Top Platforms for Tokenized Treasuries: Features, Fees, and Security

Tokenized treasury platforms have rapidly moved from niche innovation to a strategic battleground for institutional investors seeking compliant, liquid access to U. S. government debt. As we enter 2025, the market is crowded with platforms promising everything from 24/7 liquidity and fractional ownership to bulletproof compliance and robust blockchain security. But not all platforms are created equal, especially when it comes to the nuances of fees, security protocols, and regulatory alignment.

Why Tokenized Treasuries Matter in 2025

Tokenization of U. S. Treasuries is no longer a theoretical exercise, it’s a practical solution to age-old frictions in fixed income. By leveraging blockchain technology, these platforms allow investors to hold, trade, and settle digital representations of Treasury bills and bonds with unprecedented speed and transparency. The result? Enhanced liquidity, reduced settlement risk, and the democratization of access for both traditional institutions and crypto-native funds.

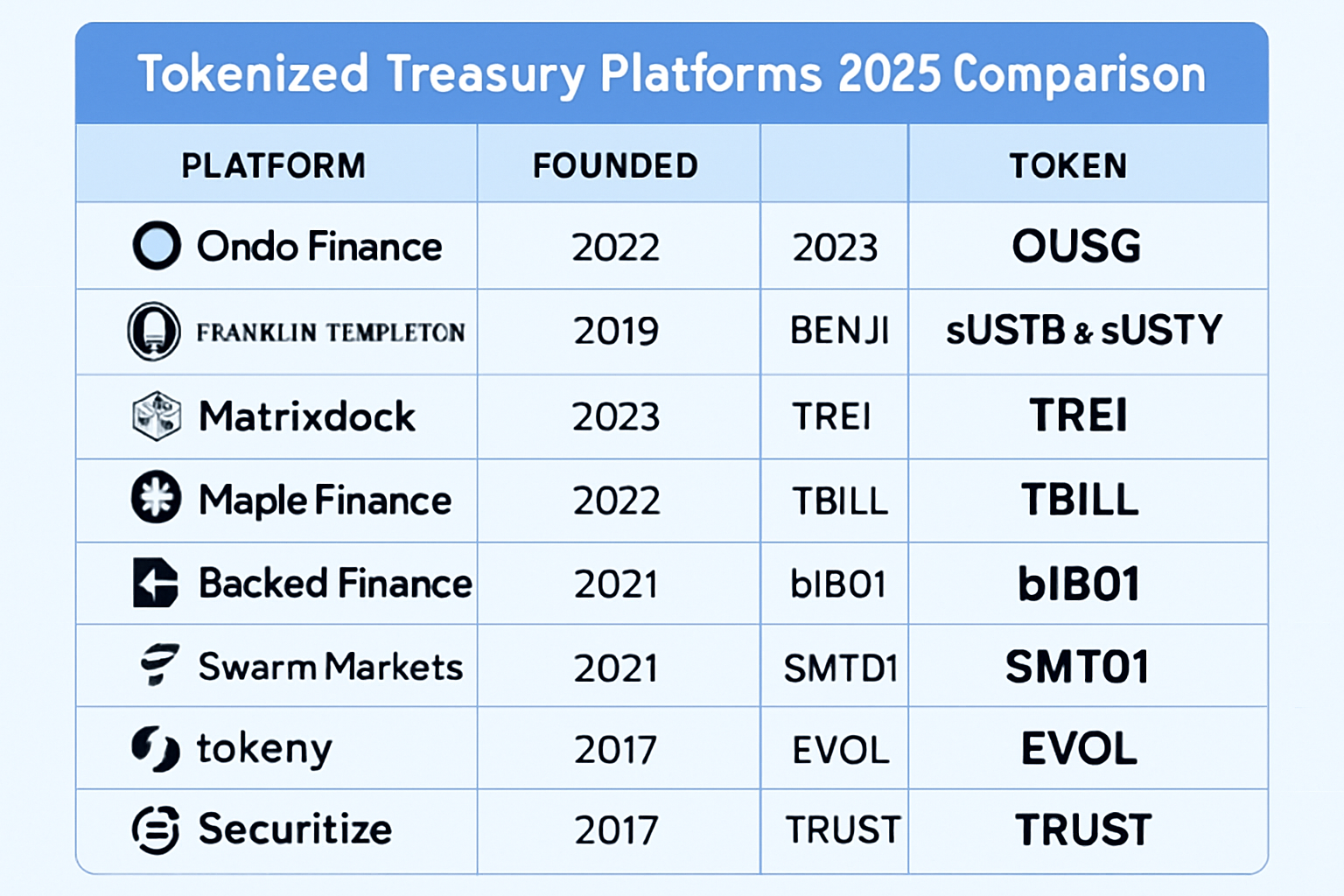

The following list spotlights the top 10 tokenized treasury platforms as of September 2025. Each platform has been evaluated on features, fee structure, regulatory rigor, and security architecture, critical factors for any serious investor considering this emerging asset class.

Top 10 Tokenized Treasury Platforms for 2025

-

Ondo Finance enables on-chain access to U.S. Treasuries through products like USDY and OUSG. It bridges DeFi liquidity with real-world yields, offering institutional-grade compliance and zero management fees for USDY.

-

Franklin Templeton (Benji Investments) offers the Franklin OnChain U.S. Government Money Fund (FOBXX), providing tokenized shares of a regulated money market fund primarily invested in U.S. government securities, with a 0.15% management fee and Stellar blockchain security.

-

Matrixdock (STBT) issues Short-Term Treasury Bill Tokens (STBT), fully collateralized by U.S. Treasury bills. The platform emphasizes transparency, daily proof-of-reserves, and robust compliance, making it a go-to for institutional investors.

-

Maple Finance (Cash Management Pool) provides access to tokenized U.S. Treasury yields via its Cash Management Pool, targeting institutional and DeFi users seeking secure, on-chain fixed-income exposure.

-

OpenEden Treasury enables users to mint yield-bearing tokens backed by U.S. Treasury bills, with on-chain transparency and real-time auditing. The platform focuses on compliance and seamless integration with DeFi protocols.

-

Backed Finance offers tokenized real-world assets, including U.S. Treasury ETFs, through fully collateralized and regulated products tradable on major blockchains. It prioritizes investor protection and regulatory adherence.

-

Swarm Markets is a regulated DeFi platform that tokenizes U.S. Treasury bonds and other assets, providing liquidity, compliance, and secondary trading for institutional and retail investors.

-

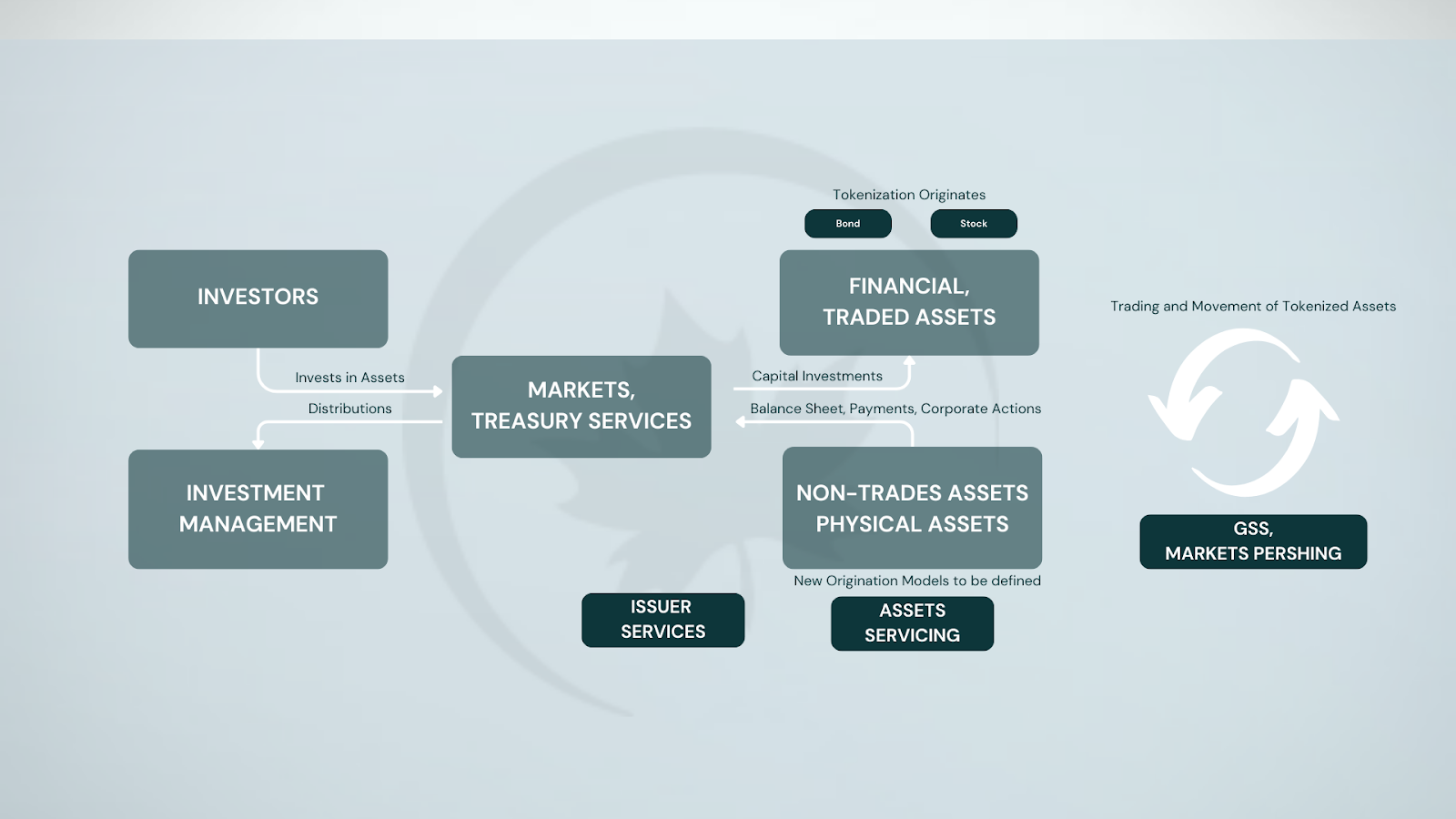

Tokeny Solutions delivers end-to-end infrastructure for tokenizing securities, including U.S. Treasuries, with a focus on compliance, investor onboarding, and secure asset management on public and permissioned blockchains.

-

Securitize Markets offers a regulated platform for issuing, managing, and trading tokenized U.S. Treasuries and other securities, with automated compliance and access to a secondary market via its Alternative Trading System (ATS).

-

Bosonic provides institutional-grade infrastructure for tokenized assets, including U.S. Treasuries, with a focus on real-time settlement, security, and interoperability across digital and traditional finance ecosystems.

In-Depth Platform Overviews

Ondo Finance

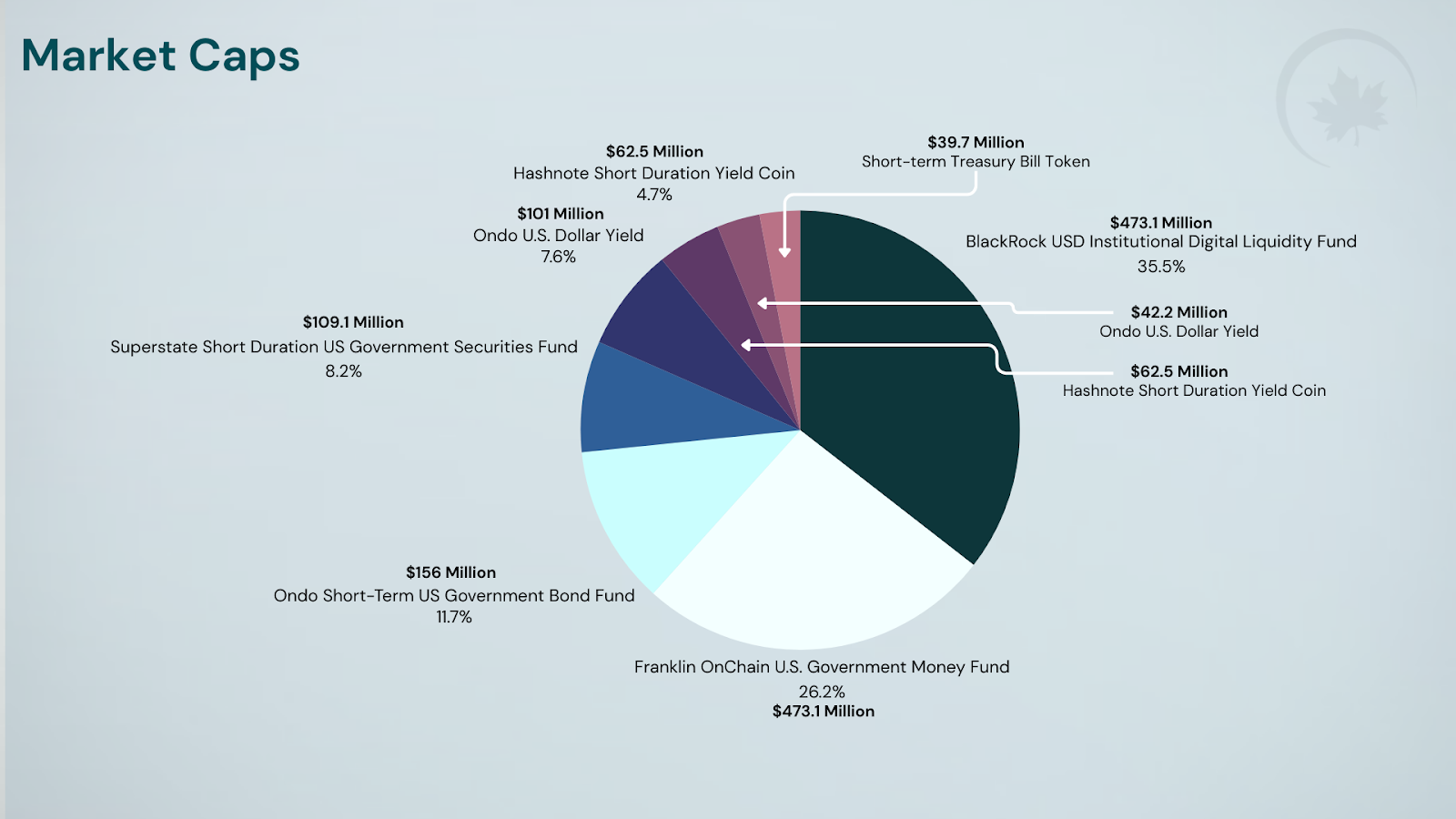

Ondo Finance has established itself as a DeFi-to-TradFi bridge by offering tokenized U. S. Treasuries through products like USDY (U. S. Dollar Yield token) and OUSG (Ondo Short-Term US Treasuries Fund). Ondo’s model is notable for its seamless integration between DeFi liquidity pools and real-world yield generation, a rare feat among competitors.

- Features: Real-time redemption windows, low entry barriers, institutional-grade custody.

- Fees: USDY offers an annual interest rate of 4.90% with zero management or performance fees.

- Security: KYC/AML onboarding plus smart contract audits; built on Ethereum.

Franklin Templeton (Benji Investments)

Franklin Templeton’s Benji Investments, via the Franklin OnChain U. S. Government Money Fund (FOBXX), brings traditional money market expertise into the blockchain era. FOBXX invests at least 99.5% in government securities or cash equivalents, making it one of the most conservative options on-chain.

- Features: Stable NAV targeting $1 per share; available on Stellar blockchain for efficient settlement.

- Fees: Management fee stands at a competitive 0.15% annually.

- Security: High-grade custody standards; SEC-regulated structure; Stellar-based transaction layer.

Matrixdock (STBT)

Matrixdock’s STBT, or Short-Term Treasury Bill Token, offers full collateralization by U. S. Treasury bills with transparent on-chain proof-of-reserves. Matrixdock has already surpassed $100M in issuance, a testament to growing institutional demand for digital T-bills.

- Features: Daily liquidity windows; proof-of-reserve dashboard; integration with major DeFi protocols.

- Fees: Management fees are typically between 0.20%–0.30%, depending on volume tiering and custody arrangement.

- Security: Multi-signature wallets; regular third-party audits; operates primarily on Ethereum mainnet.

The Next Generation: Expanding Access and Security

The momentum behind tokenized treasuries isn’t limited to early movers, new entrants are raising the bar on compliance, user experience, and interoperability across blockchains. Platforms like Maple Finance (Cash Management Pool), OpenEden Treasury, Backed Finance, Securitize Markets, Bosonic, Securitize Markets, Bosonic, Securitize Markets, Bosonic, Securitize Markets, Bosonic, Securitize Markets, Bosonic, Securitize Markets, Bosonic. Each brings its own approach to solving persistent pain points around secondary market liquidity or cross-border compliance checks.

Maple Finance (Cash Management Pool)

Maple Finance has carved out a unique position by focusing on institutional-grade cash management via tokenized treasury pools. The Cash Management Pool allows accredited investors to earn U. S. Treasury yields while benefiting from blockchain’s programmability and transparency.

- Features: Automated yield distribution, daily liquidity, DeFi-native integrations.

- Fees: Management fees typically range from 0.20%–0.40% per annum, with no performance fees.

- Security: Robust smart contract audits, KYC onboarding for institutions, and segregated custody solutions.

OpenEden Treasury

OpenEden Treasury targets both crypto funds and traditional asset managers with its on-chain T-bill vaults. OpenEden’s architecture is designed to maximize composability, making it easy to plug tokenized treasuries into broader DeFi strategies without sacrificing regulatory rigor.

- Features: Real-time proof-of-reserves, permissioned access for compliant investors, cross-chain operability.

- Fees: Typically 0.25%–0.35% annual management fee; transparent cost structure published on-chain.

- Security: Multi-layer security protocols, including regular third-party audits and institutional-grade custody partners.

Backed Finance

Backed Finance specializes in the tokenization of traditional securities, including U. S. Treasuries, on public blockchains. Its compliance-first approach ensures tokens are only accessible to verified investors while maintaining secondary market flexibility through whitelisted trading venues.

- Features: Tokenized securities fully backed by underlying assets; streamlined onboarding for institutions; whitelisted peer-to-peer transfers.

- Fees: Project-based fee model; typically 0.20%–0.50% depending on asset type and volume.

- Security: KYC/AML at both issuance and trading levels; assets held with regulated custodians; smart contract audits conducted regularly.

Comparison of Top Tokenized Treasury Platforms (2025)

| Platform | Features 🛠️ | Fees 💸 | Security 🔒 |

|---|---|---|---|

| Swarm Markets | – Token issuance & management – DeFi integration – Automated compliance |

Variable; typically project-based fees | Regulated in Germany 🇩🇪 Smart contract audits |

| Tokeny Solutions | – End-to-end asset tokenization – KYC/AML onboarding – Modular compliance tools |

Custom pricing based on services | ISO 27001 certified Multi-layer security |

| Securitize Markets | – Tokenize U.S. Treasuries & RWAs – Automated investor onboarding – Secondary market via regulated ATS |

Project-dependent; varies by service | SEC-compliant 🏛️ Multi-signature wallets Smart contract audits |

Securitize Markets

Securitize Markets stands out for its regulated Alternative Trading System (ATS) that enables secondary trading of security tokens, including those backed by U. S. Treasuries, in full compliance with U. S. SEC regulations.

- Features: : Investor onboarding with automated KYC/AML checks; seamless integration between primary issuance and secondary trading.

- Fees: : Variable depending on service level, primary issuance, ATS listing, or ongoing transfer agent services.

- Security: : Multi-signature wallets; SOC2-compliant operations.

Bosonic

Bosonic takes a different approach by offering a settlement network purpose-built for institutional-grade digital asset trading, including tokenized treasuries, without counterparty risk or balance sheet exposure to intermediaries.

- Main Features: Atomic settlement layer connecting major custodians and liquidity providers directly;