How Tokenized Treasury Bills Are Transforming Institutional Fixed-Income Portfolios

Institutional fixed-income investing is undergoing a seismic shift, and it’s happening at the intersection of blockchain technology and government debt. Tokenized treasury bills, digital representations of short-term U. S. government securities on blockchain networks, are rewriting the rules for liquidity, transparency, and portfolio agility. What was once a staid corner of finance is now a hotbed of innovation, with real-time settlement, 24/7 trading, and programmable assets making headlines.

Why Tokenized Treasury Bills Are Gaining Traction

Let’s face it: traditional T-bill markets are slow. Settlement delays can tie up capital for days, and trading hours are limited to legacy market windows. Enter tokenized treasury bills. By leveraging blockchain rails, these digital securities allow instant settlement and round-the-clock access. For institutional investors managing billions in fixed income, that flexibility is game-changing.

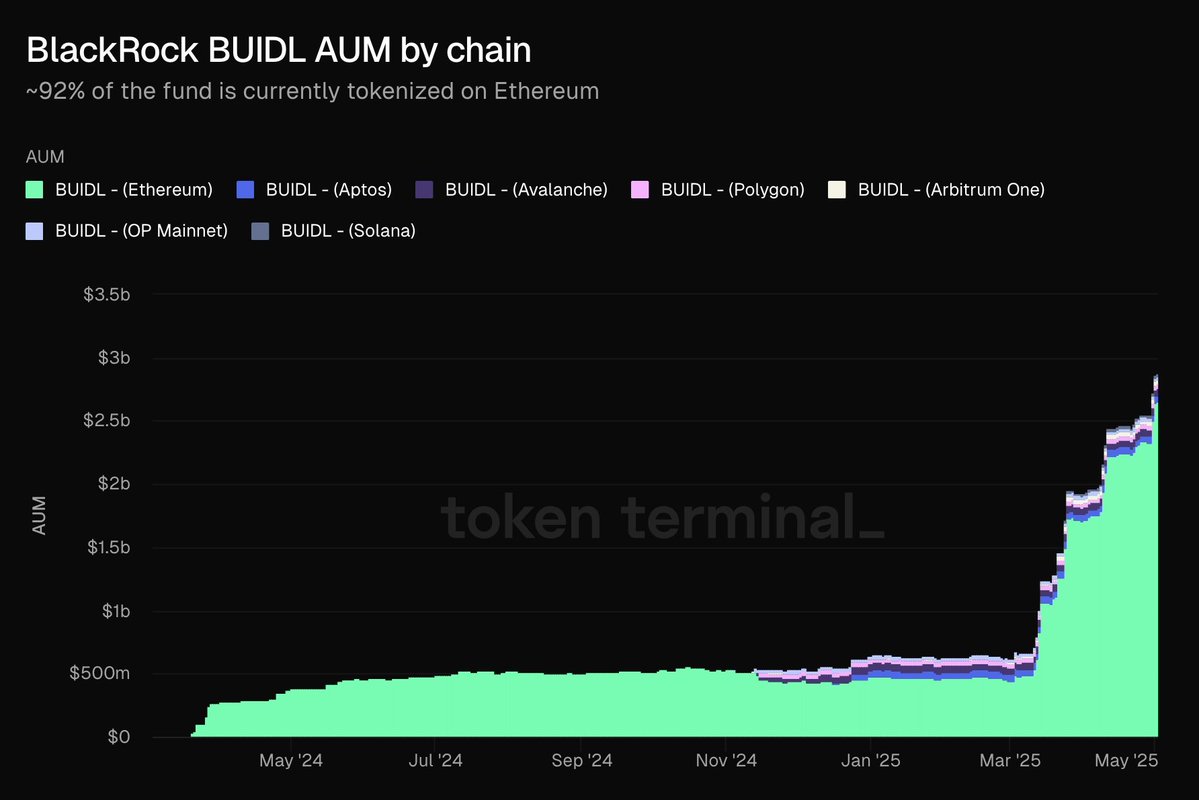

The numbers speak volumes. Platforms like OpenEden’s $TBILL fund have already surpassed $50 million in total value locked, a clear sign that institutions are taking on-chain yield seriously (source). Meanwhile, BlackRock’s BUIDL fund has demonstrated how tokenizing U. S. Treasury bonds and repurchase agreements can empower dynamic portfolio rebalancing in response to market shifts (source).

The Mechanics: How Tokenized T-Bill Platforms Work

So what’s actually happening under the hood? At its core, tokenization converts rights to real-world assets, like U. S. Treasury bills, into digital tokens that live on secure blockchains. Custodians such as BNY Mellon hold the underlying T-bills in regulated vaults while issuing tokens that represent proportional ownership (source). Investors can buy, sell, or use these tokens as collateral across DeFi platforms or within their institutional workflows.

This approach brings several key benefits:

Top 5 Advantages of Tokenized Treasury Bills for Institutions

-

1. Enhanced Liquidity & 24/7 TradingTokenized T-bills allow real-time settlement and round-the-clock trading, unlike traditional markets with limited hours and settlement delays. For example, BlackRock’s BUIDL fund enables dynamic portfolio rebalancing in response to market shifts.

-

2. Cost Efficiency & Fractional OwnershipTokenization reduces intermediary fees and enables fractional investment in T-bills, making them more accessible. OpenEden’s $TBILL fund has surpassed $50 million in total value locked, reflecting growing institutional adoption.

-

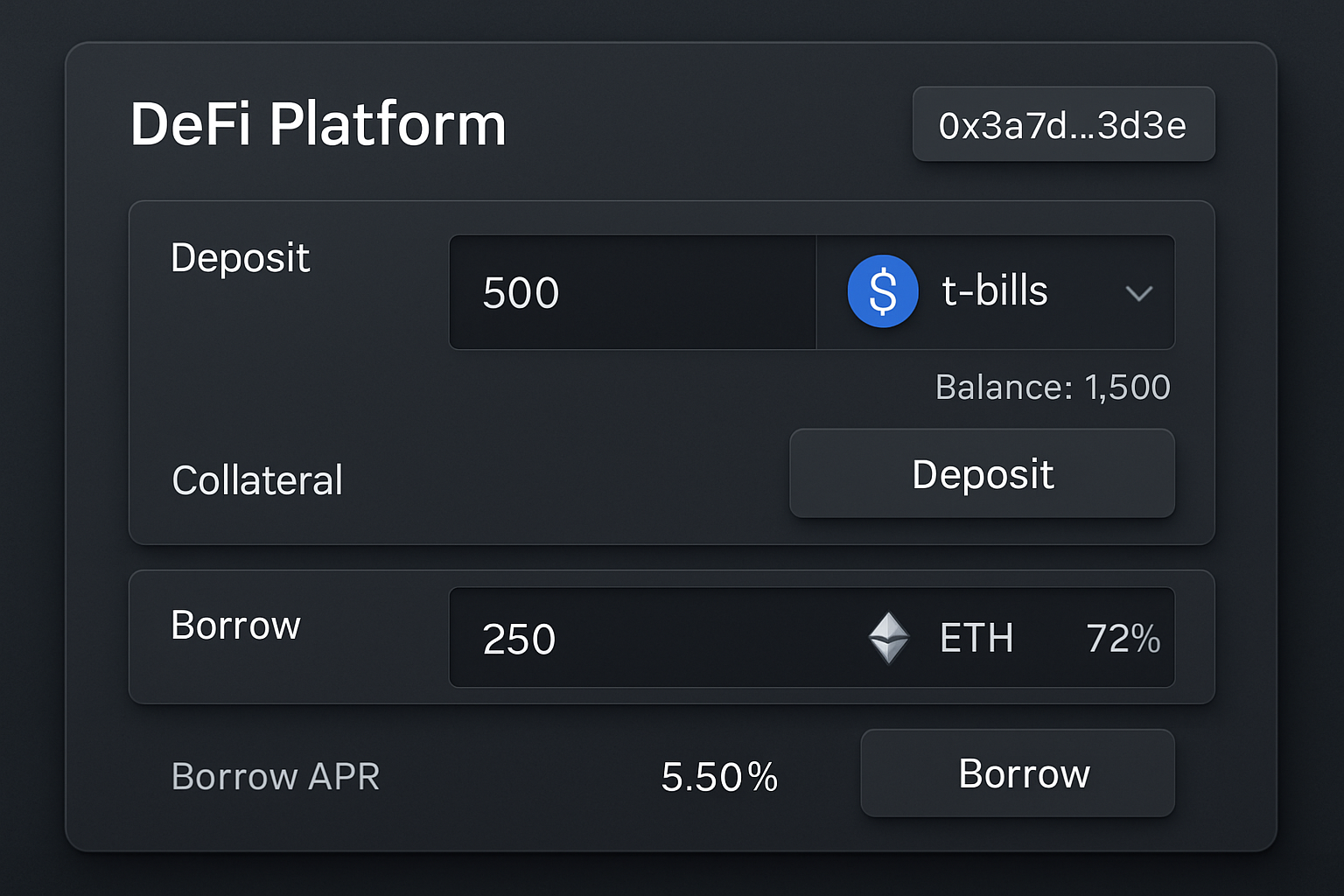

3. Seamless Integration with DeFi PlatformsTokenized T-bills can be used as collateral for lending and staking on DeFi platforms, bridging traditional finance and decentralized finance for new institutional yield opportunities.

-

4. Improved Transparency & SecurityBlockchain technology provides immutable records and transparent ownership tracking, reducing operational risks and enhancing trust for institutional investors.

-

5. Regulatory Support & Institutional-Grade RatingsGrowing regulatory clarity and ratings from agencies like Moody’s (which gave an ‘A’ rating to OpenEden’s $TBILL fund) are boosting institutional confidence in tokenized treasuries.

Fractional ownership is especially noteworthy; it enables investors to access T-bill exposure with much smaller minimums than traditional products allow. This democratizes access while preserving the safety and yield profile of government debt.

From Wall Street to Web3: Integration With DeFi Ecosystems

The most exciting frontier? Integration with decentralized finance (DeFi). Tokenized T-bills aren’t just held passively, they’re being plugged into lending protocols and staking pools to generate additional yield streams or serve as pristine collateral. This bridges two worlds: the stability of U. S. government debt and the programmability of smart contracts.

This isn’t just theoretical anymore; funds like OpenEden’s $TBILL have received an investment-grade ‘A’ rating from Moody’s (source). Regulatory clarity is finally catching up with technical innovation, and that’s accelerating adoption among banks, asset managers, and fintech disruptors alike.

The New Playbook for Institutional Fixed-Income Portfolios

Tokenized treasury bills are more than just a new wrapper for old assets, they’re a catalyst for rethinking risk management, liquidity provision, and cross-border capital flows in institutional portfolios.

With programmable settlement and real-time auditability, blockchain treasuries are streamlining compliance for institutional investors. Automated reporting and on-chain proof of reserves provide transparency that legacy custodians simply can’t match. This level of visibility is crucial for large asset managers who must answer to regulators and clients in an increasingly complex risk environment.

The composability of t-bill tokens also unlocks new strategies. Imagine a portfolio manager instantly swapping exposure between digital securities for institutions, or deploying idle cash into tokenized T-bills as overnight collateral, all without the friction of traditional clearing systems. The ability to move in and out of positions 24/7, with atomic settlement, is fundamentally changing how liquidity desks operate.

Challenges and amp; What’s Next: Scaling Tokenized Treasury Bill Adoption

Of course, the road ahead isn’t without obstacles. Institutional fixed-income investing must grapple with interoperability between blockchains, evolving regulatory frameworks across jurisdictions, and the need for robust custody solutions. While platforms like OpenEden’s $TBILL vault have set a high bar by working with blue-chip custodians and earning top-tier ratings (source), industry-wide standards are still emerging.

Yet the momentum is undeniable. According to EY, 64% of high-net-worth investors and 33% of institutional investors plan to allocate to tokenized bonds by the end of 2024 (source). As more DeFi-native protocols integrate with regulated issuers, expect new products that blend yield optimization with real-world stability, a combination that’s hard to ignore in today’s rate environment.

Top 5 Reasons Institutions Are Embracing Blockchain Treasuries

-

1. Enhanced Liquidity and 24/7 Trading: Tokenized U.S. Treasury bills enable real-time settlement and round-the-clock trading, unlike traditional T-bill markets with limited hours and delayed settlements. BlackRock’s BUIDL fund exemplifies this by allowing dynamic portfolio rebalancing at any time.

-

2. Cost Efficiency and Fractional Ownership: Blockchain treasuries reduce intermediary fees and make fractional ownership possible, increasing accessibility for a broader range of investors. OpenEden’s $TBILL fund has surpassed $50 million in total value locked, showcasing institutional trust in on-chain yield.

-

3. Seamless Integration with DeFi Platforms: Tokenized T-bills are increasingly used as collateral for lending and staking in decentralized finance (DeFi), bridging traditional and digital finance. This integration opens new yield opportunities for institutions. DeFi platforms now routinely support tokenized treasury products.

-

4. Regulatory Support and Institutional-Grade Ratings: Growing regulatory clarity and oversight have boosted institutional confidence. OpenEden’s $TBILL fund, for example, earned an investment-grade ‘A’ rating from Moody’s, signaling mainstream acceptance of tokenized treasuries. BNY Mellon also provides custody for tokenized treasury products.

-

5. Improved Accessibility and Global Reach: Tokenized treasuries allow global investors to access U.S. debt markets without the need for intermediaries or complex settlement processes. This democratizes access and enables institutions worldwide to diversify their fixed-income portfolios efficiently.

The next leap will likely involve seamless bridges between traditional trading platforms and on-chain markets. When portfolio managers can rebalance across both realms without operational headaches or compliance concerns, fixed-income will finally catch up with the digital age.

Rethinking Yield, Liquidity and amp; Access

If you’re an institutional allocator or treasury professional, the message is clear: tokenized treasury bills aren’t just a curiosity anymore, they’re setting new benchmarks for efficiency and access in global finance. Whether you’re looking for instant liquidity windows, reduced transaction costs, or novel DeFi integrations, these digital assets deliver a toolkit that simply didn’t exist five years ago.

The most forward-thinking funds aren’t just dipping their toes in; they’re actively building strategies around t-bill tokens as core liquidity anchors. As regulatory certainty grows and technical standards mature, tokenized treasuries will likely become table stakes for sophisticated fixed-income portfolios worldwide.