How Fidelity’s Tokenized U.S. Treasuries Fund on Ethereum Signals a New Era for Institutional Blockchain Adoption

Fidelity Investments has quietly redefined the landscape for institutional blockchain adoption with the launch of its Digital Interest Token (FDIT) – a tokenized share class of its Treasury money market fund, now live on the Ethereum blockchain. This move is more than just another headline in the ongoing race to tokenize real-world assets; it’s a practical demonstration of how legacy financial giants are embracing public blockchain rails to deliver traditional fixed-income products in a radically new form. With over $200 million in assets already onboarded and 203 million tokens issued, Fidelity’s entry marks a pivotal moment for both digital asset markets and mainstream finance.

Fidelity’s FDIT: Bridging Wall Street and Ethereum

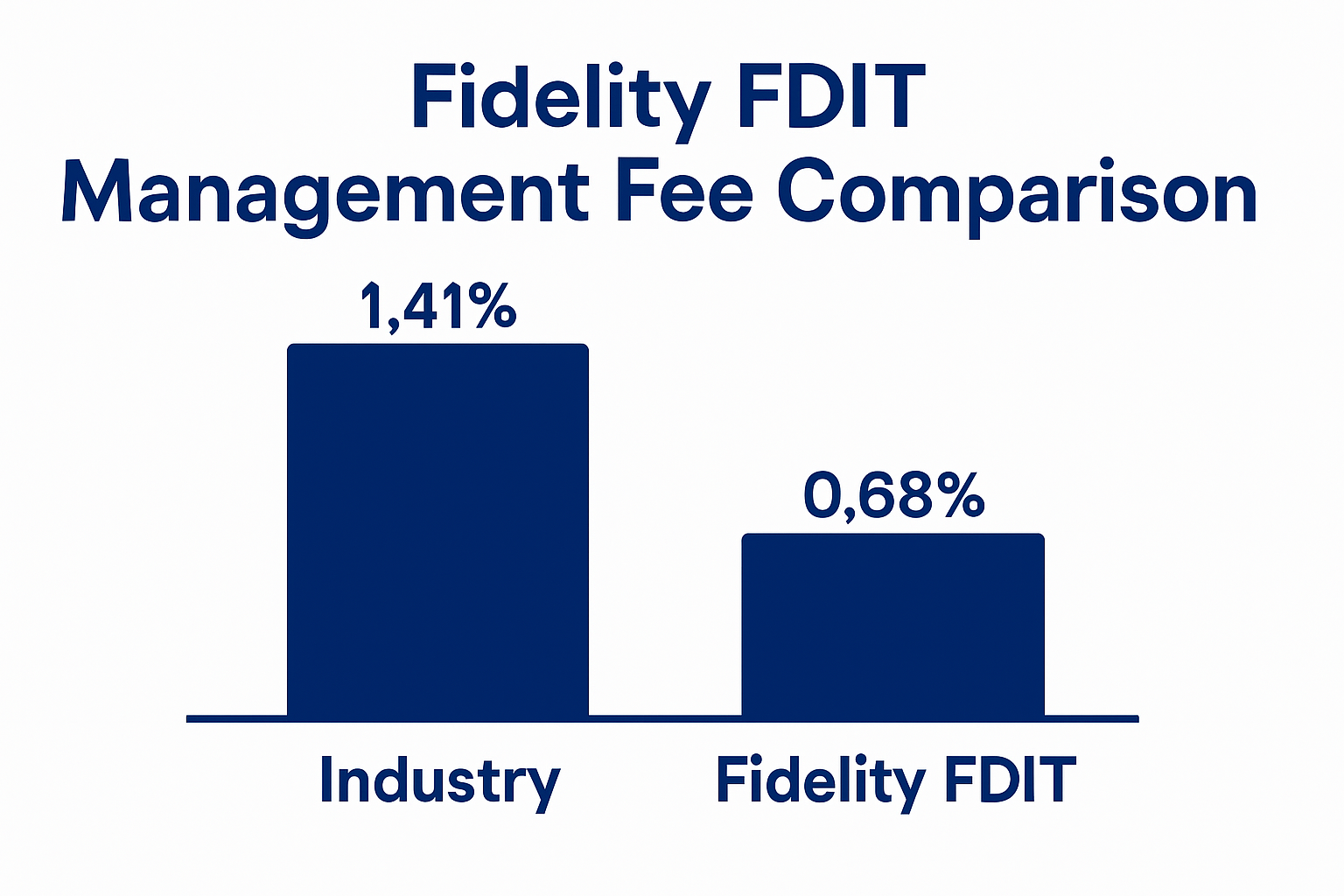

At its core, FDIT allows investors to access short-term U. S. Treasuries through an ERC-20 token, merging the security and regulatory rigor of a blue-chip asset manager with the composability and transparency of decentralized infrastructure. The fund holds more than $200 million in U. S. Treasuries and cash equivalents, custodied by Bank of New York Mellon, with a lean 0.20% annual management fee. By leveraging Ethereum – currently priced at $4,495.05 – Fidelity is not just experimenting; it’s making a statement about where institutional-grade finance is headed.

This launch comes at a time when Ethereum dominates real world asset tokenization, hosting approximately 70% of the $7.46 billion tokenized U. S. Treasury market. The move puts Fidelity alongside other titans like BlackRock (whose BUIDL fund now tops $2 billion), but what sets FDIT apart is its seamless integration with on-chain liquidity protocols and settlement layers.

Why Tokenized Treasury Funds Matter Now

The rapid growth in tokenized treasury funds isn’t just about novelty or crypto-native demand. Institutional allocators are seeking solutions that offer:

- Near-instant settlement: Reducing counterparty risk and freeing up capital compared to T and 1 or T and 2 legacy systems.

- 24/7 market access: Enabling global investors to participate outside traditional trading hours.

- Programmable compliance: Automated restrictions based on KYC/AML or jurisdictional rules baked into smart contracts.

- Transparency: On-chain proof of reserves and transaction history visible in real time.

This new paradigm doesn’t just streamline back-office operations; it fundamentally changes how fixed-income products are distributed, traded, and serviced worldwide.

Ethereum (ETH) Price Prediction 2026-2031 Post-Fidelity FDIT Launch

Forecast based on institutional adoption momentum, real-world asset tokenization, and evolving market dynamics

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,800 | $5,300 | $7,000 | +18% | Post-FDIT adoption grows; potential regulatory clarity boosts confidence, but volatility remains |

| 2027 | $4,250 | $6,200 | $8,500 | +17% | Broader integration of tokenized assets; new institutional entrants; scaling improvements |

| 2028 | $4,900 | $7,200 | $10,500 | +16% | Ethereum upgrades (e.g., Danksharding) increase throughput; competition from alternative L1s persists |

| 2029 | $5,600 | $8,100 | $12,800 | +13% | Tokenized asset market matures; ETH benefits from network effects, but macro risks linger |

| 2030 | $6,400 | $9,000 | $15,200 | +11% | Mainstream finance deeply integrated with Ethereum; regulatory frameworks stabilize |

| 2031 | $7,200 | $9,800 | $17,500 | +9% | ETH consolidates as core Web3 infrastructure; real-world asset tokenization becomes standard |

Price Prediction Summary

Ethereum’s price outlook from 2026 to 2031 is bullish, underpinned by growing institutional adoption, especially following Fidelity’s FDIT launch. While short-term volatility remains due to broader market cycles and potential regulatory hurdles, the long-term trend favors steady appreciation as Ethereum cements its role as the leading platform for real-world asset tokenization and institutional finance integration.

Key Factors Affecting Ethereum Price

- Institutional adoption acceleration post-FDIT and similar tokenized funds

- Expansion of real-world asset tokenization (Treasuries, money markets, etc.)

- Ethereum network upgrades improving scalability and cost-efficiency

- Regulatory clarity and global acceptance of tokenized assets

- Competition from other smart contract blockchains (e.g., Solana, Avalanche)

- Macro-economic factors affecting risk appetite and investment flows

- Potential for further DeFi and TradFi integration on Ethereum

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Institutional Blockchain Tipping Point

The significance of Fidelity’s move goes far beyond one product or one platform. As highlighted by The Defiant, this is widely seen as a “tipping point” for institutional blockchain adoption. The quiet scale achieved so rapidly – over $203 million in assets within weeks – signals growing confidence among asset managers that public blockchains like Ethereum can support regulated financial products at scale.

This momentum is reinforced by macro trends: stablecoins now drive 95% of all dollar volume on Ethereum, while approximately 82% of all tokenized real-world assets sit on its rails. The infrastructure is maturing fast enough that risk-averse institutions are no longer asking if but when they should onboard their first digital bonds or treasury tokens.

The Road Ahead for Tokenized US Treasuries on Ethereum

The implications reach well beyond Fidelity itself. As more blue-chip managers follow suit, we’ll see increased interoperability between DeFi protocols and regulated funds, broader participation from global investors previously locked out by operational frictions or minimum ticket sizes, and ultimately a reimagining of how liquid fixed income fits into diversified portfolios.

Yet, the true potential of tokenized US Treasuries on Ethereum lies in their ability to unlock new forms of liquidity and composability. Imagine a world where treasury-backed tokens can be instantly pledged as collateral in DeFi lending markets, seamlessly traded 24/7 across borders, or integrated into automated portfolio strategies. This is not a distant vision, Fidelity’s FDIT brings us several steps closer.

For institutional investors, the calculus is shifting fast. Not only do tokenized treasury funds like FDIT offer daily liquidity and transparent audit trails, but they also lower operational costs by automating settlement and compliance. The result is a more frictionless experience for allocators who have long been frustrated by legacy infrastructure bottlenecks.

Risks and Considerations for Institutions

No innovation comes without challenges. While the blockchain rails promise efficiency, institutions must still navigate evolving regulatory frameworks and smart contract risks. Due diligence on custodianship, here provided by Bank of New York Mellon, and ongoing assessment of protocol security remain paramount. Additionally, secondary market liquidity for these tokens will depend on continued adoption by both crypto-native and traditional players.

“The embrace of tokenized assets by established firms like Fidelity signals that digital securities are moving from proof-of-concept to mainstream allocation tools. ”

This shift is accelerating conversations among asset managers about how to blend traditional custody with on-chain programmability. As more players enter the space, expect rapid improvements in reporting standards, investor protections, and cross-platform interoperability.

Key Benefits of Fidelity’s FDIT for Institutions

-

On-Chain Access to U.S. Treasuries: FDIT enables institutional allocators to invest in short-term U.S. Treasury securities directly on the Ethereum blockchain, merging traditional finance with decentralized infrastructure.

-

Enhanced Transparency & Auditability: By leveraging blockchain technology, FDIT offers real-time, immutable records of fund holdings and transactions, improving oversight and operational trust.

-

Faster Settlement & Operational Efficiency: Tokenization on Ethereum reduces settlement times compared to legacy systems, streamlining processes and potentially lowering operational costs for institutions.

-

Increased Liquidity & Accessibility: FDIT tokens can be transferred 24/7 on-chain, potentially broadening market participation and making U.S. Treasuries more accessible to a global base of institutional investors.

-

Institutional-Grade Security & Custody: With Bank of New York Mellon as custodian, FDIT combines blockchain innovation with established financial safeguards, addressing key institutional risk concerns.

-

Competitive Management Fees: FDIT offers a 0.20% annual management fee, providing cost efficiency compared to some traditional treasury fund vehicles.

-

Accelerated Blockchain Adoption: Fidelity’s move signals growing confidence among major asset managers in blockchain-based products, paving the way for broader institutional adoption and innovation.

What Comes Next?

With Ethereum priced at $4,495.05, its role as the dominant public ledger for real-world asset tokenization appears secure, for now. But competition is heating up as other blockchains race to attract institutional-grade products with lower fees or enhanced privacy features. The continued success of Fidelity’s tokenized treasuries may well set new benchmarks for transparency and efficiency across global capital markets.

For investors watching this space, the message is clear: tokenization is no longer a theoretical exercise but an investable reality shaping how fixed income will be accessed and managed in the years ahead. As infrastructure matures and regulatory clarity improves, expect a wave of new products that blur the lines between traditional finance and blockchain-powered innovation.