How Fidelity’s Tokenized U.S. Treasuries Fund on Ethereum Signals a New Era for On-Chain Fixed-Income

The world of fixed-income investing is experiencing a seismic shift, and the latest tremor comes straight from Wall Street’s digital frontier. Fidelity Investments, one of the most trusted names in finance, has officially launched the Fidelity Digital Interest Token (FDIT) on the Ethereum blockchain. In one bold move, Fidelity is bridging the gap between traditional U. S. Treasuries and the borderless, transparent world of blockchain – a leap that could redefine how institutions approach on-chain fixed income.

Fidelity Tokenized Treasuries: A $203 Million Bet on Blockchain

Let’s get straight to the numbers: as of today, FDIT has amassed approximately $203.7 million in assets, with each token representing a share in a fund backed by U. S. Treasury securities and cash. This isn’t just a tech demo or a speculative experiment – it’s real capital moving onto public blockchain rails. What makes this even more striking is that FDIT only began operations in August 2025, underscoring the velocity of institutional adoption.

Why does this matter? For starters, tokenized government bonds like FDIT offer 24/7 liquidity, ultra-fast settlement times, and fractional ownership – all powered by Ethereum smart contracts. Investors can now access U. S. Treasury exposure without waiting for legacy clearing systems or being boxed out by high minimums.

“Fidelity’s move into tokenized treasuries isn’t just about efficiency – it’s about reimagining what access to government debt can look like in a global digital economy. ”

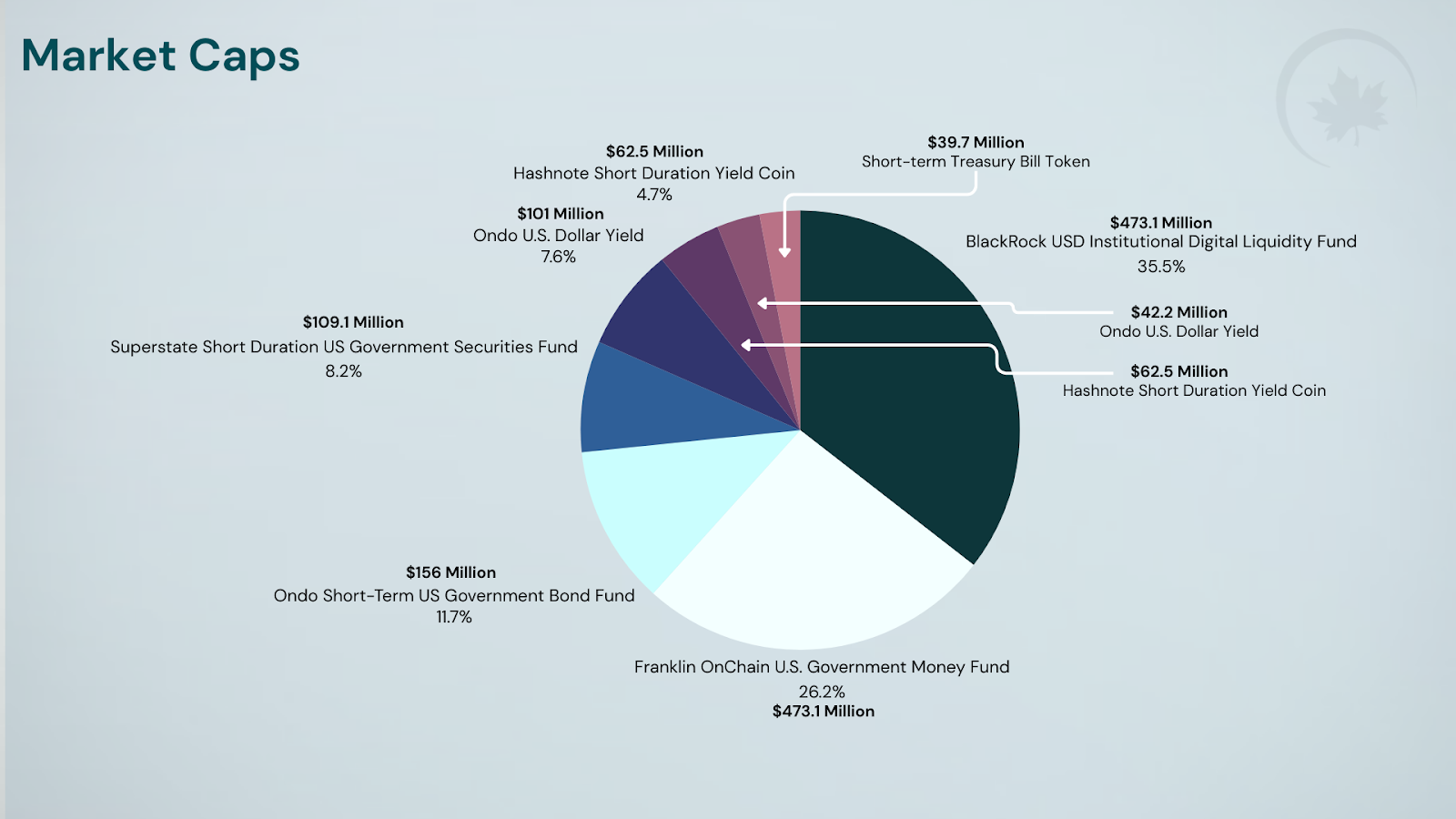

Ethereum Treasury Fund vs. BlackRock: The On-Chain Fixed Income Race

The launch of FDIT puts Fidelity head-to-head with BlackRock’s BUIDL fund, another heavyweight tokenized treasury product that has already reached $2.2 billion in assets under management (AUM). Both funds are built on Ethereum, leveraging its robust security and programmable infrastructure to record ownership transparently.

This isn’t just an arms race among giants; it signals the broader maturation of digital assets as investable vehicles for institutions. According to recent research from Fidelity Digital Assets, Bitcoin and Ethereum have evolved into distinct asset classes worthy of serious portfolio allocation.

The Mechanics Behind FDIT: Transparency Meets TradFi Security

What sets FDIT apart from traditional treasury funds? It’s all about the mechanics under the hood:

- On-chain transparency: Every transaction and share transfer is recorded immutably on Ethereum.

- Fractional trading: Investors can buy fractions of treasuries instead of whole bonds or large-lot shares.

- Reduced counterparty risk: Smart contracts automate settlement and reduce reliance on intermediaries.

- Lower fees: With an expense ratio around 0.20%, FDIT undercuts many legacy products while offering round-the-clock access.

Comparison of Fidelity FDIT and BlackRock BUIDL Tokenized Treasury Funds

| Feature | Fidelity FDIT | BlackRock BUIDL |

|---|---|---|

| Launch Date | August 2025 | March 2024 |

| Blockchain | Ethereum | Ethereum |

| Assets Under Management (AUM) | $203.7 million | $2.2 billion |

| Number of Holders | 2 (one major holder) | Multiple institutional holders |

| Underlying Assets | U.S. Treasury securities, cash | U.S. Treasury securities, cash |

| Issuer | Fidelity Investments | BlackRock |

| Management Fee | 0.20% | (Not publicly disclosed; generally competitive) |

| Liquidity | 24/7 on-chain trading | 24/7 on-chain trading |

| Target Investors | Institutional (initially) | Institutional |

| Key Benefits | Fractional ownership, fast settlement, transparency | Fractional ownership, fast settlement, transparency |

| Market Position | New entrant, rapid growth | Market leader, largest AUM |

| Notable Fact | Single investor controls majority of supply | Largest tokenized treasury fund to date |

The kicker? Despite being early days (with only two holders so far), these innovations point toward a future where digital treasury securities are as easy to trade as stablecoins – but with all the regulatory clarity and backing that institutional investors demand.

Paving the Way for Institutional Blockchain Adoption

The implications go far beyond just one fund or one blockchain ecosystem. By putting U. S. Treasuries on Ethereum at today’s ETH price of $3,831.52, Fidelity is inviting other asset managers to rethink their approach to product design and investor experience.

Ethereum (ETH) Price Prediction 2026-2031: Impact of Institutional Adoption and Tokenization

Forecast based on TradFi integration, tokenized assets growth, and evolving blockchain use cases

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg %) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,200 | $4,600 | $6,000 | +20% | Initial maturation of tokenized asset market; TradFi inflows continue, but volatility remains high. |

| 2027 | $3,800 | $5,600 | $7,800 | +22% | Broader institutional adoption; regulatory clarity improves, driving steady growth. Increased competition from L2s and other chains. |

| 2028 | $4,400 | $6,900 | $9,500 | +23% | Tokenized U.S. Treasuries and RWAs on Ethereum reach critical mass; network upgrades boost scalability. |

| 2029 | $5,000 | $8,300 | $12,000 | +20% | Ethereum cements its position as leading tokenization platform; TradFi/DeFi convergence accelerates. |

| 2030 | $5,800 | $9,400 | $13,500 | +13% | Regulatory frameworks mature; ETH faces competition but remains dominant in tokenized securities. |

| 2031 | $6,300 | $10,400 | $15,000 | +11% | Mainstream adoption of on-chain fixed-income; ETH benefits from continued institutional and retail inflows. |

Price Prediction Summary

Ethereum is poised for significant growth over the next six years, fueled by the rapid adoption of tokenized assets by major financial institutions like Fidelity and BlackRock. As Ethereum becomes the backbone for on-chain fixed-income products and real-world asset tokenization, its network utility and demand are expected to increase. While short-term volatility and competition may temper gains, the long-term outlook remains bullish, especially as regulatory clarity and technological upgrades support further institutional investment.

Key Factors Affecting Ethereum Price

- Institutional adoption of tokenized assets (Fidelity, BlackRock, etc.)

- Growth of tokenized U.S. Treasuries and other RWAs on Ethereum

- Ethereum network upgrades (scalability, security, staking)

- Regulatory developments impacting tokenization and crypto

- Competition from other blockchains and Layer 2 solutions

- Macroeconomic conditions influencing risk appetite and capital flows

- Potential for increased transaction fees and network congestion with adoption

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

If you’re tracking how real-world assets are migrating onto blockchains – or wondering what this means for your own portfolio strategy – you’re witnessing history unfold in real time. The race is officially on to see who will define the future standard for tokenized fixed income.

Already, the impact of Fidelity’s Ethereum treasury fund is rippling across both traditional and digital finance circles. The $203.7 million in assets, concentrated among just two holders, highlights that while institutional adoption is still in its infancy, the appetite for on-chain fixed income products is unmistakable. As regulatory frameworks mature and more institutions gain confidence in blockchain infrastructure, expect this early concentration to give way to broader participation from asset managers, hedge funds, and even forward-thinking treasurers.

What Tokenized Treasuries Mean for Investors

For investors used to the friction of legacy markets, think T and 2 settlement cycles, high minimums, and opaque pricing, Fidelity’s FDIT offers a radically different experience. With 24/7 trading windows and near-instantaneous settlement on Ethereum, investors can respond to macro events or liquidity needs without being chained to banking hours. The ability to own a fraction of a U. S. Treasury bill is not just a technical upgrade; it’s a democratization of access that could reshape portfolio construction for everyone from family offices to decentralized autonomous organizations (DAOs).

Key Benefits of Tokenized Treasuries for Investors

-

24/7 Liquidity and Trading: Tokenized treasuries like Fidelity’s FDIT on Ethereum allow investors to buy, sell, or transfer their holdings at any time, unlike traditional markets that operate only during business hours.

-

Fractional Ownership: Blockchain-based tokens enable investors to purchase fractions of a U.S. Treasury security, making high-quality fixed-income assets accessible to both institutional and retail investors with smaller capital.

-

Faster Settlement and Reduced Counterparty Risk: Settling trades on blockchain can occur in minutes rather than days, minimizing delays and reducing the risk of default between parties.

-

Enhanced Transparency: Every transaction and ownership record is visible on the Ethereum blockchain, giving investors real-time, auditable insight into fund activity and holdings.

-

Lower Fees and Operational Costs: With funds like FDIT offering competitive fees (0.20%), tokenized treasuries can reduce intermediaries and administrative expenses compared to traditional fixed-income products.

-

Direct Blockchain Integration: Investors can seamlessly integrate tokenized treasuries with DeFi platforms, digital wallets, and other blockchain-based services, enhancing portfolio flexibility and innovation.

And let’s not overlook the transparency factor. Every FDIT token movement is recorded on-chain, visible, auditable, and immutable, empowering both compliance teams and everyday investors with real-time insight into fund flows and ownership.

Challenges Ahead: Adoption, Fees and Ethereum Network Effects

Of course, no revolution is without its hurdles. While FDIT’s 0.20% fee structure is competitive by legacy standards, Ethereum network fees can fluctuate dramatically depending on activity, sometimes eating into returns or complicating large transactions during periods of high congestion. For now, with ETH trading at $3,831.52, institutional players are absorbing these costs as part of their innovation premium.

The real test will be how quickly these products can scale beyond a handful of early adopters. Will we see pension funds or sovereign wealth managers dip their toes into tokenized government bonds? If so, expect even greater pressure on other asset managers to launch competing offerings, and perhaps even a migration toward Layer 2 solutions or alternative chains if gas costs become prohibitive.

“Fidelity’s entry marks a tipping point for institutional blockchain adoption, ” says one industry analyst. “This isn’t about crypto speculation, it’s about modernizing capital markets. ”

The Road Ahead: From Niche Product to Market Standard?

If history is any guide, we’re at the beginning, not the end, of this transformation. As more funds like FDIT and BlackRock BUIDL prove out the model at scale, regulators will have clearer blueprints for oversight while investors get increasingly comfortable with digital wrappers around familiar assets.

The next wave? Watch for tokenized versions of municipal bonds, corporate debt, or even multi-asset portfolios, all settling on public blockchains at lightning speed. Fidelity’s move makes it clear: tokenized treasuries are no longer theory, they’re investable reality.

For those ready to embrace this new era, whether you’re an institution seeking yield or an individual investor looking for transparency, the door just swung wide open.