How Fidelity’s Tokenized U.S. Treasuries Fund on Ethereum Changes Fixed-Income Investing

Fidelity’s move to launch the Fidelity Digital Interest Token (FDIT), a tokenized share class of its Treasury fund on Ethereum, is shaking up the fixed-income landscape in ways that few could have predicted even a year ago. This is not just another incremental fintech upgrade – it’s a leap that merges the world’s most trusted government-backed assets with blockchain’s transparency, efficiency, and accessibility. As institutional investors hunt for yield and operational edge, Fidelity’s tokenized U. S. Treasuries fund stands out as a game-changer for both traditional finance and crypto-native players.

Why Fidelity’s Tokenized Treasuries Matter Now

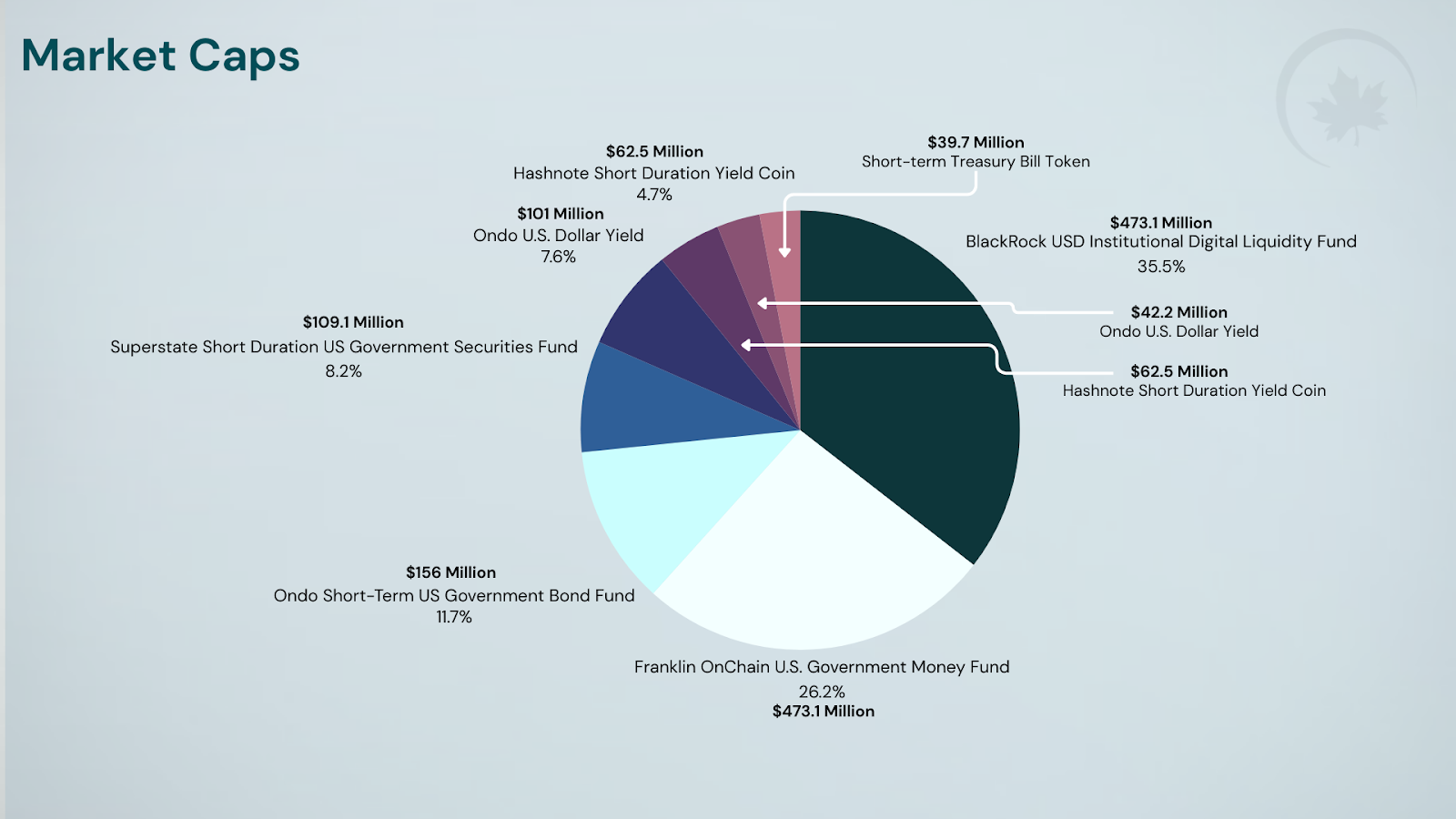

The timing couldn’t be better. With the tokenized U. S. Treasuries market now surpassing $7 billion in value, institutional appetite for blockchain-based fixed-income solutions is undeniable. Fidelity’s FDIT joins the ranks of BlackRock’s BUIDL and Franklin Templeton’s BENJI, but brings heavyweight credibility and scale to the space.

Key Benefits of Fidelity’s Tokenized Treasuries

-

Real-Time Transparency: FDIT leverages Ethereum’s public blockchain, allowing investors to view and verify share ownership and transactions in real time—a significant upgrade from traditional opaque fund reporting.

-

Faster Settlement and Lower Costs: By recording transactions on-chain, settlement times are reduced and operational costs are minimized compared to legacy Treasury fund infrastructure.

-

Fractional Ownership: Tokenization enables investors to buy fractions of U.S. Treasury shares, lowering the minimum investment and democratizing access to government-backed assets.

-

24/7 Accessibility: As an ERC-20 token, FDIT can be accessed and traded around the clock, unlike traditional funds limited by market hours.

-

Institutional-Grade Security and Custody: Bank of New York Mellon serves as custodian, ensuring secure asset management alongside blockchain’s inherent security features.

-

Competitive Management Fees: FDIT charges a 0.20% annual management fee, making it cost-effective compared to many traditional Treasury funds.

What makes FDIT unique? For starters, it operates as an ERC-20 token on Ethereum, giving investors real-time visibility into their holdings and transactions. The fund itself is backed by U. S. Treasury securities and cash – not speculative assets – ensuring capital preservation and liquidity at its core. Investors pay a 0.20% annual management fee, with Bank of New York Mellon providing custody, further reinforcing institutional-grade security.

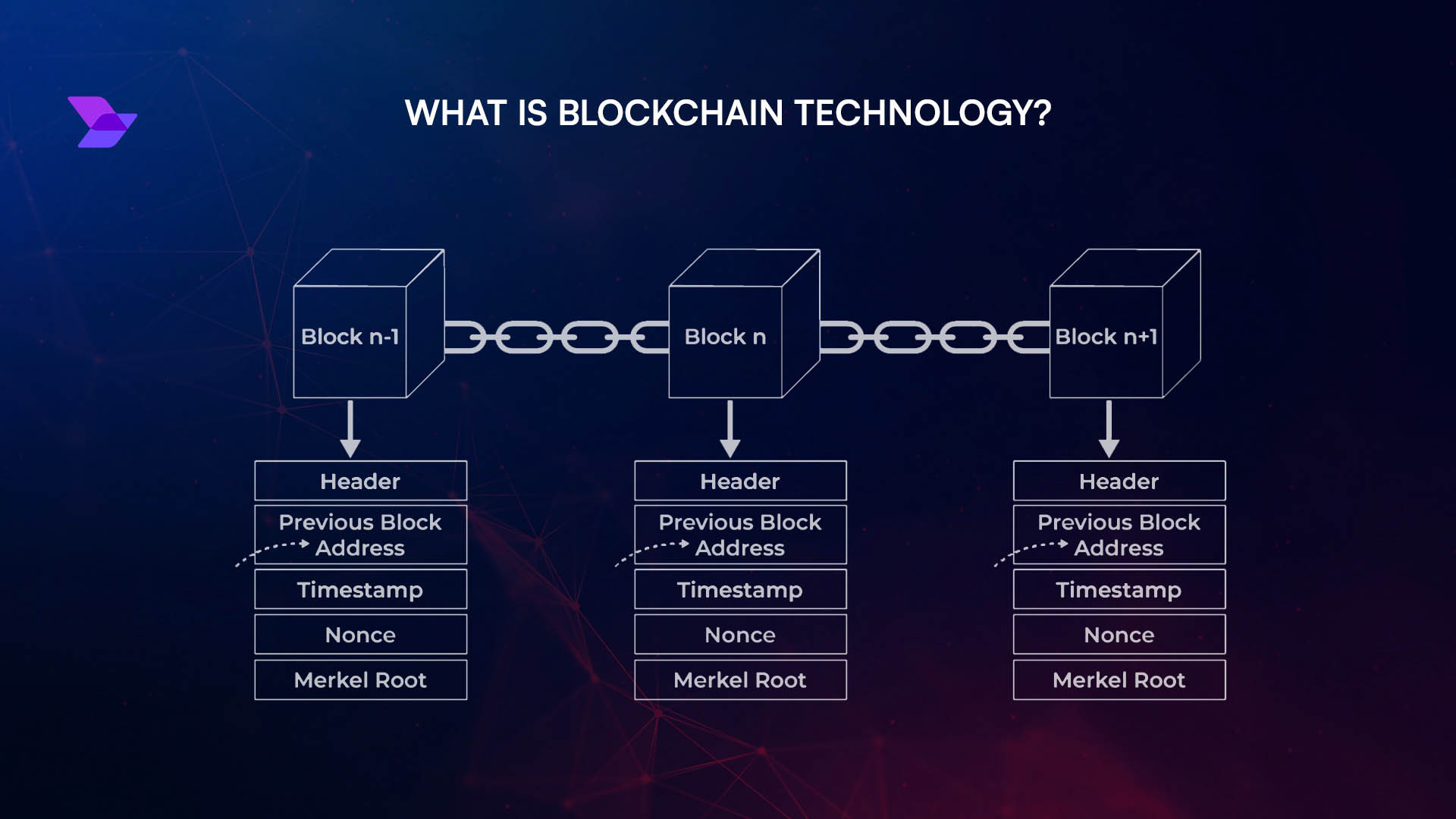

The Mechanics: How Ethereum Unlocks New Value

Let’s break down what this means in practice. By recording share ownership directly on the Ethereum blockchain, FDIT delivers unprecedented transparency. Every transaction is publicly verifiable yet privacy-preserving for participants. Settlement times shrink from days to near-instantaneous; operational costs drop as manual reconciliations become obsolete.

The true innovation lies in fractional ownership. Tokenization lets investors buy slivers of a Treasury fund rather than full shares or minimum lots – democratizing access to what was once an exclusive club for large institutions or high-net-worth individuals. This opens up new possibilities for portfolio construction, liquidity management, and risk diversification across investor types.

The implications reach far beyond convenience. As more asset managers follow Fidelity into on-chain fixed income products, we’re witnessing the birth of programmable money markets where smart contracts can automate compliance, payouts, or even collateralization in real time.

Pushing Institutional Blockchain Bonds Into the Mainstream

Fidelity isn’t just dipping its toes into crypto waters – it’s cannonballing straight in with over $200 million already allocated to its Ethereum-based Treasury fund by mid-2025. Major DeFi protocols like Ondo are now routing significant flows through these products; Ondo’s investment alone has hit $202 million, making up more than a quarter of its flagship OUSG Treasury fund exposure.

This trend signals growing confidence among institutions that blockchain fixed-income investing isn’t just hype – it delivers real-world benefits at scale. The transparency provided by public blockchains makes audit trails bulletproof while reducing counterparty risks that have plagued legacy systems for decades.

If you’re looking to understand how these innovations are reshaping institutional access to safe-haven assets or want deeper insights into how programmable bonds will evolve next, check out our guide on how Fidelity’s tokenized U. S. Treasuries fund is changing institutional access.

With the arrival of FDIT, we’re seeing a fundamental shift in how capital flows into fixed-income markets. The ability to move, settle, and redeem shares on-chain means that institutions can deploy cash with agility previously reserved for crypto-native assets. This is especially relevant as treasurers and fund managers demand intraday liquidity and granular control over their portfolios, features that simply weren’t possible with legacy settlement rails.

Democratizing Access and Liquidity

The impact of fractionalization cannot be overstated. By lowering minimum investment thresholds, Fidelity tokenized treasuries put the world’s safest assets within reach for a broader spectrum of investors. This is true democratization, not just for individuals, but also for DAOs, fintech apps, and global allocators looking to park stablecoin reserves in yield-bearing instruments without sacrificing transparency.

Real-World Use Cases Powered by Ethereum Treasury Tokens

-

Instant, 24/7 Settlement for Institutional Investors: Platforms like Ondo Finance use Ethereum-based tokens (such as FDIT and OUSG) to enable real-time, around-the-clock settlement of U.S. Treasury assets, eliminating traditional banking hours and delays.

-

Fractional Ownership and Global Access: Fidelity’s FDIT token allows investors worldwide to own fractions of U.S. Treasury securities, lowering minimum investment thresholds and democratizing access to safe, yield-bearing assets.

-

Automated Compliance and Transparency: With share ownership recorded on Ethereum, products like Franklin Templeton’s BENJI and BlackRock’s BUIDL provide transparent, auditable records of transactions, streamlining regulatory reporting and audits.

-

DeFi Integration and On-Chain Collateral: Tokenized treasuries such as FDIT and BUIDL can be used as collateral in decentralized finance (DeFi) protocols, enabling borrowing, lending, and liquidity provision directly on-chain.

-

Operational Efficiency for Asset Managers: Blockchain-based funds like Fidelity’s FDIT and Ondo OUSG reduce back-office costs and settlement risks by automating processes and reducing reliance on intermediaries.

Liquidity is another major draw. Tokenized U. S. Treasuries can be traded 24/7 on secondary markets or integrated as collateral in DeFi protocols, creating new avenues for both risk management and yield generation. As more participants enter this space, secondary market depth will only improve, further tightening spreads and reducing friction for large trades.

What Sets Fidelity’s Approach Apart?

Unlike some early entrants who prioritized speed over compliance or security, Fidelity has engineered FDIT with institutional rigor from day one. The involvement of Bank of New York Mellon as custodian reassures risk committees while the transparent fee structure (0.20% annually) keeps costs competitive against both on-chain and off-chain alternatives.

Perhaps most importantly, Fidelity’s embrace of public blockchains signals a turning point in regulatory perception. By choosing Ethereum, a network with robust developer tooling and global liquidity, Fidelity is betting that open infrastructure will win out over permissioned silos in the long run.

Ethereum Technical Analysis Chart

Analysis by Lucas Avery | Symbol: BINANCE:ETHUSDT | Interval: 4h | Drawings: 9

Technical Analysis Summary

Draw an aggressive uptrend line from the July swing low near $2,200 to the mid-August highs near $4,800, capturing the big impulsive swing. Overlay a secondary, steeper downtrend line from the September high (~$4,850) to the recent low (~$3,800), illustrating the current correction. Mark horizontal support at $3,800 (recent bounce) and $3,400 (historical swing low). Resistance zones should be highlighted at $4,400 (recent breakdown) and $4,800 (prior local high). Add rectangles to shade the late July to mid-August accumulation (before breakout) and the September distribution/consolidation band. Place vertical lines at key breakout/breakdown events, and use the long/short position tool to illustrate aggressive entry/exit zones. Annotate MACD/volume signals if visible.

Risk Assessment:high

Analysis: ETH volatility is elevated due to major institutional flows and DeFi tokenization narratives.Current price action is reacting sharply to both upside momentum and corrections.

Aggressive entries at $3,800 support offer high reward but come with significant downside risk if the level fails.

Lucas Avery’s Recommendation: For high-risk, active swing traders, buy the $3,800 support with tight stops, aim for $4,400 and $4,800 targets.

Watch the $4,400 level closely—if reclaimed, go aggressive long.

Stay nimble and ready to flip bias if $3,800 breaks;

in that case,

step aside or look for shorts below $3,700.

Trade smarter,

not harder!

Looking Ahead: What’s Next for Tokenized Fixed-Income?

The pace of adoption is only accelerating. With more than $7 billion now locked into tokenized Treasury funds across the industry, and Fidelity’s own Ethereum-based offering already commanding over $200 million: the writing is on the wall: programmable fixed-income is here to stay.

Expect further innovation around composability (think: seamless integration with lending protocols), real-time NAV tracking, and even automated tax reporting via smart contracts. As regulatory clarity improves and interoperability standards emerge, we’ll see an explosion in new products tailored to both institutional giants and nimble fintechs alike.

If you’re curious how these trends are shaping institutional strategies or want to compare FDIT against other leading blockchain bond offerings, dive deeper with our feature on how Fidelity’s tokenized U. S. Treasuries fund is shaping institutional on-chain fixed income.