How Institutional Investors Use Tokenized Treasury Bills for On-Chain Yield and Liquidity

Institutional investors are rapidly transforming their fixed-income strategies by leveraging tokenized US Treasury bills to access on-chain yield and liquidity. As blockchain technology matures, these digital representations of short-term government debt are emerging as a core tool for asset managers, hedge funds, and corporate treasurers seeking both stability and flexibility in a digital-first market. With the total value locked in tokenized U. S. Treasuries reaching an all-time high of $7.42 billion as of August 2025, the momentum behind blockchain treasuries is undeniable.

What Are Tokenized Treasury Bills?

Tokenized Treasury bills are digital tokens issued on public blockchains like Ethereum and Arbitrum, each representing a fractional claim on actual U. S. T-bills held in custody. This process, known as asset tokenization, allows institutions to purchase, trade, and settle government securities with unprecedented speed and transparency. Every token is backed 1: 1 by real-world T-bills, ensuring that on-chain assets retain the same creditworthiness and yield profile as their traditional counterparts.

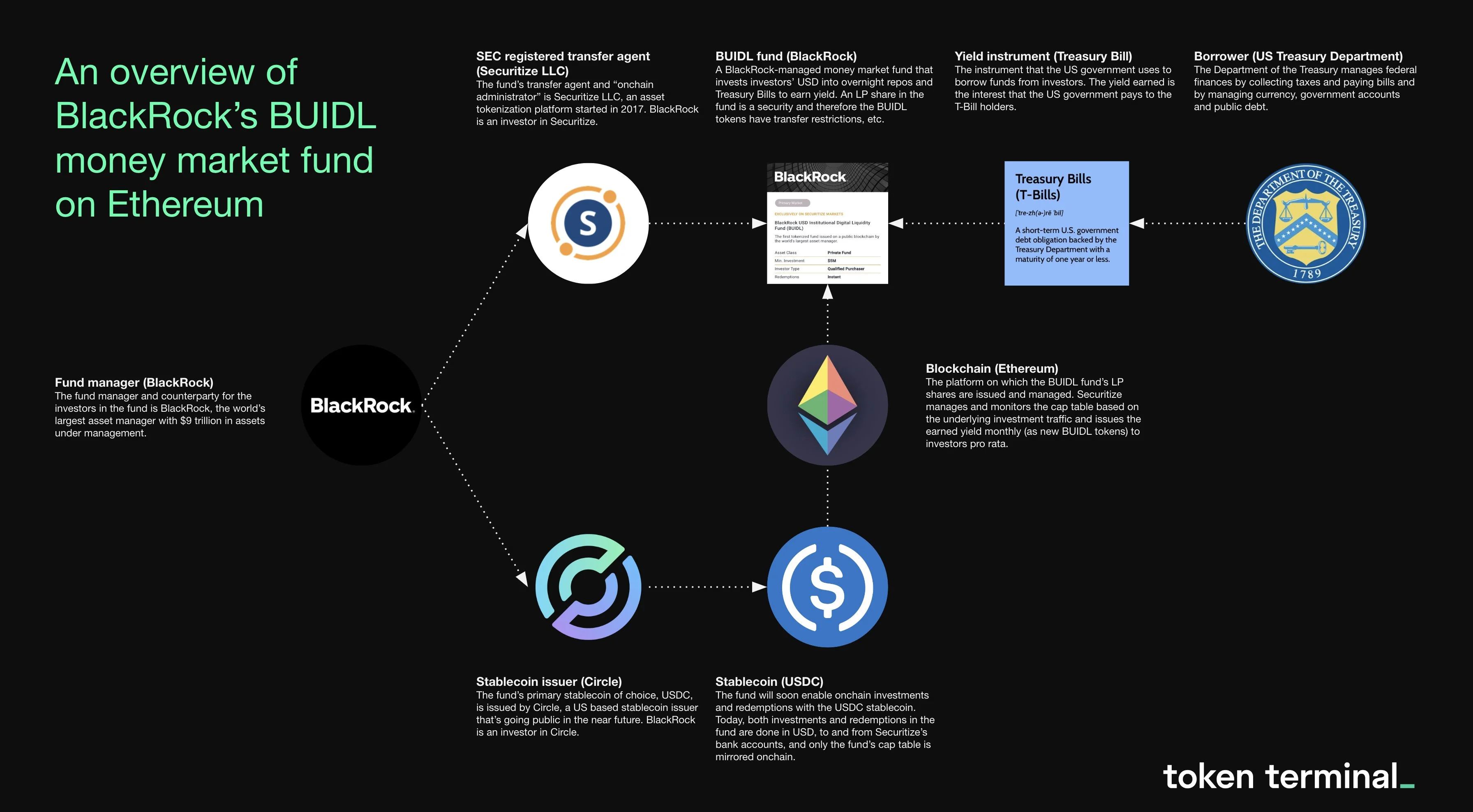

The mechanics are straightforward: investors buy tokens from issuers such as BlackRock, Ondo Finance, or Franklin Templeton. The issuer holds the underlying T-bills in a segregated account, while holders receive daily yield distributions directly to their wallets. This structure preserves regulatory compliance while unlocking the programmability of blockchain-based assets.

Why Institutions Are Turning to Blockchain Treasuries

The appeal for institutional investors lies in three primary benefits: enhanced liquidity, improved yield opportunities, and seamless DeFi integration. Unlike legacy markets restricted by business hours and intermediaries, tokenized T-bills can be traded 24/7 on-chain. Instant settlement reduces counterparty risk and operational friction, which is particularly valuable for funds managing large cash balances or seeking to optimize treasury operations.

With traditional savings rates lagging inflation in many regions, the 4, 5% yields offered by T-bill tokens are drawing increasing attention. Unlike stablecoins that may introduce credit or depegging risk, these tokens are directly collateralized by U. S. government debt, providing a stable yield in a programmable wrapper.

Market Leaders: BlackRock BUIDL Fund, Ondo OUSG, and Fidelity

The landscape of Ethereum tokenized treasuries is quickly evolving, led by major players:

Leading Institutional Tokenized Treasury Products

-

BlackRock USD Institutional Digital Liquidity Fund (BUIDL): Launched in March 2025, BUIDL is a tokenized fund investing in cash, U.S. Treasury bills, and repurchase agreements. By mid-2025, it reached approximately $2.5 billion in assets under management (AUM), offering institutional clients on-chain access to U.S. government money market funds and daily yield distribution.

-

Ondo Finance OUSG Token: The OUSG token provides real-time, on-chain exposure to short-term U.S. government bonds. By mid-2025, it had a market cap of around $670 million, enabling seamless integration between DeFi liquidity and real-world Treasury yields.

-

Franklin Templeton OnChain U.S. Government Money Fund: This fund is natively issued on blockchain platforms like Stellar and Ethereum, investing in U.S. government securities. By mid-2025, it managed over $380 million in AUM, providing daily liquidity and real-time net asset value (NAV) to investors.

BlackRock’s BUIDL Fund, introduced in March 2025, has amassed approximately $2.5 billion in assets under management (AUM). The fund invests in cash, U. S. Treasury bills, and repurchase agreements – providing institutional clients with real-time access to government-backed money market yields directly on-chain. Read more about the BUIDL Fund.

Ondo Finance’s OUSG Token offers daily yield accruals backed by short-term T-bills and boasts a market cap of around $670 million as of mid-2025. Its transparent structure and seamless DeFi integration allow funds to move between traditional and decentralized finance ecosystems with minimal friction. For deeper insights into OUSG’s growth and mechanics, visit this resource.

Fidelity has also entered the market with an Ethereum-based share class of its U. S. Treasuries money market fund, signaling growing mainstream acceptance of blockchain treasuries among global asset managers.

How Tokenized T-Bills Power On-Chain Yield Strategies

The programmability of blockchain treasuries enables a range of advanced yield strategies for institutional investors. Tokens can be used as collateral in lending protocols or integrated into automated portfolio rebalancing systems through smart contracts. This unlocks new forms of capital efficiency – for example, using Arbitrum treasury tokens or Ondo USDY as building blocks within DeFi platforms.

As the infrastructure matures and regulatory clarity improves, expect more sophisticated RWA yield strategies to emerge – from cross-chain arbitrage to dynamic liquidity provisioning using tokenized government debt.

Institutional adoption of tokenized US Treasury bills is accelerating as asset managers seek to optimize cash management and risk-adjusted returns. The ability to move seamlessly between traditional finance and DeFi, while maintaining exposure to the world’s most trusted debt instruments, is fundamentally reshaping how institutions think about fixed income allocations. With $7.42 billion now locked in tokenized Treasuries on public blockchains, the market is no longer a niche experiment but a cornerstone of digital asset strategy.

Beyond yield and liquidity, the transparency provided by blockchain rails is a critical draw. Every transaction and yield payment is recorded on-chain, allowing for real-time auditing and reducing operational opacity. This level of transparency is simply unattainable in legacy financial infrastructure, where settlement times and counterparty risks can obscure underlying exposures.

“Tokenized treasuries are giving institutions programmable access to the safest yield in the world, with the flexibility and transparency only blockchain can offer. ”

The Role of Instant Settlement and 24/7 Liquidity

Perhaps the most transformative feature of blockchain treasuries is instant settlement. Traditional T-bill transactions can take one or more business days to clear, introducing unnecessary delays and liquidity traps. By contrast, tokenized T-bills settle within minutes on networks like Ethereum and Arbitrum, allowing institutional investors to redeploy capital with unprecedented speed. This is especially valuable for funds engaged in arbitrage, collateral management, or high-frequency treasury operations.

24/7 access to liquidity means portfolio managers are no longer shackled by the 9-to-5 market cycle or forced to accept suboptimal yields from overnight sweep accounts. Instead, they can respond dynamically to market movements, rebalance positions in real time, and participate in emerging DeFi protocols that reward on-chain collateral.

Risks and Regulatory Considerations

While the benefits are significant, it’s important for institutions to weigh potential risks. Regulatory clarity continues to evolve; issuers must adhere strictly to custody and investor protection standards. Counterparty risk remains a factor, investors should scrutinize the legal structure of each tokenization vehicle and confirm that underlying T-bills are held in segregated accounts with reputable custodians.

Smart contract risks also merit careful evaluation. While leading issuers undergo rigorous audits and maintain robust security practices, the possibility of protocol vulnerabilities cannot be discounted entirely.

Checklist for Institutional Participation in Tokenized Treasuries

What’s Next for Tokenized Treasuries?

Industry leaders like BlackRock and Fidelity have validated Ethereum tokenized treasuries as an institutional-grade product class. As new products launch on platforms like Arbitrum and as regulatory guidance matures, we’re likely to see broader participation from pension funds, insurers, and sovereign wealth vehicles seeking programmable exposure to U. S. government debt.

The rapid growth in RWA yield strategies, coupled with ongoing innovation in custody, compliance, and cross-chain interoperability, points toward a future where every fixed-income asset could be managed on-chain.

- Liquidity: Trade tokenized T-bills 24/7 with instant settlement

- Yield: Access daily accruals directly from U. S. government debt

- Transparency: On-chain records for real-time auditing

- Programmability: Integrate tokens into DeFi lending or collateral strategies

The institutional embrace of tokenized US Treasury bills is not just a technological upgrade, it’s a fundamental shift in how capital flows across global markets. Those who adapt early will be best positioned to harness the full spectrum of on-chain yield and liquidity in the digital age.