Ondo USDY Tokenized US Treasuries on Sei Network: Institutional Yield and 24/7 Liquidity Guide 2026

Picture this: tokenized US treasuries racing across a blazing-fast blockchain, delivering institutional-grade yields with the snap of 24/7 liquidity. Ondo Finance just flipped the switch on USDY for the Sei Network, and as of January 30,2026, it’s trading at a rock-solid $1.10. That’s after a minor 24-hour dip of $-0.0100 (-0.009010%), with a high of $1.13 and low of $1.07. Backed by short-term U. S. Treasuries and bank deposits, this $1.2 billion market cap beast is the first permissionless tokenized Treasury on Sei, handing non-U. S. investors and institutions a yield-bearing dollar asset that composes like a stablecoin dream.

Ondo USDY Technical Analysis Chart

Analysis by Market Analyst | Symbol: BYBIT:USDYUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

To annotate this USDYUSDT chart effectively in my balanced technical style, start by drawing an uptrend line connecting the swing low at 2026-01-15 around $1.02 to the recent high on 2026-01-28 at $1.13, using ‘trend_line’. Add horizontal lines at key support $1.07 (recent low) and $1.00 (psychological), and resistance at $1.13 and $1.15 with ‘horizontal_line’. Mark the consolidation range from 2026-01-20 to 2026-01-29 between $1.08-$1.12 using ‘date_price_range’. Place arrow markers for volume spikes (‘arrow_mark_up’) and MACD bullish crossover (‘arrow_mark_up’). Use vertical line for Sei launch news on 2026-01-29. Add text callouts for entry zone near $1.08 and profit target $1.15. Finally, rectangle for accumulation zone early Jan.

Risk Assessment: medium

Analysis: Uptrend intact but recent pullback to 1.07 adds volatility; stablecoin nature limits downside but DeFi hype introduces swings. Medium tolerance suits longs here.

Market Analyst’s Recommendation: Enter long on dip to 1.08 with stop at 1.05, target 1.15. Monitor volume for confirmation.

Key Support & Resistance Levels

📈 Support Levels:

-

$1.07 – Recent 24h low, strong volume support

strong -

$1 – Psychological level and historical base

moderate

📉 Resistance Levels:

-

$1.13 – Recent 24h high, breakout level

strong -

$1.15 – Next Fibonacci extension from Jan low

weak

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$1.08 – Bounce from support with MACD bullish divergence, aligns with uptrend

medium risk -

$1.07 – Strong support retest, high reward potential

low risk

🚪 Exit Zones:

-

$1.15 – Profit target at resistance extension

💰 profit target -

$1.13 – Trailing stop at recent high if broken

🛡️ stop loss -

$1.05 – Invalidation below key support

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Increasing on up candles, confirming accumulation

Volume spikes on green candles near $1.10, bullish divergence from pullback

📈 MACD Analysis:

Signal: Bullish crossover above signal line

MACD line crossed above signal with histogram expanding positively

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

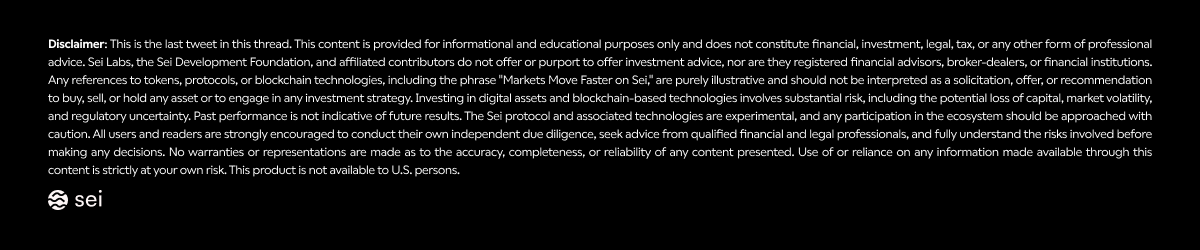

Sei’s sub-400ms finality and tens of thousands of TPS make USDY not just accessible, but explosive in DeFi. Think seamless collateral for lending, trading, or yield farming without the legacy finance drag. Ondo USDY on Sei isn’t hype; it’s the momentum play bridging TradFi and crypto, and savvy swing traders are already positioning.

USDY Ignites Sei’s RWA Revolution

Ondo USDY Sei deployment hits like a turbo boost for tokenized US treasuries on Sei. Offering around 4.25% annual yield, it’s tailor-made for institutions craving stability amid crypto volatility. Sei users now tap high-quality collateral that slots into ecosystems effortlessly, powering everything from DEX trades to advanced lending protocols. This isn’t your average stablecoin; USDY accrues real yield daily from underlying assets, compounding without the lockups that plague traditional T-bills.

USDY by OndoFinance is one of the most adopted tokenized Treasury products in the market.

With Sei’s parallelized execution, transactions fly through at warp speed, slashing costs and risks. For momentum chasers like me, this setup screams opportunity: enter at $1.10, ride the ecosystem growth wave, and exit on spikes toward recent highs. But respect the risk; that tight 24-hour range from $1.07 to $1.13 shows USDY dances to macro Treasury yields and Sei TVL flows.

Sei’s Speed Unlocks 24/7 Institutional Yield Plays

Sei Network’s 2025 surge – TVL blasting past $670M with 821% YoY growth – set the stage perfectly for USDY yield on Sei Network. High-performance Layer-1 means no more waiting on Ethereum gas wars or Solana outages. Ondo Finance tokenized T-bills like USDY thrive here, offering RWA treasuries on Sei 2026 with instant finality. Institutions get dollar-denominated yield without borders, while DeFi degens leverage it for amplified returns.

Visualize the chart: USDY hugging $1.10 amid a sea of green Sei volume. Short-term, watch for breakouts if TVL keeps climbing; longer-term, tokenized treasuries dominance could push it higher. Practical tip: pair USDY with Sei’s native DEXs for liquidity farming – deposit, earn yield, withdraw anytime. No KYC walls, pure permissionless access.

Momentum Strategies for Ondo USDY on Sei

As a swing trader glued to digital bonds, I see USDY as prime momentum fuel. Current price at $1.10 sits comfy post-launch, with that negligible 24h change signaling consolidation before the next leg up. Key levels: support at $1.07 low, resistance near $1.13 high. Enter longs on dips if Sei TVL ticks higher; targets? Eye 5-10% swings tied to Fed rate vibes and Ondo expansions.

Risk management is non-negotiable: size positions at 2-5% portfolio, trail stops below daily lows. Use USDY as collateral in Sei protocols for leveraged yield – double-dip that 4.25% while chasing alpha. This is institutional tokenized treasuries USDY at its finest: practical, visual momentum on a network built for speed.

USDY Price Prediction 2027-2032

Ondo USDY Tokenized US Treasuries on Sei Network: Institutional Yield and Liquidity Outlook

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $1.05 | $1.15 | $1.30 | +4.5% |

| 2028 | $1.10 | $1.22 | $1.40 | +6.1% |

| 2029 | $1.15 | $1.32 | $1.55 | +8.2% |

| 2030 | $1.20 | $1.45 | $1.75 | +9.8% |

| 2031 | $1.28 | $1.60 | $1.95 | +10.3% |

| 2032 | $1.40 | $1.78 | $2.20 | +11.3% |

Price Prediction Summary

USDY, now live on Sei Network with $1.2B+ market cap and trading at $1.10 as of early 2026, is projected to experience gradual price appreciation driven by yield accrual (around 4-5%), surging TVL on Sei, DeFi integrations, and institutional RWA adoption. Average prices are expected to climb from $1.15 in 2027 to $1.78 by 2032, with bullish maxima reflecting high demand and momentum, while minima account for potential bearish corrections or regulatory hurdles.

Key Factors Affecting Ondo USDY Tokenized US Treasuries Price

- Explosive TVL growth on Sei Network (from $670M in 2025) boosting USDY liquidity and usage

- Stable to rising US Treasury yields supporting 4-5% annual returns

- Regulatory clarity and institutional inflows into tokenized RWAs

- Enhanced DeFi composability as collateral/lending asset on high-speed Sei chain

- Crypto market cycles influencing risk appetite for yield-bearing stables

- Competition from other tokenized treasuries and stablecoins

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Layer that prediction with Sei’s ecosystem momentum, and USDY becomes a no-brainer for yield hunters. Picture TVL exploding further in 2026, pulling USDY along for the ride toward fresh highs beyond $1.13. But momentum trading demands precision; track Ondo announcements and Sei volume spikes for entry signals.

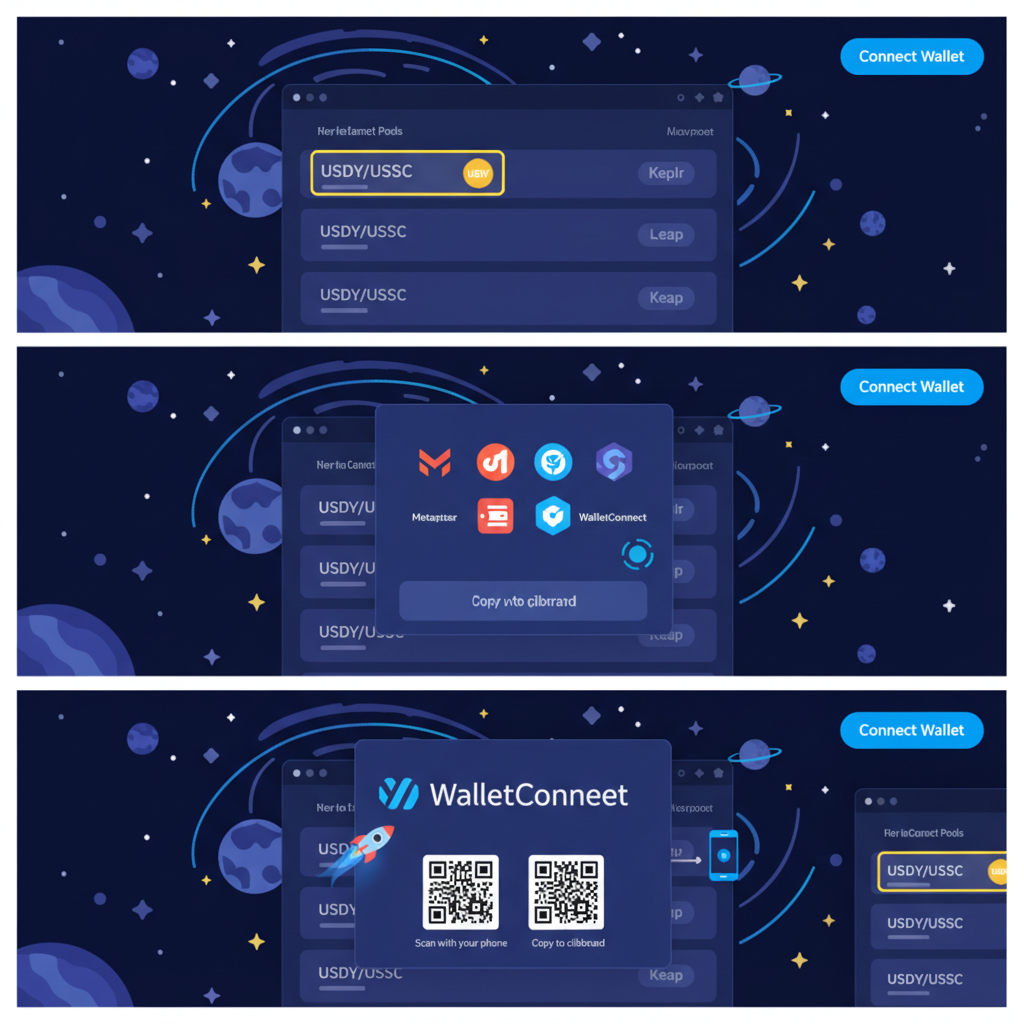

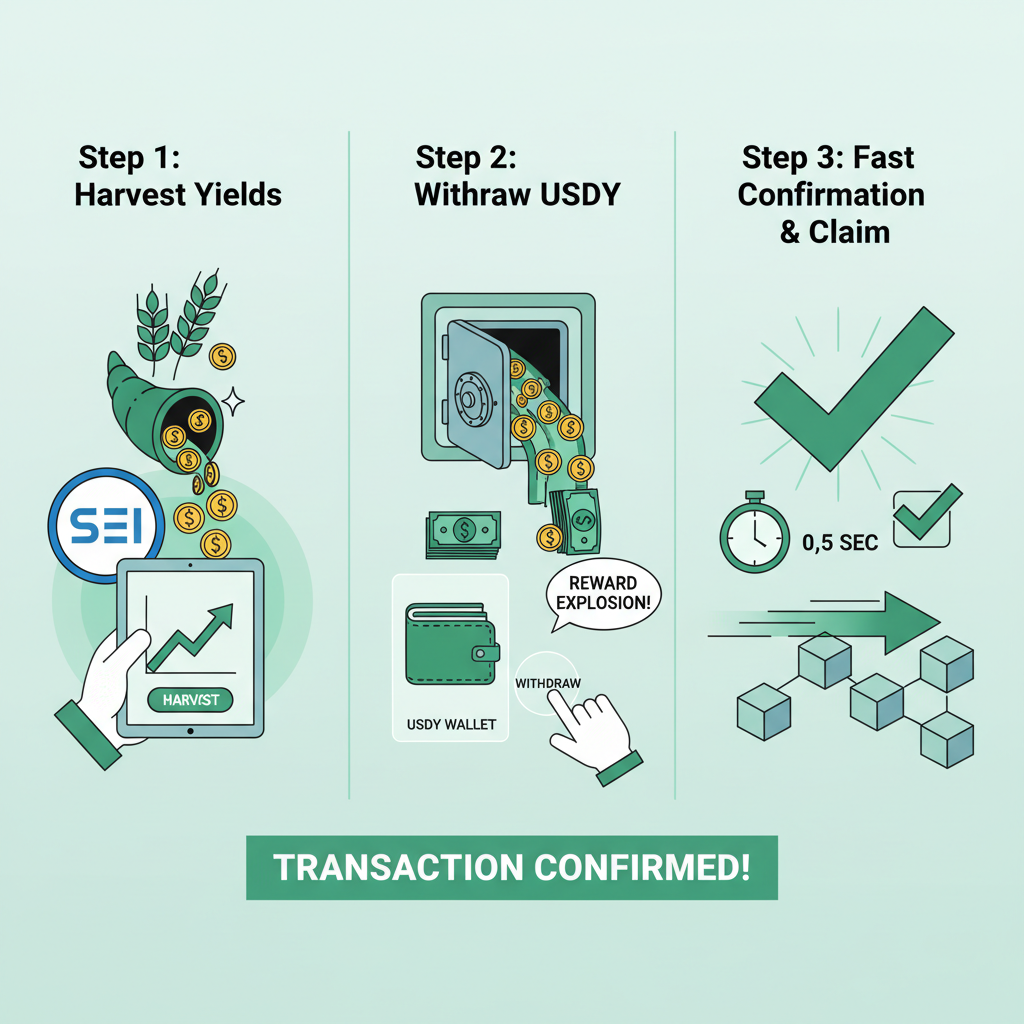

Practical Plays: Yield Farming and Collateral Magic with USDY

USDY on Sei isn’t just a hold-and-forget; it’s a composability powerhouse. Deposit into lending protocols for boosted APYs, or collateralize for leveraged positions without liquidation jitters from yield accrual. At $1.10, the entry math works: snag that 4.25% base yield while farming Sei-native rewards. Swing traders, stack USDY longs on pullbacks to $1.07, scaling out at resistance. Visual cue: watch the 24-hour range tighten before breakouts, signaling institutional inflows.

DeFi on Sei turns USDY into a liquidity engine. No more siloed TradFi assets; this flows seamlessly into DEXs, perps, and perps markets. Institutions love the 24/7 access, non-U. S. folks dodge regulatory headaches, and everyone rides daily compounding. Pair it with Sei’s speed for near-zero slippage trades, turning tokenized US treasuries Sei into everyday alpha.

Navigating Risks in the USDY Sei Momentum Wave

Ride the wave, but respect the risk – my mantra holds here. USDY’s tight 24h change of $-0.0100 (-0.009010%) reflects resilience, but macro shifts like Fed cuts could pressure yields. Smart money hedges with stops at $1.07, eyes on black swan events in Treasuries. Sei’s uptime is stellar, yet smart contract audits matter; Ondo’s track record shines with $1.2B AUM.

Opinion: Skip FOMO buys at peaks; wait for dips post-TVL pumps. This setup favors patient swings over day-trading frenzy. USDY elevates RWA treasuries on Sei 2026, blending safety with crypto upside – perfect for diversified portfolios chasing 5-15% quarterly pops.

| Factor | Bullish Signal | Bearish Signal |

|---|---|---|

| Price Action | Hold above $1.10 | Break below $1.07 |

| Sei TVL | and gt;$670M growth | Stagnation |

| Yield | Stable 4.25% | Fed rate drop |

That table snapshots the battle lines. Green across the board? Accelerate longs. Reds flashing? Sideline and reassess.

Ondo USDY (USDY) Price Prediction 2027-2032

USDY/USDC Projections on Sei DEX | Based on RSI/MACD Signals, Support at $1.07, Resistance at $1.13, and Institutional Adoption Trends

| Year | Minimum Price | Average Price | Maximum Price | YoY Change % (Avg) |

|---|---|---|---|---|

| 2027 | $1.05 | $1.12 | $1.20 | +1.8% |

| 2028 | $1.06 | $1.15 | $1.25 | +2.7% |

| 2029 | $1.07 | $1.18 | $1.30 | +2.6% |

| 2030 | $1.08 | $1.22 | $1.35 | +3.4% |

| 2031 | $1.10 | $1.25 | $1.40 | +2.5% |

| 2032 | $1.12 | $1.30 | $1.45 | +4.0% |

Price Prediction Summary

USDY is projected to exhibit stable growth with a gradual premium buildup from its current $1.10 level, driven by tokenized treasury adoption on Sei’s high-speed network. Average prices are expected to rise to $1.30 by 2032 in bullish DeFi scenarios, while minimums reflect potential regulatory or yield compression risks. Overall outlook remains bullish for institutional yield-bearing assets amid RWA tokenization trends.

Key Factors Affecting Ondo USDY Tokenized US Treasuries Price

- Sei Network’s sub-400ms finality enhancing 24/7 liquidity

- Rising TVL and adoption of tokenized U.S. Treasuries ($1.2B+ market cap)

- US Treasury yield fluctuations (currently ~4.25%) impacting premiums

- Regulatory advancements in RWA and stablecoin frameworks

- DeFi composability for lending/collateral use cases

- Crypto market cycles favoring yield-bearing stables over volatile assets

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

USDY’s Role in Sei’s DeFi Dominance

Ondo USDY Sei cements tokenized treasuries as DeFi bedrock. With sub-400ms finality, it’s tailor-made for high-frequency strategies institutions crave. Swing my style: 3-7 day holds on volume surges, banking 2-4% gains per cycle. Practical edge – use USDY to fund perps without yield bleed, multiplying returns visually on the chart.

2026 outlook? As Sei scales, USDY could anchor multi-billion TVL, drawing more RWAs. Current $1.10 price tags early positioning; that minor dip sharpens the rebound setup. Institutions pile in for liquidity, degens for composability – everyone wins in this yield revolution.

USDY on Sei redefines fixed-income momentum. Grab your wallet, eye those levels, and let’s catch the next wave.