How Fidelity’s Tokenized U.S. Treasuries Fund on Ethereum Changes Institutional Fixed-Income Investing

Fidelity’s entrance into the world of tokenized U. S. Treasuries is more than a headline-grabber – it’s a seismic shift for institutional fixed-income investing. With the launch of the Fidelity Digital Interest Token (FDIT) on Ethereum, Fidelity brings over $200 million in assets directly onto the blockchain, offering 24/7 liquidity and a transparent, programmable alternative to legacy money market funds. This is not simply another crypto experiment; it’s a signal that the world’s largest asset managers are betting big on tokenized finance as the next frontier for bonds and treasuries.

Fidelity’s FDIT: Real-World Assets Meet Ethereum

The FDIT is an ERC-20 token representing shares in Fidelity’s Treasury money market fund (FYOXX), which holds short-term U. S. Treasury securities and cash. This means every FDIT token is fully backed by real-world assets, with Bank of New York Mellon acting as custodian – familiar territory for risk-averse institutions. The annual management fee stands at just 0.20%, undercutting many traditional offerings while enabling on-chain transfers and round-the-clock access.

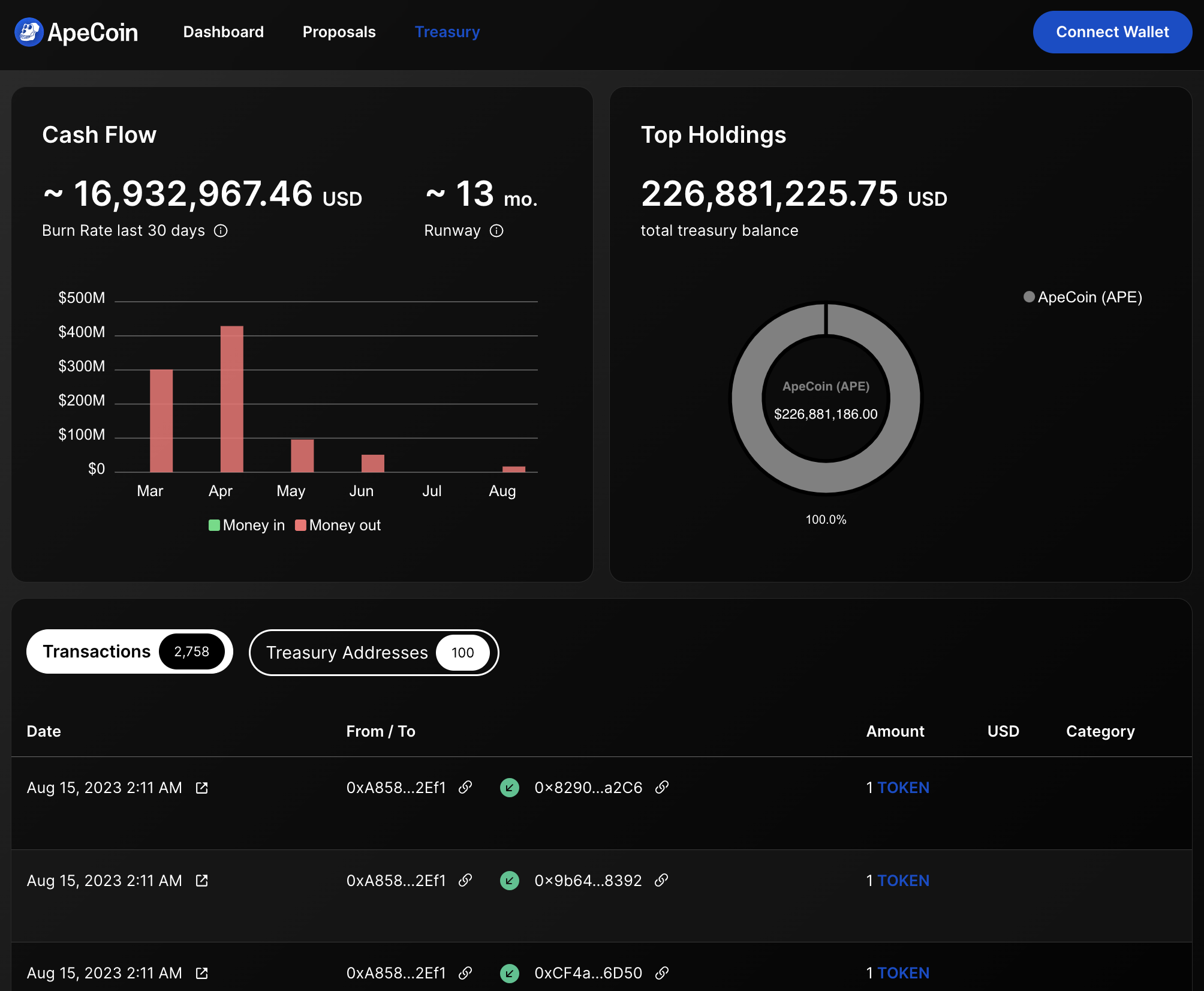

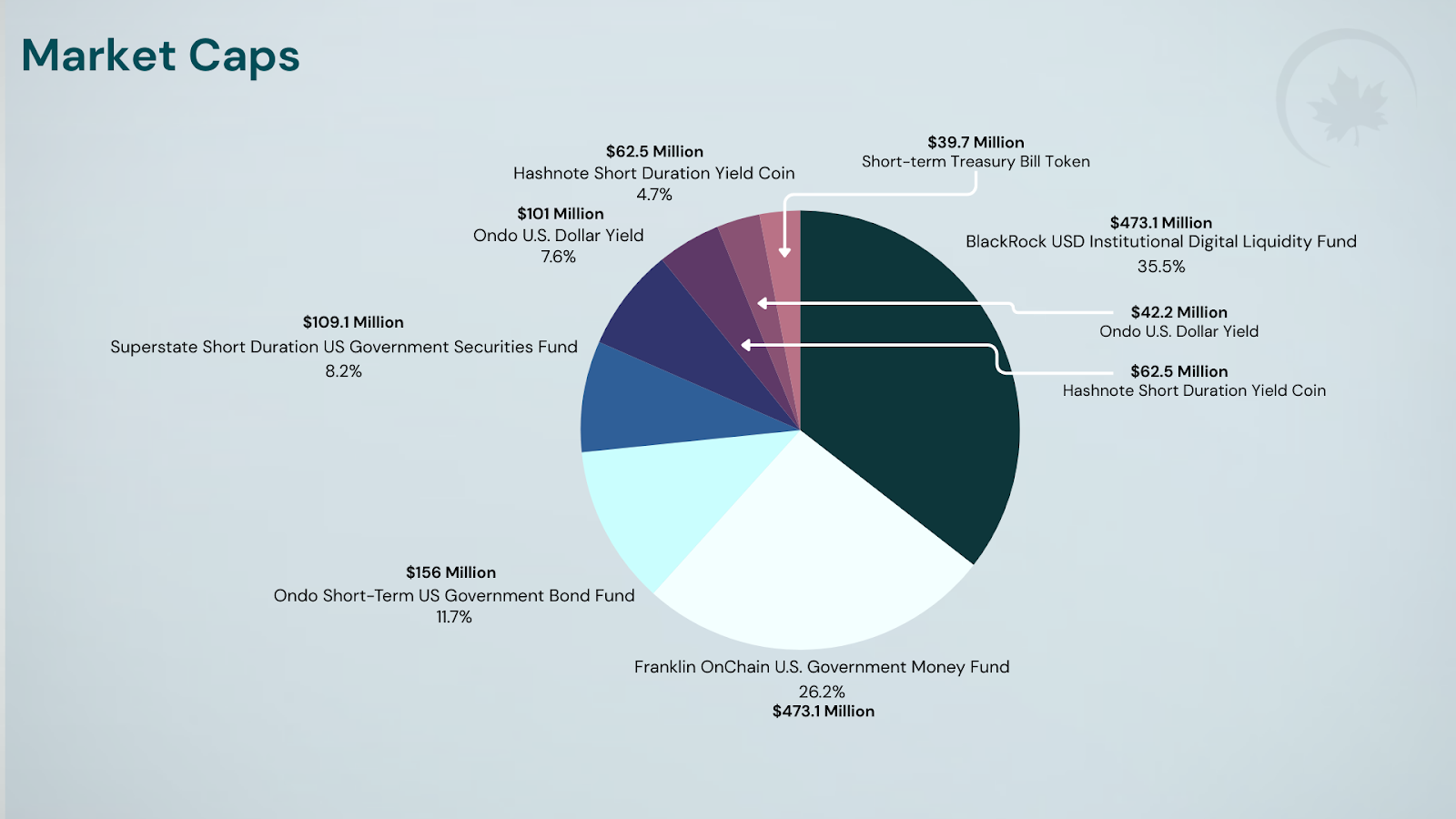

This isn’t hypothetical: since its launch in August 2025, FDIT has already attracted over $200 million in assets under management (see detailed breakdown). That makes it one of the largest players in a tokenized treasury market now exceeding $7 billion, with analysts projecting a $10 billion trajectory by 2025.

Why Tokenize Treasuries? The Institutional Case

The appeal for institutional investors is clear:

Key Benefits of Tokenized Treasuries for Institutions

-

24/7 Liquidity on Ethereum: Fidelity’s FDIT tokens can be traded and transferred at any time, unlike traditional markets that are limited to business hours, giving institutions continuous access to fixed-income exposure.

-

Real-Time Settlement: On-chain transactions enable near-instant settlement, reducing counterparty risk and eliminating the delays associated with legacy clearing systems.

-

Enhanced Transparency: All FDIT token movements and fund holdings are visible on the Ethereum blockchain, allowing for unprecedented auditability and trust in fund operations.

-

Lower Fees: Fidelity charges a competitive 0.20% annual management fee for the FDIT fund, which is lower than many traditional fixed-income investment vehicles.

-

Reduced Reliance on Intermediaries: Tokenization streamlines access to U.S. Treasuries by minimizing the need for brokers, clearinghouses, and custodians, leading to operational efficiencies.

-

Regulated and Secure Custody: The FDIT fund’s assets are held with Bank of New York Mellon, ensuring institutional-grade security and compliance standards for digital asset custody.

-

Improved Accessibility: Institutions worldwide can access U.S. Treasuries via Ethereum, broadening participation and enabling new investment strategies for global investors.

- Real-time settlement: On-chain transactions cut out days-long clearing cycles and reduce counterparty risk.

- Enhanced transparency: Blockchain provides an immutable record of ownership and flows, simplifying audits and compliance.

- Programmable access: Institutions can automate complex workflows – think collateralization or instant repo – using smart contracts.

- 24/7 liquidity: Unlike traditional markets that shut on weekends or holidays, tokenized assets trade around the clock.

This aligns perfectly with growing demand from hedge funds, family offices, and even DAOs seeking safe yield without sacrificing flexibility or transparency. As digital bonds and on-chain fixed income products proliferate, we’re seeing the architecture of finance itself being reimagined – not just digitized, but fundamentally upgraded.

The Big Picture: From Experiment to Market Infrastructure

If you’re wondering why this matters beyond crypto circles, consider this: major asset managers like Fidelity are validating blockchain as core financial infrastructure. Their move into on-chain fixed income isn’t simply about riding a trend; it’s about future-proofing their role as gatekeepers to global capital flows.

The impact ripples far beyond Ethereum gas fees or technical debates about custody. By bringing regulated U. S. Treasuries onto public blockchains with institutional-grade controls, Fidelity is bridging Wall Street and decentralized finance (DeFi). If successful at scale, this model could unlock new levels of efficiency across repo markets, cross-border payments, and collateral management – areas long plagued by friction and opacity.

Smart contract automation is particularly transformative. Imagine instant, programmable repo agreements or seamless collateral swaps, all executed transparently on-chain. This is no longer a theoretical possibility; it’s an emerging reality as institutions experiment with these new rails for capital efficiency. The FDIT’s early traction demonstrates that when real-world assets meet the programmability of Ethereum, the result isn’t just faster settlement but an entirely new design space for financial products.

“Tokenized U. S. Treasuries aren’t just a more efficient wrapper, they’re the foundation for programmable money markets. ”

Critically, Fidelity’s approach also addresses longstanding institutional concerns. With Bank of New York Mellon as custodian and strict regulatory compliance baked in, the FDIT structure reassures even the most conservative asset allocators. The result: a product that feels familiar to traditional finance professionals but delivers the operational advantages of digital assets.

What Comes Next? Scaling Tokenized Fixed Income

The big question now is scale. Can tokenized treasuries move from niche innovation to mainstream allocation? Early signals are promising: with $200 million already on-chain and a total market nearing $7 billion, institutional acceptance is accelerating faster than many predicted. As more funds tokenize their fixed-income offerings, potentially including ETFs and corporate bonds, the liquidity flywheel could spin even faster.

How Tokenized Treasury Funds Could Transform Bond Markets

-

24/7 Liquidity and Real-Time Settlement: Tokenized treasury funds like Fidelity Digital Interest Token (FDIT) on Ethereum enable institutional investors to trade U.S. Treasuries around the clock, with near-instant settlement, reducing traditional market downtime and delays.

-

Lower Costs and Fewer Intermediaries: By leveraging blockchain infrastructure, tokenized funds minimize the need for custodians and clearinghouses, as seen with FDIT’s 0.20% annual management fee and on-chain transfers, potentially lowering transaction and management costs.

-

Enhanced Transparency and Accessibility: Blockchain-based funds provide real-time auditability and transparent ownership records. With FDIT operating as an ERC-20 token, institutional investors can verify holdings and transactions directly on the Ethereum blockchain.

-

Broader Global Access to U.S. Treasuries: Tokenized funds on public blockchains allow investors worldwide to access U.S. Treasury exposure without traditional geographic or banking barriers, opening the market to a wider range of participants.

-

Integration with Decentralized Finance (DeFi): Platforms like FDIT can bridge regulated institutional finance and DeFi, potentially enabling new use cases such as on-chain collateralization and programmable finance for bond markets.

There are still hurdles ahead. Ethereum’s transaction costs and throughput must keep pace with institutional demand, and regulatory clarity will be crucial as adoption widens. But if the trajectory continues, we may see a world where digital bonds become standard portfolio components, not just for crypto-native firms but for pension funds, insurers, and sovereign wealth managers.

For those tracking this evolution closely, Fidelity’s move is both a milestone and a catalyst. It signals that blockchain-based infrastructure isn’t just compatible with traditional finance, it can actively enhance it. The next few years will determine whether this experiment becomes the backbone of global fixed-income markets.

If you want to dive deeper into how Fidelity’s FDIT is reshaping institutional access to treasuries, and what it means for your portfolio, explore our in-depth analysis here. The future of fixed income isn’t just digital; it’s programmable, transparent, and available 24/7.