How Fidelity’s Tokenized U.S. Treasuries Fund on Ethereum Changes Institutional Fixed-Income Investing

Institutional fixed-income investing is experiencing a seismic shift, and the catalyst is Fidelity’s newly launched tokenized U. S. Treasuries fund on Ethereum. With over $200 million in assets as of September 2025, the Fidelity Treasury Digital Fund (FYOXX) demonstrates that blockchain isn’t just for crypto natives anymore, it’s now a serious tool for major asset managers seeking to modernize access to government debt. If you’re tracking the intersection of traditional finance and blockchain, this is a watershed moment.

Fidelity’s On-Chain Leap: What Makes This Fund Different?

Let’s cut through the noise: Fidelity isn’t just dabbling in digital assets for headlines. The FYOXX fund brings U. S. Treasury money market exposure directly onto Ethereum, offering tokenized shares that can be transferred 24/7, settled within minutes, and integrated with DeFi protocols. The core assets, U. S. Treasury bills and cash, are held securely by Bank of New York Mellon as custodian, but investors interact with their positions through digital tokens rather than legacy paperwork.

This approach slashes operational friction while boosting transparency and accessibility. Institutional allocators can now move in and out of Treasuries at any time, sidestepping the usual banking hours or settlement delays. And with fees as low as 0.20%, FYOXX is positioned to compete not only with traditional funds but also with blockchain-native offerings like BlackRock’s BUIDL fund.

Key Benefits of Tokenized Treasuries for Institutions

-

24/7 Liquidity and Trading: Tokenized U.S. Treasuries like Fidelity’s FYOXX on Ethereum allow institutional investors to trade and settle assets around the clock, bypassing traditional market hours and improving flexibility.

-

Fractional Ownership and Lower Entry Barriers: Tokenization enables institutions to purchase fractional shares of U.S. Treasury securities, making it easier to diversify portfolios and access high-quality assets with less capital.

-

Enhanced Transparency and On-Chain Settlement: Using the Ethereum blockchain, all transactions are recorded immutably, giving institutions real-time visibility into holdings and transfers, and reducing reconciliation errors.

-

Operational Efficiency and Cost Reduction: Blockchain automation streamlines settlement, compliance, and reporting, cutting down on administrative overhead and potentially lowering management fees, as seen with Fidelity’s 0.20% fee for FYOXX.

-

Seamless Integration with DeFi and Digital Ecosystems: Tokenized Treasuries on Ethereum can interact with decentralized finance (DeFi) protocols, unlocking new yield opportunities and composability for institutional portfolios.

Ethereum: The Beating Heart of Tokenized Fixed Income

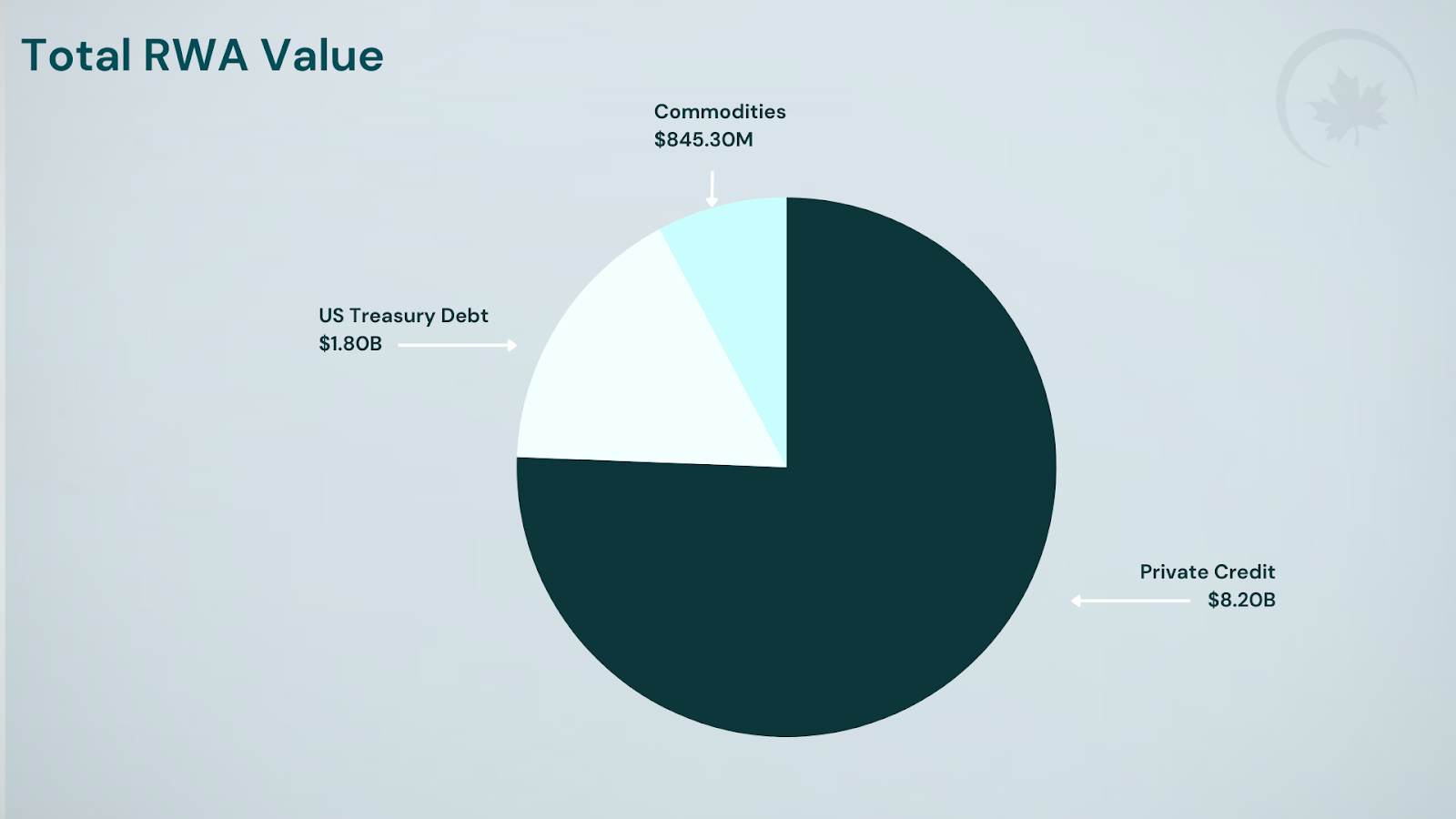

The choice of Ethereum as the settlement layer isn’t accidental. As of September 2025, Ethereum hosts 72% of all on-chain U. S. Treasuries, an impressive concentration that highlights its dominance in real-world asset (RWA) tokenization. The total market for tokenized U. S. Treasuries now stands at $7.5 billion, more than triple the size from just a year ago.

This rapid growth is fueled by Ethereum’s robust security model, developer ecosystem, and interoperability with DeFi infrastructure. For institutions used to walled gardens and siloed systems, this means newfound liquidity and composability, imagine being able to pledge your Treasury tokens as collateral in lending protocols or instantly swap them for stablecoins during off-market hours.

The Institutional Domino Effect

Fidelity’s entry into the space signals a tipping point for blockchain fixed income adoption among large asset managers and global banks. In fact, FYOXX has already attracted over $200 million, rivaling early movers like BlackRock while validating demand for regulated on-chain alternatives to legacy products.

The implications are profound:

- Fractionalization: Investors can own smaller slices of high-grade government debt without minimums that would have been prohibitive before.

- 24/7 Markets: No more waiting for T and 1 or T and 2 settlements; liquidity is always on tap.

- Programmability: Institutions can automate compliance checks or integrate yield strategies directly into smart contracts.

If you want a deeper dive into how these innovations are reshaping access to institutional-grade fixed income, check out our detailed guide at this link.

But it’s not just about the technology, it’s about what this means for the future of capital markets. When a giant like Fidelity moves $200 million of U. S. Treasuries onto Ethereum, it sends a clear message: tokenized fixed income isn’t a niche experiment anymore. It’s a growing market with real institutional buy-in, and the competitive landscape is heating up fast. BlackRock’s BUIDL may have the early lead with $2.2 billion in AUM, but Fidelity’s arrival is accelerating the shift from proof-of-concept to mainstream adoption.

Operational Efficiency and Regulatory Confidence

One of the most overlooked advantages here is operational efficiency. The FYOXX fund leverages smart contracts to automate record-keeping, compliance, and settlement, tasks that typically eat up time and resources in traditional systems. For institutional investors, this means faster onboarding, fewer intermediaries, and reduced counterparty risk.

Regulatory clarity is also advancing. Fidelity’s approach, backed by established custodians like Bank of New York Mellon, demonstrates how tokenized funds can stay within existing legal frameworks while still reaping blockchain’s benefits. This blend of innovation and compliance is crucial for attracting conservative capital that has historically shied away from crypto-native products.

The Ripple Effect: What Happens Next?

With over $7.5 billion in on-chain U. S. Treasuries as of September 2025, we’re witnessing a feedback loop: increased institutional involvement drives greater liquidity and infrastructure investment, which in turn attracts even more capital to blockchain-based fixed income.

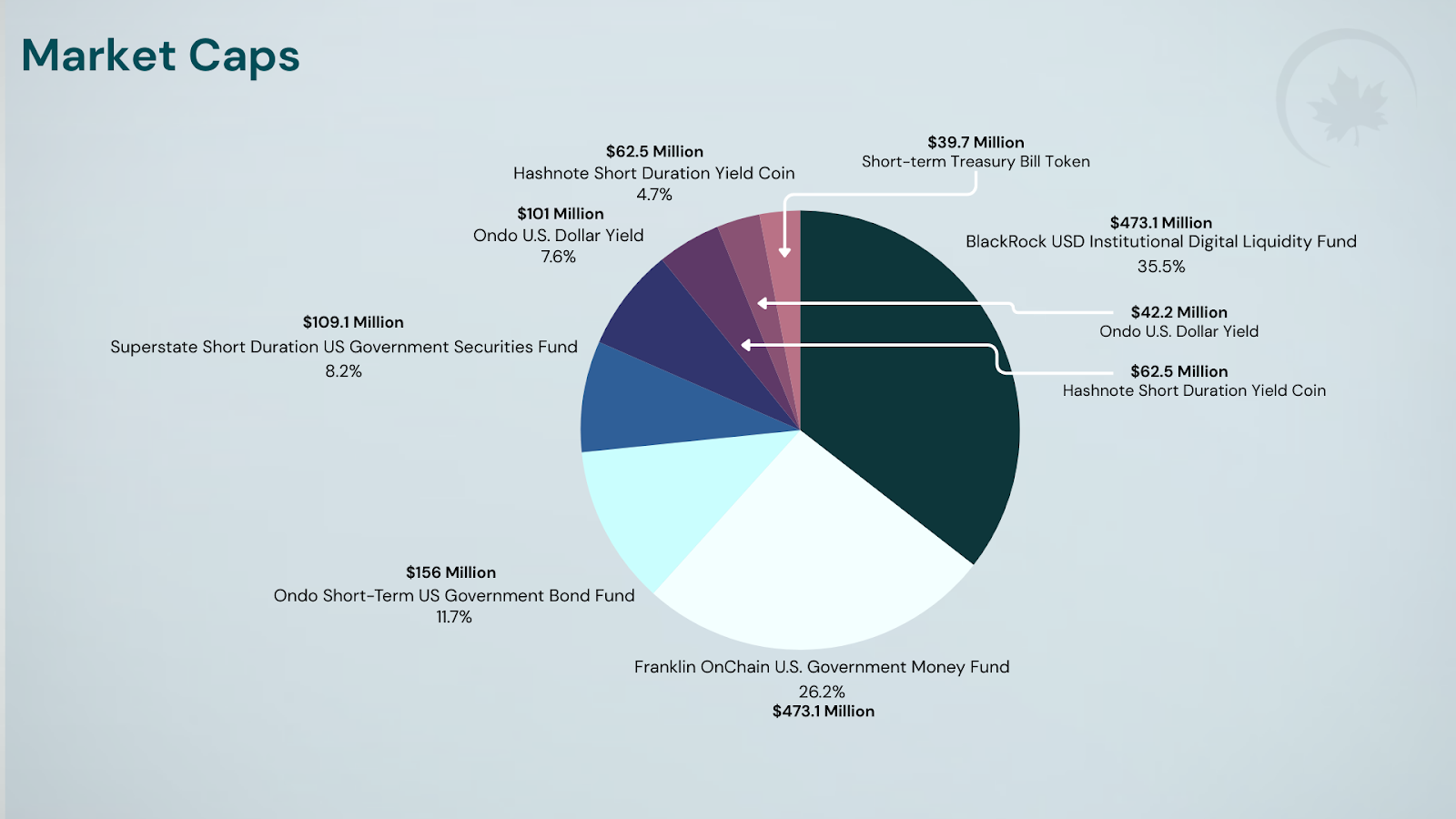

Comparing Top Tokenized Treasury Funds: FYOXX vs. BUIDL & More

-

Fidelity Treasury Digital Fund (FYOXX): Launched on Ethereum in September 2025, FYOXX offers institutional investors access to U.S. Treasury bills via tokenized shares, with over $200 million in assets under management. It features 0.20% fees, 24/7 trading, and Bank of New York Mellon as custodian, emphasizing transparency and operational efficiency.

-

BlackRock USD Institutional Digital Liquidity Fund (BUIDL): BlackRock’s BUIDL is the largest tokenized U.S. Treasury fund, also built on Ethereum. It boasts over $2.2 billion in assets, offering institutional-grade exposure to U.S. Treasuries with daily liquidity and robust compliance standards.

-

Ondo Short-Term U.S. Government Bond Fund (OUSG): Ondo Finance’s OUSG provides tokenized exposure to short-term U.S. Treasuries, allowing for fractional ownership and on-chain transfers. OUSG is among the leading DeFi-accessible treasury products, with hundreds of millions in AUM and a focus on seamless DeFi integration.

-

Franklin OnChain U.S. Government Money Fund (FOBXX/Benji): Franklin Templeton’s Benji platform tokenizes shares of its U.S. government money market fund on Stellar and Ethereum, enabling 24/7 access and blockchain-based transparency. It is one of the earliest and most established tokenized treasury products.

-

Matrixdock Short-term Treasury Bill Token (STBT): Matrixdock’s STBT offers tokenized short-term U.S. Treasury bill exposure on Ethereum, catering to both institutional and DeFi users. It emphasizes liquidity, compliance, and on-chain settlement.

Expect new entrants to follow Fidelity’s blueprint, offering lower fees, instant settlement, and seamless DeFi integrations. We’ll likely see:

- Expansion into other government securities, such as agency bonds or inflation-linked notes

- Integration with DeFi protocols, unlocking new yield strategies for treasurers and asset managers

- Broader international participation, as global banks look to replicate these models on their own rails

The big question now isn’t whether tokenized Treasuries will become a fixture in institutional portfolios, it’s how quickly adoption will accelerate as more asset managers cross the digital Rubicon.

Would you allocate to a tokenized U.S. Treasury fund on Ethereum like Fidelity’s FYOXX?

With over $200 million in assets and 24/7 trading, tokenized Treasury funds on Ethereum are gaining traction among institutions. Would you consider investing in this new way to access U.S. Treasuries?

Why This Matters for Investors Right Now

If you’re an allocator or treasury manager watching from the sidelines, there are compelling reasons to pay attention:

- Liquidity: On-chain US Treasuries can be traded peer-to-peer around the clock with real-time settlement.

- Transparency: Every transaction is auditable on Ethereum, no more waiting days for transfer confirmations or NAV calculations.

- Diversification: Exposure to digital assets without taking on pure crypto volatility; you get government-backed credit quality with blockchain-native flexibility.

The bottom line? Tokenization is no longer theoretical for fixed income, it’s operational at scale. As regulatory frameworks mature and technical standards solidify, expect even more innovation at the intersection of blockchain and traditional finance.

If you want to understand how this evolution could impact your portfolio allocation or risk management approach, explore our full analysis at this page.