How Fidelity’s Tokenized U.S. Treasuries Fund on Ethereum Is Revolutionizing On-Chain Fixed Income

Fidelity has just shaken the fixed-income world with a move that feels like the start of a new era: their $200 million tokenized U. S. Treasuries fund, the Fidelity Digital Interest Token (FDIT), is now live on Ethereum. This isn’t just a headline grabber for crypto diehards – it’s a wake-up call to every institutional desk still stuck in TradFi workflows. With FDIT, investors can now tap into U. S. Treasury yields via blockchain rails, unlocking 24/7 access, fractional ownership, and a level of transparency that the old world could only dream of.

Why Fidelity’s FDIT Is a Game Changer for On-Chain Fixed Income

Let’s cut through the noise. Fidelity’s FDIT isn’t just a digital wrapper around a money market fund. Each FDIT token directly represents a share in the Fidelity Treasury Digital Fund (FYOXX), which primarily invests in short-term U. S. Treasuries and cash. The fund is custodied by Bank of New York Mellon, giving institutional investors the familiar security blanket of a top-tier custodian – but with the radical twist of Ethereum-powered programmability.

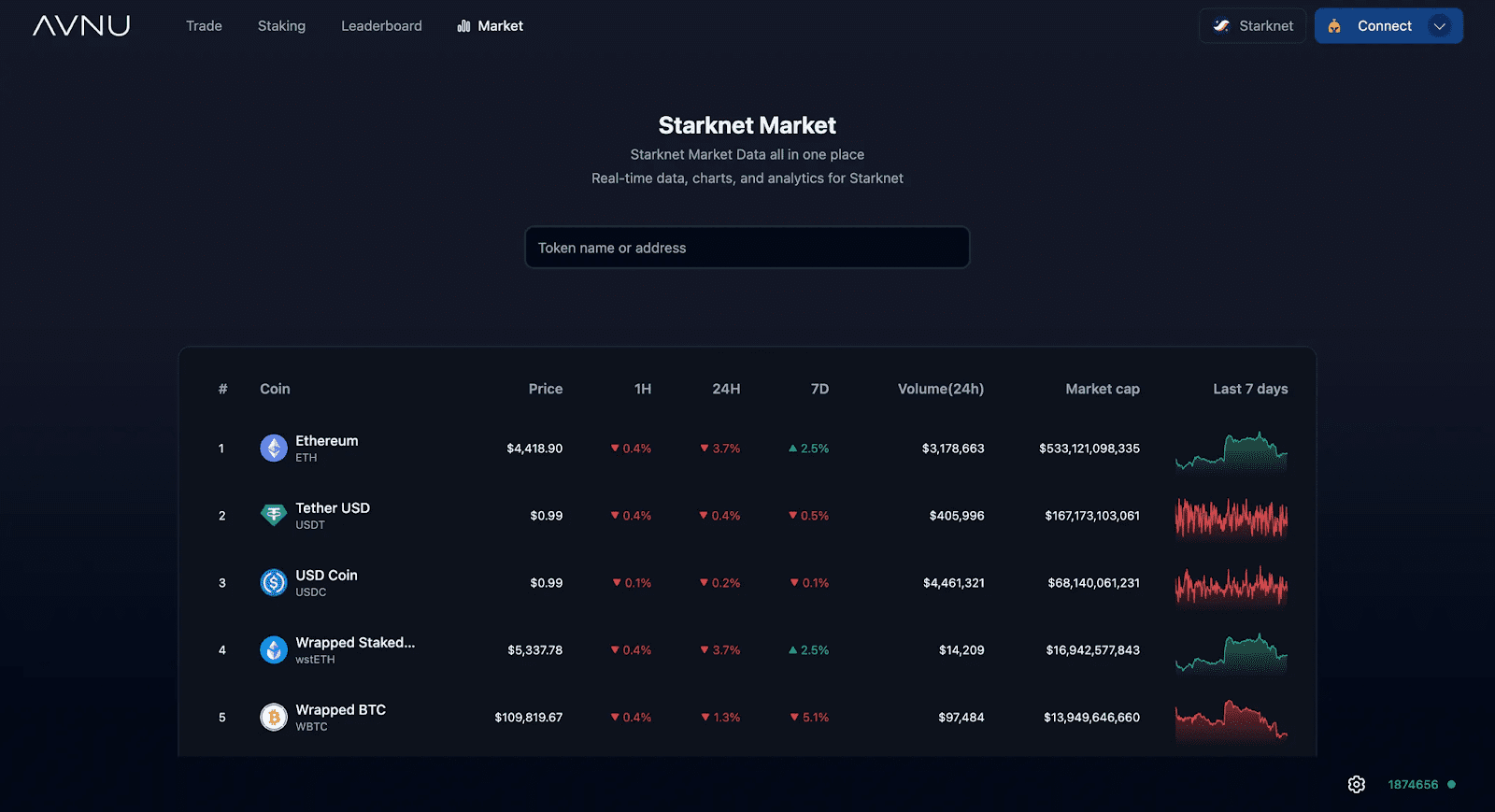

Since launch, FDIT has already attracted approximately $203.7 million in assets, cementing Ethereum’s dominance in the tokenized treasuries market with about $5.3 billion out of a $7.46 billion total market cap for on-chain U. S. Treasuries

. As more institutions follow suit, Ethereum’s role as the backbone for tokenized finance only gets stronger.

The implications are massive: not only does this open up Treasuries to a global audience (think beyond Wall Street and into emerging markets), but it also creates new rails for DeFi protocols to integrate real-world yields directly into their platforms.

The question now isn’t whether tokenized treasuries are coming – it’s how fast they’ll eat up market share from legacy products.

Want to see where experts think prices are heading next? Here’s a look at professional forecasts based on current momentum:

Ethereum (ETH) Price Prediction 2026-2031

Forecast incorporates the impact of institutional adoption, real-world asset tokenization, and evolving market dynamics following Fidelity’s FDIT launch.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Estimated % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,400 | $4,600 | $7,000 | +16% | ETH consolidates above $4k as tokenized asset adoption grows; regulatory clarity improves. |

| 2027 | $3,900 | $5,300 | $8,200 | +15% | DeFi and RWA tokenization on Ethereum accelerate; ETH benefits from increased institutional flows. |

| 2028 | $4,100 | $6,200 | $10,000 | +17% | Next crypto bull cycle; ETH upgrades (e.g., sharding) and mainstream RWA adoption drive momentum. |

| 2029 | $4,500 | $7,100 | $12,500 | +15% | Ethereum maintains dominance in tokenized treasuries; increased competition from other L1s. |

| 2030 | $5,000 | $8,300 | $15,000 | +17% | Global institutions adopt on-chain finance; ETH supply dynamics and staking boost price. |

| 2031 | $5,400 | $9,600 | $18,000 | +16% | Ethereum cements role as primary RWA platform; mature DeFi and TradFi integration. |

Price Prediction Summary

Ethereum’s price outlook from 2026 to 2031 is positive, driven by increased institutional adoption, real-world asset tokenization (exemplified by Fidelity’s FDIT), and ongoing technological enhancements. While volatility and regulatory risks remain, ETH is positioned for steady growth, with bullish scenarios projecting significant upside if institutional and mainstream adoption accelerate.

Key Factors Affecting Ethereum Price

- Institutional adoption of tokenized assets (e.g., FDIT inflows)

- Expansion of DeFi and real-world asset use cases on Ethereum

- Ongoing Ethereum protocol upgrades (scalability, security)

- Regulatory clarity and global policy trends affecting crypto

- Competition from other smart contract platforms (e.g., Solana, Avalanche)

- Macroeconomic conditions and demand for digital assets

- ETH supply dynamics (staking, EIP-1559 burn mechanism)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Tokenization is about more than just efficiency. By moving U. S. Treasuries on-chain, Fidelity has cracked open a door to programmable money market strategies, instant settlement, and composability with DeFi primitives. For institutions, this means the ability to automate complex treasury operations, access real-time reporting, and seamlessly rebalance portfolios, all while reducing operational risk and slashing middleman costs.

How FDIT Changes Institutional Access and Market Structure

With FDIT, the old barriers, limited trading hours, chunky minimums, and slow settlement, are rapidly fading. Now, a fund manager in Singapore or a DAO treasury in Berlin can tap into U. S. Treasury yields anytime, using nothing more than an Ethereum wallet. The implications for global liquidity are profound: as tokenized treasuries like FDIT become collateral in DeFi protocols, they’ll fuel a new wave of on-chain lending, borrowing, and structured products.

The 0.20% annual management fee keeps FDIT competitive with legacy money market funds, but the real draw is the flexibility. Fractional ownership means even smaller players can participate, and 24/7 blockchain rails mean no more waiting for T and 2 settlements. This is the kind of accessibility that could reshape fixed income for a digital-native generation of allocators.

Regulatory clarity will be the next battleground. With custody handled by Bank of New York Mellon and compliance embedded at the smart contract level, Fidelity is setting a high bar for transparency and auditability. Institutional investors can finally get the best of both worlds: the safety of a regulated product with the agility of crypto infrastructure. For a deeper dive into the evolving regulatory landscape and how it’s impacting institutional access, check out this analysis.

The Ripple Effect: Ethereum at $3,964.89 and the Tokenized Treasury Boom

With Ethereum trading at $3,964.89, the network’s role as the settlement layer for real-world assets has never been clearer. FDIT’s $203.7 million in assets is just the opening salvo, Ethereum’s tokenized treasury market already claims $5.3 billion out of a $7.46 billion total. This is a strong signal that institutions are not only comfortable with blockchain rails but are actively seeking them out for core portfolio allocations.

We’re witnessing the early innings of a transformation that will ripple across asset management, custody, and even central bank policy. As more funds tokenize, expect to see faster settlement times, global 24/7 liquidity, and a new breed of financial products that simply couldn’t exist in the old world. The FDIT launch isn’t just a win for Fidelity, it’s a green light for the entire on-chain fixed income ecosystem.

For institutional investors and forward-thinking allocators, the question is no longer “if” but “how much” exposure to tokenized treasuries is prudent. As the rails mature and liquidity deepens, the opportunity cost of ignoring on-chain fixed income will only grow.

Curious how this shift stacks up against competing products and what it means for your strategy? Explore our feature on how Fidelity’s tokenized treasuries are changing fixed income investing.