How Tokenized T-Bills Are Revolutionizing Institutional Liquidity Management

Tokenized T-Bills are rapidly emerging as a cornerstone in the evolution of institutional liquidity management. By leveraging blockchain infrastructure, these digital representations of U. S. Treasury Bills combine the time-tested safety of government debt with the speed, transparency, and programmability of digital assets. For institutional investors navigating today’s volatile macro landscape, tokenized T-Bills are not just a technical upgrade – they represent a strategic shift in how liquidity is sourced, deployed, and optimized.

Enhanced Liquidity: From T and 2 to T-Instant

The traditional fixed income market is notorious for its settlement delays and operational friction. Conventional Treasury trades often settle on a T and 1 or T and 2 basis – meaning cash and securities change hands one or two business days after the trade date. In contrast, tokenized T-Bills enable near-instant settlement on blockchain rails. This real-time liquidity unlocks new flexibility for treasury teams and asset managers who need to respond quickly to market shifts or margin calls.

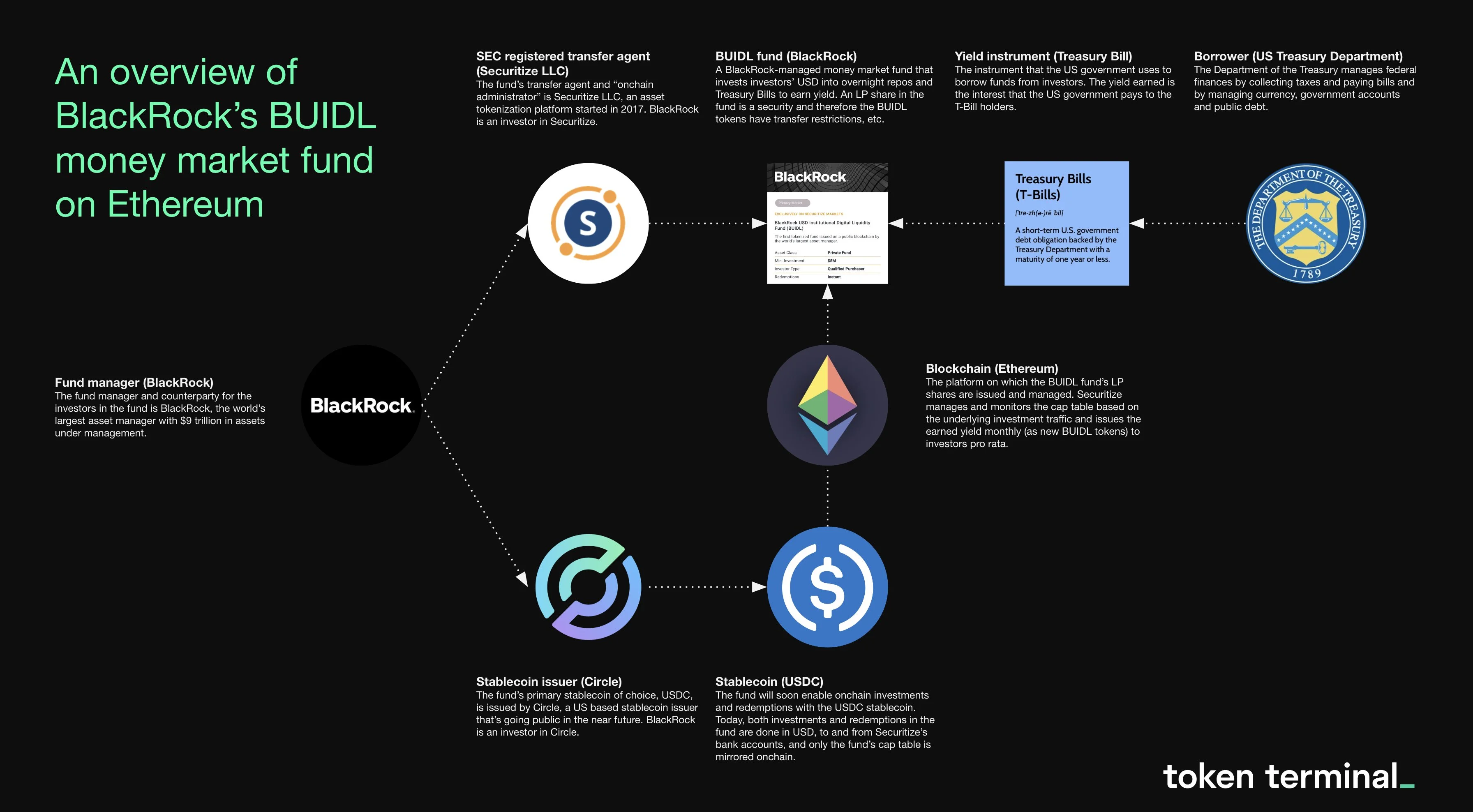

Consider BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), which has surpassed $1 billion in AUM as of June 2025 and now operates across multiple blockchains including Ethereum, Arbitrum, Avalanche, Optimism, Polygon, and Aptos (source). By tokenizing Treasury exposure and enabling seamless transfers around the clock, BUIDL gives institutions unprecedented control over their working capital.

Operational Efficiency and Cost Reduction

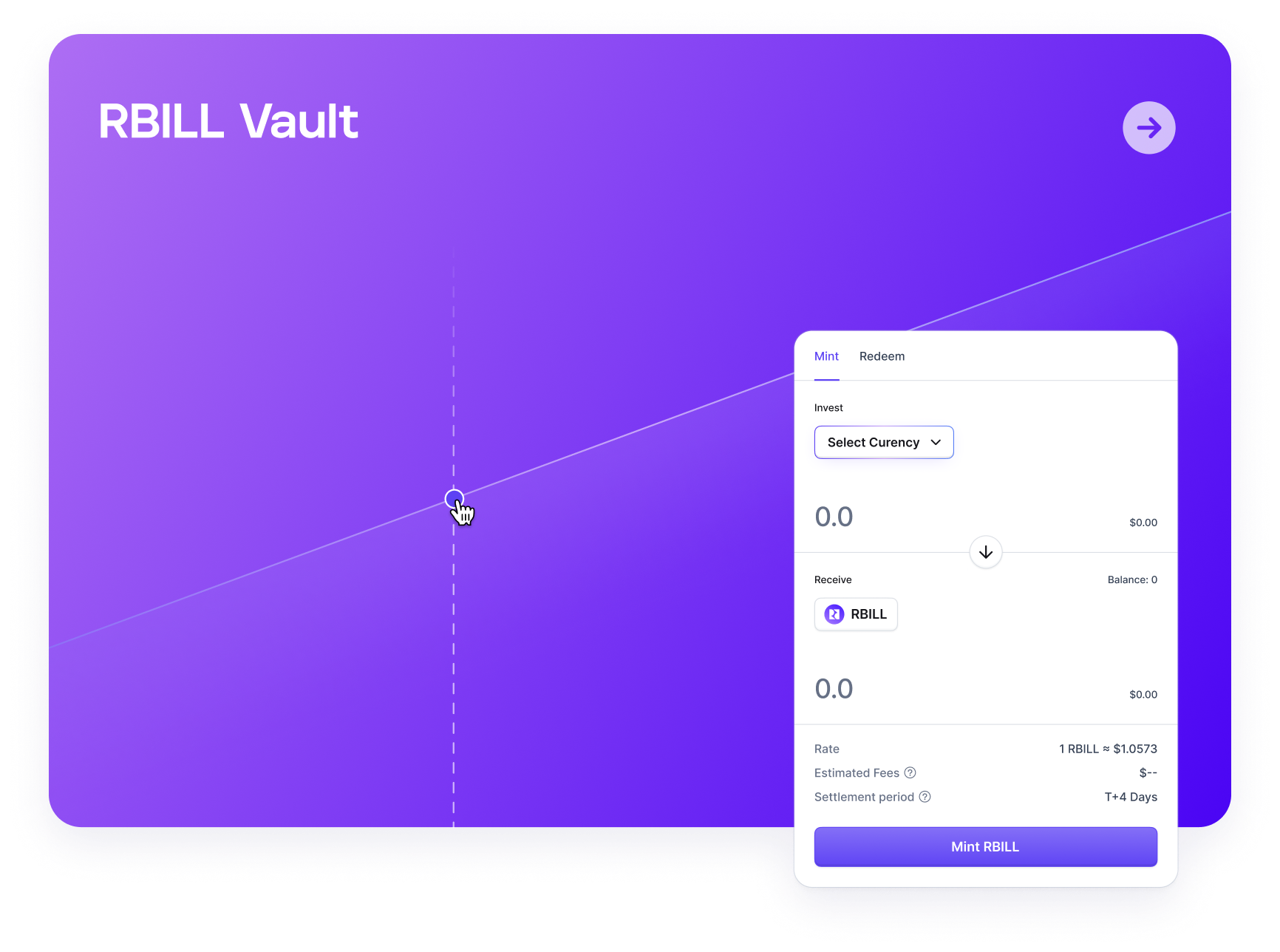

Blockchain treasury bills don’t just move faster – they also cost less to administer. Smart contracts automate much of the issuance, transfer, and redemption process that would otherwise require armies of back-office staff. The Realize T-BILLS Fund in Abu Dhabi exemplifies this next-gen approach by offering direct tokenization with zero management or performance fees (source). For institutions managing large pools of short-term cash or collateral, these savings add up quickly.

This efficiency translates into tangible advantages: reduced counterparty risk thanks to atomic settlement; lower operational overhead; and far fewer reconciliation headaches across global entities operating in different time zones.

Key Benefits of Tokenized T-Bills for Institutions

-

Enhanced Liquidity and 24/7 Accessibility: Tokenized T-Bills enable near-instant trading and settlement on blockchain platforms, allowing institutions to manage liquidity in real-time across global markets. Example: BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) operates on multiple blockchains, providing seamless, around-the-clock access.

-

Operational Efficiency and Cost Reduction: Blockchain-based tokenization streamlines issuance, trading, and settlement, minimizing administrative overhead and transaction fees. The Realize T-BILLS Fund offers a directly tokenized T-Bills fund with zero management, performance, and tokenization fees.

-

Integration with DeFi and Collateral Utility: Tokenized T-Bills can be used as collateral on DeFi platforms, enabling institutions to earn yield and enhance capital efficiency while maintaining liquidity. BUIDL tokens are accepted as collateral on Crypto.com and Deribit for trading margin requirements.

-

Rapid Market Growth and Institutional Adoption: The market for tokenized short-term funds reached $5.7 billion in assets by June 2025, reflecting strong institutional demand for these instruments and their benefits in compliance and efficiency.

-

Regulatory Compliance and Asset Security: Leading tokenized T-Bill platforms partner with established custodians and investment managers to ensure compliance and protect investor assets. OpenEden’s $TBILL Fund is managed and custodied by affiliates of The Bank of New York Mellon Corporation.

Integration with DeFi and New Use Cases

The ability to use tokenized T-Bills as programmable collateral is catalyzing entirely new financial strategies. In June 2025, BUIDL was accepted as eligible collateral on major crypto trading venues like Crypto. com and Deribit (source). This means institutions can park idle treasury allocations into yield-bearing tokens while simultaneously using them to cover margin requirements – maximizing capital efficiency without sacrificing liquidity or security.

The integration of tokenized government debt into DeFi protocols isn’t just theoretical anymore – it’s driving real-world adoption at scale. The total market for tokenized short-term funds reached $5.7 billion by June 2025 (source), reflecting broad-based demand from both crypto-native firms and traditional asset managers seeking compliance-friendly digital securities liquidity solutions.

As adoption accelerates, we’re seeing a convergence between traditional finance and digital asset infrastructure. Tokenized T-Bills are increasingly being managed and custodied by established financial institutions, providing a familiar compliance framework while leveraging the efficiency of blockchain rails. Take OpenEden’s $TBILL Fund, which appointed affiliates of The Bank of New York Mellon Corporation as investment manager and primary custodian, an example of how regulatory rigor is being woven into the digital securities ecosystem (source).

Unlocking 24/7 Liquidity and Global Mobility

The programmable nature of tokenized T-Bills means institutions can access liquidity around the clock, regardless of jurisdiction or banking hours. This is a game-changer for treasury teams that have historically been constrained by market closures, cross-border frictions, or slow-moving correspondent banking networks. Now, large asset allocators can rebalance portfolios, meet collateral calls, or seize arbitrage opportunities in real time, no more waiting for T and 2 settlement cycles.

Moreover, the composability of blockchain-based assets unlocks new possibilities for instant global collateral mobility. Tokenized T-Bills can be seamlessly moved between wallets or platforms with full auditability and without introducing additional counterparty risk. For multi-national firms or funds with complex capital structures, this means improved agility and lower systemic exposure.

The Road Ahead: Opportunities and Strategic Considerations

The rapid advance of tokenized government debt brings both opportunities and new strategic imperatives for institutional players. On one hand, early adopters are gaining access to enhanced liquidity management tools that were previously out of reach, such as 24/7 trading windows, instant settlement, and integration with DeFi lending protocols. On the other hand, questions remain around interoperability between blockchains, evolving regulatory standards across jurisdictions, and the long-term resilience of smart contract infrastructure.

Asset managers should approach this landscape pragmatically: pilot tokenized T-Bill allocations in parallel with legacy processes; work closely with regulated custodians; stress-test operational workflows; and maintain a clear focus on compliance as frameworks mature globally. The market’s surge to $5.7 billion in tokenized short-term funds as of June 2025 is just the beginning, the real transformation will unfold as more institutions reimagine their liquidity stack for a digital-first era.

Frequently Asked Questions About Tokenized T-Bills

Ultimately, tokenized T-Bills are not simply an incremental improvement, they represent a paradigm shift in how capital flows through global markets. For those willing to adapt early and strategically engage with blockchain treasury bills, the payoff will be measured not only in cost savings but also in newfound agility and competitive advantage.