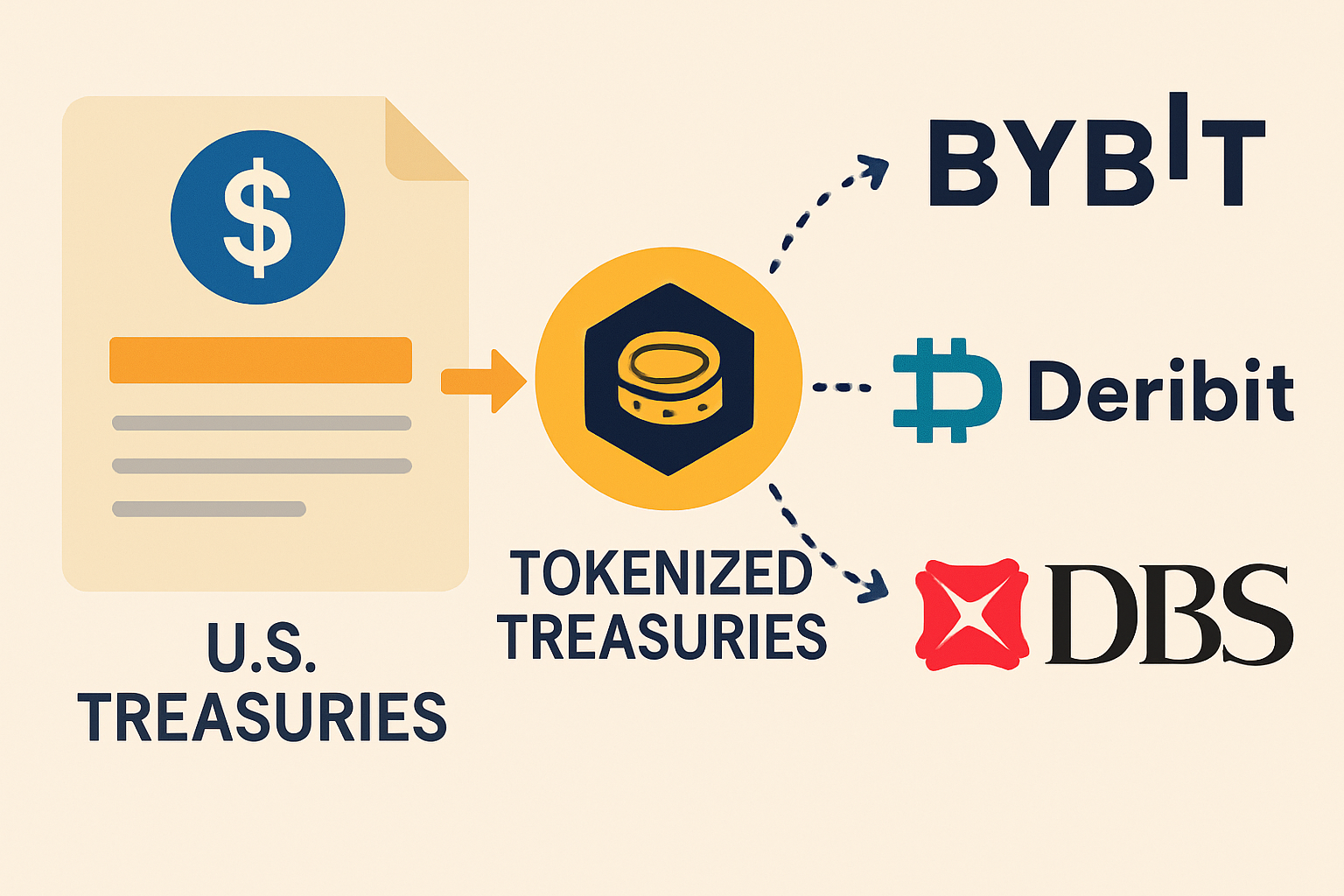

Tokenized US Treasuries as On-Chain Collateral: Bybit Deribit Margin Trading and DBS Repo Use Cases 2025

Tokenized U. S. Treasuries have surged past $8.6 billion in market capitalization, marking a pivotal shift from passive yield generators to dynamic on-chain collateral assets. This evolution is reshaping margin trading on platforms like Bybit and Deribit, while banks such as DBS explore repo use cases that promise 24/7 liquidity. As a risk management specialist, I see this as a game-changer for balancing yield and leverage in volatile markets, allowing investors to earn steady returns even on posted collateral.

Institutions are no longer sidelined by settlement delays or opportunity costs. Instead, they deploy tokenized Treasuries directly on blockchain rails, unlocking capital efficiency that traditional finance could only dream of. BlackRock’s BUIDL fund, now at $2.9 billion, exemplifies this trend, accepted as margin collateral on Deribit since June 2025. Traders post these assets for leveraged positions while the underlying Treasuries accrue daily yield, a dual benefit that minimizes drag on returns.

Bybit’s Pioneering Step with Tokenized MMF Collateral

Bybit set a precedent in late September 2024 by integrating QCDT, a DFSA-approved tokenized money market fund backed by U. S. Treasuries. This move enables traders to collateralize perpetual futures and options with yield-bearing assets, sidestepping the pitfalls of volatile crypto collateral. Imagine posting stable, interest-accruing tokens against high-leverage bets on Bitcoin or Ethereum; it’s a risk mitigator I recommend for anyone navigating 2025’s choppy waters.

The platform’s adoption aligns with broader institutional uptake. Tokenized treasuries collateral now powers sophisticated strategies, reducing liquidation risks during downturns. Bybit’s initiative, coupled with Swift’s ISO 20022 integration via Chainlink, bridges TradFi messaging to blockchain, ensuring seamless verification of collateral quality.

Deribit’s Yield-Bearing Margin Revolution

Deribit took it further in October 2024 with Hashnote’s USYC, an ERC-20 token backed by reverse repos on U. S. government securities. This cross-margin collateral option lets traders earn yield across portfolios, a boon for options desks managing multi-asset exposures. Fast-forward to June 2025, and BlackRock’s BUIDL joins the fray, supercharging institutional participation with its $2.9 billion scale and proven stability.

Institutional traders can now leverage tokenized Treasuries while those assets work for them, earning yield that offsets funding costs.

This isn’t hype; it’s practical risk management. During market stress, yield-bearing collateral preserves value better than pure stablecoins, which often depeg. Deribit’s innovations provide granular control, from portfolio margining to real-time yield accrual, empowering pros to optimize every basis point.

DBS Bank’s Repo Experiments Pave the Way

While exchanges lead in trading applications, DBS Bank’s repo tests signal TradFi’s on-chain pivot. These experiments, alongside consortium efforts like the Canton Network’s 24/7 U. S. Treasury financing against USDC in August 2025, demonstrate tokenized repos’ potential. Banks of America, Citadel, and Societe Generale executed real-time settlements on a weekend, bypassing T and 1 constraints.

DBS’s involvement hints at Asian hubs adopting similar models, using tokenized treasuries for intraday collateral mobility. This fluidity reduces hairpin risk in repo chains, where collateral gets stuck in transit. For risk-averse investors, it’s a supportive step toward resilient portfolios that thrive in a tokenized future.

Swift and Chainlink’s collaboration with UBS further cements this trajectory, linking $100 trillion fund industries to blockchain via standardized messages. UBS’s end-to-end tokenized fund transaction underscores atomic settlement’s reliability, vital for collateral ops.

These advancements aren’t isolated; they form a cohesive ecosystem where tokenized treasuries collateral flows seamlessly between exchanges, banks, and messaging networks. For institutional players, this means collateral that never sleeps, generating yield around the clock while securing positions.

Consider the mechanics on Bybit’s Bybit tokenized MMF margin system. Traders deposit QCDT, which accrues interest from its U. S. Treasury backing, then leverage it up to 10x on perps. This setup captured headlines when tokenized volumes hit $8.6 billion, drawing DFSA oversight for compliance. It’s a stark contrast to legacy collateral, where idle cash earns nothing during trade holds.

Capital Efficiency Meets Real Yield

Zooming into Deribit tokenized treasuries trading, USYC and BUIDL offer portfolio-wide yield accrual. A trader might post $1 million in BUIDL for a BTC options spread; that capital earns 4-5% APY from Treasuries, offsetting borrow rates that spike in volatility. I’ve modeled this in my risk simulations: it shaves 20-30 basis points off effective leverage costs annually, a quiet edge in competitive desks.

DBS Bank’s repo experiments amplify this. Picture tokenized Treasuries pledged intraday, recalled instantly via smart contracts. Their tests, echoing the Canton Network’s August 2025 breakthrough, enable DBS tokenized repo markets that operate weekends and holidays. No more tri-party agents tying up billions; instead, atomic swaps against USDC or stablecoins ensure instant liquidity. As someone who’s navigated repo squeezes, I view this as a firewall against systemic haircuts.

| Platform | Collateral Token | Key Benefit | Yield Source |

|---|---|---|---|

| Bybit | QCDT | Perp/options margin | U. S. Treasuries MMF |

| Deribit | USYC/BUIDL | Cross-margin yield | Reverse repos/Treasuries |

| DBS/Canton | Tokenized Treasuries | 24/7 repo financing | Gov securities |

This table underscores the versatility. Yet, success hinges on smart risk layering. Smart contract vulnerabilities or oracle failures could cascade, but platforms mitigate with Chainlink proofs and overcollateralization. Swift’s ISO 20022 bridge, tested with UBS, verifies off-chain holdings on-chain, slashing settlement risk to near zero.

Navigating Risks in On-Chain Collateral

Don’t get swept up in the excitement without scrutiny. Liquidity mismatches top my watchlist: tokenized markets, while booming at $8.6 billion, pale against the $27 trillion U. S. Treasury universe. A mass redemption could pressure prices, though BUIDL’s scale at $2.9 billion provides ballast.

Regulatory flux adds nuance. DFSA nods for QCDT reassure, but U. S. clarity lags. I advise diversified baskets: blend USYC for short-duration stability with BUIDL for scale. Monitor Chainlink’s Swift Chainlink UBS tokenized funds rollout; it standardizes proofs, curbing disputes in cross-border repos.

For retail pros dipping in, start small. Use Deribit’s demo mode to test yield drag on liquidations. My mantra holds: manage risk first, then chase reward. These tools reward the prepared, turning collateral from cost center to profit engine.

Looking to 2025, expect ISO 20022 blockchain treasuries to standardize further, with more exchanges listing variants. DBS-like pilots could spawn Asian repo hubs, while Bybit and Deribit expand to tokenized corporate bonds. Investors blending TradFi safety with DeFi speed will lead, their portfolios resilient amid crypto’s swings and bond yield gyrations.

The $8.6 billion milestone isn’t an endpoint; it’s launchpad for on-chain treasury collateral 2025. Platforms evolve, banks adapt, and yield compounds relentlessly. Position accordingly, and watch traditional barriers dissolve.