How Smart Contracts Power Transparency in Tokenized Fixed-Income Products

Picture this: a world where every step in the bond market is visible, verifiable, and automated. That world isn’t science fiction, it’s unfolding right now thanks to smart contracts and the tokenization of fixed-income products. The traditional bond market, long criticized for opacity and manual processes, is being reshaped by blockchain-powered transparency. Let’s dive into how smart contracts are setting a new gold standard for trust, efficiency, and compliance in tokenized bonds.

Smart Contracts: The Backbone of Tokenized Bonds

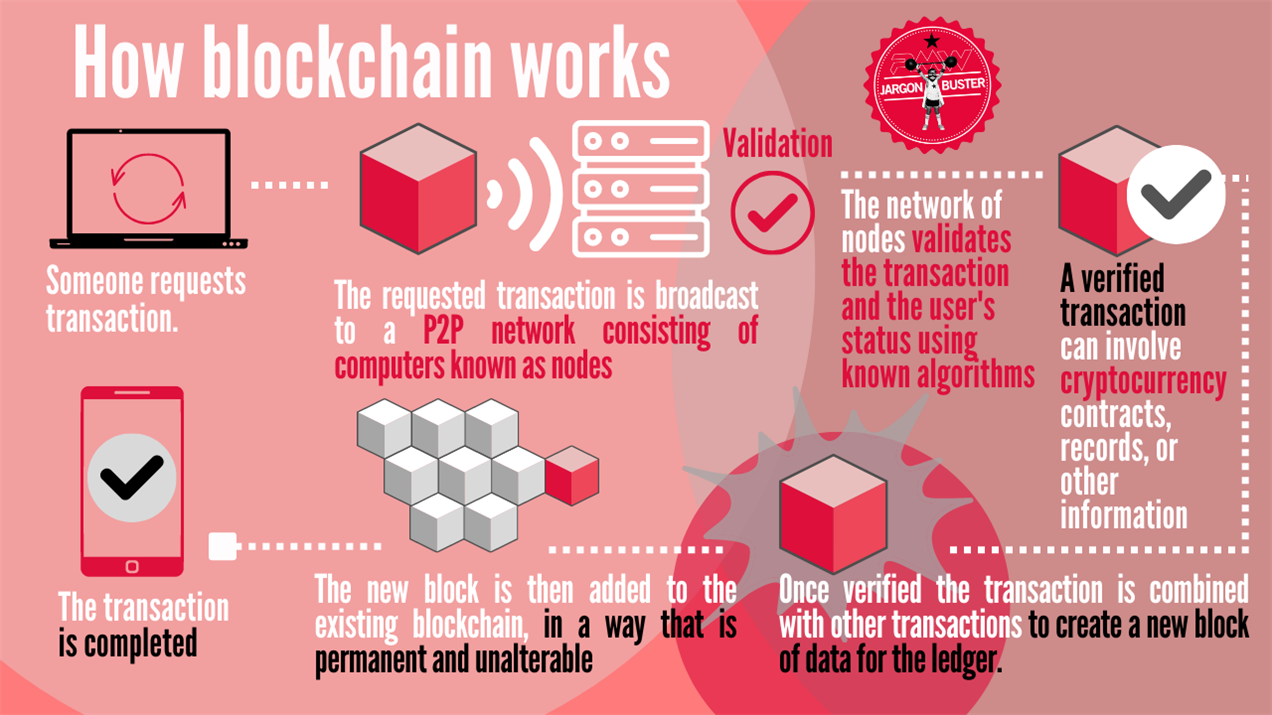

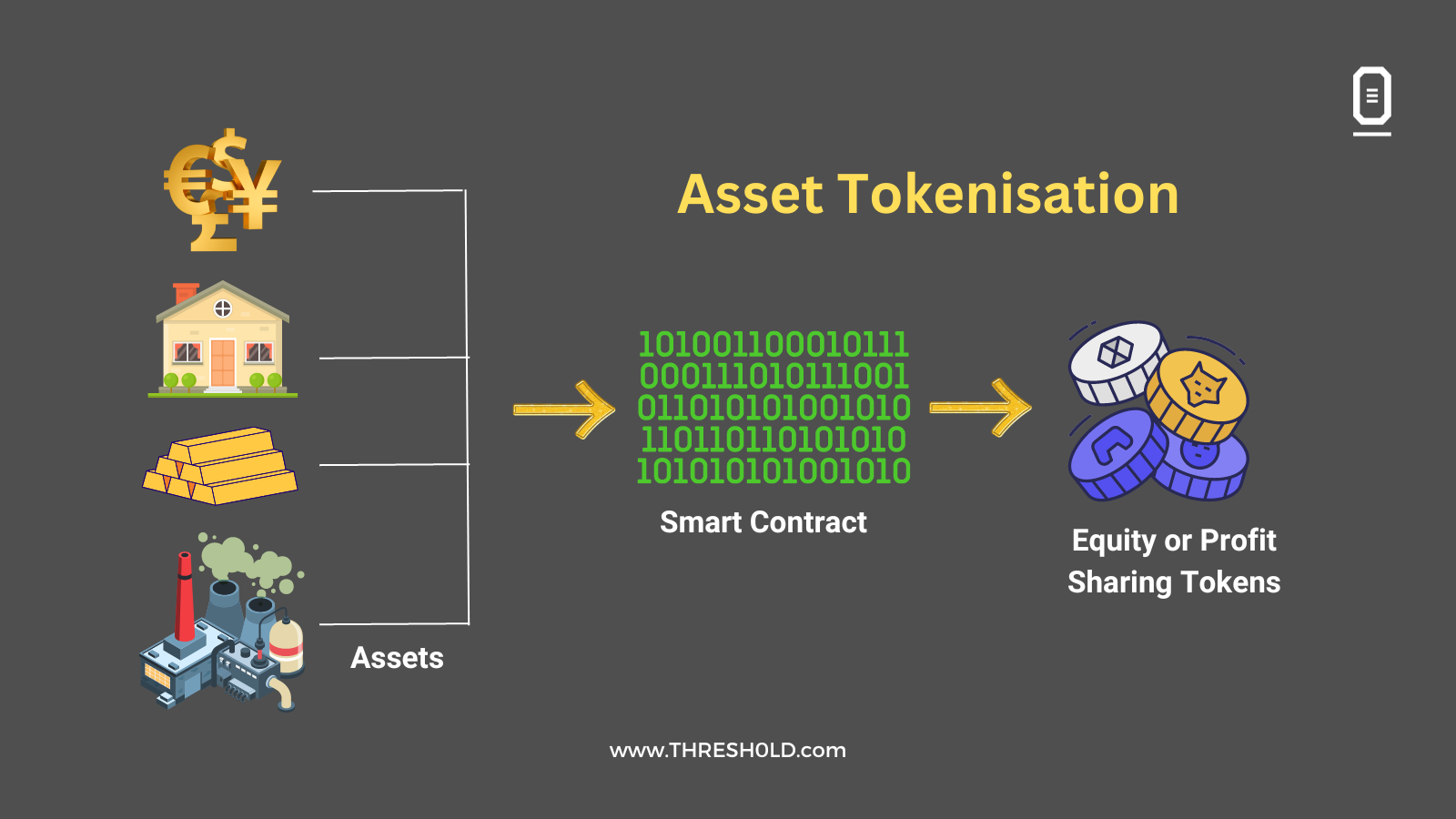

At the heart of this transformation are smart contracts. Unlike old-school paperwork or even centralized digital ledgers, smart contracts are self-executing code deployed on public blockchains. They automate the entire lifecycle of a bond, from issuance to interest payments and final redemption, without human intervention or clerical errors. As explained by the Federal Reserve Board’s research (source), these contracts offer a level of transparency that legacy systems simply can’t match.

The result? Every transaction, whether it’s an investor buying a tokenized T-bill or receiving an interest payment, is instantly recorded on an immutable ledger. This means all participants have access to real-time data about their holdings and the underlying asset performance, reducing information asymmetry and boosting investor confidence.

Transparency That Goes Beyond Hype

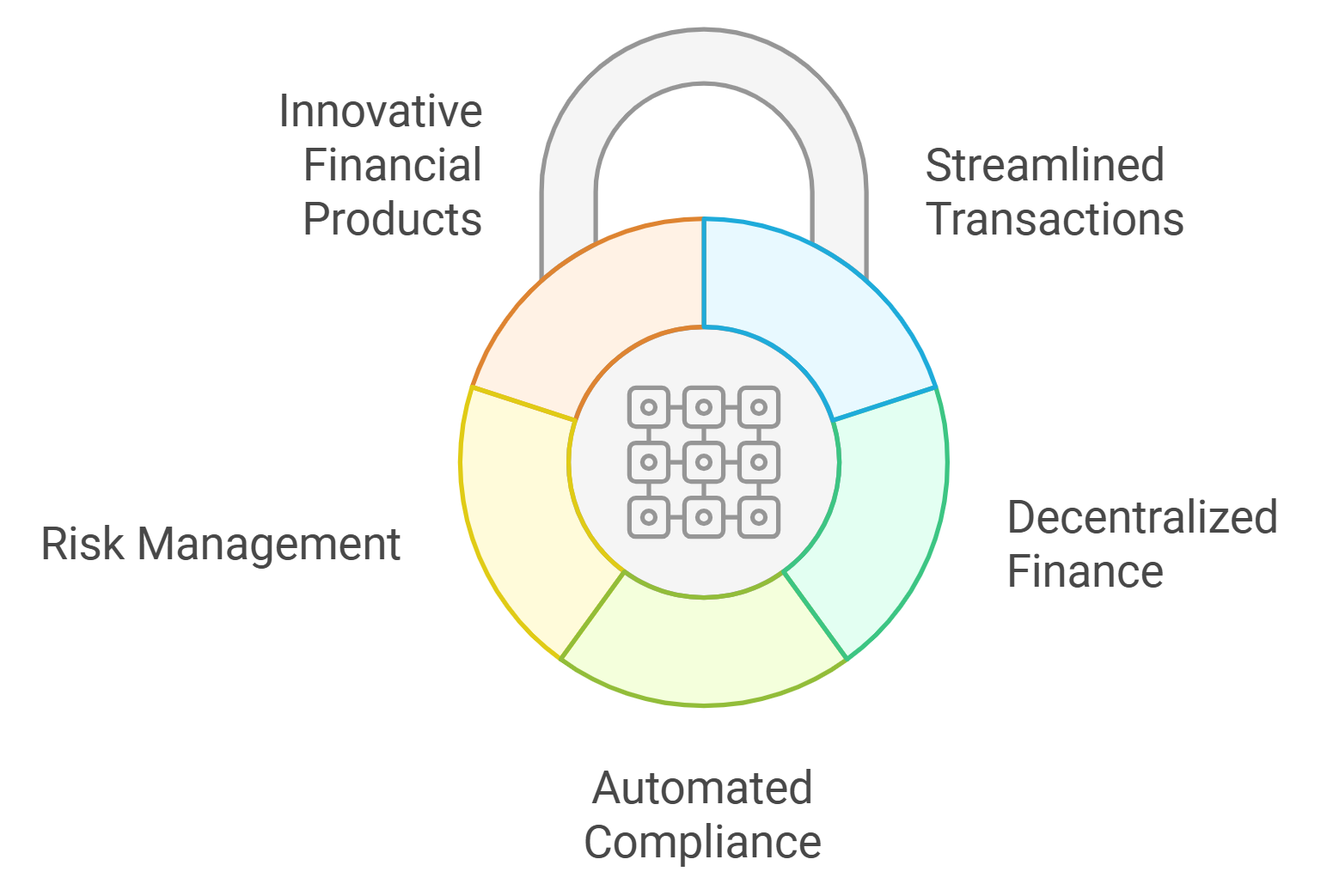

Blockchain transparency in fixed income isn’t just about visibility, it’s about accountability and trust baked into every line of code. Smart contracts provide:

Key Transparency Benefits of Smart Contracts in Tokenized Fixed-Income

-

Real-Time Reporting: Smart contracts on public blockchains like Ethereum enable investors and issuers to access up-to-the-minute data on bond performance, interest payments, and ownership changes. This transparency builds trust and empowers informed decision-making.

-

Instant Audit Trails: Every transaction, from issuance to redemption, is immutably recorded on the blockchain. This creates a transparent, tamper-proof audit trail that regulators and auditors can verify at any time.

-

Reduced Fraud Risk: By embedding rules and automating processes, smart contracts minimize opportunities for manipulation or unauthorized transfers, significantly lowering the risk of fraud in platforms like SettleMint and Gate.io.

-

Streamlined Interest and Principal Payments: Solutions from Blockchain App Factory automate the distribution of interest and principal directly to investors’ wallets, eliminating delays and manual intervention.

This level of openness is especially valuable for institutional investors navigating complex regulatory landscapes. With compliance logic embedded directly into smart contracts, such as KYC protocols or jurisdictional restrictions, transactions are automatically vetted before execution. There’s no need for slow manual checks or after-the-fact audits; everything is visible on-chain as it happens.

Automated Bond Settlement: Speed Meets Security

The old days of waiting days (or weeks) for bond settlements are fading fast. Thanks to automated bond settlement, smart contracts enable near-instant transfer of ownership once trade conditions are met. Interest payments? Automatically credited to your digital wallet at precisely scheduled intervals (see LCX analysis). Redemption? Triggered exactly when the contract matures, no paperwork required.

This automation slashes operational overhead while minimizing counterparty risk. Plus, because every step is tracked on-chain, regulators and investors alike can trace funds with unprecedented clarity, a major leap forward from traditional opaque processes.