Ondo USDY Tokenized US Treasuries Launches on Sei Network for Faster DeFi Lending

Ondo Finance has just deployed its flagship USDY tokenized US treasuries on the Sei Network, unlocking faster DeFi lending opportunities for global investors. Trading at a robust $1.11 with a 24-hour gain of and $0.0300 ( and 2.78%), USDY hit a high of $1.12 and low of $1.08 amid surging demand. This move brings a yield-bearing asset, offering around 4.25% APY backed by short-term US Treasuries and bank deposits, to one of the quickest Layer-1 blockchains, blending traditional fixed-income stability with crypto’s speed.

Ondo USDY Technical Analysis Chart

Analysis by Market Analyst | Symbol: BYBIT:USDYUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

On this USDYUSDT chart, draw an uptrend line connecting the swing low at 2026-01-15 around $1.00 to the recent high at 2026-02-14 $1.12. Add horizontal support at $1.08 (24h low) and resistance at $1.12. Mark entry zone near $1.09 with stop loss at $1.07. Use fib retracement from recent low $1.08 to high $1.12. Highlight volume spike with callout on 2026-02-14. Draw rectangle for consolidation phase Jan 2026 $0.98-$1.02. Vertical line for Sei launch news impact. Arrow up for bullish MACD crossover.

Risk Assessment: medium

Analysis: Positive news catalyst with clean uptrend, but stablecoin volatility and macro treasury yields pose reversal risks

Market Analyst’s Recommendation: Enter long on dip to $1.09 with tight stops, target $1.15; favorable R:R for medium tolerance

Key Support & Resistance Levels

📈 Support Levels:

-

$1.08 – 24h low and psychological support near recent swing low

strong -

$1 – Long-term peg level and accumulation base

moderate

📉 Resistance Levels:

-

$1.12 – 24h high and initial breakout resistance

moderate -

$1.15 – Projected extension based on momentum

weak

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$1.09 – Pullback to 50% fib retracement of recent rally, high volume confirmation

medium risk

🚪 Exit Zones:

-

$1.15 – Measured move target from consolidation breakout

💰 profit target -

$1.07 – Below key support invalidating uptrend

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Increasing on upside breakout

Volume spike on 2026-02-14 coincides with price surge to $1.11, confirming buyer conviction

📈 MACD Analysis:

Signal: Bullish crossover

MACD line crossing above signal with histogram expanding positively

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Non-US investors now tap into this permissionless product seamlessly, sidestepping barriers to direct Treasury access while enjoying on-chain composability. Sei’s infrastructure, handling tens of thousands of transactions per second, positions USDY for real-time lending and borrowing, a game-changer in tokenized treasuries DeFi.

USDY’s Core Appeal: Yield Without the Yield Chase

In a world where stablecoins often prioritize peg stability over returns, USDY stands out by delivering economic exposure to short-term US Treasuries without being the securities themselves. Holders earn daily yields accrued from underlying assets, redeemable 1: 1 for USD. This isn’t speculative crypto; it’s institutional-grade fixed income tokenized for blockchain rails.

Ondo USDY Sei integration marks a milestone as the first such product on this high-speed chain. With Ondo Finance Sei synergy, users access tokenized US treasuries Sei style, enhancing portfolio diversification amid volatile forex and commodity swings. From my vantage in global markets, this bridges TradFi liquidity pools to DeFi, stabilizing dollar-denominated flows in emerging crypto hubs.

USDY tokens provide economic exposure to short-term US treasuries, combining utility with yield.

Sei’s Edge: Ultra-Fast Infrastructure for Treasury Token Power

Sei Network isn’t just another Layer-1; it’s engineered for trading velocity, boasting record 1.2 million daily active addresses post-launch. Deploying USDY here leverages parallelized EVM compatibility and sub-second finality, ideal for USDY lending Sei protocols where latency kills alpha.

Picture this: traditional Treasuries lock capital for months; USDY on Sei turns them liquid, composable assets. Global traders, from Asia’s forex desks to Europe’s bond funds, gain frictionless entry. Sei’s throughput crushes bottlenecks in lending markets, where speed dictates borrow rates and liquidation risks. This deployment underscores tokenized assets’ migration to performant chains, outpacing slower networks in RWA adoption.

Instant DeFi Hooks: Lending, Swapping, and Bridging Unleashed

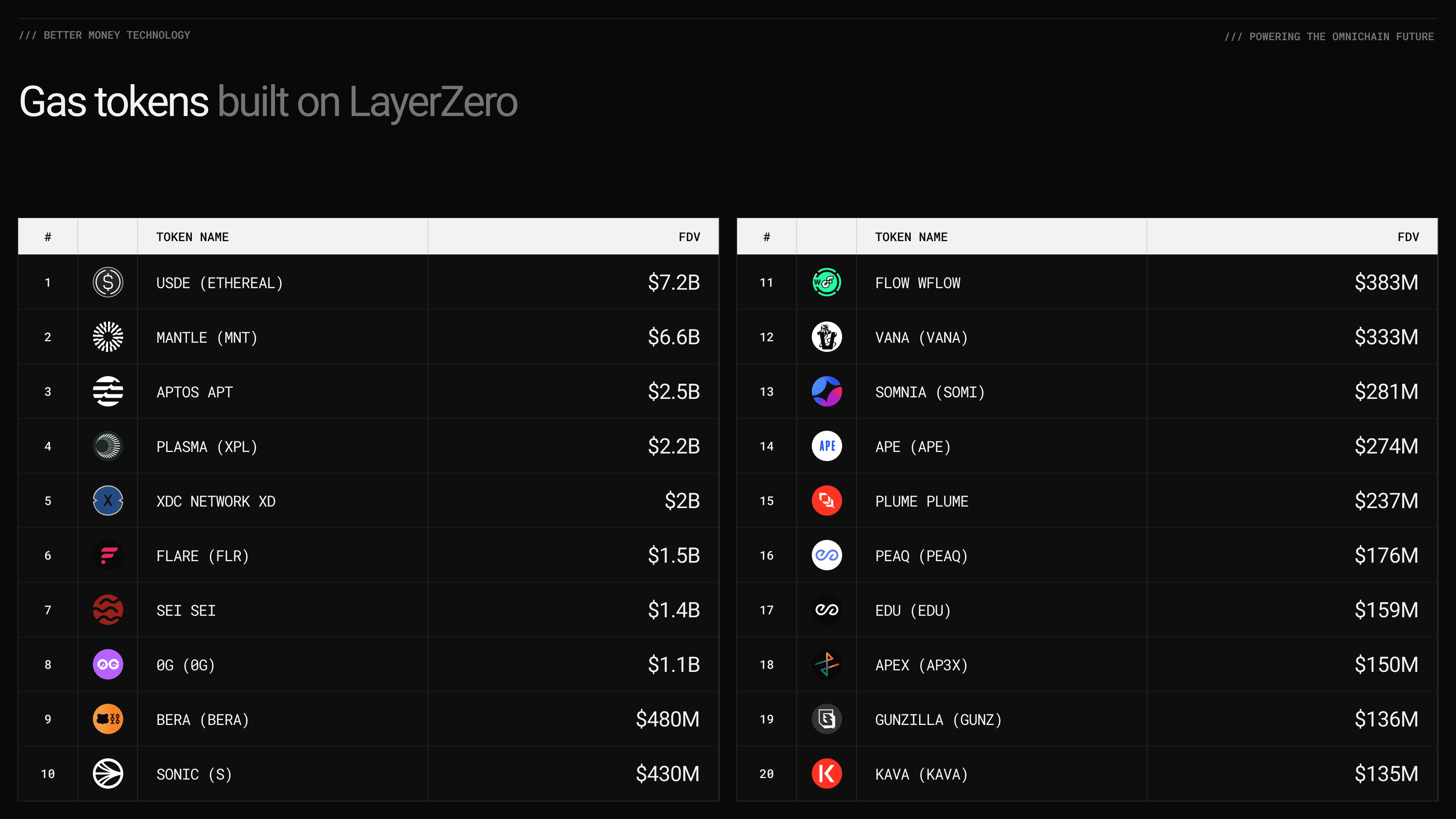

USDY didn’t arrive solo. Moments after launch, integrations lit up: Saphyre for swaps, Takara Lend and Yei Finance for borrow/lend markets, LayerZero for cross-chain bridging. This ecosystem plug-and-play supercharges tokenized treasuries DeFi, letting users collateralize USDY for leveraged positions or earn enhanced yields lending it out.

In practice, Sei users now supply USDY to lending pools, capturing 4.25% base yield plus protocol incentives, all while maintaining dollar parity at $1.11. For crypto enthusiasts eyeing fixed-income alpha, this is liquidity on steroids – fast executions minimize slippage in volatile DeFi environments. As someone tracking currency flows, I see this accelerating dollar hegemony on-chain, drawing institutional capital wary of pure stablecoin risks.

Ondo USDY (USDY) Price Prediction 2027-2032

Long-term forecast based on RWA adoption, Sei Network integration, yield trends, and crypto market cycles

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $1.02 | $1.20 | $1.38 | +7.1% |

| 2028 | $1.08 | $1.30 | $1.50 | +8.3% |

| 2029 | $1.15 | $1.42 | $1.65 | +9.2% |

| 2030 | $1.22 | $1.55 | $1.80 | +9.2% |

| 2031 | $1.30 | $1.70 | $2.00 | +9.7% |

| 2032 | $1.40 | $1.88 | $2.25 | +10.6% |

Price Prediction Summary

USDY is forecasted to see steady appreciation from its 2026 baseline of ~$1.12, fueled by Sei Network’s DeFi integrations and tokenized Treasury demand. Average prices are projected to grow at ~9% CAGR, reaching $1.88 by 2032 in bullish adoption scenarios, with mins providing downside protection near $1+ amid yield stability.

Key Factors Affecting Ondo USDY Price

- Sei’s ultra-fast Layer-1 enabling seamless DeFi lending, swaps, and yield farming with USDY

- ~4.25% APY from short-term US Treasuries attracting yield-seeking investors globally

- Rising RWA tokenization trend and institutional adoption of on-chain Treasuries

- Regulatory tailwinds for compliant tokenized assets and clearer stablecoin frameworks

- Crypto bull cycles amplifying liquidity and demand for yield-bearing dollar assets

- Competition from other RWA platforms and traditional stablecoins pressuring premiums

- Expanding partnerships and tech upgrades enhancing USDY’s composability and utility

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Early metrics show promise: USDY’s $1.2 billion TVL footprint expands to Sei, fueling on-chain RWA momentum. Borrowers tap cheap, yield-backed dollars for perpetuals or perps trading, while suppliers compound returns in a low-risk wrapper.

These dynamics position Ondo USDY Sei as a cornerstone for diversified strategies, especially in regions where forex volatility amplifies the allure of steady dollar yields. Suppliers lock in compounded returns, while leveraged plays on Sei perps benefit from USDY’s stability at $1.11, buffering against crypto drawdowns.

Ondo Finance Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:ONDOUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

As a seasoned technical analyst with a balanced approach, start by drawing a prominent downtrend line connecting the swing high at approximately $1.20 on 2026-10-15 to the recent swing low around $0.95 on 2026-12-20, using the ‘trend_line’ tool to highlight the dominant bearish channel. Add horizontal lines at key support $1.08 (24h low) and resistance $1.12 (24h high) with labels. Mark the recent consolidation range from $1.05-$1.10 between 2026-01-20 and 2026-02-10 using ‘rectangle’. Place long position entry zone at $1.08-$1.09 with ‘long_position’ tool. Indicate profit target at $1.20 and stop loss at $1.05 using ‘order_line’. Annotate volume spike on the sharp drop with ‘arrow_mark_down’ and callout ‘High volume sell-off’. For MACD, add ‘arrow_mark_up’ at recent bullish crossover. Vertical line at 2026-02-14 for USDY Sei launch news. Fib retracement from low $0.95 to high $1.20. Text notes for insights like ‘Positive news catalyst amid oversold conditions’.

Risk Assessment: medium

Analysis: Bearish trend intact but oversold with strong news catalyst and volume exhaustion; aligns with medium risk tolerance

Market Analyst’s Recommendation: Consider long positions on dip to $1.08-$1.09 targeting $1.20, monitor for breakout above $1.12

Key Support & Resistance Levels

📈 Support Levels:

-

$1.08 – 24h low and recent chart low, strong demand zone

strong -

$0.95 – December swing low, prior test

moderate

📉 Resistance Levels:

-

$1.12 – 24h high, immediate overhead supply

weak -

$1.2 – October high, major resistance

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$1.09 – Bounce from support $1.08 with positive news and volume divergence

medium risk

🚪 Exit Zones:

-

$1.2 – Fib 61.8% retracement and prior high

💰 profit target -

$1.05 – Below support invalidation

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: High volume on downside spike, now declining on pullbacks indicating exhaustion

Bearish volume climax followed by dry-up, bullish sign

📈 MACD Analysis:

Signal: Bullish crossover emerging near current $1.11

MACD line crossing signal from below, momentum shift

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Risks remain, of course. Smart contract vulnerabilities in nascent protocols like Takara Lend demand vigilance, and regulatory scrutiny on tokenized RWAs could tighten. Yet Ondo’s track record – audited reserves, daily accruals – mitigates these, offering protections akin to TradFi custodians. At $1.11, with a 24-hour surge to $1.12, market appetite underscores confidence.

Key Integrations at a Glance: Sei’s DeFi Ecosystem Lights Up

Benefits of USDY on Sei

-

Saphyre swaps enable instant liquidity for USDY trading on Sei.

-

Takara Lend and Yei Finance borrow markets offer leveraged yields with USDY.

-

LayerZero bridging provides seamless cross-chain access for USDY.

-

Perpetual trading collateral backed by USDY’s 4.25% base APY.

-

Sub-second executions on Sei minimize slippage for USDY transactions.

These hooks aren’t theoretical. Traders supply USDY to earn dual yields – base Treasury plus lending premiums – often pushing effective APYs past 5% in bull runs. Borrowers secure positions in Sei’s high-volume perps markets, where USDY lending Sei underpins margin trading without fiat ramps. This composability elevates tokenized treasuries DeFi, turning idle Treasuries into engines for on-chain leverage.

Zoom out to broader Ondo Finance Sei integration: USDY’s $1.2 billion TVL infusion bolsters Sei’s 1.2 million daily actives, a metric rivaling top chains. For commodities traders like myself, this stabilizes dollar legs in gold-oil pairs, curtailing basis risk. Crypto natives gain a non-correlated anchor, while institutions test RWA waters with permissionless ease.

Looking ahead, expect more protocols to orbit USDY – oracles for real-time yields, automated vaults for optimization. As Sei scales, USDY could anchor a full DeFi primitive stack, rivaling centralized yield products. In fragmented global markets, this fusion of speed, yield, and security carves a path for tokenized bonds to dominate fixed-income flows, rewarding patient allocators with compounded edges.