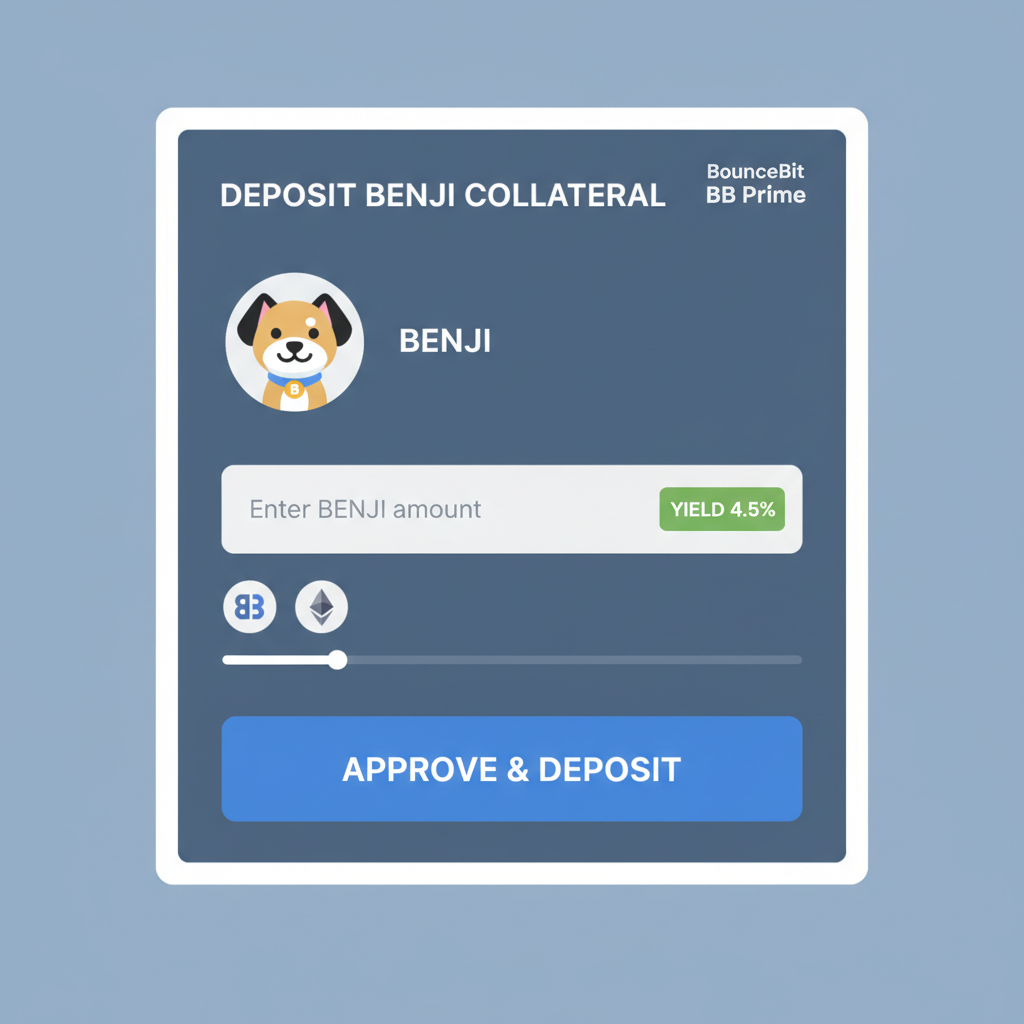

BENJI represents shares in the Franklin OnChain U. S. Government Money Fund, delivering a reliable on-chain yield around 4.5% from U. S. Treasuries. BounceBit’s BB Prime, a structured yield platform, now lets users deploy this tokenized fund alongside crypto executions, creating dual-yield opportunities that blend Treasury income with DeFi leverage.

Franklin Templeton BENJI: Bridging TradFi Stability to Blockchain

Franklin Templeton has been a pioneer in tokenization, and BENJI exemplifies their push into blockchain-powered money markets. Unlike volatile cryptos, BENJI offers predictable income from short-term U. S. government securities, making it ideal for risk-averse portfolios seeking yield without the drama of meme coins or altcoin swings. The token’s design supports intraday transfers, meaning you can earn yield even during partial-day ownership, a patent-pending innovation that boosts liquidity.

As a risk management specialist, I appreciate how BENJI mitigates downside through its backing: over $700 million in assets under management provides a solid foundation. In today’s market, where tokenized T-bills DeFi integrations are surging, BENJI’s 24-hour range from $0.001644 to $0.001766 underscores its resilience amid broader crypto fluctuations.

BounceBit BB Prime: The Engine for BENJI Collateral Strategies

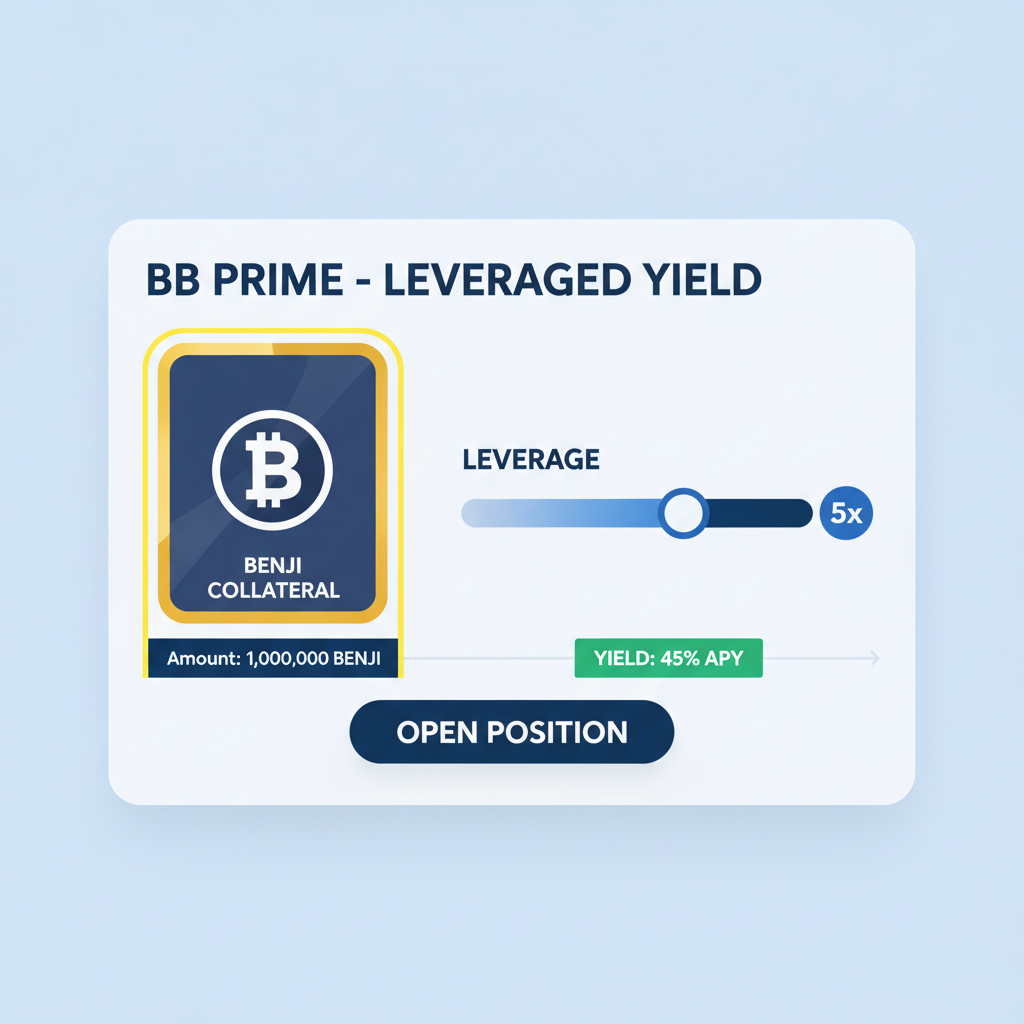

BounceBit, led by CEO Jack Lu, aims to embed tokenized treasuries into active yield frameworks, shifting RWAs from passive holdings to dynamic tools. BB Prime launches with BENJI integration, enabling traders to use it for collateral and settlement in investment strategies. This means posting BENJI to borrow against it, earning both the embedded 4.5% Treasury yield and additional returns from leveraged positions.

Imagine collateralizing BENJI to open a long on BTC derivatives while your collateral accrues daily Treasury interest. That’s capital efficiency at its finest, reducing opportunity costs that plague traditional margin trading. BounceBit’s platform handles the execution on-chain, attracting institutions wary of centralized exchanges but hungry for DeFi composability.

From a risk perspective, this setup demands careful position sizing. BENJI’s stability tempers liquidation risks, but leverage amplifies volatility. My advice: cap exposure at 2-3x and monitor funding rates closely to avoid squeezes.

BENJI Tokenized Treasury (BENJI) Price Prediction 2027-2032

Projections based on current $0.001756 price, BounceBit integrations, and RWA yield trends amid institutional adoption

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $0.0014 | $0.0025 | $0.0042 | +39% |

| 2028 | $0.0020 | $0.0040 | $0.0070 | +60% |

| 2029 | $0.0028 | $0.0062 | $0.0110 | +55% |

| 2030 | $0.0040 | $0.0095 | $0.0170 | +53% |

| 2031 | $0.0055 | $0.0145 | $0.0260 | +53% |

| 2032 | $0.0075 | $0.0220 | $0.0400 | +52% |

Price Prediction Summary

BENJI is poised for substantial growth driven by tokenized treasury integrations with BounceBit, Franklin Templeton, and Binance, enabling yield strategies and institutional capital inflows. Average prices reflect progressive adoption in RWA markets, with min/max capturing bearish regulatory hurdles and bullish DeFi expansion scenarios. By 2032, avg price could exceed $0.022, a 1,150%+ rise from 2026 levels.

Key Factors Affecting BENJI Tokenized Treasury Price

- RWA tokenization boom and institutional demand for yield-bearing collateral

- Strategic partnerships with BounceBit BB Prime, Franklin Templeton BENJI fund (~4.5% yield)

- DeFi yield strategies enhancing capital efficiency

- Regulatory clarity for tokenized assets and U.S. Treasuries on-chain

- Market cycles favoring stable, high-yield RWAs amid crypto volatility

- Competition from other tokenized funds (e.g., BUIDL) and tech upgrades

- Broader crypto bull runs and Bitcoin halving cycles influencing sentiment

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Why BENJI Collateral Redefines Yield Optimization

Using BENJI as BENJI productive margin unlocks layers of yield stacking previously siloed between TradFi and crypto. Traders earn on the underlying Treasuries, plus platform incentives, and potentially amplified returns from borrowed assets. Sources like CoinDesk highlight how this boosts Treasury yields in strategies, while Binance notes the CEO’s vision for RWAs in active circulation.

This integration aligns with broader trends, where tokenized funds like BENJI serve off-exchange collateral for platforms including Binance via Ceffu custody. For Franklin Templeton BounceBit synergy, it’s a win: institutions gain on-chain access without sacrificing compliance or yield accrual. Current data shows BENJI holding steady at $0.001756, with minimal 24h volatility, positioning it as a bedrock for sophisticated plays.

Institutional adoption is accelerating, as evidenced by BENJI’s role in structured products. Yet, success hinges on smart risk controls: diversify across yield sources, stress-test for rate hikes, and always prioritize liquidity. BounceBit’s move isn’t hype; it’s a practical step toward hybrid portfolios where stability fuels growth.

Delving deeper into practical application, let’s explore how investors can operationalize BENJI on BB Prime without overextending. The platform’s intuitive interface lowers barriers, but discipline remains key in leveraging BounceBit tokenized treasuries.

Getting Started with BENJI Collateral: A Risk-Aware Roadmap

Once set up, the real magic unfolds in yield stacking. BENJI’s embedded 4.5% yield accrues continuously, even as you deploy it productively. Pair it with BounceBit’s lending markets or perpetuals for compounded returns, all while the token holds firm at $0.001756. Its 24-hour low of $0.001644 and high of $0.001766 reflect the kind of low-beta behavior that anchors volatile DeFi plays.

From my vantage as an FRM-certified risk manager, this isn’t blind optimism. BENJI’s backing by Franklin Templeton’s money market fund, now surpassing $700 million in AUM, adds institutional-grade ballast. Yet, correlations to broader RWA trends matter; as tokenized treasuries expand, so does BENJI’s utility in tokenized T-bills DeFi.

Key Advantages of BENJI Productive Margin

Top 5 BENJI Collateral Benefits

-

1. Dual Yields: Earn ~4.5% U.S. Treasury yield from BENJI plus BounceBit yield strategies for compounded returns.

-

2. Capital Efficiency: Deploy BENJI as collateral on BB Prime without selling, maximizing RWA utilization.

-

3. Intraday Liquidity: Patent-pending transfers allow intraday movement while accruing full-day yield.

-

4. Low Volatility: Stable at $0.001756 (24h +0.0117%), ideal for reliable collateral.

-

5. Institutional Compliance: Franklin Templeton-backed, enabling regulated yield strategies on BounceBit.

These edges position BENJI ahead of plain stablecoins, which lack native yield accrual. BounceBit’s integration, as noted in recent coverage from TronWeekly, fuses TradFi predictability with DeFi speed, drawing in professionals tired of yield-chasing in pure crypto.

Risks aren’t absent, though. Interest rate shifts could pressure Treasury yields, indirectly nudging BENJI’s NAV. Leverage introduces liquidation thresholds, especially if crypto markets gyrate. Counter this by maintaining conservative loan-to-value ratios below 50%, hedging with shorts on rate futures, and setting alerts for BENJI dipping below $0.001644. Diversification across RWAs prevents single-asset blind spots.

“Tokenized Treasuries such as FT’s BENJI are being increasingly used for collateral and settlement as real-world asset adoption spreads. ” – Yahoo! Finance Canada

This momentum echoes the sector’s growth, detailed in analyses of tokenized U. S. treasuries hitting record market caps and shifting to active collateral on major venues like Bybit, Deribit, and DBS repo markets.

Answering Investor Questions on BENJI Strategies

Addressing these head-on builds confidence. For instance, BENJI’s yield floats with short-term rates but has hovered near 4.5%, paid daily on-chain. BB Prime values collateral at real-time oracle prices, ensuring fairness at $0.001756.

Looking ahead, expect more protocols to emulate this model. Franklin Templeton’s innovations, like intraday yield accrual, pave the way for 24/7 tokenized fixed income. BounceBit’s BB Prime could evolve into a hub for RWA derivatives, amplifying Franklin Templeton BounceBit ties.

For portfolio builders, allocate 10-20% to BENJI collateral strategies as a yield stabilizer. Monitor BENJI’s steady climb, with its and 0.0117% 24-hour gain signaling resilience. This fusion of stability and opportunity lets you manage risk while chasing reward, turning tokenized treasuries into everyday powerhouses.