How Tokenized U.S. Treasuries Became the Go-To Collateral for Banks and Crypto Exchanges in 2025

In November 2025, the market for tokenized U. S. Treasuries has reached a defining moment. With market capitalization surging to $8.6 billion, these digital representations of government debt are no longer niche experiments on the blockchain, they have become the preferred collateral for both global banks and leading crypto exchanges. The shift is not just about technological novelty. It marks a fundamental reconfiguration of how liquidity, trust, and risk are managed across traditional and digital finance.

From Yield Product to Institutional-Grade Collateral

The original promise of tokenized treasuries was simple: unlock instant, borderless access to U. S. government bonds and money-market funds through blockchain rails. But in 2025, their role has evolved dramatically. Today, major financial institutions like BlackRock, Circle, and Franklin Templeton are not just issuing these tokens, they are integrating them into core financial plumbing as onchain collateral.

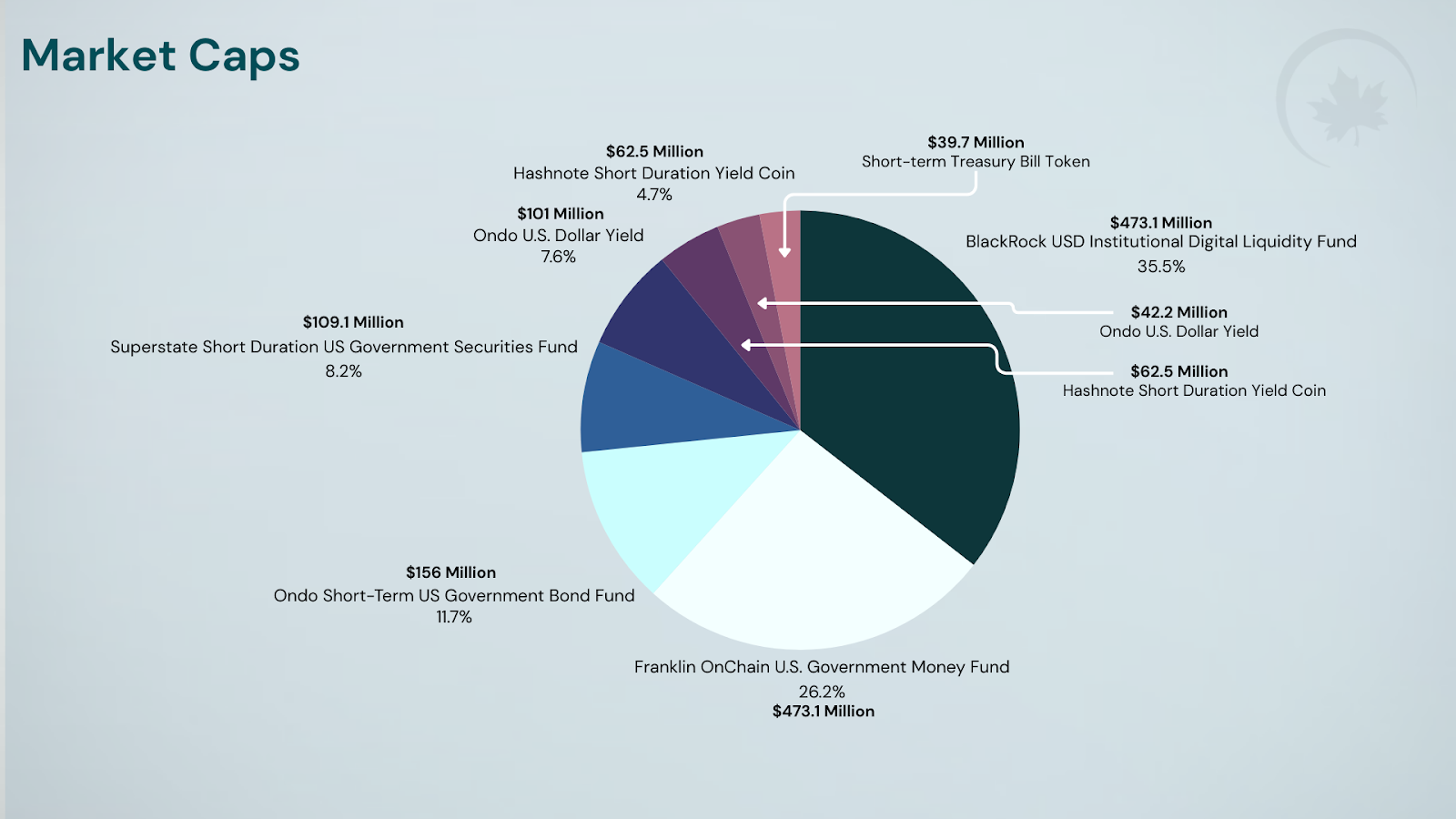

For example, BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), now valued at approximately $2.85 billion, is widely accepted on platforms such as Crypto. com and Deribit for margin trading and secured lending operations. Circle’s USYC and Franklin Templeton’s BENJI funds, each with around $865 million in assets, are also being used by banks for repo transactions and by exchanges as high-quality collateral backing user positions.

This transformation is not accidental; it reflects a growing recognition that tokenized treasuries combine the safety of sovereign debt with the programmability and settlement speed of blockchain networks.

Market Growth Driven by Institutional Demand

The numbers tell a compelling story: from mid-September to late October alone, total market cap climbed from $7.4 billion to $8.6 billion. That’s an 80% increase since the start of 2025, a pace that outstrips most other digital asset categories this year.

This rapid expansion is fueled by three primary factors:

- Liquidity needs: Banks require high-quality liquid assets (HQLA) for regulatory compliance and efficient funding operations. Tokenized treasuries meet these criteria while enabling real-time settlement.

- Crypto exchange risk management: Exchanges increasingly demand transparent, auditable collateral that can be instantly verified onchain to reduce counterparty risk.

- Bilateral trading efficiency: The ability to move collateral within minutes, rather than days, means less capital tied up in clearinghouses or intermediaries.

This institutional momentum is also reflected in the diversity of participants entering the space, from Singapore’s DBS Bank piloting tokenized fund trading, to U. S. -regulated broker-dealers leveraging these assets for repo markets.

The Regulatory Green Light: OCC Guidance and The GENIUS Act

No discussion of this trend would be complete without addressing regulatory catalysts. In March 2025, the U. S. Office of the Comptroller of the Currency (OCC) clarified that national banks can engage in select crypto activities, including custodying digital assets and participating in distributed ledger networks, without pre-approval from regulators.

This was followed by July’s passage of the GENIUS Act, which allows financial institutions to issue stablecoins backed by high-quality collateral such as U. S. Treasuries, a move that has turbocharged confidence among compliance teams at major banks and custodians.

Together, these developments have removed key legal uncertainties that previously kept many institutions on the sidelines, and have opened doors for new products blending traditional fixed-income security with blockchain-native features.

The Technology Layer: Interoperability and Settlement Speed

If regulation provided clarity, technology delivered the means to act on it at scale. Platforms like Chainlink and Swift have piloted solutions enabling seamless interoperability between banking infrastructure and public or permissioned blockchains. This means tokenized treasuries can now be moved or pledged as collateral within hours, not days, across disparate financial ecosystems.

The result? Banks can optimize liquidity buffers more dynamically while crypto exchanges gain access to real-time proof-of-reserves using transparent onchain records, a critical upgrade after years of opacity-driven crises in digital asset markets.

The speed and transparency enabled by these systems have fundamentally altered the risk calculus for both lenders and borrowers. Where previously, collateral verification and settlement delays introduced friction and credit risk, tokenized treasuries offer programmable compliance checks and instant asset transfers. This is particularly valuable in volatile markets, where margin calls or liquidity needs can arise by the hour. The ability to mobilize $8.6 billion in high-quality collateral across global platforms is not just an efficiency gain, it is a structural shift in how financial stability is engineered.

A New Blueprint for Collateral Markets

As tokenized U. S. Treasuries become a staple of onchain collateral strategies, we are witnessing the convergence of traditional finance (TradFi) discipline with decentralized finance (DeFi) innovation. This new blueprint is characterized by:

- Programmable settlement: Smart contracts automate margin calls, repo rollovers, and interest payments, reducing operational overhead and error rates.

- Global accessibility: Institutions worldwide can access U. S. Treasury exposure without legacy barriers such as time zones, market holidays, or correspondent banking limits.

- Risk transparency: Onchain ledgers provide continuous auditability, regulators and counterparties can verify collateral status in real time.

This model also addresses longstanding pain points in both crypto and traditional markets. For crypto exchanges, tokenized treasuries help restore confidence after years of opaque reserves and insolvency scares. For banks, they unlock new revenue streams from repo lending and collateral transformation, without compromising regulatory standards or liquidity ratios.

Top Institutional Uses for Tokenized Treasury Collateral in 2025

-

Derivatives Trading Margin: Leading crypto exchanges like Deribit and Crypto.com now accept BlackRock’s BUIDL fund (valued at approximately $2.85 billion) as margin collateral, enabling faster settlement and reduced counterparty risk for institutional traders.

-

Repo Transactions in Traditional Finance: Major banks leverage tokenized U.S. Treasuries for repurchase (repo) agreements, streamlining overnight lending and collateral management with blockchain’s instant settlement capabilities.

-

On-Chain Lending and Credit Facilities: Platforms such as Circle’s USYC and Franklin Templeton’s BENJI (each around $865 million in assets) are used as high-quality collateral for on-chain loans, enhancing liquidity for institutional DeFi participants.

-

Stablecoin Issuance Backing: Following the GENIUS Act, banks and fintechs issue regulated stablecoins fully backed by tokenized Treasuries, ensuring transparency and compliance while providing a robust foundation for digital dollars.

Macro Implications: Liquidity, Safety, and Systemic Resilience

The macro case for tokenized U. S. Treasuries as go-to collateral extends well beyond short-term trading advantages. As global interest rate cycles remain unpredictable and cross-border capital flows accelerate, institutions crave assets that combine safety with agility. Tokenized treasuries deliver both: the creditworthiness of the U. S. government paired with near-instant transferability.

This duality has systemic consequences. Liquidity shocks can be absorbed more smoothly when high-quality collateral can move at blockchain speed; market participants are less exposed to bottlenecks or forced liquidations due to settlement lags. Moreover, as more jurisdictions adopt compatible regulatory frameworks (inspired by the OCC guidance or the GENIUS Act), we may see a harmonization of global collateral standards around blockchain-native instruments.

The endgame? A world where sovereign debt circulates frictionlessly between banks, asset managers, trading venues, and DeFi protocols, bridging silos that once defined financial markets.

Looking Ahead: What Comes Next?

The rapid ascent of tokenized U. S. Treasuries to $8.6 billion signals a profound change but also raises new questions about market structure and risk management going forward. Will other sovereign bonds follow suit? How will central banks respond as more liquidity migrates onto programmable rails? And what role will decentralized identity or privacy-preserving tech play in future iterations?

For now, one thing is clear: the integration of tokenized treasuries into mainstream collateral frameworks is not a passing trend but a durable evolution in capital markets infrastructure, a development that rewards disciplined macro thinking as much as technological agility.