Ondo USDY Tokenized US Treasuries Live on Sei Network: Yield Opportunities for DeFi Users

Ondo Finance has brought its flagship USDY tokenized US Treasuries to the Sei Network, opening doors for DeFi users to tap into institutional-grade yields with unprecedented efficiency. Trading at a current price of $1.11, up 0.9090% over the past 24 hours with a high of $1.12 and low of $1.10, USDY represents a maturing bridge between traditional fixed income and blockchain innovation. This launch isn’t just another token drop; it’s a calculated step toward embedding real-world asset returns directly into high-speed DeFi protocols.

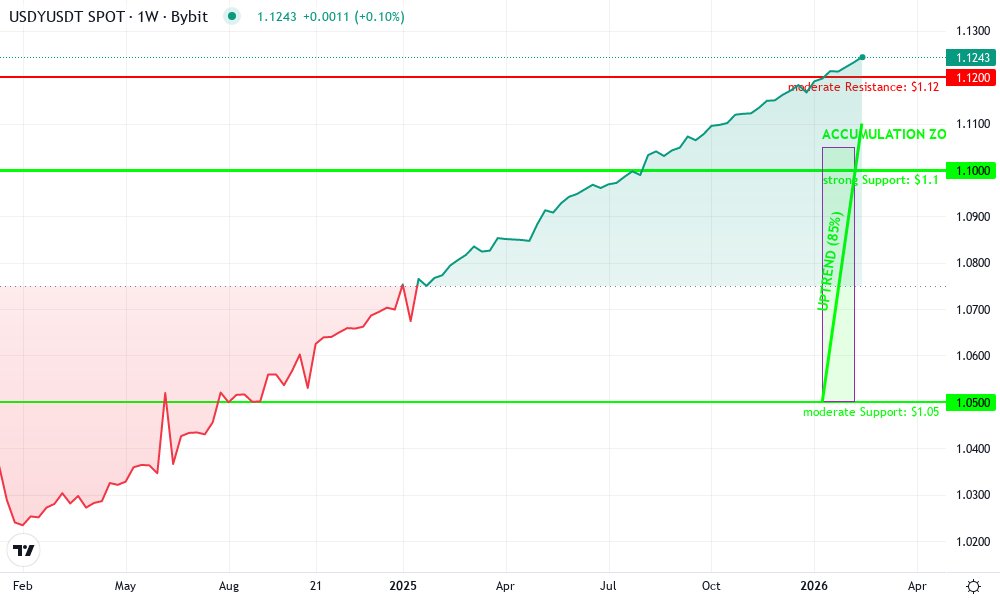

Ondo USDY Technical Analysis Chart

Analysis by Lila Bennett | Symbol: BYBIT:USDYUSDT | Interval: 1W | Drawings: 5

Technical Analysis Summary

As Lila Bennett, apply conservative overlays: subtle trend_line connecting lows from early 2026 consolidation to current appreciation at $1.11; horizontal_line at key support $1.10 and resistance $1.12; rectangle for recent accumulation zone; callout on volume spikes post-Sei launch; fib_retracement from recent low to high for pullback levels; text annotations emphasizing yield accrual stability over volatility.

Risk Assessment: low

Analysis: USDY’s Treasury backing ensures principal stability; chart shows controlled appreciation with tight ranges, ideal for low-tolerance portfolios amid 2026 fiscal uncertainties

Lila Bennett’s Recommendation: Hold or accumulate conservatively for yield; avoid leverage—patience yields lasting value

Key Support & Resistance Levels

📈 Support Levels:

-

$1.1 – Strong base coinciding with 24h low and historical yield floor post-Sei news

strong -

$1.05 – Deeper support from January token unlock dip

moderate

📉 Resistance Levels:

-

$1.12 – 24h high resistance; psychological barrier before next yield tick

moderate -

$1.13 – Recent swing high; conservative target pending macro confirmation

weak

Trading Zones (low risk tolerance)

🎯 Entry Zones:

-

$1.105 – Dip buy near strong support in uptrend channel, low-risk accumulation for yield

low risk -

$1.1 – Break below invalidates; conservative entry only on hold above

low risk

🚪 Exit Zones:

-

$1.12 – Profit target at resistance; secure gains prudently

💰 profit target -

$1.08 – Tight stop below support to preserve capital

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Increasing on upmove

Volume rise post-Sei launch (Jan 2026) confirms institutional interest without euphoria

📈 MACD Analysis:

Signal: Bullish crossover

MACD line above signal in recent bars, subtle momentum aligning with fundamentals

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Lila Bennett is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (low).

In a market where tokenized Treasuries have swelled to around $10 billion by late January 2026, Ondo USDY Sei integration stands out. Backed by short-term U. S. Treasuries and bank deposits, USDY delivers yield through subtle price appreciation rather than static pegs like many stablecoins. For Sei users, this means deploying capital in lending, trading, or liquidity pools while earning returns tied to the safety of government securities. I’ve long advocated for prudence in fixed income; this setup aligns perfectly, offering stability amid crypto’s volatility.

USDY’s Mechanics: Yield Accrual Without the Friction

At its core, USDY is a permissionless tokenized U. S. Treasury product, now thriving on Sei. Holders see value compound daily as the token’s price inches upward, mirroring underlying Treasury maturities typically under three months. Unlike yield farming gimmicks that expose you to impermanent loss or smart contract risks, USDY’s backing provides a fundamentals-driven return. Current pricing at $1.11 reflects not hype, but genuine accrual; that and $0.0100 24-hour gain underscores steady momentum.

Accessibility remains key. Non-U. S. individuals and entities can participate after Ondo’s onboarding and transfer allowlist, ensuring regulatory compliance without stifling innovation. This thoughtful design mitigates the pitfalls I’ve seen in unregulated RWA plays, where opacity erodes trust. On Sei, USDY slots in as high-quality collateral, a cash management tool, and even a payments medium across capital markets protocols.

Sei’s Architecture: Perfect Fit for Tokenized Treasuries

Sei Network’s parallelized EVM shines here, boasting roughly 400ms finality and 12,500 transactions per second. For tokenized US treasuries Sei deployment, this translates to near-instant settlements for institutional assets, a far cry from congested chains. Imagine pledging USDY in a lending market with sub-second confirmations; that’s the yield opportunity DeFi users now enjoy.

Ondo Finance treasuries Sei pairing leverages this speed to expand on-chain RWA adoption. Sei’s ecosystem, geared for trading and DeFi, amplifies USDY’s utility. Corporate cash managers and institutions eyeing tokenized treasuries DeFi can now park funds on-chain, earning yields while maintaining liquidity. From my vantage in macro strategy, Sei’s throughput addresses a critical bottleneck in scaling fixed income digitization.

Ondo USDY (USDY) Price Prediction 2027-2032

Forecasts incorporating Treasury yields, Sei Network adoption, RWA growth, and market cycles (based on 2026 baseline of $1.11)

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $1.08 | $1.20 | $1.35 |

| 2028 | $1.12 | $1.28 | $1.50 |

| 2029 | $1.18 | $1.38 | $1.70 |

| 2030 | $1.25 | $1.50 | $1.95 |

| 2031 | $1.35 | $1.65 | $2.25 |

| 2032 | $1.45 | $1.80 | $2.60 |

Price Prediction Summary

USDY is projected to experience gradual appreciation from its current $1.11 level, driven by accrued Treasury yields (3-5% annually) and expanding use cases on high-performance networks like Sei. Average prices are expected to rise 8-10% YoY on average, reaching $1.80 by 2032 in a base case, with bullish maxima up to $2.60 amid RWA adoption surges and DeFi integration. Bearish minima account for potential yield drops, regulatory hurdles, or crypto downturns.

Key Factors Affecting Ondo USDY Price

- Underlying U.S. Treasury yields and interest rate environment

- Adoption of USDY as collateral in Sei Network DeFi protocols

- Growth of tokenized RWA market (currently $10B+ with USDY contributing $1.2B on Sei)

- Regulatory developments favoring permissionless tokenized assets

- Broader crypto market cycles and institutional inflows

- Competition from other yield-bearing stablecoins and supply dynamics

- Technological enhancements in Sei (e.g., parallelized EVM for faster settlements)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Strategic Advantages for DeFi Yield Strategies

USDY yield Sei Network unlocks programmable dollars that evolve beyond passive holding. Pledge it for borrows in lending apps, provide liquidity without slashing risks, or use as settlement collateral in perpetuals. This versatility suits conservative allocators; I’ve modeled similar strategies where Treasury-backed positions outperform volatile alts during uncertainty.

With tokenized Treasuries hitting $10 billion, Ondo USDY Sei’s arrival signals broader convergence. DeFi protocols on Sei gain credible backing assets, drawing sophisticated capital. Yet, prudence dictates monitoring ONDO token dynamics, like recent unlocks pressuring prices, though USDY’s isolation shields its integrity. At $1.11, it’s positioned for measured growth, rewarding patient holders in this USDY yield Sei Network era.

Institutions and high-net-worth players stand to benefit most from this Ondo USDY Sei synergy. Picture corporate treasurers allocating idle cash to USDY for overnight yields, then seamlessly deploying into Sei’s perpetuals markets. This isn’t speculative DeFi; it’s fixed income with blockchain’s programmability, a combination I’ve championed for years in macro reports.

Key USDY Use Cases on Sei

-

High-quality collateral in lending protocols: USDY serves as reliable backing for loans in Sei’s DeFi ecosystem, allowing users to borrow while holdings accrue U.S. Treasury yields via gradual price appreciation.

-

Liquidity provision in DEXes without impermanent loss: Provide liquidity using USDY in decentralized exchanges on Sei, benefiting from its yield-bearing nature that minimizes IL risks.

-

Cash management for institutions: Institutions can hold USDY for on-chain U.S. Treasury yields ($1.11 current price), backed by short-term Treasuries and bank deposits.

-

Payments medium in capital markets: Use USDY for efficient, yield-generating payments and settlements across Sei’s high-performance capital markets infrastructure.

Navigating Risks: Prudence in a Yield-Bearing World

Tokenized US treasuries Sei brings undeniable appeal, yet no asset class escapes scrutiny. USDY’s allowlist and onboarding, while compliant, introduce a gatekeeping layer that could slow retail adoption. Regulatory winds shift quickly; U. S. persons remain sidelined, a deliberate firewall against broader exposure. On the chain side, Sei’s EVM parallelism minimizes congestion risks, but smart contract audits and protocol maturity warrant vigilance. I’ve dissected enough RWA failures to stress this: yield accrual at $1.11 tempts overleverage, so position sizing matters.

External pressures linger too. The ONDO token unlock on January 18,2026, flooded circulation with 1.94 billion tokens, dampening sentiment despite USDY’s independence. Tokenized treasuries DeFi matures, but correlation risks persist in crypto winters. My advice? Treat USDY as a core holding, not a trading flip. Its 24-hour range from $1.10 to $1.12, closing up 0.9090%, exemplifies the steady grind over moonshots.

Outlook: Tokenized Treasuries Reshape DeFi Foundations

Ondo Finance treasuries Sei rollout positions USDY yield Sei Network as a bellwether for RWAs. With the sector at $10 billion and USDY commanding over $1.2 billion in backing, expect cascades: more chains hosting similar products, DeFi TVL swelling from credible inflows. Sei’s 12,500 TPS ceiling supports this scaling, potentially onboarding billions in sidelined capital. BlackRock’s RWA pivot underscores the macro tailwind; programmable yield dollars like USDY eclipse pegged stables in utility.

From a strategist’s lens, this convergence demands patience. Short-term Treasury rates hover, but fiscal policy tweaks could nudge yields higher, boosting USDY’s appreciation. I’ve run projections tying USDY performance to Fed paths and blockchain throughput; the upside skews positive for fundamentals-focused portfolios. DeFi users gain a ballast asset, institutions a liquidity ramp. At $1.11, USDY invites measured accumulation, embodying the prudence that outlasts hype cycles.

Sei users, seize this yield window thoughtfully. Ondo USDY Sei isn’t a revolution overnight, but a foundational shift toward resilient on-chain finance. In fixed income’s digital dawn, those blending blockchain speed with Treasury sanctity will harvest enduring returns.