How Tokenized US Treasuries Became the Fastest-Growing On-Chain Asset in 2025

In 2025, a seismic shift has taken place in the world of fixed income: tokenized US Treasuries have become the fastest-growing on-chain asset class, with market capitalization surging to an unprecedented $8.7 billion as of November. This remarkable ascent is not a fluke or a fleeting trend; it is the result of deep structural changes in both traditional finance and blockchain ecosystems. The convergence of institutional adoption, technological innovation, and evolving investor preferences has propelled tokenized Treasuries into the spotlight, offering a blend of security, liquidity, and programmability that legacy instruments simply cannot match.

Institutional Giants Drive On-Chain Treasury Growth Past $8.7 Billion

The landscape in 2025 is defined by heavyweight financial institutions embracing blockchain infrastructure at scale. BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) leads the pack with $2.85 billion in assets under management. Not far behind are Franklin Templeton’s BENJI fund ($865 million) and Circle’s USYC ($866 million). Perhaps most telling is Fidelity’s quiet yet decisive entry: its Digital Interest Token (FDIT), launched on Ethereum in August 2025, amassed over $232 million within months.

This wave of adoption signals more than just experimentation; it marks a turning point where real-world assets (RWAs) are now integral to on-chain finance. Institutions are no longer watching from the sidelines, they’re actively building products that marry regulatory compliance with blockchain-native settlement. As reported by Cointelegraph, over 57% of these assets reside on Ethereum, underscoring its dominance as the preferred network for secure and transparent tokenization.

The Rise of On-Chain Yield: Why Investors Are Flocking to Tokenized T-Bill Tokens

The appeal isn’t just about novelty or blockchain hype; it’s grounded in fundamentals. Investors are increasingly seeking low-risk yield options amid persistent macroeconomic uncertainty. Tokenized T-bill tokens offer exposure to short-duration US government debt, one of the world’s safest assets, while delivering a seven-day average yield (APY) around 3.72%. This compares favorably to most traditional savings accounts and even some money market funds.

- Transparency: Every transaction and ownership change is recorded immutably on-chain.

- Liquidity: Programmable smart contracts enable near-instant settlement and collateralization across DeFi protocols.

- Accessibility: Global investors can access these products 24/7 without relying on legacy banking rails or intermediaries.

The integration into mainstream financial workflows has been equally transformative. Platforms like J. P. Morgan’s Onyx Tokenized Collateral Network (TCN) have moved from pilot projects to live production environments, enabling intra-day pledging and release of tokenized MMF shares as collateral, with programmable conditions that simply aren’t possible off-chain.

The Technological Foundations: Why Ethereum Dominates Tokenized Treasuries

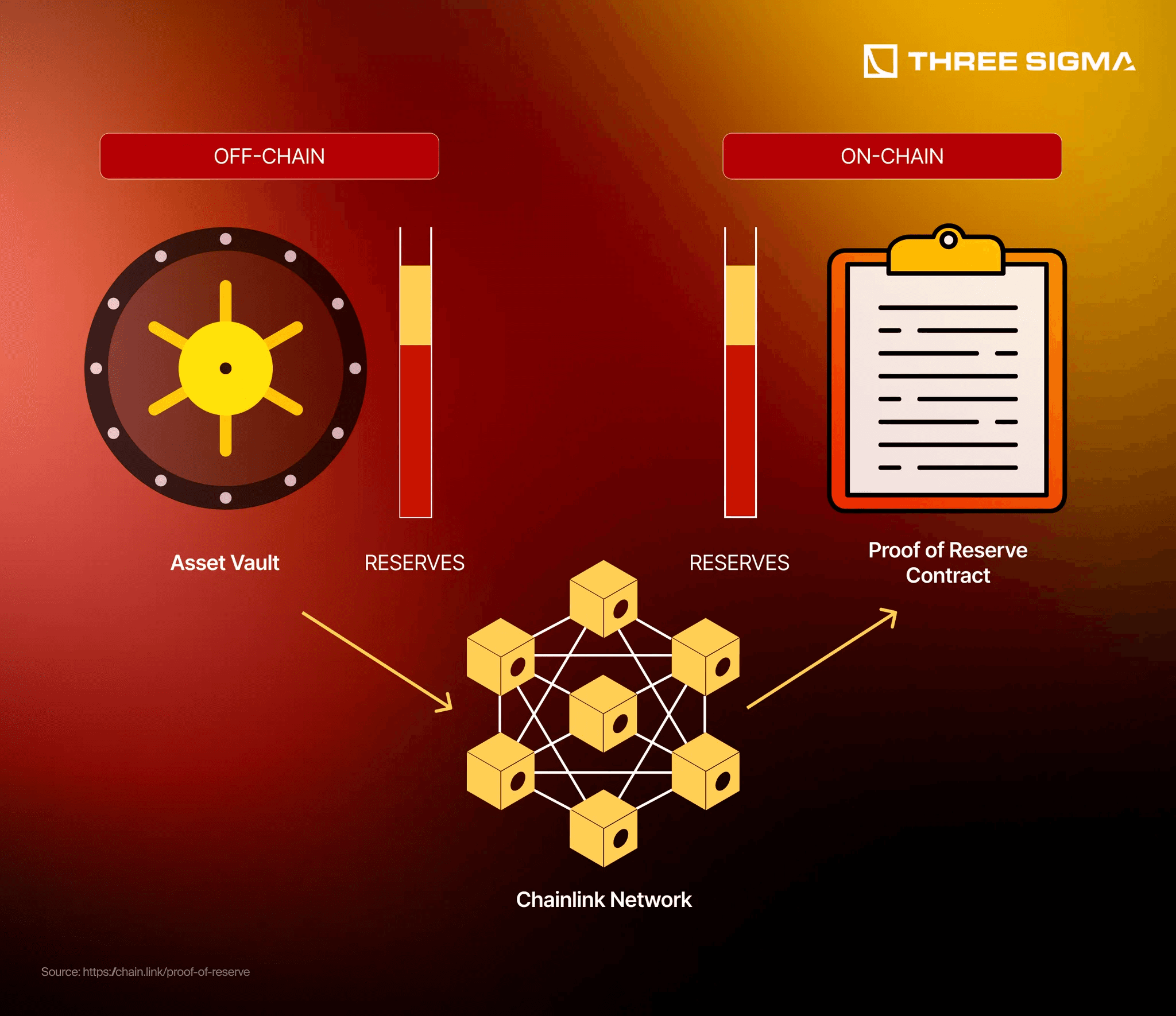

The technical backbone supporting this growth is robust, and increasingly battle-tested. According to recent data, Ethereum hosts roughly 57.5% of all tokenized US Treasuries due to its mature ecosystem for security audits, decentralized validation, and interoperability with DeFi protocols. This preference reflects both risk management priorities for institutions and demand for composability among crypto-native investors.

Other blockchains are making inroads, Solana and Polygon among them, but Ethereum remains the gold standard for now thanks to its network effects and proven resilience under institutional-grade workloads.

The result? A historic moment where regulated financial giants like BlackRock, Franklin Templeton, Circle, Ondo Finance, and Fidelity are not only legitimizing but accelerating on-chain fixed-income markets at scale, a development that would have seemed improbable just two years ago.

Looking forward, the implications of this transformation reach well beyond simple product innovation. By bridging the liquidity and regulatory assurances of U. S. Treasuries with the transparency and efficiency of blockchain, tokenized treasuries are reshaping global capital markets from the ground up. The integration of these on-chain assets into repo markets, credit facilities, and cross-border settlements is fundamentally altering how institutions manage risk and access yield.

Crucially, programmable settlement, enabled by smart contracts, has unlocked new efficiencies for collateral management. With platforms like J. P. Morgan’s Tokenized Collateral Network (TCN) now live, institutional investors can pledge and release tokenized money market fund shares intra-day, automating workflows that once required days or even weeks to process. This capability offers a significant edge in rapidly moving markets where speed and certainty are paramount.

Meanwhile, DeFi protocols are evolving to welcome these institutional-grade assets as pristine collateral. The ability to use tokenized US Treasuries in lending, derivatives, and liquidity pools is driving a new wave of composability between traditional finance (TradFi) and decentralized finance (DeFi). As a result, we’re seeing the emergence of hybrid financial systems where regulated entities interact directly with on-chain infrastructure, often for the first time.

A New Era for Safe-Haven Yield: Market Cap Surges to $8.7 Billion

The scale is undeniable: with $8.7 billion in tokenized US Treasuries now circulating on public blockchains as of November 2025, the asset class has officially outpaced most other real-world asset categories in terms of growth rate and adoption. For perspective, this figure represents a nearly tenfold increase since early 2023, a testament to both surging demand for digital safe havens and the maturation of supporting legal frameworks.

Market participants are quick to note that this growth isn’t solely about yield; it’s about trust. On-chain T-bill tokens offer a unique blend of regulatory clarity (backed by major asset managers), real-time auditability via public ledgers, and operational flexibility through 24/7 market access. This combination has proven especially attractive during periods of volatility in both crypto and broader macro markets.

For those seeking further insight into how these trends have made tokenized treasuries a preferred safe haven for institutions during periods of crypto volatility, see our deep dive here.

What’s Next? Challenges and Opportunities on the Road Ahead

Despite their meteoric rise, tokenized US Treasuries still face hurdles before reaching full mainstream acceptance. Regulatory harmonization across jurisdictions remains a work in progress; questions around secondary market liquidity and interoperability between chains persist as well. Yet if current momentum holds, and all signs point to further acceleration, these obstacles appear surmountable.

The next phase will likely see even deeper integration with global payment systems, expansion onto additional blockchains optimized for institutional use cases, and more sophisticated on-chain analytics tools for risk management. As these innovations unfold, expect continued collaboration between TradFi giants and crypto-native pioneers, a dynamic that will shape not only fixed-income investing but also the very architecture of tomorrow’s financial system.