How Tokenized Treasuries are Shaping the Future of DeFi Yield Strategies in 2024

Tokenized treasuries have rapidly emerged as a transformative force in decentralized finance (DeFi), fundamentally reshaping how both institutional and crypto-native investors approach yield generation in 2024. As the appetite for more stable, compliant, and transparent yield strategies grows, t-bill tokens and tokenized bonds are bridging the gap between real-world assets (RWAs) and on-chain protocols. This shift is not just theoretical: the market for tokenized U. S. Treasuries has recently surpassed the $2 billion milestone, with institutional titans like BlackRock driving adoption and liquidity. The result? A new breed of DeFi yield strategies that combine the reliability of government-backed securities with the composability and efficiency of blockchain.

How Tokenized Treasuries Power the Next Generation of DeFi Yield

At their core, tokenized treasuries are blockchain-based representations of U. S. Treasury bills and bonds. By converting these government securities into digital tokens, investors unlock 24/7 trading, instant settlement, and global accessibility, features that traditional bond markets simply cannot match. This tokenization process has enabled a new class of DeFi users to access low-risk, yield-bearing assets directly on-chain.

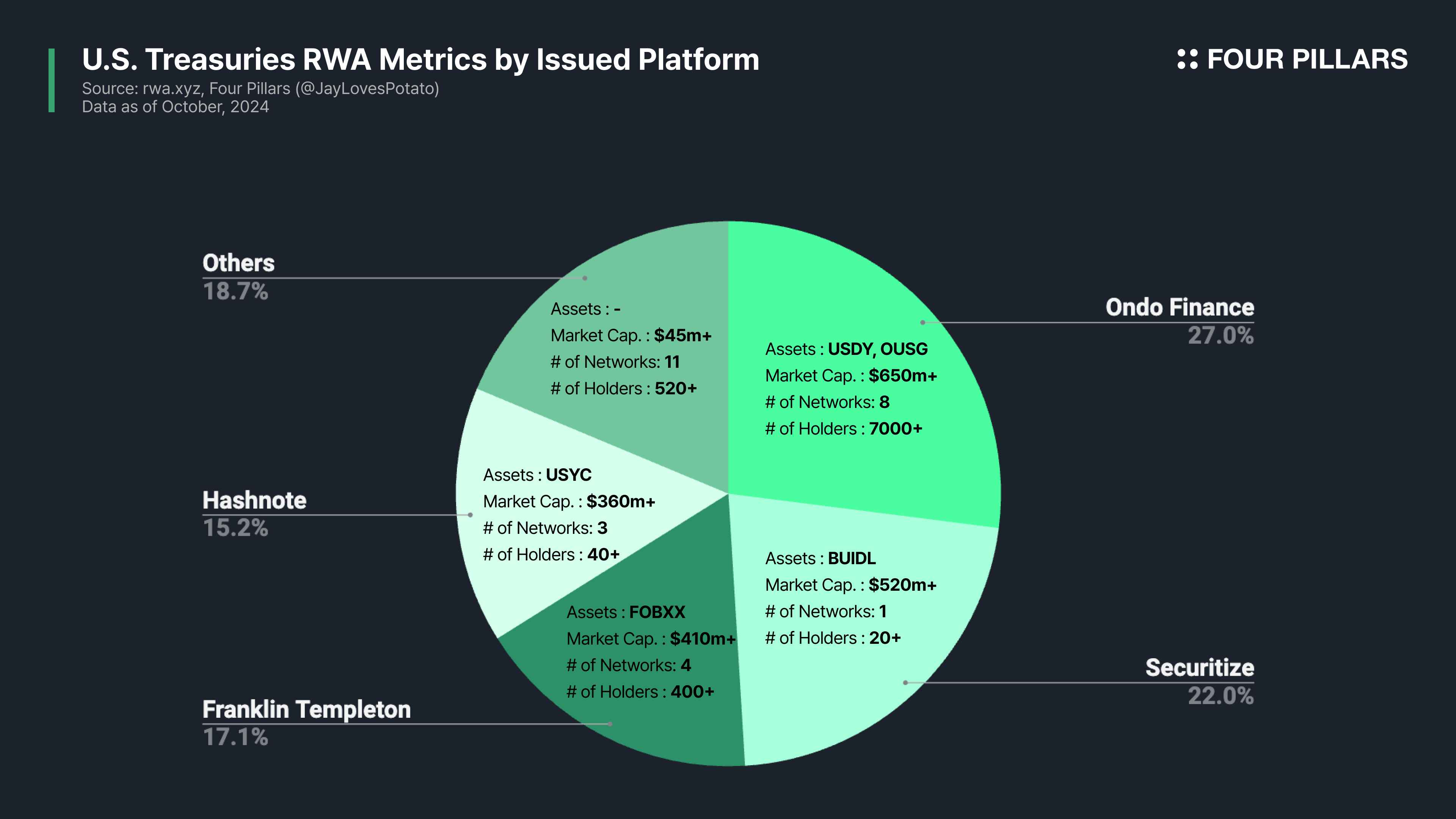

Platforms like Ondo Finance have pioneered this movement with products such as USDY and OUSG, which wrap U. S. Treasuries into ERC-20 tokens tradable across DeFi protocols. These tokens deliver yields in the mid-single digits while providing the transparency and composability demanded by crypto investors. More importantly, they serve as foundational building blocks for a range of passive income crypto strategies that prioritize capital preservation alongside yield.

Yield Farming with Tokenized Treasuries: Stable Returns Meet On-Chain Innovation

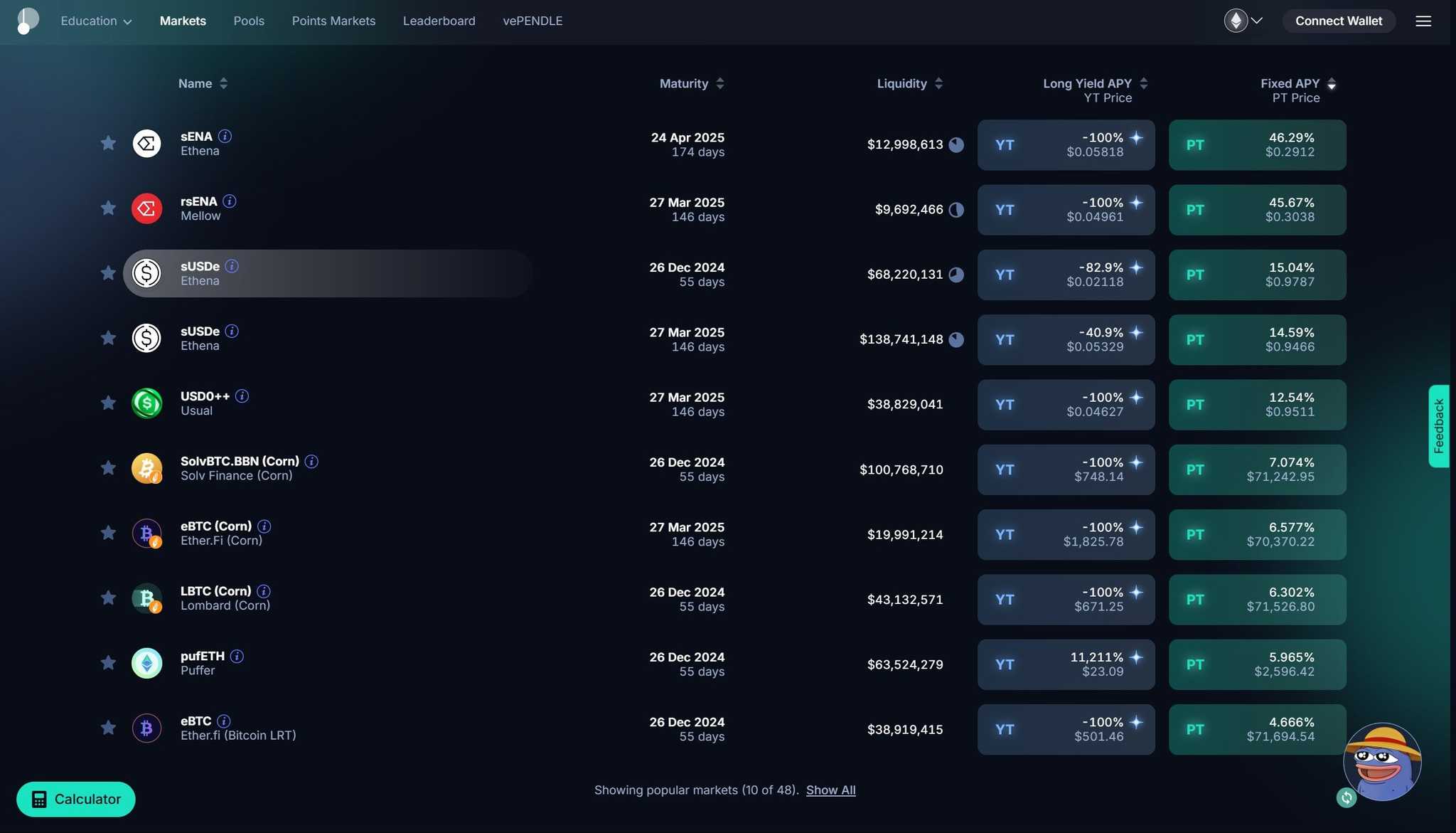

Yield farming strategies have matured beyond speculative altcoins and high-risk liquidity pools. Today’s leading protocols incorporate tokenized treasuries as core components in their yield stacks. For example, Pendle Finance enables users to stake t-bill tokens and separate their principal from future yield streams, a sophisticated approach that lets DeFi participants trade or hedge interest rate exposure while potentially boosting APYs.

This evolution means DeFi users can now pursue passive income crypto strategies anchored by real-world yield sources rather than just protocol incentives or inflationary token emissions. The result is a more sustainable ecosystem where both risk-averse and yield-seeking participants can thrive.

Top 5 DeFi Protocols Integrating Tokenized Treasuries in 2024

-

Ondo Finance leads the market with its USDY and OUSG tokens, which represent tokenized U.S. Treasuries. Ondo enables users to earn stable, mid-single-digit yields and provides seamless integration with other DeFi protocols for staking and collateralization.

-

Pendle Finance revolutionizes yield strategies by allowing users to separate and trade the principal and interest components of tokenized Treasuries. This enables innovative yield farming and APY-boosting strategies using assets like USDY and OUSG.

-

Aave has embraced tokenized Treasuries through its Horizon initiative, allowing institutions to use these assets as collateral for stablecoin loans. This integration has driven a 72% increase in lending activity and enhanced risk management for DeFi participants.

-

Backed Finance offers tokenized versions of U.S. Treasury bills (such as bIB01 and bIBTA), bridging traditional securities with DeFi. These tokens can be used for lending, collateral, and yield generation across multiple protocols.

-

BlackRock BUIDL Fund represents a major institutional entry into DeFi, with over $3 billion in tokenized U.S. Treasuries by mid-2025. BUIDL tokens are used as collateral in DeFi protocols, providing 24/7 liquidity and real-time settlement for institutional and retail investors alike.

Regulatory Clarity and the Path Forward

One of the most significant tailwinds for tokenized treasuries in DeFi is the increasing regulatory clarity provided by frameworks such as the U. S. SEC’s 2024 roundtable on tokenization and the EU’s MiCA regime. This regulatory alignment is critical for institutional adoption: it reduces the risk of abrupt policy shifts and legitimizes blockchain fixed income products as durable portfolio components.

As tokenized RWAs reach $30 billion globally and more institutions allocate directly into on-chain treasury tokens without relying on legacy intermediaries, the distinction between traditional finance and DeFi continues to blur. The future of DeFi yield strategies will be defined by this convergence, where transparency, efficiency, and risk management are not just buzzwords but operational realities for every investor.

Regulatory momentum is also fueling secondary market innovation. With clearer compliance rails, platforms are rolling out features like permissioned pools and whitelisted access, making it easier for institutional capital to participate without sacrificing DeFi’s hallmark efficiency. This is especially relevant for funds and family offices seeking exposure to blockchain fixed income but requiring robust KYC and AML controls. The result: a new class of compliant, high-liquidity DeFi products powered by tokenized treasuries.

“Tokenized treasuries are not just another crypto yield fad, they’re the connective tissue bringing real-world yield into programmable finance. The liquidity, transparency, and accessibility they unlock are fundamentally changing how institutions think about on-chain investing. ”

The composability of on-chain treasury tokens is also driving new forms of collateralization. DeFi lending markets like Aave’s Horizon now accept t-bill tokens as collateral, allowing borrowers to access stablecoins with lower liquidation risk compared to volatile crypto assets. This has led to a spike in loan-to-value ratios and a 72% increase in lending volumes in Q1 2025 alone, demonstrating that real world assets DeFi strategies can scale without compromising risk management.

What’s Next for Tokenized Treasuries in DeFi?

The path forward points to even deeper integration between traditional financial instruments and decentralized protocols. As tokenized bonds and T-bill tokens become foundational building blocks for passive income crypto portfolios, expect further innovation around structured products, automated portfolio managers, and cross-chain interoperability.

For investors eager to explore these opportunities or compare leading protocols, resources like our in-depth guide provide actionable insights into yield optimization using tokenized U. S. Treasuries. Staying informed is crucial as new entrants and evolving regulations continue to shape the landscape.

Top 5 Advantages of Tokenized Treasuries in DeFi Yield Strategies

-

1. Enhanced Collateralization and Lower RiskTokenized Treasuries are increasingly used as collateral on DeFi lending platforms like Aave, improving loan-to-value ratios and reducing liquidation risks. This enables safer borrowing and lending, as seen with Aave’s Horizon initiative, which blends KYC compliance with on-chain efficiency.

-

2. Stable and Predictable Yield GenerationPlatforms such as Ondo Finance offer tokenized U.S. Treasuries like USDY and OUSG, providing mid-single digit yields. These products allow DeFi users to earn consistent returns, reducing exposure to crypto market volatility.

-

3. Increased Institutional ParticipationMajor players like BlackRock have entered the space with products such as the BUIDL fund, which reached $3 billion in AUM by mid-2025. This institutional adoption boosts liquidity, trust, and overall market maturity in DeFi.

-

4. 24/7 Global Liquidity and Real-Time SettlementTokenized Treasuries enable round-the-clock trading and instant settlement on public blockchains, unlike traditional markets. This provides DeFi participants with unmatched flexibility and access to liquidity across time zones.

-

5. Improved Regulatory Clarity and ComplianceRecent regulatory developments, including the U.S. SEC’s 2024 roundtable and the EU’s MiCA framework, have increased legal certainty for tokenized Treasuries. This encourages broader adoption by both retail and institutional investors, fostering a more stable DeFi ecosystem.

Ultimately, the rise of tokenized treasuries signals a paradigm shift: fixed-income investing is no longer confined to Wall Street hours or legacy infrastructure. By blending the trust of government-backed securities with the programmability of smart contracts, blockchain fixed income is democratizing access to stable yield on a global scale. Whether you’re an institution allocating billions or an individual seeking passive income, the future of DeFi yield strategies will be built on this powerful convergence.