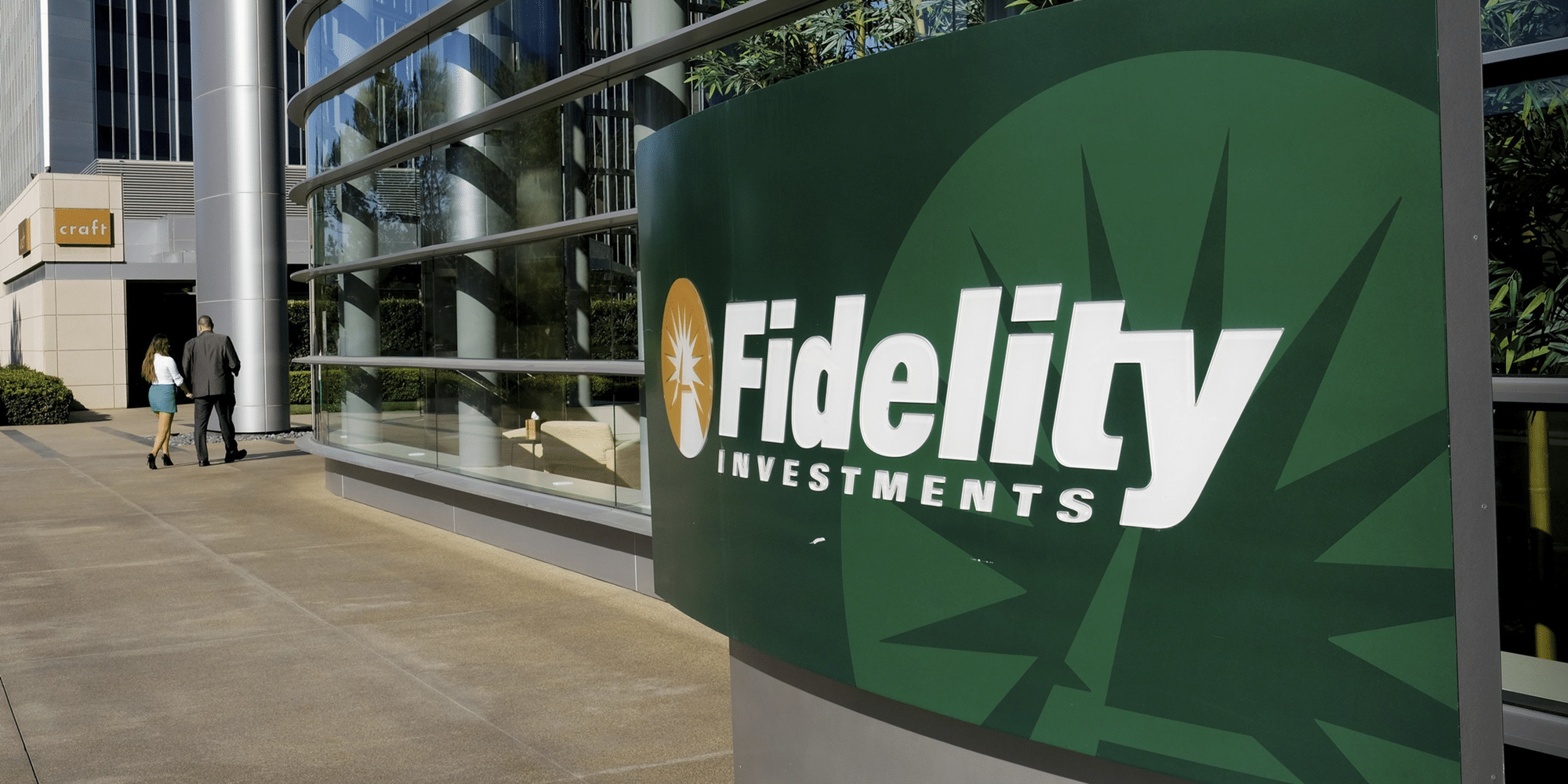

How Fidelity’s Tokenized U.S. Treasuries Fund on Ethereum Is Shaping Institutional On-Chain Fixed-Income

Fidelity’s launch of the Fidelity Digital Interest Token (FDIT) on Ethereum is more than a headline-grabbing first for a major asset manager. It is a calculated response to the surging demand for tokenized U. S. Treasuries and a signal that institutional fixed-income investing is rapidly evolving. With $202 million in assets under management at debut, FDIT immediately became one of the largest players in the $7.5 billion tokenized Treasuries market, underscoring both Fidelity’s scale and the accelerating migration of real-world assets onto public blockchains.

Fidelity’s Entry: Institutional Validation for On-Chain Fixed-Income

The FDIT fund, structured as an ERC-20 token on Ethereum, gives institutional investors direct, programmable access to short-term U. S. Treasury securities and cash equivalents. Unlike legacy share classes settled through intermediaries with limited hours, FDIT offers 24/7 transferability, real-time settlement, and composability with DeFi protocols. This enables new forms of collateralization, liquidity provision, and automated portfolio management previously unavailable in traditional fixed-income markets.

The fund charges a competitive 0.20% annual management fee and leverages Bank of New York Mellon as its custodian – maintaining robust institutional controls while providing blockchain-native benefits. Notably, Ondo Finance holds a substantial portion of FDIT tokens as reserves for its OUSG product, integrating Fidelity’s offering into broader DeFi yield strategies and further enhancing secondary market liquidity.

Tokenized Treasuries Market Surges Past $7.5 Billion

The timing of Fidelity’s move is critical: the tokenized U. S. Treasuries market has more than tripled year-over-year to reach $7.5 billion, driven by rising interest rates, DeFi adoption, and growing recognition among asset managers that blockchain can deliver efficiency without sacrificing compliance or security.

At the time of writing, Ethereum (ETH) trades at $4,183.24, reflecting robust network activity as institutions increasingly deploy capital on-chain via products like FDIT.

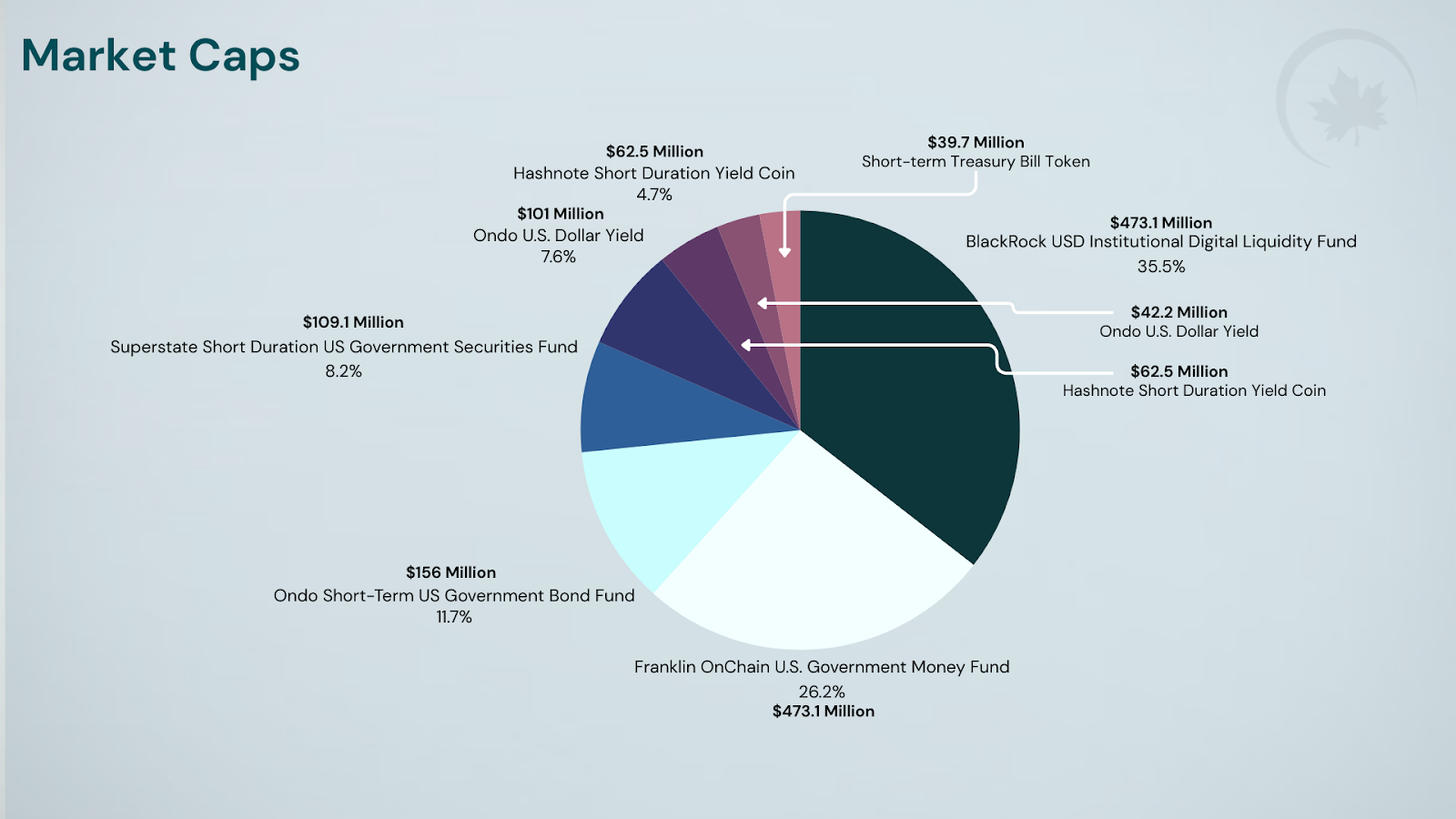

This explosive growth has not gone unnoticed by competitors; BlackRock’s BUIDL fund and Franklin Templeton’s BENJI have also entered the space recently. However, Fidelity’s brand recognition and distribution capabilities set it apart as a likely catalyst for broader adoption among banks, asset allocators, and treasury managers seeking digital rails for fixed-income exposure.

Why Institutions Are Turning to Blockchain-Based Treasury Products

- Liquidity and Market Access: Tokenized treasuries like FDIT can be bought or sold around the clock, far beyond Wall Street trading hours, giving global investors continuous access to dollar-backed yields.

- Settlement Efficiency: On-chain settlement eliminates multi-day clearing cycles and counterparty risks associated with legacy infrastructure.

- Composability: ERC-20 tokens like FDIT can be integrated into DeFi lending pools or used as collateral in smart contracts, unlocking new capital efficiency levers for sophisticated investors.

- Transparency: Blockchain-based funds offer real-time auditability of holdings and flows, a significant upgrade over opaque fund accounting systems.

Ethereum (ETH) Price Prediction 2026-2031

Incorporating the impact of institutional adoption, tokenized Treasuries, and evolving DeFi use cases

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,800 | $4,600 | $6,200 | +10% | Consolidation as institutional adoption grows; volatility from regulatory clarity |

| 2027 | $4,200 | $5,400 | $7,800 | +17% | Bullish momentum from broader tokenized asset adoption; possible ETF approvals |

| 2028 | $4,800 | $6,300 | $9,200 | +17% | DeFi and RWAs (real-world assets) drive demand; increased global regulation |

| 2029 | $5,500 | $7,400 | $11,000 | +17% | Ethereum upgrades improve scalability; competition from L2s and alt-L1s |

| 2030 | $6,200 | $8,500 | $13,500 | +15% | Mainstream acceptance, further institutional inflows, DeFi innovation |

| 2031 | $7,000 | $9,600 | $15,800 | +13% | Matured market, integration with traditional finance, stable growth |

Price Prediction Summary

Ethereum is positioned for steady growth over the next six years, underpinned by institutional adoption of on-chain assets, the expanding tokenized Treasuries market, and Ethereum’s dominance in DeFi. While volatility and competition remain, the trend toward integrating traditional finance with blockchain technology supports a bullish long-term outlook. Average price predictions suggest a compound annual growth rate of 13-17%, with potential for higher gains in bullish scenarios if regulatory and technological landscapes remain favorable.

Key Factors Affecting Ethereum Price

- Institutional adoption of tokenized Treasury and money market funds on Ethereum (e.g., Fidelity, BlackRock)

- Expansion and innovation in the DeFi sector and real-world asset tokenization

- Ethereum network upgrades (scalability, cost reduction, security)

- Global regulatory developments impacting digital assets and on-chain finance

- Competition from alternative L1s and Layer 2 scaling solutions

- Macroeconomic factors (interest rates, institutional investment appetite)

- Integration with traditional finance and improved investor access

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This fusion of regulated asset management with Web3 infrastructure marks what some analysts are calling an industry tipping point, a view echoed by many following Fidelity’s strategic leap into blockchain-based fixed income (read more).

As the tokenized fixed-income landscape matures, Fidelity’s FDIT fund illustrates how traditional financial institutions can harness blockchain’s strengths while upholding strict compliance and risk management standards. The presence of established custodians, like Bank of New York Mellon, ensures that institutional investors retain familiar safeguards even as they navigate novel on-chain territory.

Beyond the core benefits of 24/7 liquidity and operational efficiency, FDIT’s design unlocks unprecedented flexibility for treasury managers. For example, asset allocators can now rebalance positions or access dollar liquidity at any hour, critical in volatile macro environments or for global operations spanning multiple time zones. As more DeFi protocols incorporate FDIT and similar tokens, the boundaries between decentralized finance and regulated capital markets will continue to blur.

Key Drivers Behind Fidelity’s Blockchain Bond Strategy

Key Strategic Motivations Behind Fidelity’s Tokenized Treasuries Move

-

Expanding Institutional Access to U.S. Treasuries: By launching the Fidelity Digital Interest Token (FDIT) on Ethereum, Fidelity enables institutional investors to access U.S. Treasury securities digitally, with real-time settlement and 24/7 transfer capabilities, removing traditional market hour constraints.

-

Enhancing Market Liquidity and Efficiency: Tokenizing the Fidelity Treasury Digital Fund (FYOXX) as an ERC-20 asset allows for seamless on-chain transfers and integration with DeFi applications, supporting continuous liquidity and reducing reliance on intermediaries.

-

Responding to Rapid Growth in Tokenized Treasuries: With the tokenized U.S. Treasuries market surpassing $7.5 billion in capitalization, Fidelity’s entry positions the firm at the forefront of a rapidly expanding sector and signals growing institutional demand for blockchain-based financial products.

-

Competitive Positioning Among Leading Asset Managers: Fidelity joins major players like BlackRock and Franklin Templeton in offering tokenized funds, reinforcing its commitment to digital asset innovation and maintaining its relevance in a shifting financial landscape.

-

Leveraging Blockchain for Transparency and Operational Efficiency: Utilizing the Ethereum blockchain enhances transparency, reduces settlement times, and streamlines fund operations, aligning with institutional preferences for secure and efficient asset management.

Notably, the interoperability of ERC-20 tokenized treasuries with DeFi infrastructure is driving new use cases. Institutional clients can deploy FDIT as collateral in lending protocols or integrate it into automated cash management strategies. This composability is expected to drive further institutional inflows as risk models and compliance frameworks adapt to digital asset rails.

The surge in market capitalization, from under $3 billion a year ago to $7.5 billion today, reflects not only increased demand but also growing confidence among regulators and service providers that tokenization can coexist with robust oversight. Fidelity’s entry validates this thesis and signals that more blue-chip asset managers may soon follow suit.

What’s Next for Institutional Crypto Treasury Products?

With Ethereum maintaining a price level at $4,183.24, the network’s role as a foundation for real-world asset tokenization appears solidified for now. However, questions remain about scaling solutions, cross-chain interoperability, and evolving regulatory expectations as volumes grow.

Market watchers anticipate that continued innovation in smart contract security and on-chain identity will further accelerate adoption among banks, corporates, and sovereign wealth funds seeking programmable dollar exposure with minimal friction. Meanwhile, competition among major issuers, Fidelity, BlackRock, Franklin Templeton, will likely drive down fees while expanding product variety across durations and risk profiles.

For those evaluating digital treasury products today, due diligence around custody arrangements, smart contract audits, and secondary market liquidity remains paramount. Yet the trajectory is clear: on-chain treasury solutions are rapidly moving from experimental pilot projects to core components of modern institutional portfolios.

The Future of Tokenized U. S. Treasuries Is Institutional

Fidelity’s FDIT launch marks a watershed moment in the convergence of regulated finance and blockchain technology, a shift that is fundamentally reshaping how institutions access yield, manage risk, and participate in global capital markets.

To explore deeper analysis or practical implementation strategies for your organization’s treasury management stack using digital securities like FDIT, visit our comprehensive coverage at this resource.