How Fidelity’s Tokenized Treasury Fund on Ethereum Sets a New Standard for Institutional On-Chain Fixed Income

Fidelity’s recent launch of the Fidelity Digital Interest Token (FDIT) on Ethereum is sending a clear signal: institutional fixed income is going on-chain, and the pace is accelerating. With over $200 million in assets already tokenized, this move cements Fidelity as a leader in the real-world asset (RWA) tokenization wave that’s rapidly transforming traditional finance.

Fidelity’s Tokenized Treasury Fund: A $200 Million On-Chain Milestone

The FDIT represents shares in the Fidelity Treasury Digital Fund (FYOXX), a money market fund holding U. S. Treasury securities and cash. What sets this apart? Each share is issued as an ERC-20 token on Ethereum, offering institutional investors programmable access to short-term Treasuries with blockchain-native transparency and efficiency. At launch, Fidelity’s fund quickly amassed $201,474,315 in assets, an impressive feat considering the nascent stage of institutional DeFi adoption.

This isn’t just another crypto experiment. The fund leverages battle-tested TradFi infrastructure, Bank of New York Mellon acts as custodian, while delivering the operational advantages of blockchain rails: instant settlement, 24/7 transferability, and auditable ownership records. The annual management fee clocks in at a competitive 0.20%, with zero performance fees.

The Institutional Context: Why This Matters Now

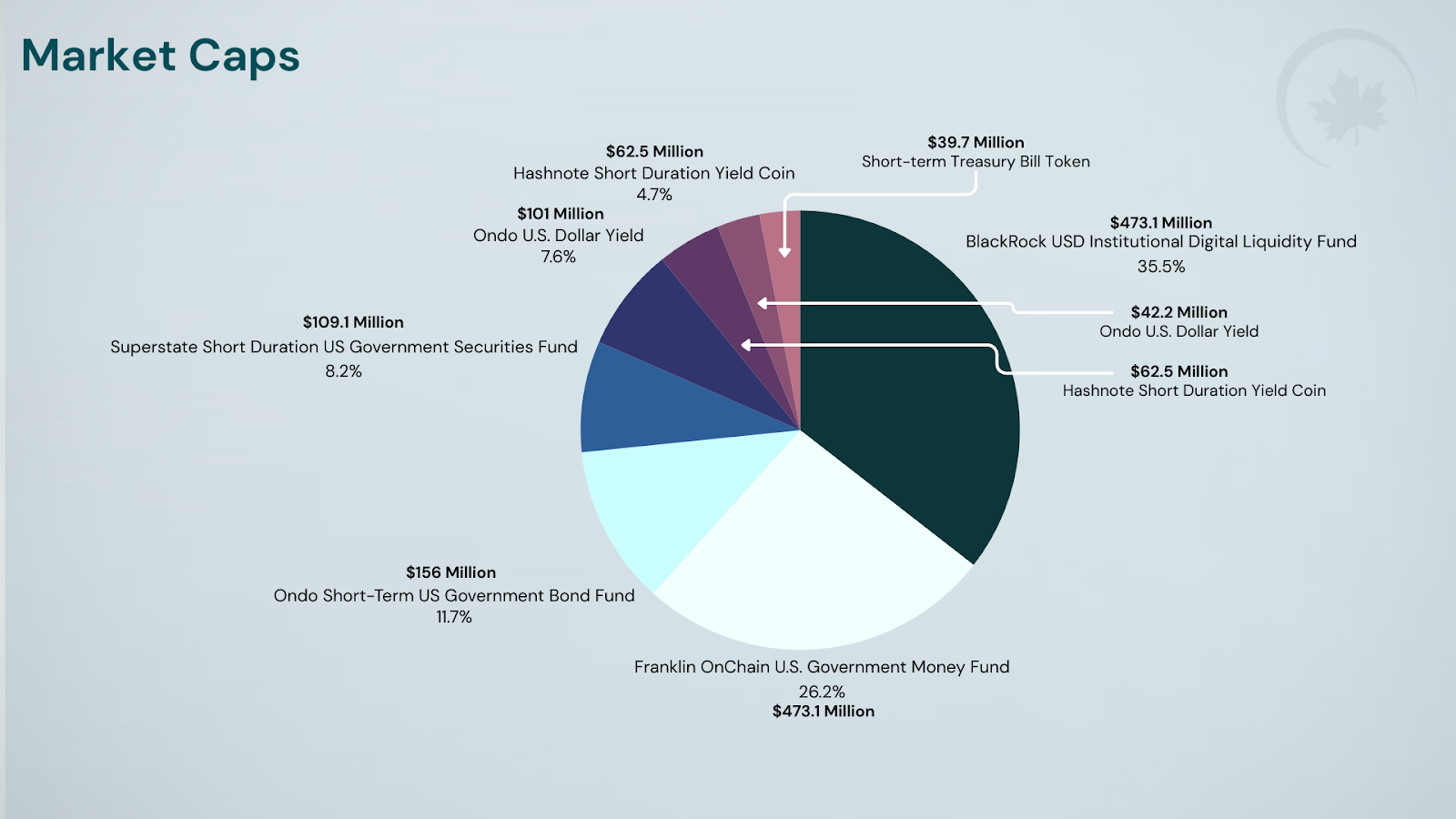

The timing couldn’t be more strategic. As of October 2025, Ethereum trades at $4,473.91, reflecting renewed confidence in smart contract platforms for RWAs. The broader market for tokenized Treasuries has ballooned past $7 billion in total value locked (TVL), led by heavyweights like BlackRock’s BUIDL ($2 billion and ). But Fidelity’s entry brings blue-chip credibility, and deep distribution channels, to a sector previously dominated by fintech upstarts.

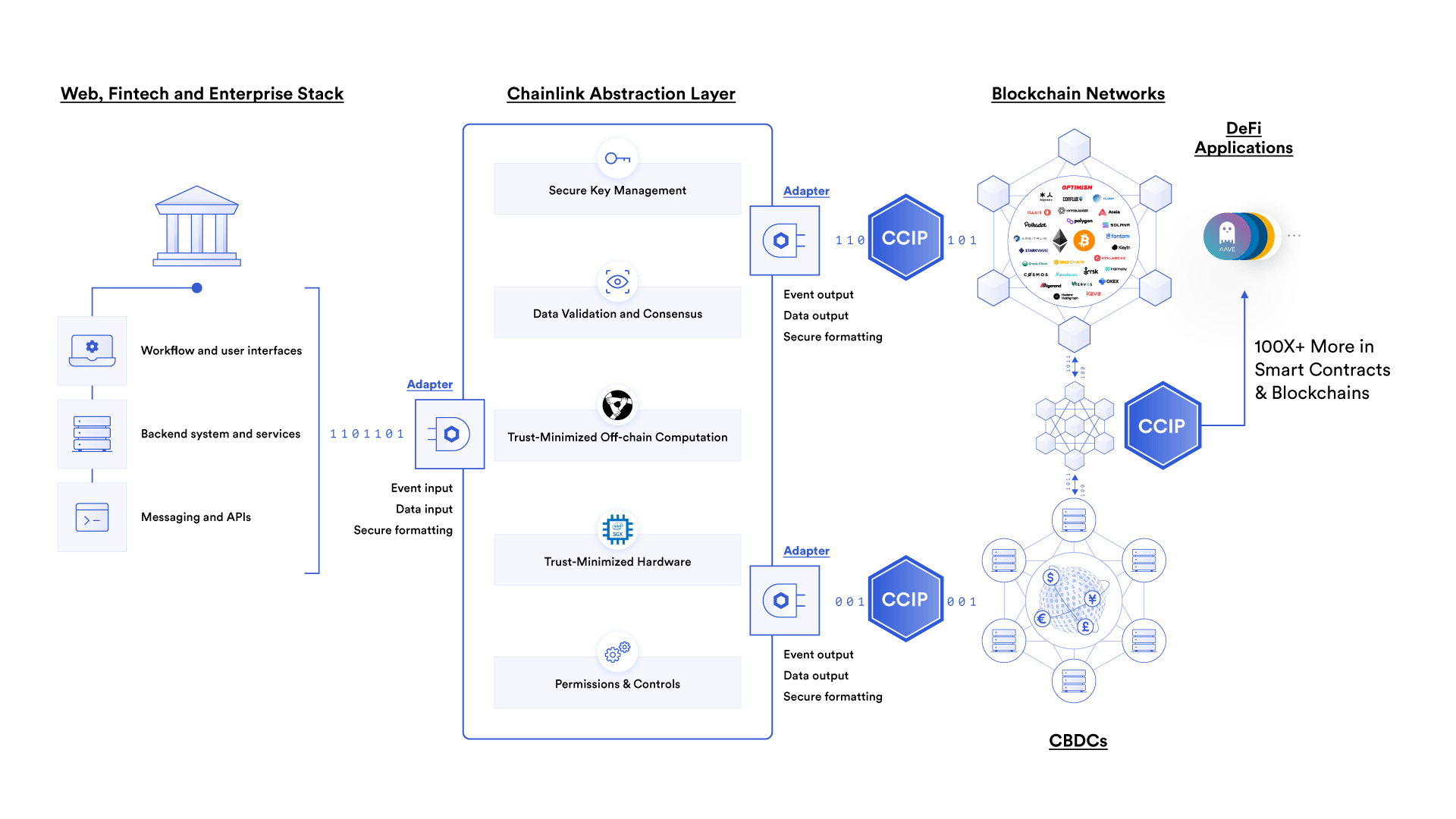

Institutional adoption isn’t just about scale; it’s about setting standards for compliance, reporting, and liquidity management. By choosing Ethereum as its base layer, Fidelity signals trust in public blockchains to handle real-world assets at scale, a sharp pivot from private-chain pilots that never reached critical mass.

How FDIT Changes the Game for Fixed Income Investors

The launch of FDIT unlocks three major advantages for institutional investors:

- Programmable Compliance: KYC/AML can be embedded directly into token smart contracts.

- Instant Settlement: No more T and 1 or T and 2 delays; transfers settle on-chain within minutes.

- Interoperability: FDIT tokens can plug into DeFi protocols for collateralization or liquidity provision, subject to regulatory guardrails.

This model also benefits from radical transparency: anyone can verify fund balances and transactions on-chain. As more institutions onboard, secondary markets for tokenized Treasuries are poised to deepen, potentially rivaling legacy repo markets for overnight funding efficiency.

Ethereum (ETH) Price Prediction 2026-2031

Projections consider the impact of institutional adoption, tokenized Treasuries, and evolving blockchain use cases.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,700 | $5,050 | $6,500 | +13% | Post-Fidelity adoption, ETH consolidates gains as RWA tokenization grows; volatility remains as regulatory clarity is pending. |

| 2027 | $4,100 | $5,800 | $8,000 | +15% | Broader institutional participation and improved DeFi integration drive demand; potential for new all-time highs if macro conditions are favorable. |

| 2028 | $4,400 | $6,700 | $9,400 | +16% | ETH benefits from scaling upgrades (e.g., Danksharding), increased RWA volume, and global regulatory acceptance; competition from L2s and alt-L1s intensifies. |

| 2029 | $5,100 | $7,900 | $11,200 | +18% | Tokenized assets exceed $25B, ETH cements role as institutional settlement layer; macroeconomic headwinds could limit max upside. |

| 2030 | $5,900 | $9,100 | $13,500 | +15% | Ethereum’s ecosystem matures, ETFs and ETPs proliferate, and transaction costs decrease; regulatory risks persist but diminish. |

| 2031 | $6,400 | $10,200 | $15,000 | +12% | Mainstream adoption of on-chain assets, robust DeFi-RWA synergy, and sustained institutional flows; possible plateau as market matures. |

Price Prediction Summary

Ethereum’s price outlook from 2026 to 2031 is bullish, with steady growth driven by institutional adoption, real-world asset tokenization, and ongoing technical improvements. While volatility and regulatory risks remain, ETH’s role as a foundational blockchain for tokenized financial products, exemplified by Fidelity’s FDIT, supports a strong long-term trajectory. Average price projections suggest a compound annual growth rate of 12–18% through 2031, with high-end scenarios dependent on macroeconomic conditions and the pace of mainstream adoption.

Key Factors Affecting Ethereum Price

- Institutional adoption of tokenized Treasuries and real-world assets (RWAs) on Ethereum

- Advancements in Ethereum scalability and lower transaction costs (e.g., Danksharding, L2 integration)

- Regulatory clarity and acceptance of blockchain-based financial products

- Increased competition from other smart contract platforms and layer-2 solutions

- Broader macroeconomic trends affecting crypto and traditional markets

- Integration of Ethereum in traditional finance via ETFs, ETPs, and tokenized funds

- Market sentiment and investor risk appetite throughout crypto cycles

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Road Ahead: Scaling Up Institutional On-Chain Fixed Income

The early data is promising but also highlights the infancy of this market, currently only two holders control all $200 million and in FDIT tokens. As distribution widens and integrations with custodians and DeFi platforms mature, expect exponential growth in both user base and product sophistication.

If you want a deeper dive into how Fidelity’s move could reshape access to fixed income markets, and what it means for your portfolio, check out our full analysis here.

Liquidity is the next frontier. As the FDIT ecosystem grows, secondary trading venues will emerge, allowing institutions to transfer exposure or manage duration risk 24/7. Unlike traditional Treasury funds, where settlement and redemption cycles can be slow and opaque, FDIT’s on-chain design means every transaction is timestamped and publicly auditable. This transparency could become a regulatory gold standard as authorities increasingly scrutinize digital asset markets.

But there are real challenges ahead. Regulatory clarity around tokenized funds remains patchy, especially regarding cross-border transfers and integration with legacy systems. Onboarding institutional investors will require seamless KYC/AML workflows and robust custody solutions. Still, Fidelity’s proactive approach, pairing established fund structures with ERC-20 rails, sets a template others are likely to follow.

Beyond Early Adopters: What Comes Next for Tokenized Treasuries?

The competitive landscape is heating up fast. BlackRock’s BUIDL may lead in assets under management, but Fidelity’s FDIT brings unmatched brand trust and operational rigor to the table. Expect more asset managers to tokenize fixed income products as demand for digital-native access to U. S. Treasuries accelerates.

Key Benefits of Tokenized Treasury Funds for Institutions

-

24/7 Blockchain Accessibility: Tokenized funds like Fidelity Digital Interest Token (FDIT) on Ethereum enable institutional investors to access U.S. Treasury securities around the clock, bypassing traditional market hours.

-

Enhanced Transparency: All transactions and fund holdings are recorded on Ethereum’s public ledger, providing real-time, auditable visibility into assets and flows.

-

Operational Efficiency: Blockchain settlement reduces intermediaries and manual processes, streamlining fund management and lowering administrative costs.

-

Improved Liquidity: Tokenized shares can be transferred peer-to-peer on-chain, potentially increasing secondary market liquidity for traditionally illiquid fixed-income assets.

-

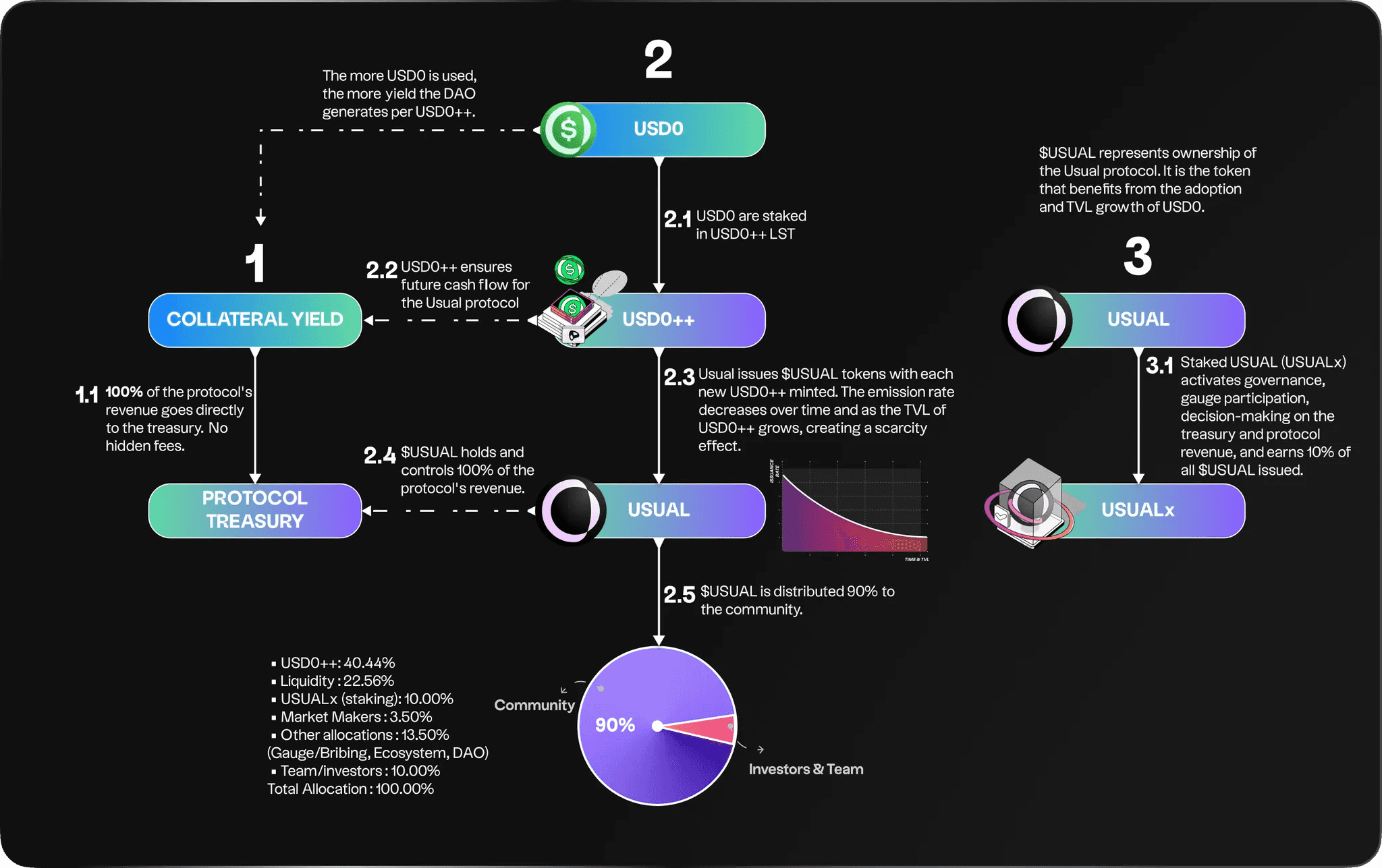

Direct Integration with DeFi: Institutional investors can leverage tokenized treasuries within decentralized finance (DeFi) protocols, unlocking new collateral and yield opportunities.

-

Lower Management Fees: Fidelity’s FDIT offers a competitive 0.20% annual fee, undercutting many traditional fixed-income funds and enhancing net returns for investors.

-

Institutional-Grade Custody: The involvement of established custodians like Bank of New York Mellon ensures robust asset security and compliance for large-scale investors.

Looking forward, interoperability will be crucial. Imagine a future where FDIT tokens can move frictionlessly between permissioned DeFi protocols, centralized exchanges, and custom institutional wallets, all while maintaining compliance and real-time reporting. That level of composability could unlock new yield strategies and liquidity pools previously unimaginable in traditional finance.

It’s also worth noting the impact on portfolio construction. With Ethereum at $4,473.91, sophisticated allocators can now blend crypto-native assets with tokenized Treasuries in a single wallet, hedging volatility or earning stable yield without ever leaving the blockchain ecosystem. This convergence of TradFi stability and DeFi flexibility could redefine risk management for the next generation of institutional managers.

Fidelity’s Signal to the Market: On-Chain Fixed Income Is Here to Stay

Fidelity’s $200 million tokenized treasury fund isn’t just a milestone, it’s a message to the market that institutional DeFi is moving from theory to execution at scale. The coming quarters will test how quickly distribution broadens beyond early adopters and how seamlessly these products integrate into both traditional finance and decentralized protocols.

If you’re tracking how blue-chip asset managers are transforming fixed income investing through blockchain technology, and what that means for market structure, compliance, and yield opportunities, follow our ongoing coverage here.