Tokenized U.S. Treasuries Hit $8.6B Market Cap as DeFi Collateral on Aave and Bybit in 2025

The market for tokenized U. S. Treasuries has crossed $8.73 billion in assets under management as of November 3,2025, marking a pivotal moment in the convergence of traditional finance and blockchain. This growth, up from $7.4 billion earlier in the year, underscores the appeal of these digital assets amid volatile crypto markets and shifting institutional strategies. Platforms like Aave and Bybit are at the forefront, integrating tokenized Treasuries as collateral to unlock new liquidity avenues in DeFi.

BlackRock’s USD Institutional Digital Liquidity Fund, known as BUIDL, commands roughly $2.92 billion, or 33.5% of the total market. This dominance highlights how legacy players are reshaping on-chain finance. Tokenized Treasuries offer stability with yields tied to short-term U. S. government debt, making them ideal for collateral in lending protocols and exchanges.

BlackRock BUIDL Leads the Charge in Tokenized Treasury Dominance

Institutional adoption has fueled this expansion. BUIDL’s scale reflects confidence in blockchain’s ability to handle high-value fixed-income products. Investors gain 24/7 settlement, fractional ownership, and programmable yields, features absent in traditional wrappers. Yet, this isn’t just hype; real capital is flowing in, with governance models like Mantle’s emerging to allocate resources efficiently across protocols.

Tokenized Treasuries are silently building the foundation of onchain finance.

From a global perspective, this trend diversifies beyond U. S. -centric assets. DBS’s tokenized treasuries repo initiatives signal Asia’s entry, while Chainlink’s Swift integrations hint at broader bond tokenization. For forex traders like myself, these shifts influence currency flows, as tokenized yields compete with offshore deposits and eurodollar markets.

Aave’s Integration Boosts DeFi Collateral Liquidity

Aave, with its AAVE token trading at $167.42 after a 24-hour dip of -6.50% (high $181.72, low $165.18), exemplifies DeFi’s maturation. Users now post tokenized Treasuries as collateral for loans, earning yields while borrowing against crypto holdings. This reduces liquidation risks during downturns, as Treasury-backed positions hold steady value.

Picture this: an institutional fund supplies $100 million in tokenized T-bills on Aave, borrows stablecoins, and deploys into higher-yield strategies. The result? Compounded returns with minimal counterparty risk. Aave’s V3 upgrades have optimized this, supporting assets from multiple issuers. Market data shows utilization rates climbing, signaling demand.

Critically, this setup bridges TradFi and DeFi. Regulated custodians back these tokens, ensuring compliance. For global investors, Aave’s multicollateral pools mean exposure to U. S. rates without FX headaches, a boon in uncertain monetary policy eras.

Aave (AAVE) Price Prediction 2025-2031

Forecasts amid tokenized U.S. Treasuries surge to $8.7B market cap and adoption as DeFi collateral on Aave

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2025 | $150 | $200 | $250 | — |

| 2026 | $160 | $260 | $420 | +30% |

| 2027 | $220 | $390 | $700 | +50% |

| 2028 | $280 | $520 | $1,000 | +33% |

| 2029 | $360 | $700 | $1,400 | +35% |

| 2030 | $460 | $950 | $2,000 | +36% |

| 2031 | $600 | $1,300 | $2,800 | +37% |

Price Prediction Summary

With tokenized U.S. Treasuries exceeding $8.7B in market cap and platforms like Aave integrating them as high-quality collateral, AAVE is positioned for robust growth. Average prices are projected to rise from $200 in 2025 to $1,300 by 2031, with maximums reaching $2,800 in bullish scenarios driven by DeFi TVL expansion, institutional adoption, and RWA trends. Minimums reflect bearish market cycles but trend upward overall.

Key Factors Affecting Aave Price

- Surge in tokenized U.S. Treasuries to over $8.7B, enhancing DeFi liquidity

- Aave’s adoption of treasuries as collateral, increasing protocol TVL and revenue

- Institutional dominance via BlackRock’s BUIDL fund ($2.92B, 33.5% market share)

- Bridging TradFi-DeFi gap, attracting more users and capital to Aave

- Aave protocol upgrades and governance improvements boosting efficiency

- Regulatory tailwinds for RWAs and clearer DeFi frameworks

- Crypto market cycles, Bitcoin halvings, and broader adoption trends

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

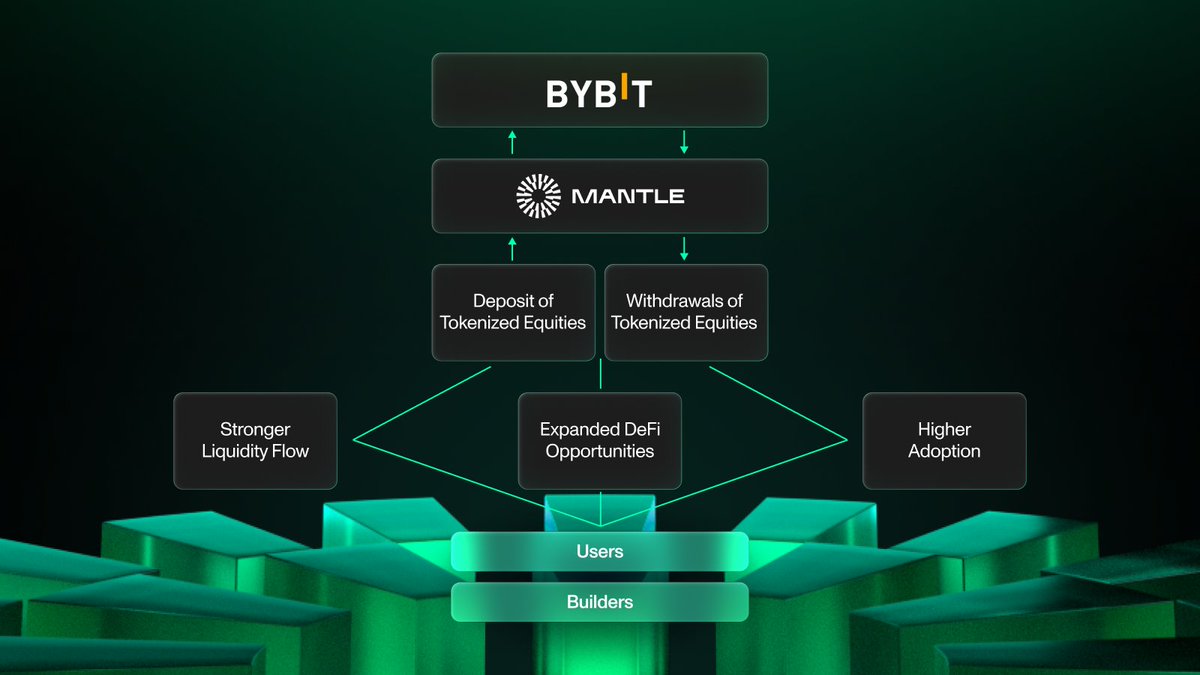

Bybit joins the party, accepting tokenized money market funds alongside spot and derivatives trading. Deribit follows suit, blending CEX efficiency with on-chain primitives. Traders margin positions with Treasuries, slashing funding costs versus pure crypto collateral.

This matters because exchanges face mounting pressure for yield-bearing collateral. Tokenized U. S. Treasuries fit perfectly, offering sub-5% yields with zero credit risk. In 2025’s landscape, as crypto corrections test resolve, these assets act as flight-to-safety havens. Volumes on Bybit for such pairs have spiked, per recent reports.

Opinion: While DeFi purists decry centralization, hybrid models accelerate adoption. Bybit’s move democratizes access for retail, previously locked to institutions. Globally, this pressures competitors like Binance to innovate, potentially sparking a collateral arms race.

Read more on related trends in how tokenized U. S. Treasuries became the fastest-growing on-chain asset in 2025 and how they emerged as an $8 billion safe haven.

Exchanges like Bybit are not alone in this shift. Deribit has similarly onboarded tokenized money market funds, creating margin efficiencies that traditional collateral cannot match. These platforms report surging volumes, with tokenized U. S. Treasuries tokenized US treasuries $8.6B becoming the preferred backing for derivatives amid crypto’s 2025 volatility.

Top tokenized U.S. Treasuries issuers by AUM 💰

| Issuer | Token | AUM | Market Share |

|---|---|---|---|

| BlackRock | BUIDL | $2.92B | 33.5% 👑 |

| OpenEden | TBILL | $1.2B | 13.7% 📈 |

| Franklin Templeton | OnChain U.S. Govt Money Fund | $900M | 10.3% 🏦 |

| Ondo Finance | US Dollar Yield | $700M | 8.0% 🚀 |

| Total Market | – | $8.73B | 100% 🌍 |

From my vantage in global markets, this proliferation affects more than just crypto. Tokenized Treasuries introduce U. S. rate exposure into forex strategies, hedging commodity trades against dollar strength. As central banks diverge, these assets offer a neutral yield anchor, influencing eurodollar spreads and emerging market carry trades.

Challenges and the Road Ahead for Tokenized Collateral

Despite momentum, hurdles persist. Regulatory clarity lags, with SEC scrutiny on yield-bearing tokens testing issuers. Scalability on Ethereum remains a bottleneck, though layer-2 solutions like Mantle are deploying governance to allocate capital toward infrastructure. Krzysztof Gogol notes exchanges like Bybit and Deribit accepting these as collateral, but oracle reliability for real-time pricing is crucial to prevent exploits.

Yet, optimism prevails. Aave’s resilience, holding at $167.42 despite a -6.50% daily pullback (from a high of $181.72 to low $165.18), underscores protocol strength amid tokenized treasury inflows. Bybit’s hybrid model appeals to institutions wary of pure DeFi, blending CEX speed with on-chain transparency.

Globally, Asia leads innovation. DBS Bank’s tokenized treasuries repo pilots enable 24/7 funding markets, rivaling Singapore’s offshore hubs. Chainlink’s Swift collaborations for tokenized bonds could expand this to longer-duration debt, reshaping cross-border flows. For commodities traders, this means stable collateral for gold or oil positions, decoupled from crypto beta.

Institutional flight to yield accelerates as crypto corrections expose leverage risks. Tokenized U. S. Treasuries, now at $8.73 billion, provide that ballast. Aave’s multicollateral pools and Bybit’s margin tools exemplify how DeFi evolves into a mature alternative to TradFi lending desks.

Looking across markets, these developments signal a structural pivot. Forex pairs like USD/JPY benefit from repatriation yields, while tokenized treasuries as DeFi collateral stabilize on-chain lending. Banks and funds will increasingly view blockchain not as a threat, but as an efficiency layer for fixed income. With Aave trading firmly around $167.42, the protocol stands ready for further growth.

Explore deeper insights in how tokenized U. S. Treasuries power on-chain collateral markets.