Ondo USDY Tokenized US Treasuries Now Live on Sei Network for High-Speed Yield Farming

In the fast-evolving world of on-chain finance, Ondo Finance has just supercharged the Sei Network with USDY, its flagship tokenized US Treasuries product. Now live, USDY brings over $1.2 billion in yield-bearing exposure backed by short-term US Treasuries and bank deposits directly to Sei’s high-performance blockchain. Trading at a robust $1.11 with a 24-hour gain of and $0.0100 ( and 0.91%), this launch opens doors for high-speed yield farming that traditional finance could only dream of.

Ondo US Dollar Yield Technical Analysis Chart

Analysis by Tristan Doyle | Symbol: BYBIT:USDYUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

On this USDYUSDT daily chart spanning early 2026, draw a primary uptrend line connecting the swing low at 2026-01-15 around $1.00 to the recent high on 2026-02-18 at $1.13, using ‘trend_line’ tool in green. Add horizontal support at $1.10 (recent 24h low) and resistance at $1.13 (24h high) with ‘horizontal_line’. Mark a consolidation rectangle from 2026-02-10 to present between $1.10-$1.13 using ‘rectangle’. Place arrow markers for volume spikes on up days and MACD bullish signal. Add callouts for Sei integration news impact and fib retracement from low to high at 38.2% ($1.105). Vertical line at 2026-02-19 for latest market event. Entry long zone at $1.105 with long_position marker, exits at $1.13 profit and $1.095 stop.

Risk Assessment: medium

Analysis: Yield-bearing stablecoin with treasury backing tempers downside, but crypto volatility and new chain integration add swings—aligns with my medium tolerance

Tristan Doyle’s Recommendation: Long on dip to $1.105 with tight stops; hybrid play: 5-10% portfolio allocation for yield + upside

Key Support & Resistance Levels

📈 Support Levels:

-

$1.1 – Recent 24h low and psychological stablecoin floor, backed by treasury yield stability

strong -

$1.05 – Mid-Jan swing low, prior consolidation base

moderate

📉 Resistance Levels:

-

$1.13 – 24h high and near-term target post-Sei launch euphoria

strong -

$1.15 – Projected extension if volume sustains

weak

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$1.105 – Fib 38.2% retrace of upmove + support confluence, ideal hybrid dip buy

medium risk

🚪 Exit Zones:

-

$1.13 – Test recent high for profit take, respecting resistance

💰 profit target -

$1.095 – Below key support invalidates uptrend

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Increasing on green candles, climactic on pullback

Bullish volume profile supports uptrend continuation, typical for yield accrual assets

📈 MACD Analysis:

Signal: Bullish crossover above zero line

Momentum confirms uptrend intact despite minor pullback

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Tristan Doyle is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

USDY isn’t your average stablecoin. It appreciates over time as interest accrues from its underlying assets, making it a composable powerhouse for DeFi. On Sei, an ultra-fast Layer 1 blockchain optimized for trading, users can now deploy this asset in lending protocols, as collateral, or for seamless global payments, all with sub-second finality.

Ondo USDY Sei: Tokenized Treasuries Meet Blazing Speed

The integration of Ondo USDY Sei marks a pivotal moment for tokenized US Treasuries on Sei. Ondo Finance announced the deployment on July 17, positioning USDY as the first permissionless tokenized US Treasury Bill primitive on the network. Backed by a diversified pool of short-term Treasuries and bank deposits, USDY delivers economic exposure to these safe-haven assets without the holders owning the Treasuries themselves.

What sets this apart? Transferability via LayerZero allows USDY to bridge chains effortlessly, enhancing its utility across ecosystems. For institutional investors and crypto enthusiasts alike, this means accessing yields from a $10 billion-plus tokenized Treasuries market right on a chain built for speed. Sei’s architecture, designed for high-throughput DeFi, eliminates the bottlenecks that plague slower networks, enabling real-time yield farming strategies that capitalize on USDY’s steady appreciation.

USDY, a tokenized U. S. Treasury product by Ondo Finance, is live on the Sei Network. Tokenized Treasuries are a $10B and market, and growing.

This convergence isn’t hype; it’s a strategic play. With USDY at $1.11, its 24-hour high of $1.13 and low of $1.10 underscore resilience amid market volatility. Retail users on Sei can now farm yields permissionlessly, while institutions gain a stable, dollar-denominated RWA for cash management.

Why Tokenized US Treasuries Sei Are a Game-Changer for Yield Farmers

Imagine parking your capital in tokenized US Treasuries Sei and earning yields at warp speed. USDY on Sei unlocks this reality. As a yield-bearing stablecoin, it accrues value daily from Treasury interest, hovering around that solid $1.11 mark with positive momentum. Farmers can leverage it in DeFi protocols for amplified returns, using it as collateral without the liquidation risks of volatile tokens.

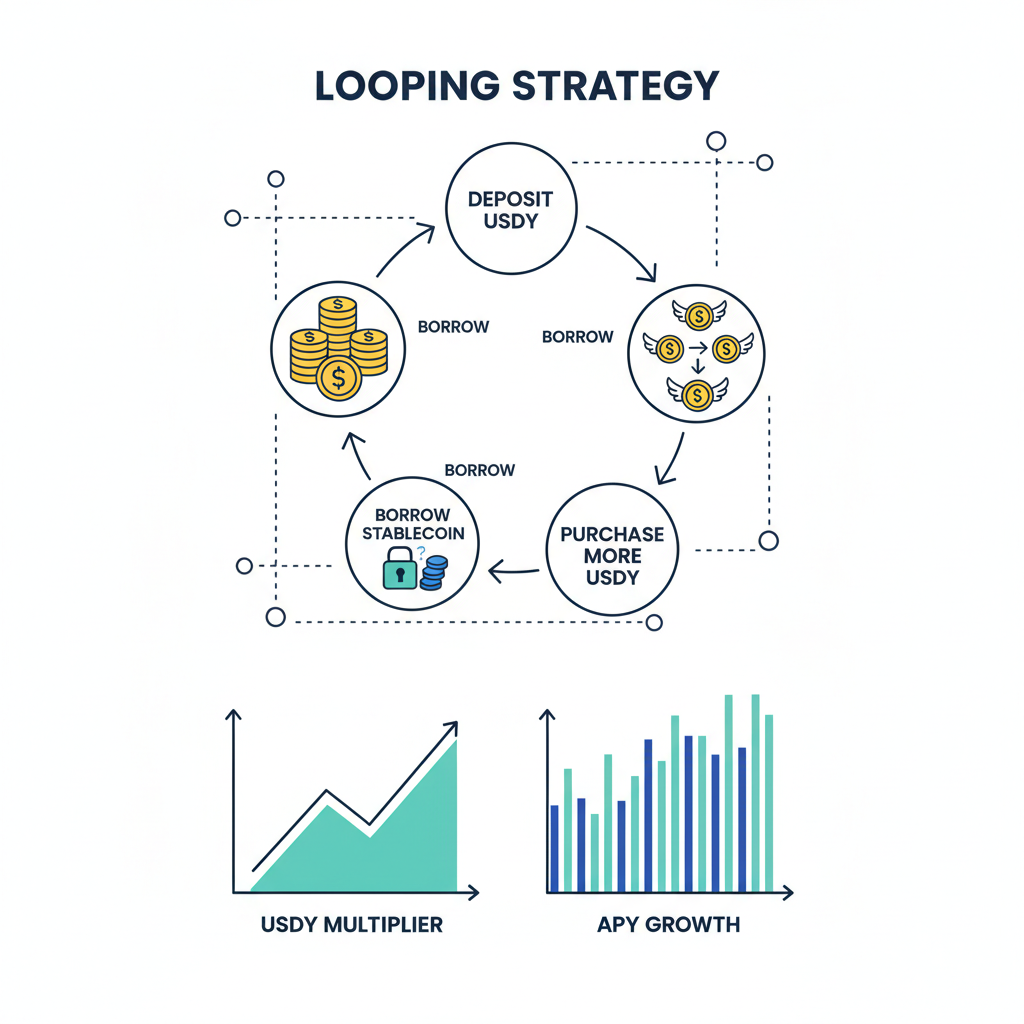

Sei’s ecosystem, already buzzing with lending and DEX activity, benefits immensely. USDY serves as a foundational layer, providing liquidity and stability. Picture looping strategies: deposit USDY, borrow against it, and redeposit for compounded yields, all executed in milliseconds. This isn’t just efficiency; it’s a competitive edge in the race for on-chain alpha.

Ondo’s track record amplifies the appeal. With billions in TVL across products, their entry validates Sei’s push into RWAs. Users gain composability too, pair USDY with other assets for sophisticated farms targeting USDY yield on Sei. Early adopters are already positioning, drawn by the network’s low fees and EVM compatibility.

Ondo Finance Treasuries Sei: Current Performance and Yield Potential

Diving into the numbers, Ondo USDY Sei shines at $1.11, up 0.91% in the last 24 hours. This uptick from a low of $1.10 to a high of $1.13 reflects strong demand post-launch. As tokenized treasuries lending on Sei ramps up, expect USDY to anchor strategies blending safety with DeFi upside.

The product’s design shines here: fully backed, audited, and redeemable, it offers transparency via on-chain proofs. For yield farmers, the real draw is composability. Integrate into perpetuals, options, or liquidity pools, and watch returns stack. Sei’s speed ensures no missed opportunities from latency, a common pain point elsewhere.

Looking ahead, this launch positions Sei as an RWA hub. With USDY’s $1.2 billion exposure now native, protocols can build around it, from institutional vaults to retail farms. The 24-hour change of and $0.0100 signals momentum, inviting savvy players to explore Ondo Finance treasuries Sei for sustainable yields.

USDY Price Prediction 2027-2032

Forecasts based on Treasury yields, Sei Network adoption, RWA growth, and market dynamics. Current price (2026): $1.11

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $1.12 | $1.24 | $1.36 |

| 2028 | $1.15 | $1.35 | $1.55 |

| 2029 | $1.20 | $1.50 | $1.80 |

| 2030 | $1.25 | $1.70 | $2.10 |

| 2031 | $1.35 | $1.95 | $2.50 |

| 2032 | $1.45 | $2.25 | $3.00 |

Price Prediction Summary

USDY is forecasted to see steady appreciation as a yield-bearing tokenized Treasury asset, with average prices compounding at ~10% annually due to interest accrual and DeFi demand on Sei. Bullish max scenarios reflect RWA boom and adoption, while mins account for bearish regulatory or yield drops.

Key Factors Affecting USDY Tokenized US Treasuries Price

- US Treasury yields (3-5% assumed base growth)

- Sei Network adoption and high-speed DeFi integration

- Real World Assets (RWA) market expansion ($10B+ tokenized Treasuries)

- Regulatory developments for on-chain securities

- DeFi composability, lending collateral, and yield farming use cases

- Competition from other yield-bearing assets

- Crypto market cycles and institutional inflows

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

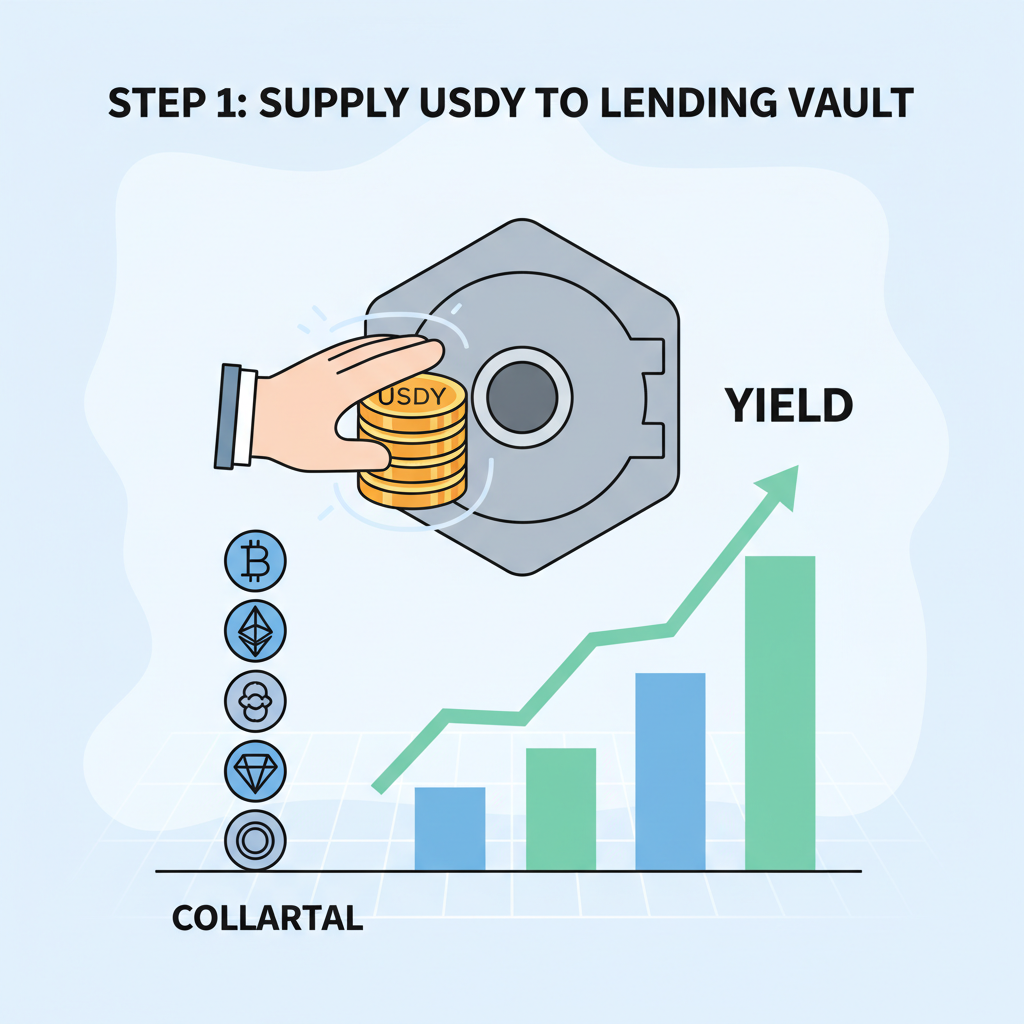

That momentum at $1.11 isn’t fleeting; it’s fueled by real utility. Yield farmers eyeing tokenized treasuries lending Sei will find USDY’s stability pairs perfectly with aggressive strategies. Deposit into lending markets, earn base Treasury yields around 4-5% annualized, then layer on protocol incentives for double-digit APYs. Sei’s parallel processing keeps gas fees under a cent, making micro-adjustments viable without eating profits.

USDY Yield on Sei: Strategies for Maximum Returns

Let’s get tactical. Start simple: supply USDY to Sei’s top lending platforms for passive income. Its yield-bearing nature means your principal grows automatically, compounding without manual claims. From there, escalate to leveraged loops – borrow stablecoins against USDY collateral, swap into yield optimizers, and redeposit. With sub-second tx speeds, you can rebalance hourly if arb opportunities pop.

I see USDY yield on Sei as the bridge retail traders need to institutional-grade plays. No more settling for subpar stablecoin farms; this is Treasuries-grade backing with DeFi multipliers. Protocols like Astroport or Levana are already integrating, turning USDY into LP fuel for concentrated liquidity pools. Early data shows TVL spiking post-launch, hinting at explosive growth as word spreads.

Risks? Minimal compared to crypto roulette. USDY’s overcollateralization and daily attestations keep it pegged near $1, but smart contract audits and Sei’s battle-tested security add layers. Volatility in borrowing rates could pinch, yet that’s the farmer’s game – timing is everything.

Ondo USDY Sei: Building the RWA Future on Sei

Beyond farming, USDY reshapes Sei’s DeFi landscape. Institutions can park cash in tokenized US Treasuries for on-chain settlement, dodging slow T-bills. Global payments get a boost too – send USDY cross-border with yields intact, settling instantly. This isn’t peripheral; it’s core infrastructure. Pair it with Sei’s perpetuals for hedged yield plays, or options vaults for asymmetric bets.

From my vantage bridging TradFi and blockchain, Ondo’s move screams maturity. Tokenized Treasuries hit $10B market cap, and Sei’s slice could balloon with USDY’s $1.2B backing. At $1.11, up 0.91% to a $1.13 high, it’s primed for inflows. Watch for copycats, but USDY’s first-mover status locks in liquidity moats.

“USDY is the first permissionless tokenized U. S. Treasury Bill primitive to debut on Sei, offering the network’s ecosystem of retail users and. . . ” – Sei Blog

Farmers, don’t sleep. Stake your claim in Ondo USDY Sei before protocols compete fiercely for this liquidity. Sei’s speed turns good ideas into great outcomes, blending Treasury safety with on-chain firepower.

Sei’s USDY era feels like 2021 DeFi summer, but with real yields. Position now at that steady $1.11, ride the 24h $0.0100 bump, and farm the convergence.