How Tokenized T-Bills Are Revolutionizing Institutional Liquidity Management

Tokenized U. S. Treasury Bills (T-Bills) are rapidly redefining the landscape of institutional liquidity management. By merging the stability of government debt with the efficiency of blockchain, these digital securities introduce a new paradigm for capital allocation, risk management, and operational agility in institutional finance. The tokenization of T-Bills, typically as ERC-20 tokens, enables not only 24/7 trading on global markets but also direct programmability for automated workflows and seamless integration with decentralized finance (DeFi) protocols.

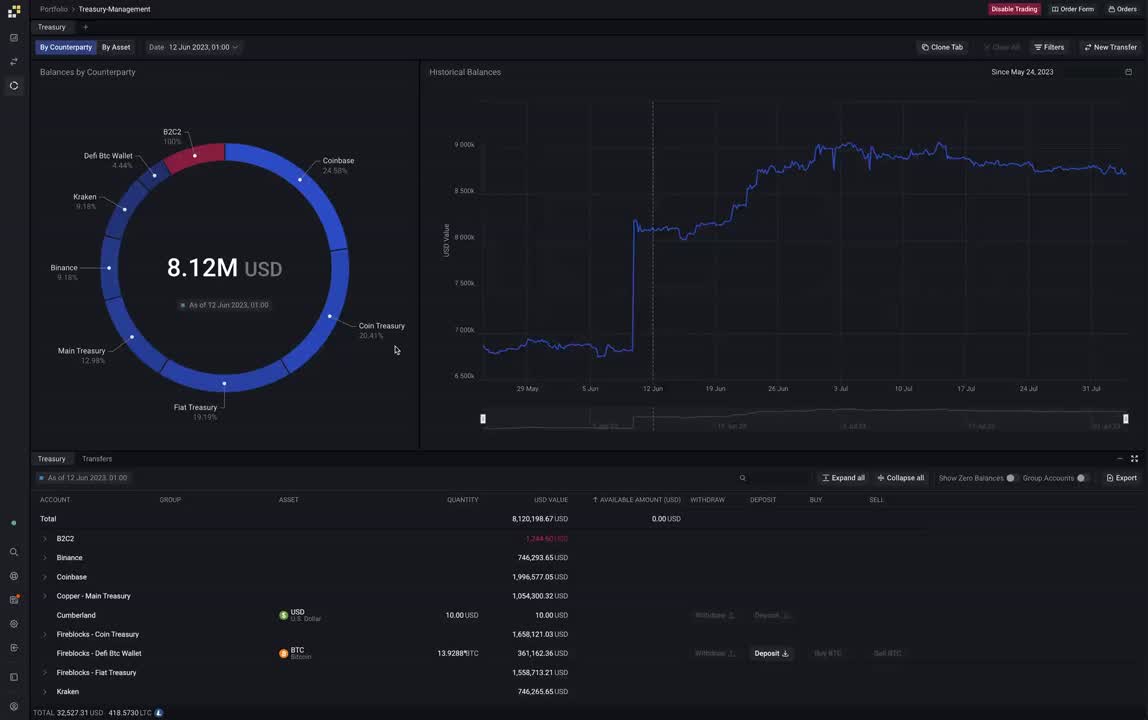

Tokenized T-Bills: A Data-Driven Foundation for Modern Treasury Management

Traditional T-Bills have long served as a cornerstone for cash management and short-term liquidity strategies. However, their utility is limited by market hours, high minimum denominations, and operational frictions such as delayed settlements. Tokenized T-Bills solve these pain points through fractional ownership, allowing institutions to deploy capital in smaller increments and rebalance portfolios with precision, any hour of the day.

Platforms like OpenEden’s $TBILL Fund exemplify this shift by offering investors direct exposure to pools of short-dated U. S. Treasuries via blockchain-based tokens. As a result, institutions benefit from instant liquidity, real-time settlement, and transparent on-chain recordkeeping. According to recent market data, tokenized short-term funds have surged to $5.7 billion in assets under management as of June 2025, reflecting growing institutional appetite for regulated, on-chain cash management solutions.

Unlocking Real-Time Settlement and Operational Efficiency

The true breakthrough lies in the operational efficiencies unlocked by blockchain treasury tokens. By reducing reliance on intermediaries such as clearinghouses and custodians, institutions can compress settlement cycles from days to seconds while lowering transaction costs. The programmability inherent in smart contracts further enables automation of complex tasks, from collateral rebalancing to compliance reporting, improving both speed and accuracy across treasury operations.

This efficiency is not theoretical; it is already being realized at scale. Major financial players are partnering with blockchain-native platforms to deliver robust custody solutions that meet institutional standards for security and regulatory compliance. For instance, BNY Mellon’s role as investment manager and custodian for OpenEden’s $TBILL Fund demonstrates how legacy financial infrastructure is converging with digital asset innovation to underpin new models of liquidity provision.

The New Institutional Standard: Accessibility Meets Security

Accessibility is another core advantage driving adoption among asset managers, hedge funds, fintechs, and corporate treasurers. With tokenized T-Bills available around the clock, and often integrated directly into DeFi protocols, institutions can swiftly respond to market shifts or funding requirements without waiting for legacy settlement windows or facing steep entry thresholds.

This new standard does not come at the expense of security or compliance. On the contrary: regulated funds like BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) are expanding across multiple blockchain networks while maintaining rigorous oversight over underlying assets. Such developments reinforce confidence among institutional allocators seeking both yield optimization and robust risk controls within their liquidity frameworks.

- 24/7 access: Trade or redeem positions any time via secure blockchain rails

- Fractionalization: Allocate precise amounts without traditional minimums

- Real-time transparency: On-chain records enable continuous auditability

- Automated workflows: Smart contracts streamline collateral management and reporting

- Custodial integration: Partnerships ensure regulatory-grade asset protection

The convergence of accessibility, transparency, and operational efficiency is setting a new benchmark for institutional cash management strategies built around tokenized fixed income instruments.

As tokenized T-Bills gain traction, their integration with existing financial infrastructure is accelerating. Strategic alliances between blockchain innovators and traditional custodians are not just a matter of convenience, they are critical for scaling adoption while meeting the stringent requirements of institutional investors. The OpenEden and BNY Mellon partnership, for example, illustrates how established custodianship and blockchain-native programmability can coexist to deliver both trust and agility. These integrations ensure that digital securities institutions can confidently hold, trade, and report on blockchain treasury tokens within familiar regulatory frameworks.

Market Growth: Quantifying Institutional Demand

The market’s rapid expansion is underpinned by clear data: as of June 2025, tokenized short-term funds have reached $5.7 billion in assets under management. This figure signals not only robust demand but also the scalability of tokenized solutions for institutional liquidity management. The growth trajectory is being driven by asset managers seeking to optimize yield and operational resilience, as well as fintechs leveraging real-time settlement fixed income products for more dynamic treasury strategies.

Moreover, the ability to programmatically allocate capital across multiple blockchain networks, such as seen with BlackRock’s BUIDL fund, demonstrates how digital securities are evolving beyond single-chain limitations. Institutions can now access diversified pools of government debt instruments with unprecedented speed and flexibility, all while maintaining compliance with global standards.

Key Drivers Behind the $5.7B Tokenized T-Bill Surge

-

Enhanced Accessibility via 24/7 Blockchain Markets: Tokenized T-Bills, such as OpenEden’s $TBILL Fund, enable institutions to access and trade U.S. Treasury exposure around the clock, with fractional ownership lowering barriers to entry and boosting liquidity.

-

Operational Efficiency and Cost Reduction: Blockchain-based settlement reduces reliance on intermediaries, slashes transaction costs, and enables programmable automation for processes like collateral management—streamlining institutional operations.

-

Rapid Institutional Adoption and Market Growth: Major financial players, including BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), are expanding tokenized T-Bill offerings across multiple blockchains, fueling the market’s rise to $5.7 billion AUM as of June 2025.

-

Integration with Established Financial Infrastructure: Collaborations between blockchain innovators and traditional custodians, such as OpenEden’s partnership with BNY Mellon, ensure regulatory compliance and institutional-grade security for tokenized T-Bill products.

-

Real-Time Settlement and Liquidity: Tokenized T-Bills enable instantaneous asset transfer and settlement, allowing institutions to manage cash positions and liquidity in real time—an advantage over traditional T-Bill settlement cycles.

Practical Implications: From Theory to Execution

The practical implications extend far beyond theoretical efficiency gains. Real-world case studies show that corporate treasurers are using tokenized T-Bills to manage liquidity buffers without sacrificing yield or transparency. Hedge funds employ these instruments for intraday cash management or as collateral in DeFi lending protocols, unlocking new sources of alpha while maintaining exposure to risk-free rates.

For institutions navigating volatile markets or cross-border payment corridors, the programmable nature of tokenized T-Bills enables automated triggers for rebalancing or liquidity provision based on predefined risk parameters. This level of control was previously unattainable with legacy systems constrained by manual processes and delayed settlement cycles.

Challenges Ahead: Regulatory Nuance and Interoperability

Despite these advances, challenges remain, particularly around regulatory harmonization and interoperability between blockchains and traditional financial systems. While regulated funds like OpenEden’s $TBILL have set a precedent for compliance-driven innovation, ongoing collaboration between regulators, custodians, and technology providers will be essential to unlock the full potential of tokenized fixed income markets.

Interoperability standards must mature to allow seamless transferability across different platforms without compromising security or auditability. As market participants continue to push boundaries, expect further advancements in cross-chain settlement protocols and regulatory clarity that will shape the next phase of adoption.

The Road Ahead: Institutional Liquidity Reimagined

The rise of tokenized T-Bills marks a decisive shift toward a more agile, transparent, and accessible model for institutional liquidity management. With programmable assets offering real-time settlement fixed income exposure around the clock, and robust partnerships ensuring security, institutions now have tools that blend the best features of traditional finance with the disruptive potential of blockchain technology.

For investors seeking deeper analysis on how these innovations impact portfolio construction or risk models within on-chain environments, our in-depth guides provide actionable insights:

- How Tokenized T-Bills Are Revolutionizing Institutional Fixed Income Portfolios

- How Institutional Investors Use Tokenized Treasury Bills for On-Chain Yield and Liquidity

- Case Studies: Real-World Adoption of Tokenized Treasuries by Asset Managers

This convergence is not just an incremental improvement, it is a foundational change poised to redefine best practices in treasury strategy globally.