How Tokenized Treasuries Unlock Cross-Border Investment Opportunities

Tokenized Treasuries are transforming the landscape of cross-border investment, offering institutional and individual investors unprecedented access to U. S. government bonds through blockchain technology. By digitizing government securities, tokenized treasuries bridge the gap between traditional finance and the global digital asset ecosystem. The result: enhanced accessibility, liquidity, and efficiency for investors worldwide.

Global Access to Government Bonds Through Tokenization

The U. S. Treasury market has long been a bedrock of global finance, but traditional barriers such as high minimum investment sizes, settlement delays, and complex cross-border procedures have limited access for many international participants. Tokenization fundamentally changes this dynamic. By issuing fractionalized digital tokens representing U. S. Treasuries on blockchain platforms, investors can now purchase smaller portions of these assets, lowering entry barriers and democratizing participation in one of the world’s most liquid markets.

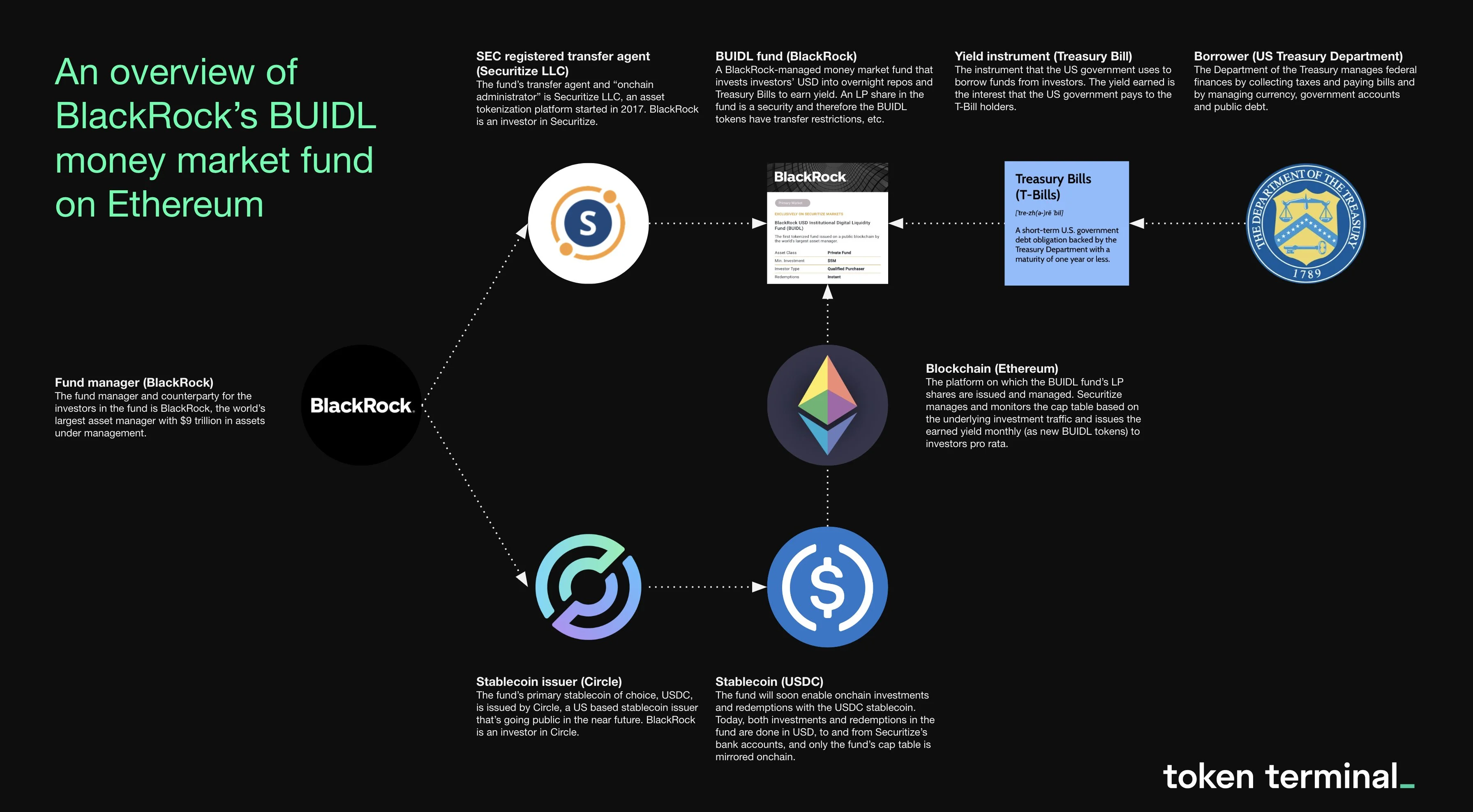

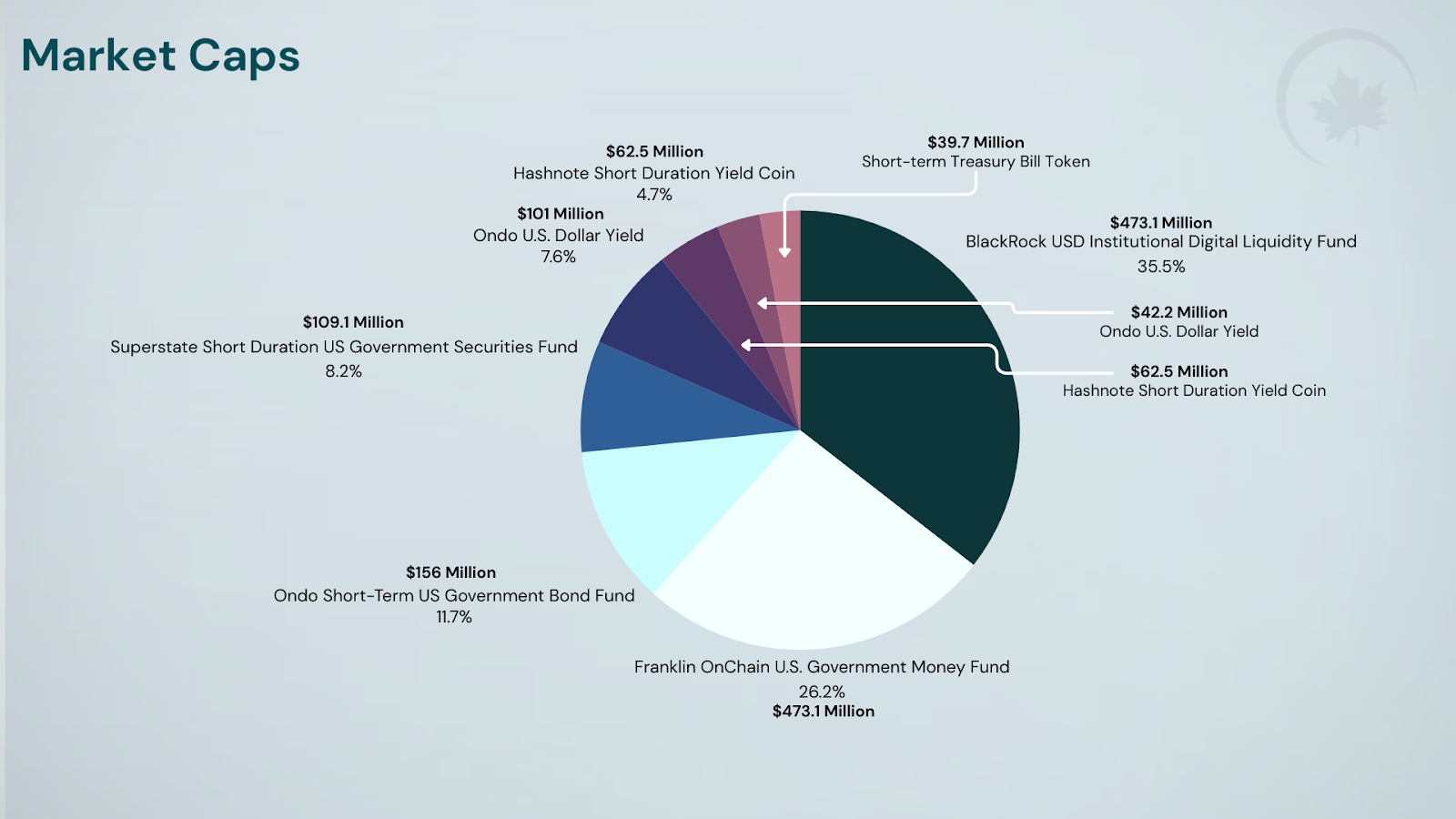

This approach is gaining momentum as platforms like Abu Dhabi’s Realize T-BILLS Fund and BlackRock’s BUIDL Fund demonstrate real-world applications. For example, the Realize T-BILLS Fund converts investments in U. S. Treasury-focused ETFs into digital tokens tradable on blockchain networks, aiming for a $200 million fund size and enabling seamless cross-border participation (Reuters).

Liquidity and 24/7 Trading: A New Paradigm for International Investing

Traditional bond markets operate within rigid timeframes and rely on intermediaries for settlement, a process that can take days when moving funds across borders or converting currencies. With tokenized treasuries, these constraints are rapidly dissolving. Digital tokens can be traded 24/7 on blockchain-based platforms, allowing investors to enter or exit positions at any time with minimal friction.

This increased liquidity is particularly valuable in volatile markets or for portfolio managers seeking tactical flexibility across jurisdictions. Moreover, by minimizing intermediaries, blockchain solutions significantly reduce transaction costs, a critical advantage for cross-border trades that typically involve multiple layers of fees (ChainUp).

Key Benefits of Tokenized Treasuries for Cross-Border Investors

-

Enhanced Accessibility: Tokenization enables fractional ownership of U.S. Treasuries, allowing investors worldwide to participate with smaller capital amounts, lowering traditional entry barriers.

-

Improved Liquidity: Tokenized Treasuries can be traded 24/7 on blockchain platforms, offering faster settlement and easier entry or exit compared to traditional bond markets.

-

Reduced Transaction Costs: Blockchain infrastructure minimizes intermediaries, resulting in lower transaction fees for cross-border investors compared to conventional processes.

-

Global Reach and Borderless Access: Platforms like the Realize T-BILLS Fund in Abu Dhabi and BlackRock’s BUIDL Fund on Ethereum allow international investors to access U.S. Treasury exposure without geographic restrictions.

-

Regulatory Momentum and Institutional Adoption: Growing regulatory frameworks and high-profile initiatives (e.g., BlackRock’s BUIDL Fund) are increasing confidence and participation from institutional investors in cross-border tokenized treasury markets.

Regulatory Progress and Harmonization Drive Institutional Confidence

The rise of tokenized treasuries is not just a technological story, it’s also a regulatory one. Global regulators are increasingly recognizing the need for harmonized frameworks that facilitate safe cross-border trading while protecting investor interests (Katten Muchin Rosenman LLP). Initiatives like Project Guardian (led by the Monetary Authority of Singapore) are exploring stablecoin-based payments infrastructure to further streamline international securities transactions.

This regulatory progress underpins growing institutional confidence in tokenized government bonds as a legitimate fixed-income vehicle with borderless reach.

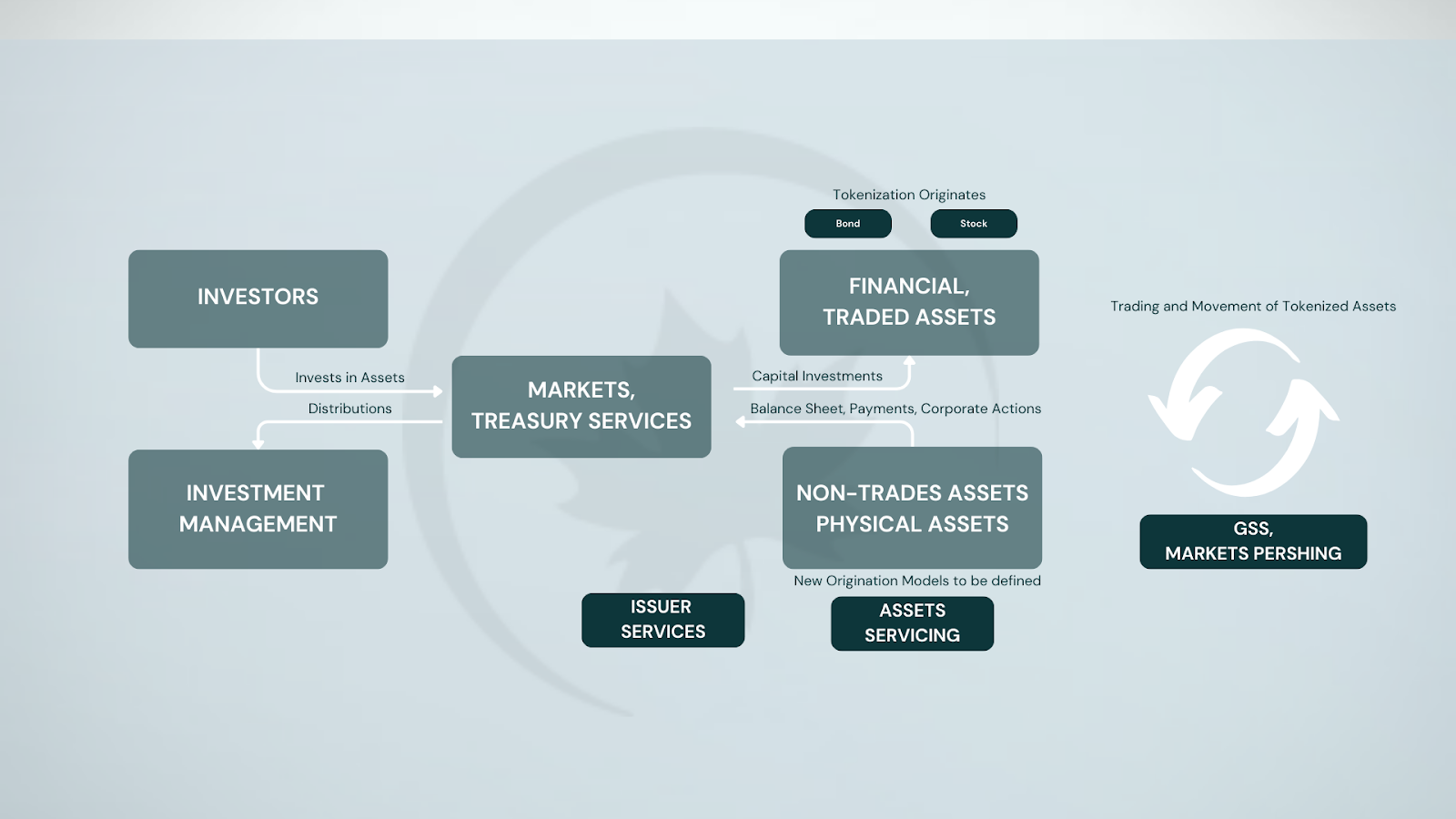

As more regulated platforms emerge, institutional investors are increasingly comfortable allocating capital to tokenized treasuries. The presence of established players such as BlackRock, which launched its BUIDL Fund on Ethereum, signals a shift from experimentation to mainstream adoption. These developments are not only expanding the market for U. S. government debt but also setting new standards for transparency and auditability in global fixed income.

One of the most transformative aspects of tokenized treasuries is their ability to facilitate real-time settlement and instant ownership transfer. Traditional cross-border bond transactions often require multiple days and involve several custodians and clearinghouses, each adding complexity and cost. Blockchain-based settlement compresses these timelines dramatically, allowing investors from Tokyo to Toronto to New York to transact seamlessly in minutes rather than days.

Real-World Use Cases: Institutional and Retail Participation

The borderless nature of tokenized government bonds is already attracting a diverse set of participants. Institutional investors can now access U. S. Treasuries without navigating cumbersome legacy systems or establishing costly local accounts. At the same time, retail investors in emerging markets gain exposure to high-grade sovereign debt with small ticket sizes previously out of reach. This democratization of access is reshaping global portfolio construction and risk management strategies.

Challenges Ahead: Interoperability and Standardization

Despite the rapid progress, several hurdles remain before tokenized treasuries become ubiquitous in cross-border investing. Interoperability between different blockchains, alignment on data standards, and continued regulatory harmonization will be essential for scaling adoption globally. Market participants must also address operational risks such as smart contract vulnerabilities and ensure robust investor protection mechanisms are in place.

“Tokenized treasuries offer a glimpse into a future where global capital flows are frictionless and transparent. ”

The market’s trajectory points toward increasing integration with traditional finance infrastructure as well as new digital-native products that leverage programmable features unique to blockchain technology. As regulatory clarity improves and technical standards mature, expect tokenized treasuries to play an even greater role in facilitating efficient cross-border capital allocation.

Key Takeaways for International Investors

-

Fractional Ownership Increases Accessibility: Tokenized U.S. Treasuries allow investors to purchase small fractions of government bonds, lowering entry barriers and enabling participation from a broader global audience.

-

Enhanced Liquidity via Blockchain: Digital tokens representing Treasuries can be traded 24/7 on blockchain platforms, making it easier to enter or exit positions without traditional market delays.

-

Lower Transaction Costs: Blockchain-based transactions reduce reliance on intermediaries, cutting fees and making cross-border investments more cost-effective.

-

Institutional Adoption Demonstrates Credibility: Major players like BlackRock (with its BUIDL Fund on Ethereum) and Abu Dhabi’s Realize T-BILLS Fund are actively offering tokenized U.S. Treasury products, signaling growing trust and market maturity.

-

Regulatory Evolution Supports Growth: Ongoing advancements in regulatory frameworks are fostering a safer, more transparent environment for cross-border tokenized investments.

-

Rapid Market Expansion: The tokenized U.S. Treasuries market is projected to grow substantially, driven by technological innovation and increasing institutional participation.

For those seeking secure yield, diversification, or simply a foothold in the next era of international investing, tokenized treasuries represent a compelling blend of safety, efficiency, and accessibility. By bridging national borders with code rather than paperwork, these digital assets are poised to redefine how the world invests in government bonds.