Ondo USDY Launches on Sei Network: Unlocking Tokenized U.S. Treasuries for High-Speed DeFi Lending

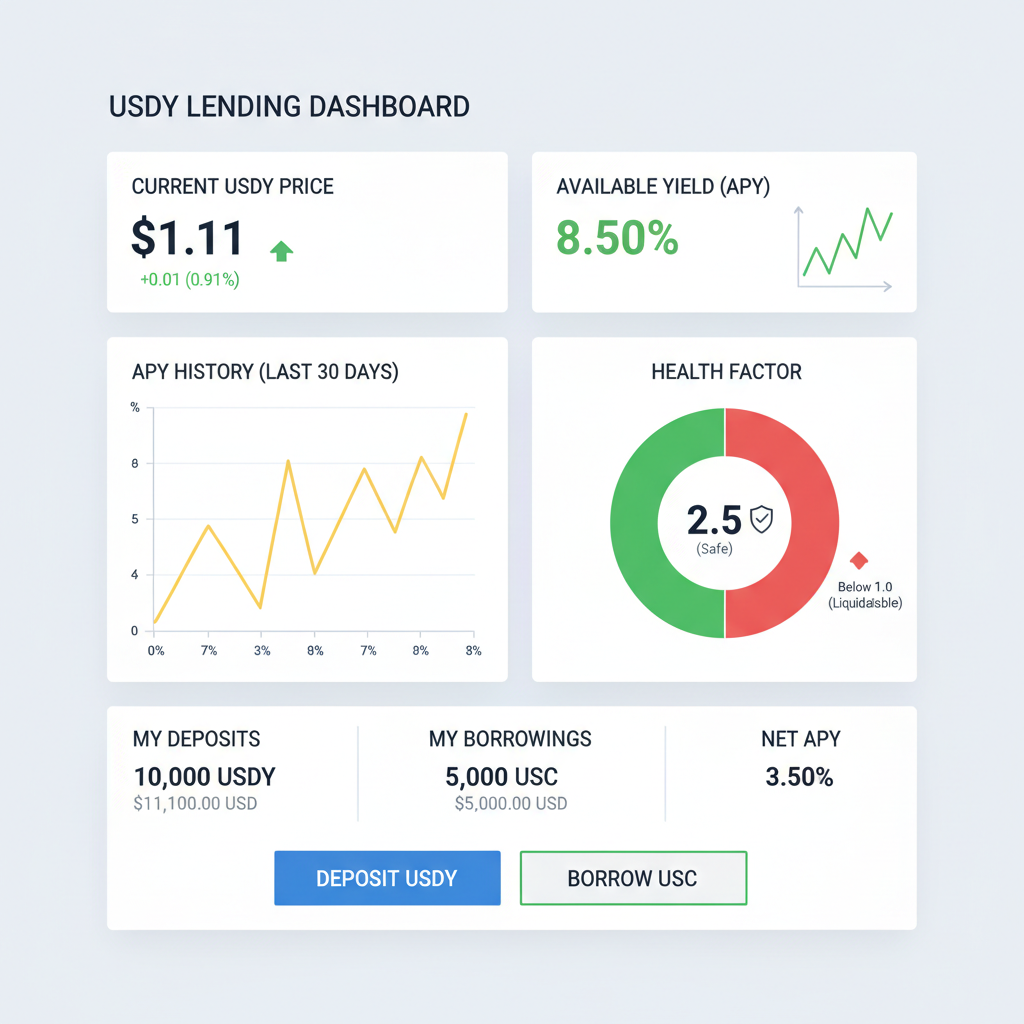

Ondo Finance just dropped a game-changer on the Sei Network: USDY, their flagship yield-bearing tokenized U. S. Treasury product, is now live. Trading at a steady $1.11, with a 24-hour high of $1.12 and low of $1.04, this launch fuses short-term U. S. Treasuries and bank deposits into a composable DeFi asset. For fans of Ondo USDY Sei and tokenized US treasuries Sei, it’s the bridge we’ve been waiting for between TradFi stability and blockchain speed.

USDY Meets Sei’s Blazing Infrastructure

Sei Network isn’t your average Layer-1; it’s engineered for high-frequency trading and DeFi at scale, boasting sub-second finality that leaves most chains in the dust. Ondo’s USDY arrival here isn’t coincidental. This tokenized treasuries Sei Network play positions USDY as the first permissionless Treasury Bill token on Sei, backed by assets yielding real returns from U. S. government securities. Non-U. S. investors, in particular, gain stablecoin-like utility without the volatility, all wrapped in institutional-grade safeguards.

Picture this: your capital parked in Treasuries, accruing yield daily, while seamlessly plugging into DeFi protocols. That’s USDY Ondo Finance in action. At $1.11, it’s holding firm amid market whispers, signaling confidence in its programmable dollar potential.

Ondo USDY Technical Analysis Chart

Analysis by Market Analyst | Symbol: BYBIT:USDYUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

As a seasoned technical analyst with 5 years of experience focusing on balanced technical setups, especially for emerging assets like tokenized treasuries, here’s how to annotate this USDYUSDT chart on TradingView: Start with a prominent uptrend line from the recent low at 2026-01-15 around $1.04 connecting to the swing high on 2026-02-10 at $1.12, using ‘trend_line’ tool in green. Draw horizontal support at $1.04 (recent 24h low) and $1.00 (psychological floor) with ‘horizontal_line’ in blue, dashed for moderate strength. Resistance horizontals at $1.11 (current) and $1.12 high in red. Mark entry zone long above $1.105 with ‘rectangle’ light green, stop below $1.04, target $1.15. Use ‘fib_retracement’ from low to high for pullback levels. Volume callout at spike on 2026-02-18 up candle with ‘callout’ noting ‘bullish volume confirmation’. MACD arrow up at bullish cross around 2026-02-05. Vertical line for USDY Sei launch on 2026-01-26T00:00:00Z in orange. Text box summary: ‘Balanced setup post-launch pump, medium risk long bias’. Keep it clean, author’s style: precise levels, no clutter.

Risk Assessment: medium

Analysis: Asset is stable-ish yield token but new integrations add volatility; supports align with current data ($1.04 low, $1.11 current), medium tolerance fits dip buys

Market Analyst’s Recommendation: Long bias on dips to $1.05-1.08, target $1.15, trail stops. Monitor Sei ecosystem volume.

Key Support & Resistance Levels

📈 Support Levels:

-

$1.04 – 24h low and recent swing low post-launch dip

strong -

$1 – Psychological and treasury par level

moderate

📉 Resistance Levels:

-

$1.12 – 24h high, initial resistance post-pump

moderate -

$1.15 – Projected extension if volume holds

weak

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$1.105 – Above current price consolidation, post-pump retrace entry

medium risk -

$1.04 – Strong support bounce for lower risk long

low risk

🚪 Exit Zones:

-

$1.15 – Fib 127.2% extension

💰 profit target -

$1.04 – Below key support

🛡️ stop loss -

$1.12 – Immediate resistance take partial

💰 profit target

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Increasing on upmove

Volume spike confirms launch pump conviction around 2026-02-18

📈 MACD Analysis:

Signal: Bullish crossover

MACD line above signal post-2026-02-05, momentum building

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Why does this matter now? Sei’s ecosystem is exploding, with integrations ready at launch across swaps on Saphyre, lending on Takara Lend and Yei Finance, plus bridging via LayerZero. This isn’t vaporware; it’s instant liquidity for US treasuries DeFi lending Sei.

Supercharging DeFi Lending with Real-World Yields

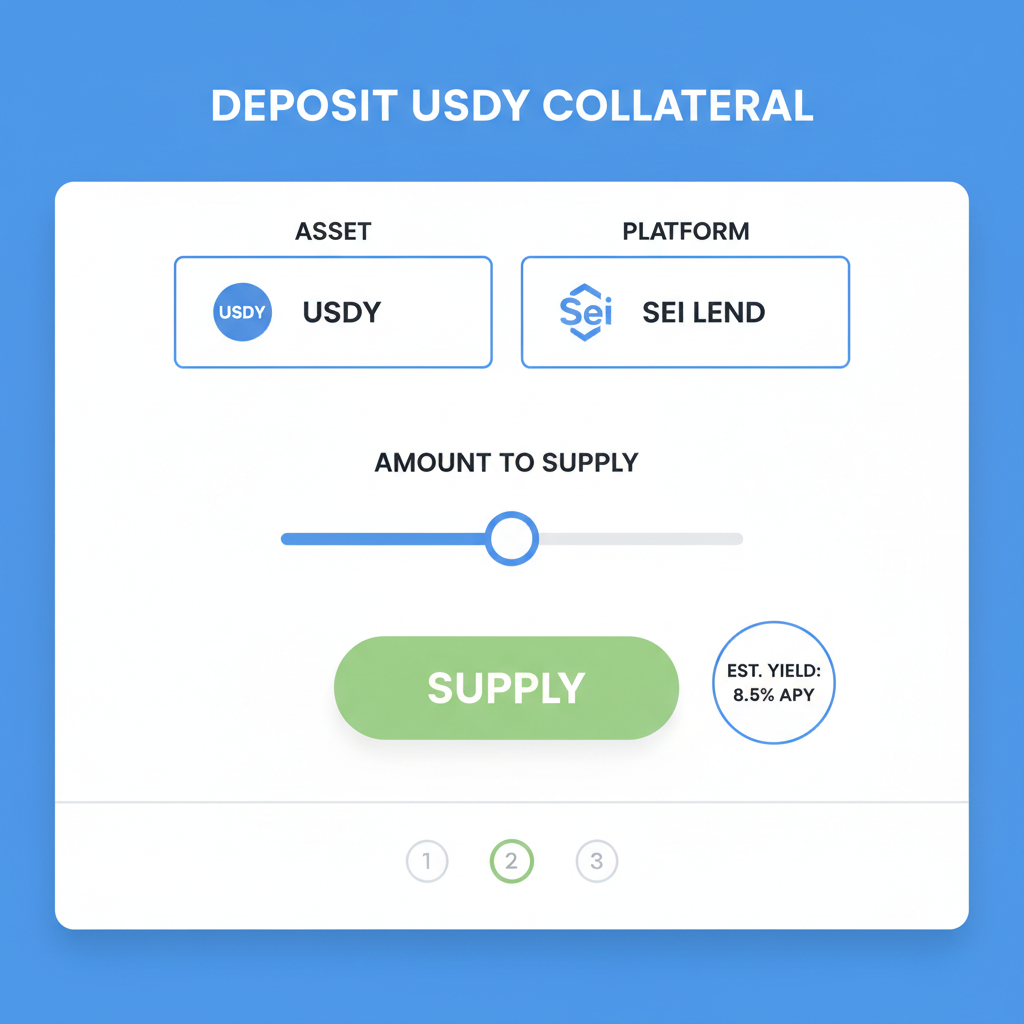

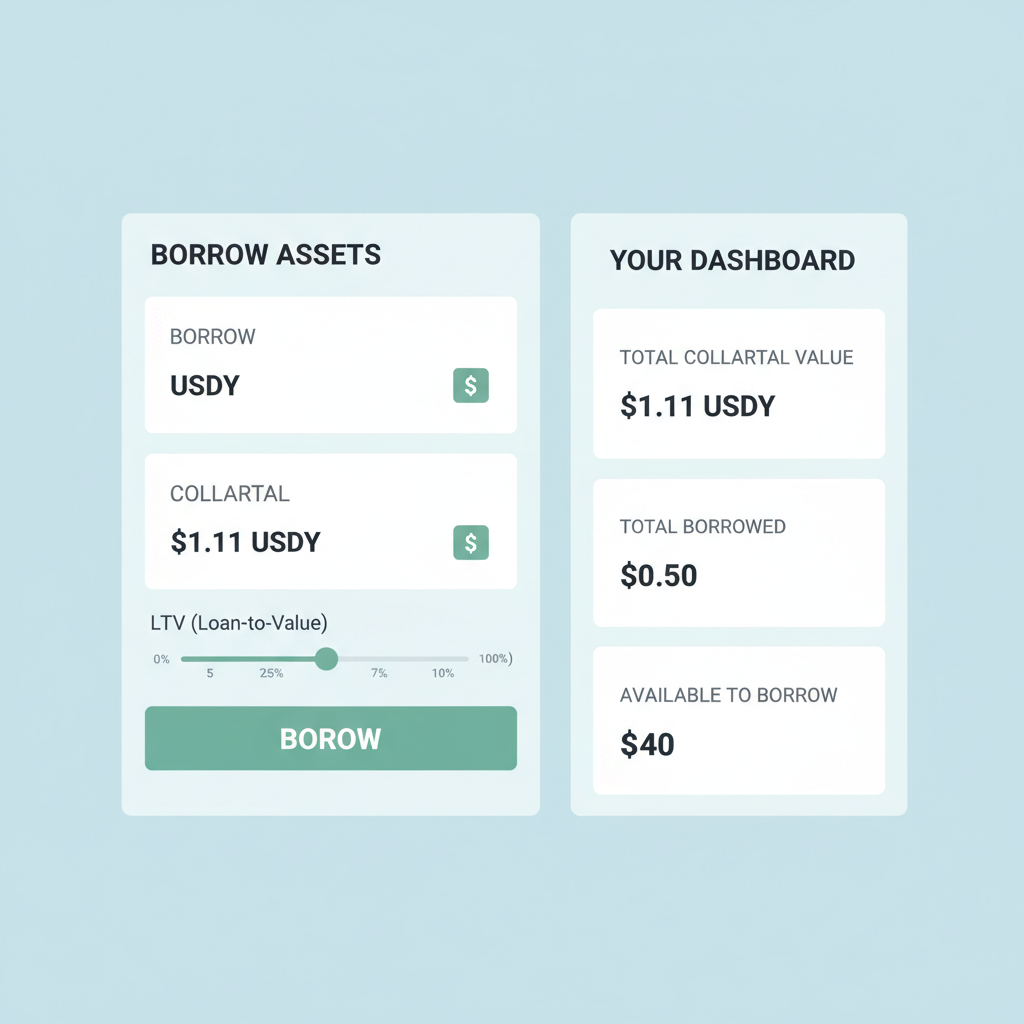

DeFi lending has always craved reliable collateral. Enter USDY on Sei, transforming tokenized Treasuries into high-speed fuel. Lenders can now collateralize positions with an asset that’s not just stable but productive, earning yields from underlying short-term U. S. Treasuries and bank deposits. On Sei, where transactions settle in real-time, this unlocks frictionless borrowing and lending loops that slower networks can only dream of.

Take Takara Lend: users deposit USDY at $1.11, borrow against it, and loop yields into amplified strategies. Or Yei Finance, where it slots into lending markets for seamless yield farming. This convergence is pushing Ondo USDY Sei toward mainstream adoption, especially as institutions eye on-chain cash management.

In a world shifting from static stablecoins to dynamic, yield-generating ones, USDY on Sei is leading the charge.

Ondo’s move reflects broader RWA momentum. With BlackRock’s tokenized fund playbook in play, USDY stands out by prioritizing composability over silos. Sei’s 1.2 million daily active addresses pre-launch? That’s the rocket fuel for tokenized US treasuries Sei growth.

Market Momentum and Future Yield Plays

USDY’s price stability at $1.11 belies its potential. Despite a flat 24-hour change of and $0.000000 (0.000000%), the 24-hour range from $1.04 to $1.12 shows resilience. Ondo Finance’s expansion to Sei taps into a network optimized for institutional products, drawing global liquidity to DeFi lending.

What’s next? Expect deeper integrations, as USDY becomes the go-to for payments, collateral, and yield optimization. For traders eyeing USDY Ondo Finance, this launch amid Sei’s surge positions it for outsized impact.

Ondo USDY (USDY) Price Prediction 2027-2032

Long-term forecast incorporating Sei Network integration, tokenized U.S. Treasuries adoption, DeFi lending growth, and Treasury yield trends, starting from current $1.11 baseline in 2026

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $0.98 | $1.15 | $1.30 |

| 2028 | $1.00 | $1.22 | $1.45 |

| 2029 | $1.02 | $1.30 | $1.60 |

| 2030 | $1.05 | $1.40 | $1.80 |

| 2031 | $1.10 | $1.50 | $2.00 |

| 2032 | $1.15 | $1.65 | $2.30 |

Price Prediction Summary

USDY is projected to exhibit stable growth with a gradually increasing price premium due to enhanced DeFi composability on Sei, rising RWA adoption, and sustained Treasury yields. Minimum prices reflect bearish scenarios like regulatory hurdles or market downturns, while maximums capture bullish adoption-driven surges. Average annual growth ~10-15% on avg price, aligning with crypto market cycles and institutional inflows.

Key Factors Affecting Ondo USDY Price

- Sei Network’s high-speed DeFi integrations boosting USDY liquidity and lending utility

- Tokenized Treasury yields (currently attractive) and bank deposit backings driving premium trading

- RWA sector expansion and institutional adoption amid favorable regulations

- Competition from other yield-bearing stables and overall crypto market volatility

- Technological advancements in cross-chain bridging (e.g., LayerZero) and real-time settlement

- Macro factors: U.S. Treasury rates, global liquidity, and DeFi TVL growth

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Institutions aren’t sleeping on this. Sei’s real-time settlement pairs perfectly with USDY’s yield accrual, creating a flywheel for US treasuries DeFi lending Sei. Borrowers get competitive rates backed by Treasuries, while lenders earn compounded returns without leaving the chain. It’s a subtle power move in the RWA race, where speed trumps hype.

Hands-On: Plugging USDY into Sei’s DeFi Engine

Enough theory; let’s talk execution. USDY shines brightest when deployed in lending markets. On Takara Lend, deposit your $1.11 USDY tokens and unlock borrows against top assets like SEI or USDC. Yei Finance takes it further with isolated pools, minimizing risk while maximizing efficiency. Saphyre swaps let you pivot liquidity instantly, all at sub-second speeds. This isn’t clunky; it’s intuitive DeFi evolved for pros chasing tokenized treasuries Sei Network alpha.

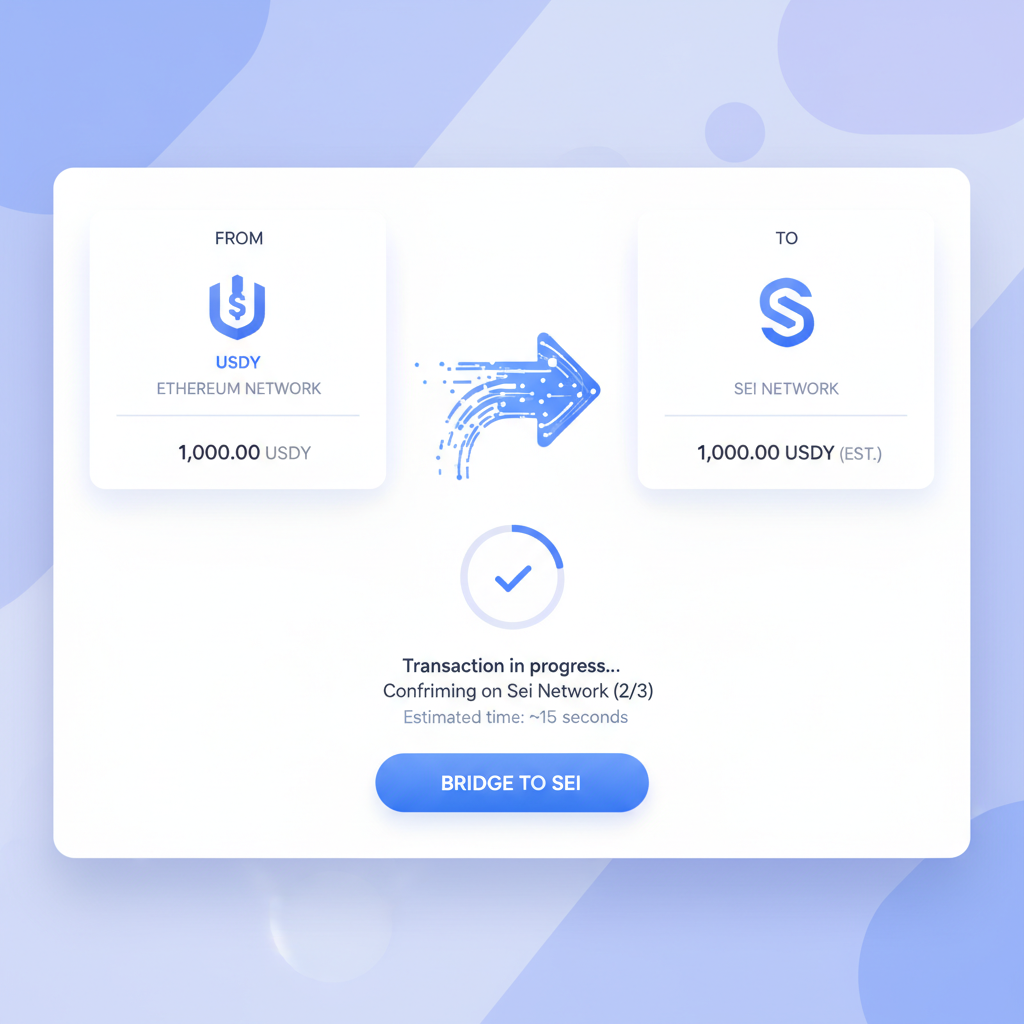

Bridging is seamless too. LayerZero endpoints mean USDY flows from Ethereum or other chains without the usual gas wars or delays. Once on Sei, it’s primed for strategies like yield looping: deposit, borrow stablecoins, redeposit for amplified Treasury exposure. At current $1.11 pricing, even modest rate spreads compound meaningfully over weeks.

I’ve seen similar setups on Solana or Aptos, but Sei’s parallel execution crushes latency issues. For Ondo USDY Sei enthusiasts, this is table stakes for 2026 portfolios blending TradFi safety with DeFi upside.

USDY vs. The Stablecoin Pack: A Quick Breakdown

USDY isn’t just another peg; it’s yield-native. Static stables like USDT or USDC offer zero return, while many yield variants dilute with counterparty risks. USDY sidesteps that with direct Treasury backing, audited transparency, and Sei’s permissionless composability. Current market data underscores its edge: holding $1.11 with negligible volatility, it’s the productive dollar DeFi deserves.

USDY vs USDC/USDT vs sDAI: Yield, Speed, Chain, and Risk Comparison

| Yield Source | Speed | Chain | Risk Level |

|---|---|---|---|

| USDY ($1.11, Treasury-backed yield) | Ultra-fast 🚀 | Sei Network | Low 🟢 |

| USDC/USDT (0% yield, centralized reserves) | Standard | Multi-chain | Medium 🟡 |

| sDAI (variable yield, Ethereum gas fees) | Slow ⏳ | Ethereum | Medium 🟠 |

Numbers don’t lie. Sei’s 1.2 million daily actives pre-launch signal pent-up demand, and USDY’s integrations tap it directly. This positions tokenized US treasuries Sei as a liquidity magnet, pulling in funds that once sat idle in CeFi.

Zoom out, and USDY on Sei feels like the missing link. Traditional Treasuries lock capital for months; here, it’s fluid, 24/7, with yields accruing daily. Non-U. S. players bypass forex headaches, gaining U. S. government-grade security on a chain built for scale. Ondo Finance nailed the timing, riding Sei’s momentum while broader markets grapple with unlocks and volatility.

For financial pros dipping into crypto, start small: allocate 10-20% to USDY lending pools. Watch as $1.11 stability meets real yields, outpacing savings accounts or idle stables. Sei proves high-performance infra isn’t niche anymore; it’s the new standard for USDY Ondo Finance plays. As RWA primitives mature, expect USDY to anchor more protocols, drawing billions in TVL. The on-chain fixed-income era just accelerated.