Ondo USDY Tokenized Treasuries on Sei Network: Yield Earning Lending Collateral Guide

Ondo Finance’s USDY tokenized treasuries have arrived on the Sei Network, blending the stability of short-term U. S. Treasuries with the speed of a high-performance blockchain. This move opens doors for non-U. S. investors to earn yield on dollar-denominated assets while using them seamlessly in DeFi applications like lending and collateral. At a current price of $1.11, USDY reflects a 24-hour gain of and $0.0100 ( and 0.9100%), underscoring its appeal in the ondo usdy sei ecosystem.

Ondo US Dollar Yield Technical Analysis Chart

Analysis by Market Analyst | Symbol: BYBIT:USDYUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

As a technical analyst with a balanced approach, start by drawing horizontal lines at key support (1.10) and resistance (1.14) levels to highlight the tight range post-Sei integration news. Add a subtle uptrend line connecting lows from mid-January 2026 around 1.08 to the recent high at 1.14, capturing the gradual appreciation driven by yield accrual. Use rectangles to mark the ongoing consolidation zone from early February 2026 between 1.10 and 1.12. Place callouts on volume spikes indicating accumulation and MACD histogram for bullish divergence. Mark entry zone near current 1.11 with low-risk long position tool, profit target at 1.15, and stop-loss below 1.10. Vertical line for the Sei launch news event on Feb 21, 2026. Fib retracement from recent low to high for potential pullback levels.

Risk Assessment: low

Analysis: Stable yield-bearing asset with minimal volatility; technicals align with fundamentals amid low volume—suits medium tolerance perfectly

Market Analyst’s Recommendation: Accumulate on dips to 1.10-1.11 for long-term hold, targeting 1.15+ as yield compounds

Key Support & Resistance Levels

📈 Support Levels:

-

$1.1 – 24h low and psychological support aligning with Treasury yield floor

strong -

$1.08 – January swing low, moderate hold during dips

moderate

📉 Resistance Levels:

-

$1.14 – 24h high post-Sei news pump

strong -

$1.15 – Next yield accrual target, recent consolidation ceiling

moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$1.11 – Current price in uptrend with Sei catalyst, low vol entry for yield play

low risk -

$1.1 – Support bounce with bullish MACD confirmation

medium risk

🚪 Exit Zones:

-

$1.15 – Profit target at resistance extension

💰 profit target -

$1.15 – Trailing stop above R1

💰 profit target -

$1.09 – Below key support invalidating uptrend

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: low but increasing on upsides

Subtle accumulation volumes on greens, confirming institutional interest sans retail frenzy

📈 MACD Analysis:

Signal: bullish histogram expansion

MACD line crossing above signal with growing histogram, early bull momentum

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Tokenized treasuries on Sei Network represent a pivotal step toward bridging traditional finance with blockchain efficiency. USDY, backed by short-term U. S. Treasuries and bank deposits, accrues yield through gradual price appreciation, offering a predictable return without the complexities of staking or complex protocols. For those eyeing tokenized treasuries sei network, this integration means high-quality liquid assets that enhance portfolio diversification.

Decoding USDY: Yield Mechanics and Backing Assets

At its core, USDY is a tokenized note designed for accessibility. Unlike static stablecoins, it captures real Treasury yields, currently manifesting in its price hovering at $1.11 after touching a 24-hour high of $1.14 and low of $1.10. This appreciation mechanism ensures holders benefit from underlying assets without daily compounding hassles. Ondo Finance structures USDY to maintain dollar parity while delivering returns, making it ideal for conservative strategies in volatile crypto markets.

I appreciate how Ondo prioritizes regulatory compliance and institutional-grade custody, drawing from partnerships that instill confidence. As a portfolio manager, I’ve seen tokenized t-bills like USDY transform fixed-income exposure, especially on chains like Sei where transaction finality rivals centralized systems. The result? Users gain usdy yield sei without sacrificing liquidity.

Ondo’s USDY provides yield backed by short-term US Treasuries, now live on the fastest L1 for lending, collateral, and more.

Sei’s High-Speed Infrastructure Powers USDY Adoption

Sei Network’s ultra-fast layer-1 architecture processes tens of thousands of transactions per second, perfectly suiting USDY’s role in dynamic DeFi. This integration, announced across Sei Blog and Ondo channels, positions ondo finance usd y sei lending as a cornerstone for ecosystem growth. With over $1.2B in circulation across products, USDY brings substantial liquidity to Sei, enabling protocols like Takara Lend and Yei Finance to offer competitive borrow rates against this collateral.

Institutions and retail users alike can now deploy USDY in liquidity pools on DEXs such as Saphyre, earning dual yields from trading fees and Treasury returns. Sei’s focus on real-world assets accelerates this, shifting from hype-driven tokens to programmable dollars that function actively in lending markets.

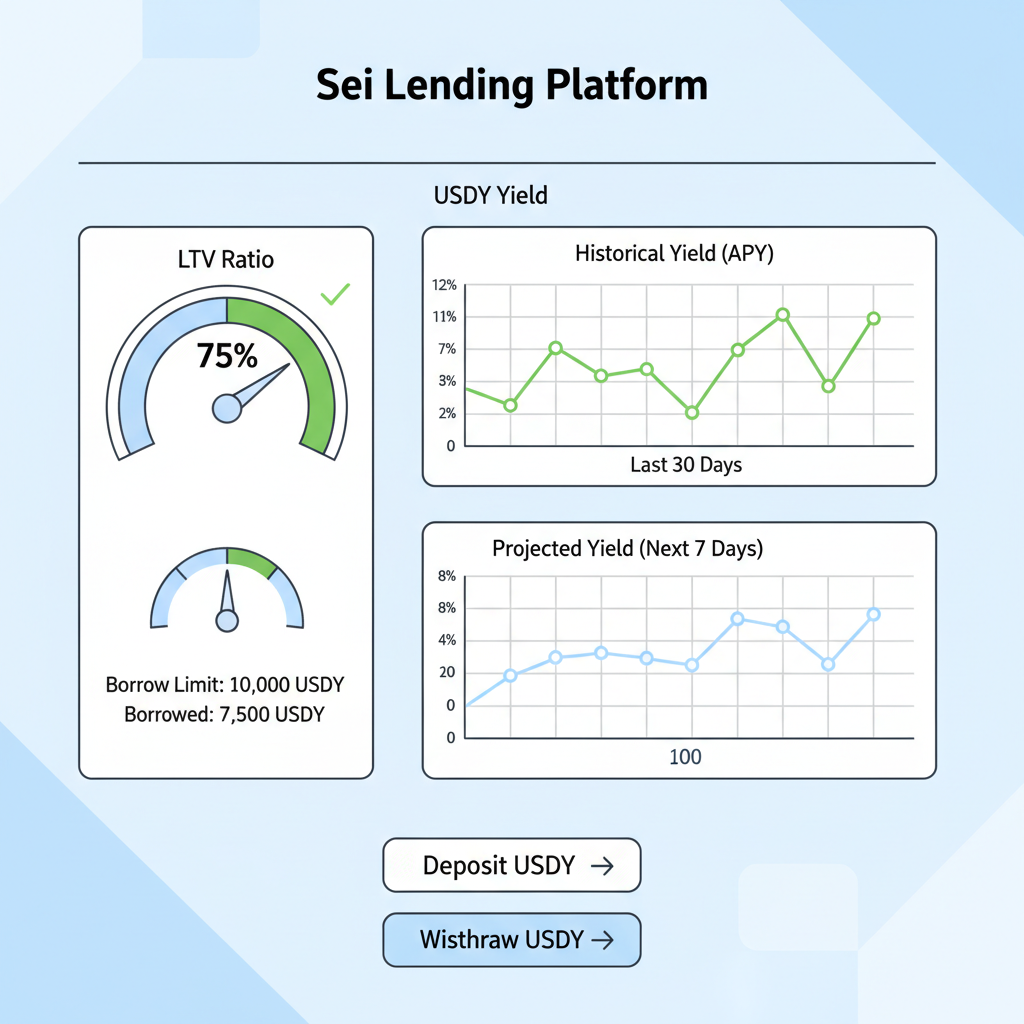

Leveraging USDY as Premium Lending Collateral

One of USDY’s strongest suits on Sei is its utility as tokenized t-bills sei collateral. Platforms like Takara Lend accept USDY deposits, allowing borrowers to access stablecoins while lenders earn competitive APYs backed by overcollateralization. To get started, complete Ondo Finance’s onboarding for the transfer allowlist, then bridge or swap into USDY via supported interfaces.

Consider a practical scenario: Deposit USDY at its current $1.11 valuation, borrow against it at low loan-to-value ratios, and redeploy proceeds into higher-risk opportunities. This strategy amplifies returns risk-adjusted, aligning with my mantra that diversification remains the only free lunch. Yei Finance further expands options with specialized pools, where USDY’s stability minimizes liquidation risks during market dips.

Ondo USDY (USDY) Price Prediction 2027-2032

Professional predictions based on Treasury yields, Sei Network adoption trends, RWA growth, and market cycles

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $1.05 | $1.16 | $1.28 | +4.5% |

| 2028 | $1.12 | $1.23 | $1.36 | +6.0% |

| 2029 | $1.20 | $1.32 | $1.46 | +7.3% |

| 2030 | $1.28 | $1.42 | $1.58 | +7.6% |

| 2031 | $1.38 | $1.54 | $1.72 | +8.5% |

| 2032 | $1.50 | $1.68 | $1.88 | +9.1% |

Price Prediction Summary

USDY is projected to show steady appreciation from its 2026 baseline of $1.11, driven by consistent U.S. Treasury yields (around 4-5%) and enhanced utility as lending collateral and liquidity provider on the high-performance Sei Network. Average prices are expected to rise progressively to $1.68 by 2032, with bullish maxima reflecting RWA adoption surges and bearish minima accounting for yield drops or regulatory hurdles.

Key Factors Affecting Ondo USDY Price

- U.S. Treasury yield fluctuations (base growth driver)

- Sei Network adoption and DeFi integrations (lending, collateral on Takara Lend, Yei Finance)

- RWA sector expansion and tokenized asset demand

- Regulatory clarity for on-chain treasuries and institutional access

- Crypto market cycles and competition from other yield-bearing assets like OUSG

- Technological improvements in Sei’s high-throughput L1 blockchain

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Current metrics show USDY’s 24-hour trading volume supporting robust activity, with its price stability at $1.11 attracting yield seekers. As Sei DeFi TVL grows, expect USDY to anchor lending markets, providing the high-quality collateral that protocols crave.

Platforms like Takara Lend stand out for their conservative risk parameters, often capping loan-to-value ratios at 70-80% for USDY collateral. This setup protects lenders while enabling borrowers to leverage their holdings effectively. In my experience managing fixed-income portfolios, such mechanisms mirror traditional margin lending but with blockchain’s instant settlement advantages.

Step-by-Step: Deploying USDY in Sei’s Lending Markets

Navigating ondo finance usd y sei lending starts with preparation. First, ensure wallet compatibility with Sei, such as Leap or Compass. Then, tackle Ondo’s allowlist process, which verifies users for compliant access to USDY transfers. Once whitelisted, acquire USDY through bridges or DEX swaps, noting its steady $1.11 price point.

After depositing, select borrow markets wisely. For instance, borrowing USDC against USDY lets you chase higher yields elsewhere, all while your collateral appreciates from Treasury returns. Yei Finance offers pooled strategies where USDY underpins variable-rate lending, blending stability with ecosystem incentives.

Real-world yields embedded in USDY, combined with lending APYs often exceeding 5-8%, create compounded growth potential. Track performance via dashboards, adjusting positions as Sei’s TVL climbs and liquidity deepens.

Risks, Rewards, and Portfolio Strategies

While USDY shines at $1.11 with a 24-hour high of $1.14, no asset is risk-free. Smart contract vulnerabilities, though mitigated by Sei’s audited infrastructure, warrant caution. Liquidity risks during extreme volatility could amplify liquidation events, so maintain buffers above maximum LTV thresholds.

From a diversification standpoint, allocate 20-30% of DeFi exposure to tokenized t-bills sei collateral like USDY. Pair it with volatile assets for balance; borrow against it to fund long positions in Sei-native tokens. This approach has proven resilient in my hedge fund days, turning Treasuries into dynamic tools rather than idle holdings.

- Conservative Play: Hold USDY solo for pure Treasury yield accrual.

- Moderate Leverage: Lend on Takara for added APY without borrowing.

- Aggressive Yield Farm: Borrow stablecoins, redeploy into DEX pools.

Ondo’s compliance focus, restricting access to non-U. S. persons appropriately, adds a layer of institutional trust. Compare this to OUSG, Ondo’s other offering: USDY edges out for shorter-duration backing and broader DeFi composability, though both deliver similar yields around current rates.

Future Outlook: USDY Anchors Sei’s RWA Boom

With USDY’s integration fresh and trading volume at levels supporting its $1.11 stability, Sei’s DeFi sector poised for expansion. Expect more protocols to adopt it as premium collateral, drawing institutional inflows chasing usdy yield sei. BlackRock’s RWA momentum only amplifies this; programmable yield dollars like USDY shift paradigms from static holdings to active capital.

As Sei processes transactions at blistering speeds, USDY users benefit from near-real-time executions, minimizing slippage in lending adjustments. Watch for ecosystem grants boosting liquidity, potentially pushing USDY’s utility beyond current platforms. For investors, this confluence of tokenized treasuries and high-performance chains redefines fixed-income accessibility.

In portfolios I’ve optimized, assets like USDY prove indispensable for ballast amid crypto swings. Its backing by over $1.2 billion in products underscores scalability. Stay engaged with Sei and Ondo updates; the yield-bearing collateral era on blockchain is just accelerating.