Yield Strategies Using Tokenized US Treasuries: Opportunities and Risks

Tokenized US Treasuries have rapidly become a cornerstone of blockchain-based fixed-income investing, offering both institutional and retail investors new pathways to access sovereign yield. By converting traditional US Treasury bills into programmable digital tokens, platforms like Ondo Finance and Matrixdock have unlocked a suite of innovative yield strategies that blend the reliability of government debt with the flexibility of decentralized finance.

Why Tokenized Treasuries Are Reshaping Yield Generation

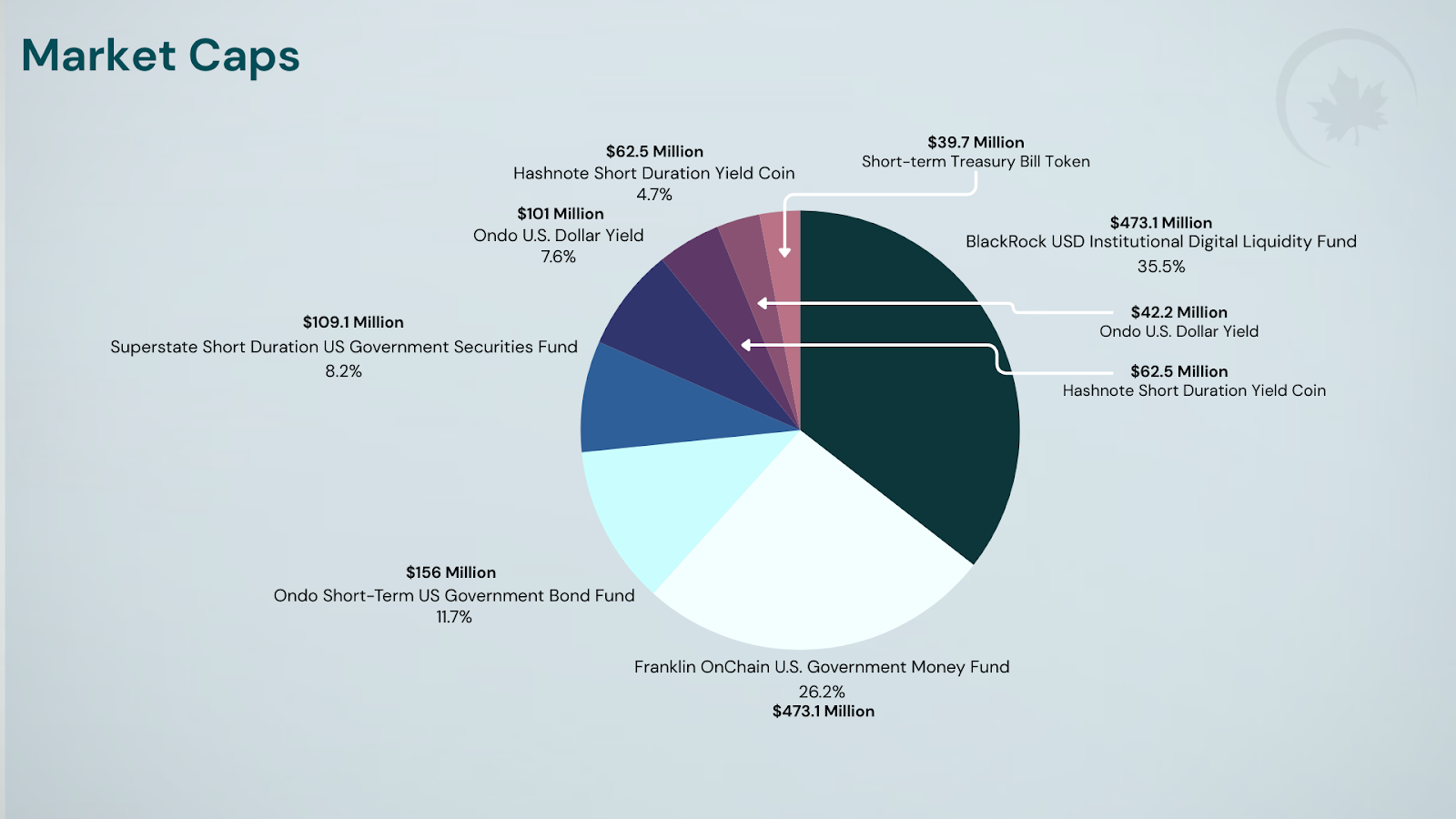

The appeal of tokenized US treasuries yield strategies lies in their unique combination of stability, transparency, and accessibility. As of May 2025, tokenized US Treasuries have grown by over 380% year-on-year, now offering an average yield to maturity of 4.14%. This surge is driven by investors seeking real-time settlement, 24/7 trading, and fractional ownership – benefits that simply don’t exist in traditional fixed-income markets. Read more about this growth on AInvest.

Yet the true innovation comes from how these assets can be deployed within digital ecosystems. Below are three actionable strategies at the forefront of this market’s evolution.

Top 3 Yield Strategies Using Tokenized US Treasuries

-

Laddering Tokenized T-Bills for Optimized Liquidity and Yield: Construct a portfolio of tokenized US Treasuries with staggered maturities (e.g., 1-month, 3-month, 6-month) using established platforms like Ondo Finance or Matrixdock. This strategy maximizes yield while ensuring regular access to liquidity and reduces reinvestment risk, leveraging the programmability and fractionalization benefits of blockchain-based tokens.

-

Utilizing Tokenized Treasuries as On-Chain Collateral for DeFi Yield Enhancement: Deploy tokenized US Treasury assets as collateral in decentralized finance (DeFi) protocols that accept real-world assets, such as Aave or Maple Finance. This approach enables investors to earn base treasury yields plus additional returns from borrowing/lending or liquidity mining incentives. However, it requires careful risk assessment of smart contracts and counterparty exposure.

-

Automatic Roll-Down Strategies via Smart Contracts: Employ automated roll-down strategies where maturing short-term tokenized T-bills are seamlessly reinvested into new issuances through programmable smart contracts on platforms like Franklin Templeton’s OnChain U.S. Government Money Fund. This minimizes manual intervention, maintains continuous yield exposure, and reduces cash drag, but investors must monitor protocol reliability and regulatory developments.

Laddering Tokenized T-Bills for Optimized Liquidity and Yield

Laddering is a time-tested approach in fixed income – but blockchain technology amplifies its efficiency. By constructing a portfolio of tokenized US Treasuries with staggered maturities (such as 1-month, 3-month, and 6-month T-bills), investors can maximize yield while ensuring regular access to liquidity. Platforms like Ondo Finance allow for seamless acquisition and management of these digital assets in fractional increments.

This method reduces reinvestment risk by ensuring that portions of your portfolio mature at frequent intervals, thus allowing you to capture prevailing interest rates or reallocate capital swiftly. The programmability inherent in tokenization means smart contracts can automate rebalancing or reinvestment upon maturity – minimizing manual intervention and reducing operational friction.

“Tokenization has turned what was once a slow-moving asset class into a dynamic tool for liquidity management. ”

Utilizing Tokenized Treasuries as On-Chain Collateral for DeFi Yield Enhancement

The integration between real-world assets (RWAs) and DeFi protocols is perhaps the most transformative aspect of blockchain treasury returns today. Investors can deploy their tokenized Treasury holdings as collateral within decentralized lending or liquidity mining platforms that accept RWAs. For instance, BlackRock’s BUIDL fund – which reached $3 billion in assets by mid-2025 – enables such dual-yield strategies on Ethereum and Polygon networks.

This approach allows investors to earn the base Treasury yield plus additional rewards from borrowing/lending activities or protocol incentives. However, it is crucial to conduct comprehensive due diligence on smart contract security and counterparty risks before leveraging these opportunities.

More on technical risks at Mitrade

Automatic Roll-Down Strategies via Smart Contracts

Automatic roll-down strategies harness smart contracts to reinvest maturing short-term tokenized T-bills into new issuances without human intervention. This ensures continuous exposure to Treasury yields while minimizing cash drag – an inefficiency where idle funds erode overall returns.

The programmability offered by blockchain allows these roll-downs to occur instantly upon maturity events, maintaining optimal portfolio allocation at all times. While this strategy streamlines operations and maximizes compounding potential, it also introduces dependencies on protocol reliability and evolving regulatory frameworks governing digital securities.

Automatic roll-down strategies are especially attractive for institutional investors seeking operational efficiency and consistent yield capture. By embedding reinvestment logic directly into smart contracts, asset managers can ensure that portfolios remain fully invested in the highest-yielding short-term Treasuries available, without the administrative burden of manual rollovers. This is particularly relevant as tokenized T-bill platforms expand support for multiple maturity tranches and real-time trading, further reducing friction compared to legacy systems.

However, it’s imperative to recognize that automated systems are only as robust as the protocols underpinning them. Recent developments highlight both the promise and pitfalls of smart contract-driven treasury management, while automation can drive efficiency, it also concentrates operational risk within protocol codebases. Investors must closely monitor protocol audits, governance structures, and regulatory updates to mitigate these risks.

Key Considerations for Tokenized Treasury Yield Strategies

While the opportunities are compelling, several factors should inform any allocation to tokenized US Treasuries:

Top Yield Strategies with Tokenized US Treasuries

-

Laddering Tokenized T-Bills for Optimized Liquidity and Yield: Construct a portfolio of tokenized US Treasuries with staggered maturities (e.g., 1-month, 3-month, 6-month) using established platforms like Ondo Finance or Matrixdock. This approach maximizes yield while ensuring regular access to liquidity and reduces reinvestment risk, leveraging the programmability and fractionalization benefits of blockchain-based tokens.

-

Utilizing Tokenized Treasuries as On-Chain Collateral for DeFi Yield Enhancement: Deploy tokenized US Treasury assets as collateral in decentralized finance (DeFi) protocols that accept real-world assets, such as Aave or MakerDAO. This strategy allows investors to earn base treasury yields plus additional returns from borrowing/lending or liquidity mining incentives, but requires careful risk assessment of smart contracts and counterparty exposure.

-

Automatic Roll-Down Strategies via Smart Contracts: Employ automated roll-down strategies where maturing short-term tokenized T-bills are seamlessly reinvested into new issuances through programmable smart contracts. Platforms like Conduit Financial and Franklin Templeton’s OnChain U.S. Government Money Fund (FOBXX) are pioneering such solutions. This minimizes manual intervention, maintains continuous yield exposure, and reduces cash drag, but investors must monitor protocol reliability and regulatory developments.

- Regulatory Environment: The legal treatment of tokenized securities remains fluid. Offerings like BlackRock’s BUIDL fund are still limited to accredited investors with minimums as high as $5 million, underscoring ongoing access barriers. Regulatory clarity will be essential for broader adoption and secondary market liquidity.

- Smart Contract Security: The composability that enables advanced yield strategies also introduces new attack surfaces. Vigilance around protocol audits and insurance mechanisms is non-negotiable for capital preservation.

- Market Depth and Volatility: Despite rapid growth, tokenized US Treasuries have expanded by over 380% year-on-year, trading volumes may still be thin relative to traditional markets. This can impact price discovery and liquidity during periods of stress.

The market’s trajectory suggests that as more institutional-grade platforms launch and regulatory frameworks mature, these challenges will abate over time. For now, prudent position sizing and diversification remain critical best practices.

The Road Ahead: Bridging Traditional Yield with Blockchain Innovation

The intersection of blockchain technology and US Treasuries is redefining what’s possible in fixed-income investing. Whether through laddering strategies that optimize liquidity cycles, leveraging assets as on-chain collateral for enhanced returns, or automating reinvestment via smart contracts, investors now have access to a toolkit once reserved for large institutions, but with greater transparency and flexibility.

As market infrastructure matures and regulatory clarity improves, expect tokenized treasuries to become a staple in both institutional portfolios and advanced retail strategies. The future belongs to those who understand both the potential rewards, and the nuanced risks, of this evolving digital fixed-income landscape.