How Tokenized Treasury Funds Became a Safe Haven During Crypto Volatility

As digital asset markets continue to experience turbulence, a new class of blockchain-based instruments has quietly established itself as a port in the storm: tokenized Treasury funds. These digital representations of U. S. government securities are increasingly sought after by crypto investors and institutions alike, particularly when volatility upends traditional stablecoins and market sentiment swings sharply. In 2025, this safe-haven narrative has become more than just a theory – it is now supported by robust data, accelerating adoption, and a marked shift in institutional allocation strategies.

Tokenized Treasuries Surge to $7.4 Billion Amid Crypto Volatility

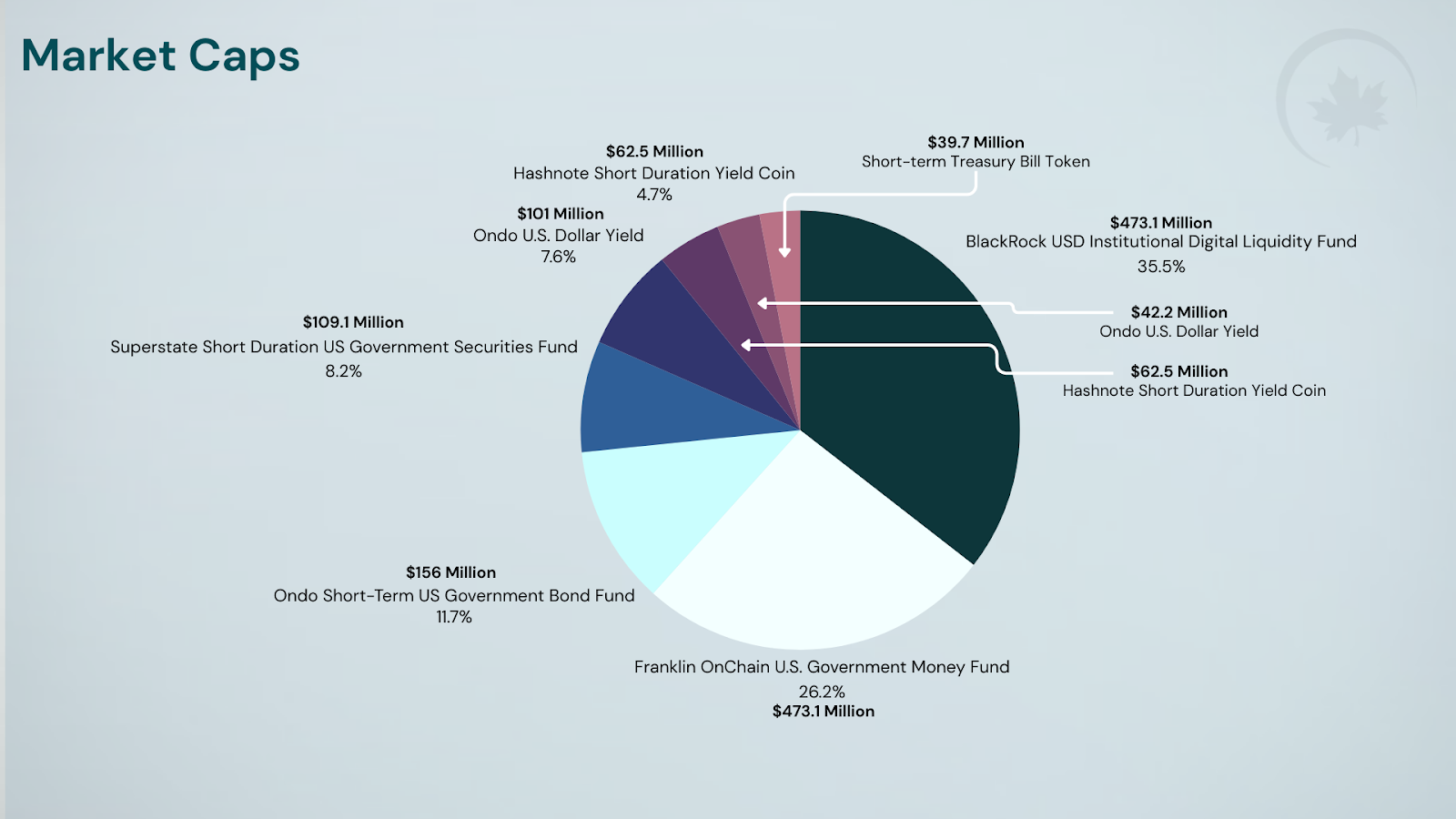

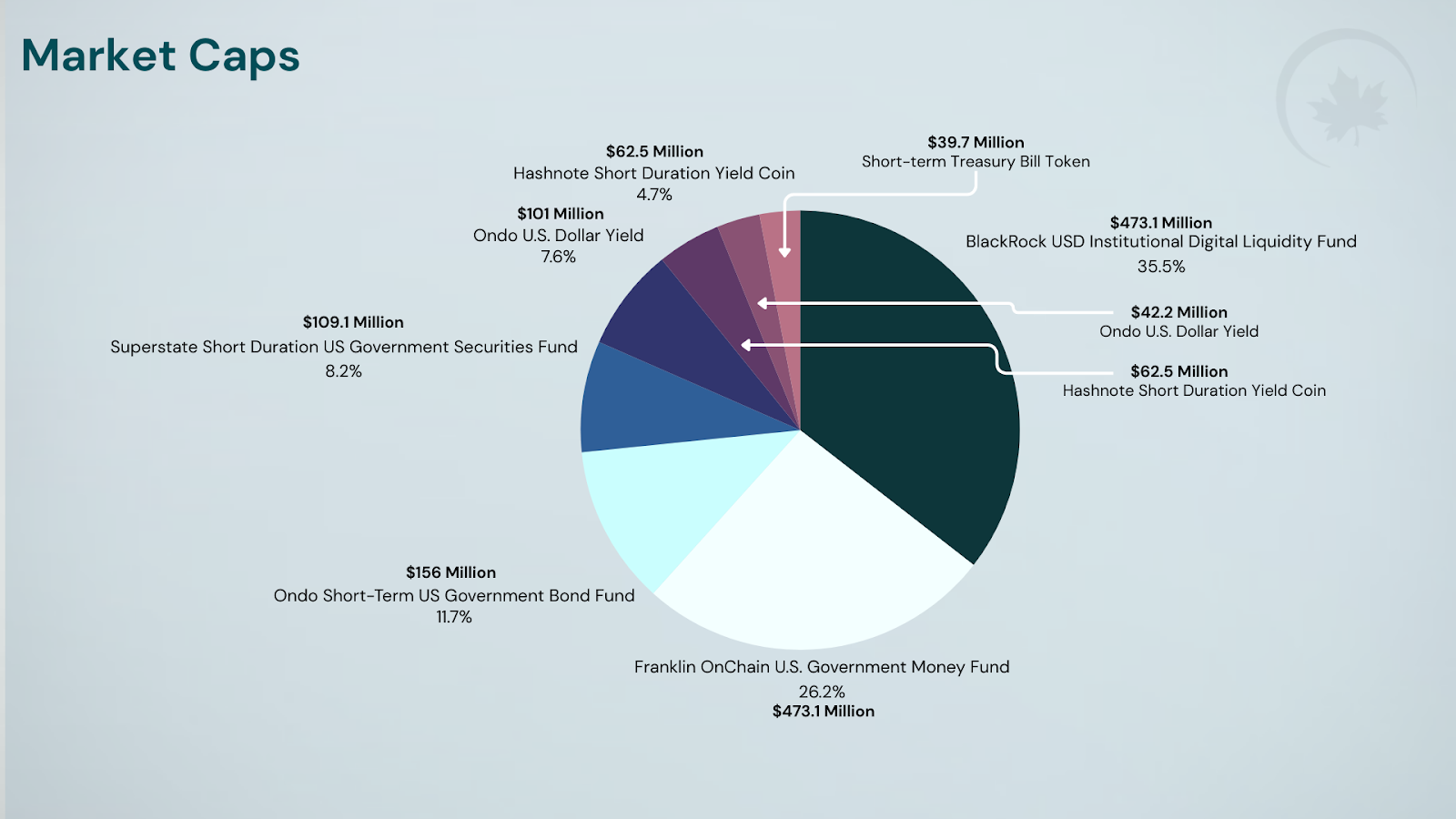

The numbers tell a compelling story. As of mid-2025, the total value of tokenized U. S. Treasuries reached $7.4 billion, reflecting an 80% increase since the start of the year. This surge is not just a headline figure – it signals a fundamental change in how investors manage risk and seek yield during periods of market stress. Major financial institutions such as BlackRock and Franklin Templeton have played pivotal roles, with BlackRock’s BUIDL fund alone amassing nearly $2.9 billion in assets.

Unlike traditional stablecoins like USDT and USDC, which function mainly as transaction mediums, tokenized Treasury funds offer annual yields between 4% and 5%. This combination of on-chain liquidity, yield generation, and robust collateralization by U. S. government debt has made these instruments especially attractive during episodes of heightened crypto volatility. For many investors, tokenized treasuries now represent the next evolution of blockchain safe haven assets, providing both stability and upside potential.

Why Institutional Money Is Flowing Into Blockchain Safe Havens

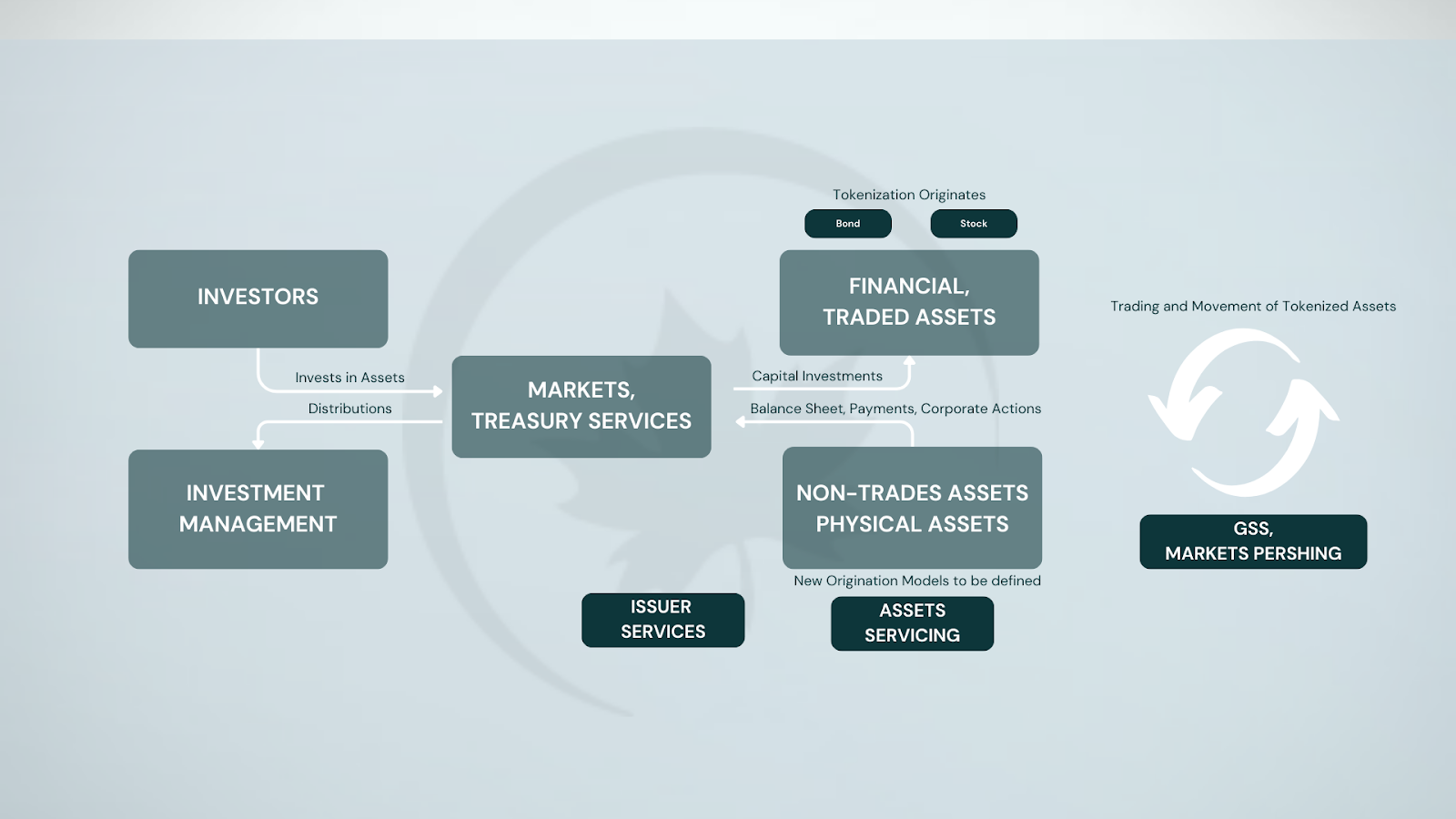

The rise of tokenized Treasury funds is tightly linked to the broader trend of institutional adoption of treasury tokens. Recent reports from EY and the CFA Institute highlight that pension funds, asset managers, and even DeFi protocols are increasing allocations to tokenized government bonds and money market funds. What’s driving this migration?

Top Reasons Institutions Choose Tokenized Treasuries During Crypto Crashes

-

Stable Yield Generation: Tokenized Treasury funds offer annual yields of 4% to 5%, providing institutions with a reliable return even during periods of extreme crypto volatility. This is a significant advantage over traditional stablecoins, which generally do not pay interest.

-

Backed by U.S. Government Securities: These funds are collateralized by U.S. Treasury bonds, the world’s benchmark for safety and liquidity, enhancing trust and minimizing credit risk for institutional investors.

-

On-chain Liquidity and 24/7 Settlement: Institutions can access, trade, and settle tokenized Treasuries around the clock on blockchain networks, unlike traditional finance markets with limited operating hours.

-

Regulatory Momentum and Clarity: The passage of the GENIUS Act (2025) in the U.S. has provided clearer regulatory guidelines, allowing banks and financial institutions to issue stablecoins backed by Treasuries, further legitimizing tokenized Treasury products.

-

Reduced Counterparty and Custodial Risks: By leveraging blockchain technology and smart contracts, tokenized Treasury funds can lower reliance on intermediaries, reducing exposure to centralized exchange failures and improving transparency.

-

Adoption by Major Financial Institutions: Leading asset managers like BlackRock (BUIDL fund) and Franklin Templeton have launched large-scale tokenized Treasury products, signaling strong institutional confidence and accelerating market adoption.

First, these instruments offer unprecedented transparency and near-instant settlement compared to legacy bond markets. Second, the ability to trade or collateralize these assets 24/7 aligns with the always-on nature of digital finance. Third, regulatory clarity is improving – the passage of the GENIUS Act in July 2025 has enabled banks and financial institutions to issue stablecoins backed by fiat or high-quality collateral such as U. S. Treasuries, further legitimizing digital treasury fund growth.

Tokenized Treasury Funds vs. Traditional Stablecoins

During recent crypto crashes, many investors learned hard lessons about counterparty risk and reserve transparency in stablecoin markets. Tokenized Treasury funds stand apart by offering direct exposure to government-backed securities, with on-chain proof of reserves and real-time auditing. While stablecoins remain essential for transactional liquidity, their lack of yield and susceptibility to regulatory scrutiny have made them less attractive as long-term stores of value.

This shift is reflected in market flows: as volatility spiked in early 2025, flows into tokenized treasuries accelerated while stablecoin market caps stagnated. The clear preference for yield-bearing, transparent instruments is underscored by major on-chain data sources and institutional statements alike.

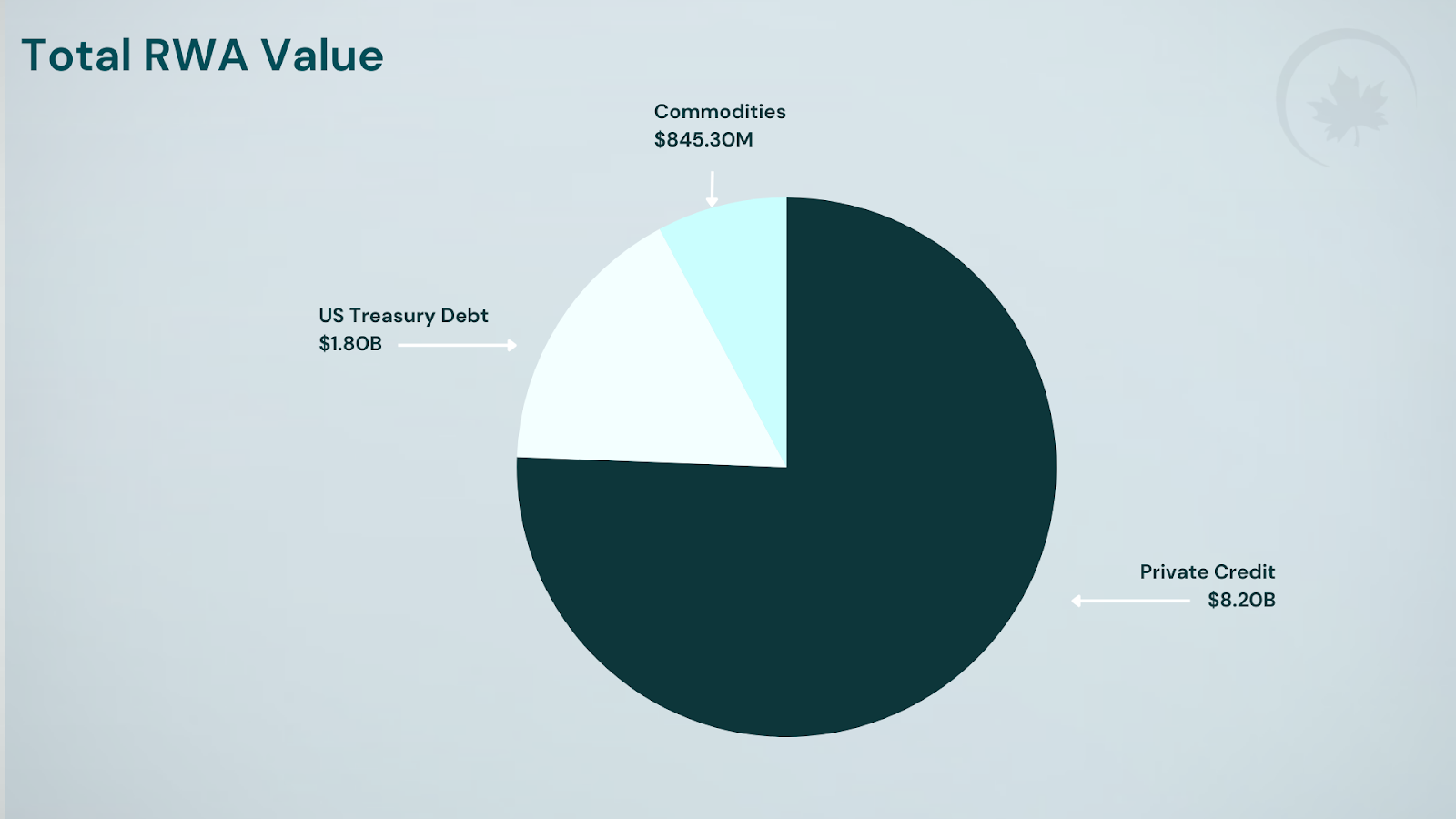

Looking ahead, the continued growth of tokenized government bonds and digital treasury funds is reshaping how both retail and institutional investors approach risk management. As the total tokenized RWA (real-world asset) market approaches $34.14 billion, Treasuries and gold-backed tokens are leading onchain adoption, offering new avenues for diversification and capital preservation in the digital era.

Operational Risks and Market Concentration

Despite their appeal, tokenized Treasury funds are not without challenges. The underlying technology is still maturing, and the market remains concentrated among a handful of large issuers. This concentration could amplify systemic risks if a key provider encounters technical or regulatory setbacks. Additionally, investors must consider smart contract vulnerabilities, custodial risks, and the evolving nature of cross-border compliance.

However, these risks are being actively addressed. Leading issuers are investing in robust cybersecurity, frequent third-party audits, and transparent reporting. The GENIUS Act’s regulatory framework has also encouraged more traditional financial institutions to experiment with tokenized sovereign bonds, further bolstering market confidence. As pension funds and treasuries continue to experiment with these instruments, the standards for security and transparency are rising across the sector.

Key Operational & Regulatory Considerations for Tokenized Treasury Investors

-

Regulatory Clarity and Compliance: With the July 2025 passage of the GENIUS Act, U.S. banks and financial institutions can now issue stablecoins backed by fiat or high-quality collateral like U.S. Treasuries. Investors must ensure their chosen tokenized Treasury funds are fully compliant with evolving regulations and operate under jurisdictions with robust oversight.

-

Issuer Credibility and Track Record: The rapid growth of tokenized Treasury funds has been led by established asset managers such as BlackRock (BUIDL Fund) and Franklin Templeton. Investors should prioritize funds managed by reputable institutions with transparent operations and proven expertise in both traditional and digital asset markets.

-

Custody and Security Infrastructure: Assess the custody solutions and security protocols used by the tokenized fund. Leading platforms employ institutional-grade custody, multi-signature wallets, and regular third-party audits to mitigate risks associated with smart contract vulnerabilities and cyber threats.

-

Liquidity and Settlement Efficiency: Tokenized Treasury funds offer on-chain liquidity and faster settlement compared to traditional bonds. However, liquidity can vary between platforms and tokens, so investors should evaluate trading volumes and redemption mechanisms before allocating significant capital.

-

Concentration and Counterparty Risk: The majority of tokenized U.S. Treasuries are currently issued by a handful of large entities. This concentration can introduce systemic risk if a major issuer experiences operational or financial distress. Diversification across multiple issuers and platforms can help mitigate this exposure.

-

Yield Generation and Transparency: Unlike stablecoins such as USDT or USDC, tokenized Treasury funds provide yields (currently 4%–5% annually) backed by U.S. government securities. Investors should verify the source of yields, fee structures, and the transparency of underlying asset holdings.

-

Technology Risk and Platform Reliability: The technology powering tokenized Treasuries is still maturing. Investors should scrutinize the blockchain protocols used, uptime history, and incident response processes of their chosen platforms to avoid disruptions from outages or technical failures.

A New Paradigm for Digital Safe Havens

For investors navigating crypto volatility, the emergence of blockchain-based safe haven assets marks a turning point. Tokenized Treasury funds now offer a credible alternative to both volatile cryptocurrencies and opaque stablecoins. Their ability to provide yield, transparency, and government-backed security is fundamentally changing the calculus for digital asset allocation.

As more institutions allocate to these instruments and regulatory clarity improves, tokenized treasuries are poised to become a core pillar of digital finance. The next phase of adoption may see DeFi protocols, fintech firms, and even central banks leveraging tokenized government debt for settlement, collateral, and liquidity management.

For a deeper dive into how tokenized treasuries are transforming institutional crypto strategy, visit this comprehensive analysis.