How Fidelity’s Tokenized U.S. Treasuries Fund on Ethereum Is Reshaping Institutional Fixed-Income Access

Fidelity Investments, a titan in asset management, has quietly set a new standard for tokenized fixed-income investing with the launch of its Fidelity Digital Interest Token (FDIT) on Ethereum. This move signals a major leap forward for institutional investors seeking U. S. Treasury exposure through blockchain rails, combining the trust of a legacy institution with the transparency and efficiency of decentralized technology.

Fidelity’s FDIT: Bringing On-Chain US Treasuries to Scale

The FDIT is not just another experiment in digital assets, it is a tokenized share class of the Fidelity Treasury Digital Fund (FYOXX), now live on Ethereum. As of September 2025, this fund has already attracted over $200 million in assets, making it one of the largest single-issuer tokenized treasury products globally. With daily yield accrual and no lockups, FDIT allows institutions to access Treasury-like returns while benefiting from instant settlement and composability within DeFi protocols.

Unlike previous attempts at blockchain-based bonds or t-bills, Fidelity’s approach is compliance-first and integrated with existing regulatory frameworks, addressing one of the core hurdles for large-scale adoption among banks, hedge funds, and fintech platforms. The fund’s rapid growth also highlights increasing demand for transparent, programmable fixed-income instruments that bridge traditional finance (TradFi) and emerging blockchain ecosystems.

Why This Matters: Macro Trends and Institutional Adoption

This launch is more than a technical milestone, it reflects a macro shift in how capital allocators think about liquidity, transparency, and access to public debt markets. The global market for tokenized treasuries now exceeds $7 billion, according to recent industry estimates (CoinDesk coverage). Fidelity’s entry validates blockchain as an institutional-grade infrastructure layer for sovereign debt exposure.

For portfolio managers navigating volatile interest rate cycles and persistent inflation risk, products like FDIT offer real-time settlement compared to T and 1 or T and 2 in legacy systems. Fractional ownership means even smaller funds or DAOs can participate without operational friction or high minimums. Most importantly, on-chain treasuries provide transparency into underlying collateral, a critical feature during periods of market stress.

Top 5 Benefits of Tokenized Treasuries for Institutions

-

24/7 Market Access & Real-Time Settlement: Tokenized U.S. Treasuries like Fidelity’s FDIT on Ethereum enable institutional investors to transact and settle instantly at any time, removing traditional banking hours and lengthy settlement delays.

-

Enhanced Transparency & On-Chain Auditability: Blockchain-based tokens provide clear, immutable records of ownership and transactions, allowing institutions to verify holdings and flows in real time.

-

Fractional Ownership & Improved Liquidity: Tokenization allows investors to purchase fractions of Treasury funds, lowering minimum investment thresholds and enabling more flexible portfolio management.

-

Streamlined Operations & Reduced Costs: By leveraging Ethereum rails, tokenized treasuries automate processes like issuance, transfer, and record-keeping, helping institutions cut operational costs and reduce reliance on intermediaries.

-

Seamless Integration with DeFi & On-Chain Ecosystems: Institutional investors can use tokenized Treasury assets (e.g., FDIT) as collateral or liquidity in decentralized finance protocols, unlocking new yield and risk management strategies.

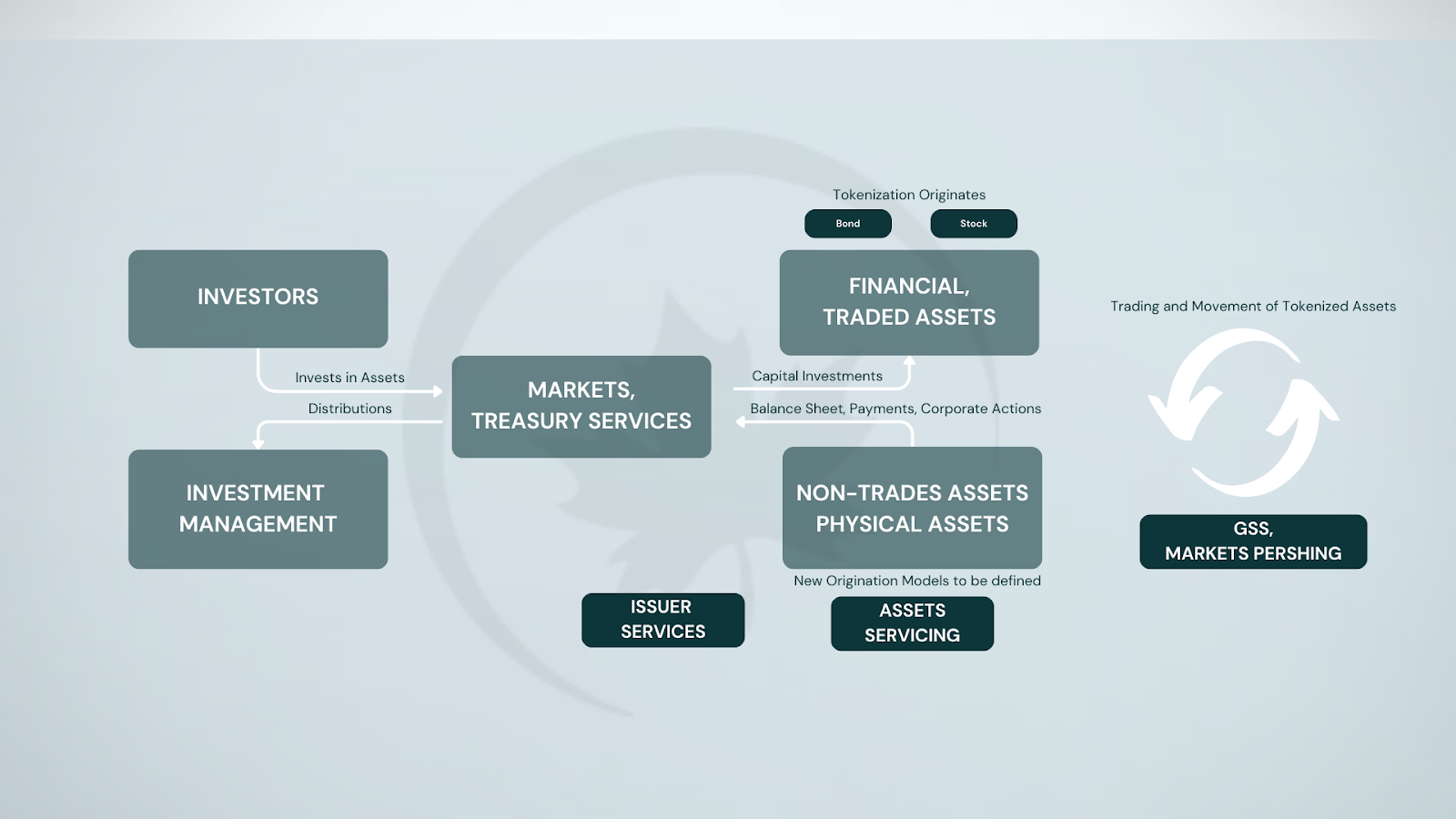

The Competitive Landscape: FDIT vs BUIDL vs JPMD

Fidelity’s move also intensifies competition among blue-chip issuers racing to define standards in institutional blockchain finance. BlackRock’s BUIDL and JPMorgan’s JPMD have made headlines with similar offerings; however, Fidelity distinguishes itself by leveraging Ethereum’s established developer community and DeFi integrations out-of-the-box. The fact that Ondo Finance holds a significant portion of FDIT as reserves for its OUSG yield token further demonstrates how these products are becoming foundational building blocks within both TradFi and crypto-native portfolios.

This convergence points toward a future where the lines between traditional securities and digital assets blur, and where real-world assets like U. S. Treasuries become as programmable as any ERC-20 token.

Yet for all the excitement, the rise of Fidelity tokenized treasuries also raises important questions about custody, interoperability, and systemic risk. Institutional allocators are right to scrutinize how smart contract security, counterparty exposure, and on-chain governance will evolve as assets migrate from legacy ledgers to public blockchains. The fact that FDIT operates within existing regulatory guardrails, unlike many early DeFi experiments, offers a measure of reassurance, but does not eliminate the need for robust risk management frameworks.

As more assets move on-chain, interoperability between permissioned and permissionless environments becomes a strategic imperative. Fidelity’s use of Ethereum is a bet on open standards and composability. However, it also means that institutions must develop new operational expertise around wallet management, private key security, and integration with both off-chain and on-chain reporting systems. The next phase of adoption will likely hinge on the development of enterprise-grade middleware and clearer global regulatory consensus.

Looking Ahead: Tokenized Fixed-Income Investing in 2026

The success of FDIT, and its rapid accumulation of over $200 million in assets, signals that institutional demand for on-chain US Treasuries is real and growing. As more blue-chip issuers enter the space, we can expect a virtuous cycle: increased liquidity begets tighter spreads and more sophisticated secondary markets. This will not only benefit large asset managers but also unlock new avenues for fintech platforms, DAOs, and even retail-facing neobanks seeking to offer U. S. Treasury yields in programmable formats.

The macro implications are profound. If tokenized treasuries become standard collateral across lending protocols or settlement layers in DeFi, they could reshape global liquidity flows and challenge traditional intermediaries’ role in fixed-income distribution. Moreover, transparent real-time auditing, enabled by blockchain rails, may set new expectations for disclosure across all asset classes.

Still, investors should approach this evolving market with disciplined risk awareness. Smart contract vulnerabilities remain a non-trivial concern; so do questions about redemption mechanisms during periods of market stress or regulatory intervention. Due diligence must extend beyond headline yields to encompass legal structure, operational controls, and counterparty alignment.

Ultimately, Fidelity’s FDIT is not just another product launch, it is an inflection point for how capital formation happens in the digital age. The line between public debt markets and programmable money is fading fast; those who understand both worlds will be best positioned to navigate whatever comes next.