How Fidelity’s Tokenized U.S. Treasuries Fund on Ethereum Changes Institutional Fixed-Income Investing

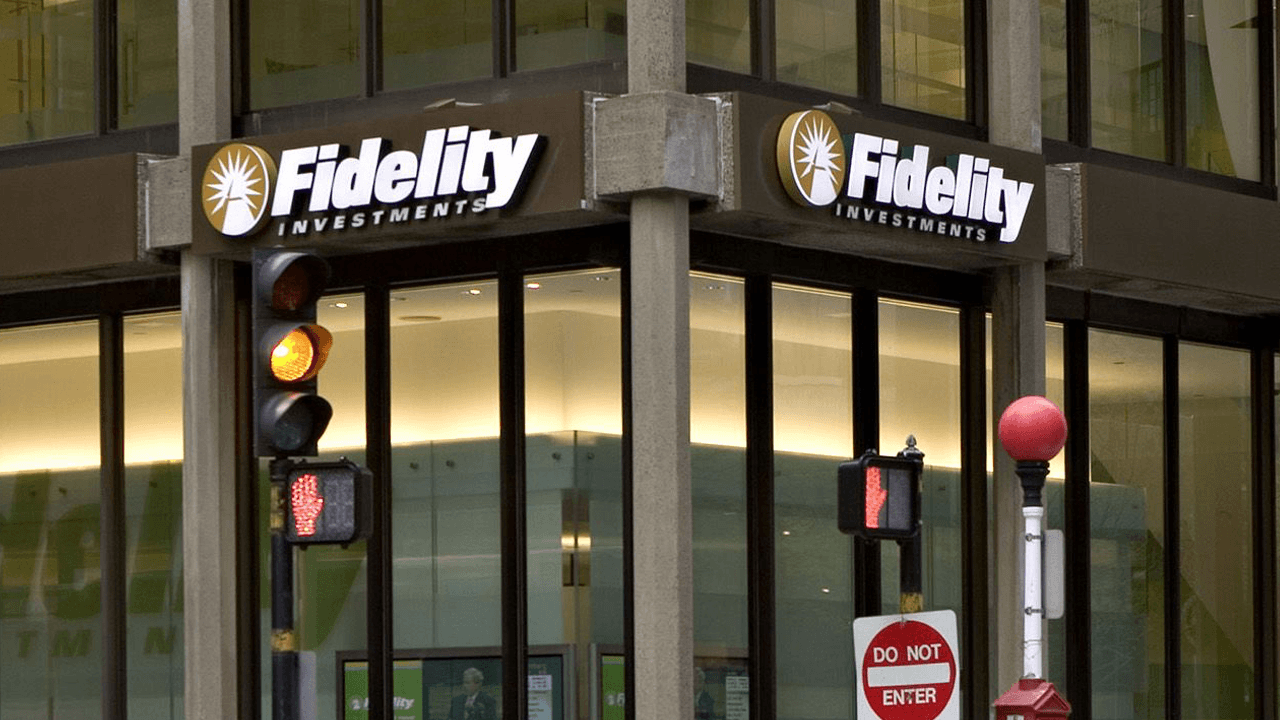

Institutional fixed-income investing is undergoing a seismic shift, and the catalyst is Fidelity’s launch of the Fidelity Digital Interest Token (FDIT) on Ethereum. With over $203.7 million in assets amassed just months after its August 2025 debut, FDIT is not simply another blockchain experiment – it represents a strategic inflection point for the entire fixed-income market. The move is more than a headline; it’s a signal that the world’s largest asset managers see real value in the tokenization of U. S. Treasuries and money market funds.

Fidelity’s FDIT: The New Blueprint for Onchain Fixed-Income

At its core, FDIT is a tokenized share class of Fidelity’s Treasury Digital Fund (FYOXX), with each token corresponding to a share in a portfolio of U. S. Treasury securities and cash. The tokens live on Ethereum, bringing the world’s most liquid government debt market onto public blockchain rails. Custody is handled by Bank of New York Mellon, and Fidelity charges a competitive 0.20% management fee – a clear statement that institutional-grade infrastructure is now available for onchain fixed-income investing.

This isn’t just about faster settlement or round-the-clock access (though those are game-changers). It’s about transparency, programmability, and composability. Institutional investors can now audit their holdings in real time, integrate tokenized T-bills into automated strategies, and potentially unlock new liquidity channels that simply don’t exist in legacy systems.

“Fidelity’s FDIT is not a proof-of-concept. It’s a working, regulated product that’s already attracted over $200 million from serious allocators. ”

Why FDIT Matters: The Strategic Edge for Institutions

The FDIT launch comes as competition in the tokenized treasuries arena heats up. BlackRock’s BUIDL fund has already crossed $2.2 billion in AUM, and upstarts like Ondo Finance and Securitize are building their own onchain bond markets. But Fidelity’s entry changes the equation for three reasons:

- Brand trust and regulatory rigor: For many institutions, Fidelity is synonymous with safety and compliance. FDIT brings instant credibility to the sector.

- Ethereum-native liquidity: By operating directly on Ethereum, FDIT can tap into DeFi protocols and global investor pools without friction.

- Operational efficiency: Real-time settlement and 24/7 access mean treasurers can manage liquidity with unprecedented precision.

The Mechanics: How FDIT Works Under the Hood

FDIT is designed for institutions seeking a blend of yield, security, and digital-native flexibility. Here’s how it operates:

Inside FDIT: Structure, Custody, and Transparency

-

Tokenized Share Class on Ethereum: FDIT represents a tokenized share class of Fidelity’s Treasury Digital Fund (FYOXX), with each token corresponding to a share in the underlying fund. This enables direct blockchain-based ownership of U.S. Treasury securities and cash.

-

Institutional-Grade Custody by BNY Mellon: Bank of New York Mellon acts as the official custodian, safeguarding the fund’s assets and ensuring institutional-grade security for investors.

-

Real-Time Transparency & Auditability: FDIT leverages Ethereum’s public ledger to provide real-time, on-chain transparency, allowing investors and auditors to independently verify token balances and fund movements at any time.

-

24/7 Access and Instant Settlement: The use of Ethereum rails means institutional investors can transact FDIT tokens around the clock, with settlement times far faster than traditional finance systems.

-

Competitive Management Fees: Fidelity charges a 0.20% annual management fee for FDIT, positioning it competitively among tokenized money market funds.

-

Rapid Asset Growth: Since its August 2025 launch, FDIT has amassed over $200 million in assets, reflecting strong institutional demand for blockchain-based fixed-income products.

Each FDIT token represents a pro-rata claim on U. S. Treasuries held by the fund. Transactions settle instantly on Ethereum, and all balances are verifiable onchain at any time – a transparency leap over legacy fund shares settled in omnibus accounts.

Key technical features include:

- ERC-20 compatibility for seamless integration into DeFi platforms and institutional wallets

- Permissioned transfer controls to comply with KYC/AML requirements

- Automated reporting for internal and regulatory audits

The result? Institutions gain access to U. S. Treasuries in a format that can be programmed, traded, or pledged as collateral with far greater agility than ever before.

The $203.7 Million Milestone: Market Confidence in Action

Surpassing $203.7 million in assets within weeks of launch sends an unambiguous message: institutional adoption of onchain fixed-income products is here, not hypothetical. This momentum is critical for mainstream acceptance, as it demonstrates that blockchain rails can handle real institutional flows without compromising on risk controls or auditability.

The implications go beyond just Fidelity. As more capital flows into products like FDIT and BUIDL, expect increased interoperability between traditional custodians and DeFi protocols, higher standards for transparency, and new opportunities for global investors to participate in U. S. sovereign debt markets.

For institutional allocators, the ability to move capital into U. S. Treasuries on a public blockchain is more than a technical upgrade, it’s a strategic lever. The operational clarity of onchain settlements, paired with Fidelity’s compliance-first approach, is lowering barriers for asset managers, hedge funds, and DAOs seeking to optimize treasury management and collateralization strategies.

Unlike legacy money market funds, FDIT’s Ethereum-native structure means investors can monitor fund inflows, outflows, and portfolio composition in real time. This level of transparency is unprecedented and directly addresses the opacity that has historically plagued fixed-income markets, especially during periods of stress. The $203.7 million mark isn’t just a headline number, it’s a validation from sophisticated institutions that onchain treasuries are viable at scale.

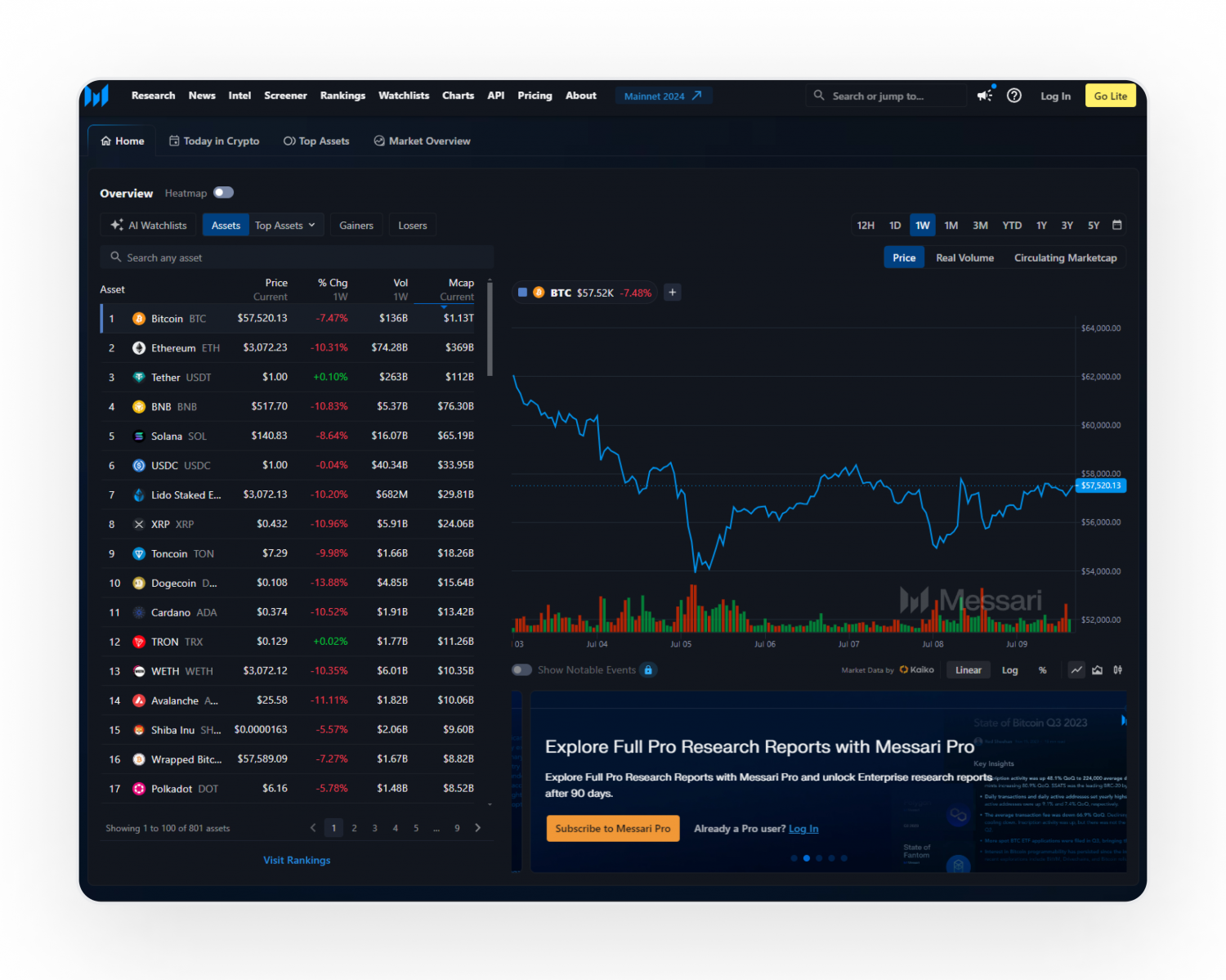

Competitive Dynamics: Fidelity vs. BlackRock and the Tokenized Treasury Race

Fidelity’s entry intensifies the competition with BlackRock’s BUIDL and innovators like Ondo Finance and Securitize. While BlackRock currently leads with $2.2 billion in AUM, Fidelity’s brand equity and institutional reach could accelerate adoption across conservative segments of the market. The race is not just about scale, it’s about who can deliver seamless access, robust compliance, and DeFi interoperability without sacrificing investor protections.

Expect further product innovation as issuers compete to offer more granular duration options, automated yield strategies, and cross-chain settlement capabilities. The next phase will see tokenized T-bills becoming core building blocks for both traditional finance and digital-native portfolios.

Comparing FDIT, BUIDL, and Ondo Treasury Tokens

-

Fidelity Digital Interest Token (FDIT) — Launched August 2025, FDIT represents shares of Fidelity’s Treasury Digital Fund (FYOXX) on Ethereum. Features include over $200 million AUM, 0.20% management fee, 24/7 blockchain settlement, and Bank of New York Mellon as custodian. Targeted at institutional investors seeking regulated, transparent U.S. Treasury exposure on-chain.

-

BlackRock USD Institutional Digital Liquidity Fund (BUIDL) — BlackRock’s BUIDL is a tokenized money market fund on Ethereum, holding over $2.2 billion in AUM as of October 2025. It offers daily liquidity, invests in U.S. Treasuries and cash, and is designed for institutions seeking on-chain access to traditional fixed-income products. Managed by BlackRock with a focus on robust compliance and transparency.

-

Ondo Short-Term U.S. Treasuries (OUSG) — Ondo Finance’s OUSG token represents shares in a short-term U.S. Treasuries ETF, issued on Ethereum. OUSG has over $200 million in AUM (as of late 2025), and provides global investors with blockchain-based access to U.S. government debt, with instant settlement and transparent on-chain ownership.

Risks and Strategic Considerations: What Institutional Investors Need to Know

While FDIT offers clear advantages, institutional investors must weigh several factors before allocating:

- Smart contract risk: Even with institutional-grade audits, code vulnerabilities remain a non-zero risk on public blockchains.

- Regulatory clarity: Jurisdictional differences around tokenized securities demand rigorous legal review before onboarding.

- Ethereum congestion and fees: Large flows could be impacted by network conditions, though Layer 2 solutions are emerging to mitigate this.

That said, the shift toward programmable treasuries is unlikely to reverse. As operational standards mature and regulatory frameworks evolve, tokenized fixed-income products will become a staple in institutional portfolios seeking yield, safety, and composability.

Looking Ahead: The Institutional Onchain Bond Market

The launch of Fidelity’s FDIT is a watershed moment for institutional blockchain bonds. With over $203.7 million in assets secured on Ethereum, the message to the market is unmistakable: the rails of fixed income are being rebuilt in real time. Institutions that adapt early will benefit from superior transparency, operational efficiency, and access to programmable liquidity that simply isn’t possible in legacy systems.

The coming years will see further convergence between traditional custodians, DeFi protocols, and global capital allocators. As the playbook for tokenized treasuries matures, expect a new era of fixed-income investing, one defined by openness, interoperability, and relentless innovation.