How Tokenized US Treasuries Enable 24/7 Global Dollar Access & On-Chain Yield

Imagine a world where access to U. S. Treasuries is as simple and continuous as sending an email. Thanks to blockchain innovation, that’s no longer a fantasy. Tokenized US Treasuries are redefining how investors worldwide tap into the security and yield of government bonds, no matter the hour or geography.

From Wall Street Hours to 24/7 Global Markets

The traditional Treasury market is bound by business hours and regional intermediaries, putting up walls for anyone outside the usual system. Now, with blockchain-based treasury tokens, these barriers are crumbling. Platforms like Ondo Finance have pioneered digital assets such as USDY, which represent short-term U. S. Treasuries and bank demand deposits. These tokens can be traded around the clock, giving investors in Asia, Europe, or Africa the same real-time access as those stateside.

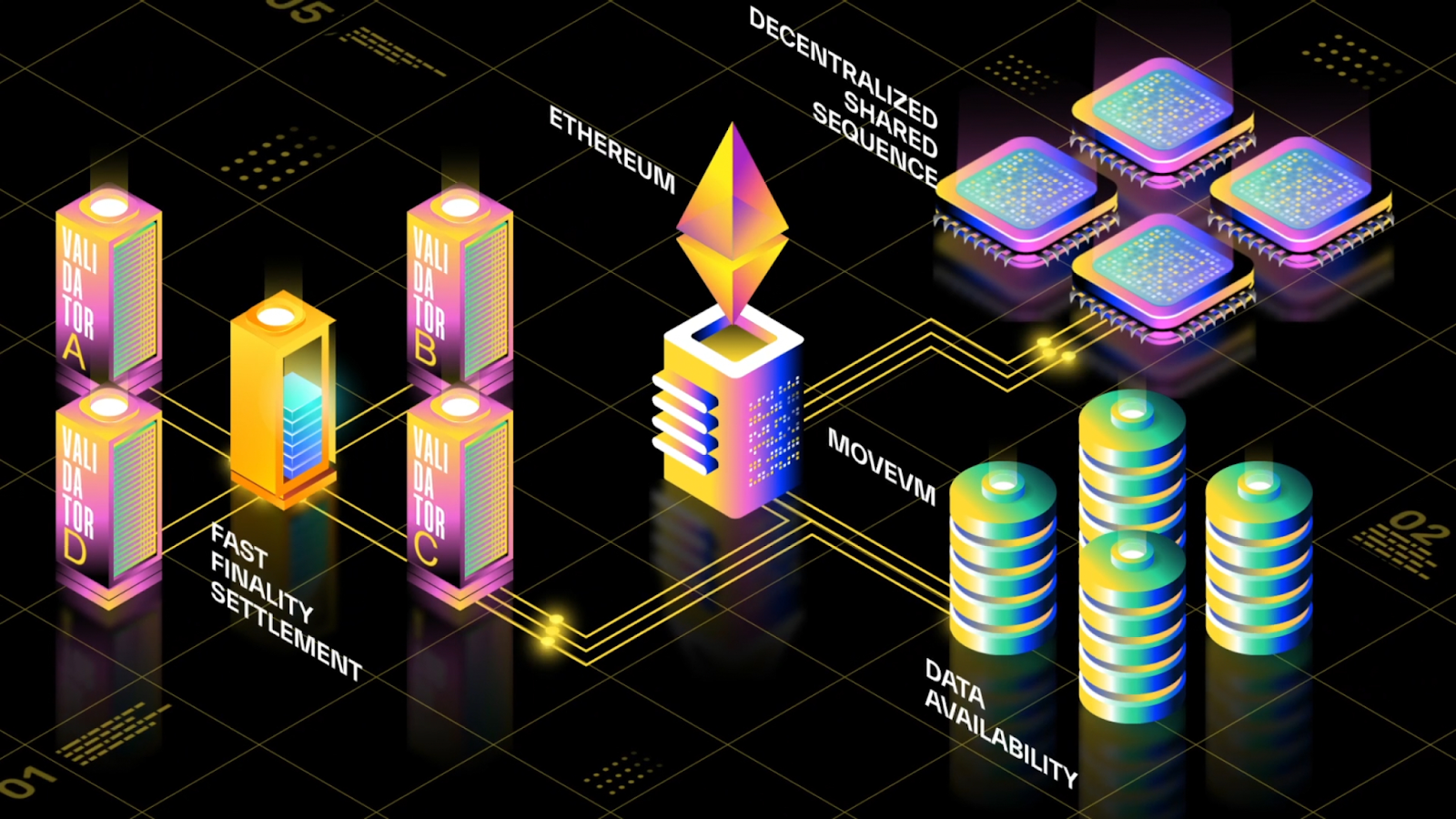

This shift isn’t just about convenience, it’s about unlocking on-chain dollar access. By converting government debt into ERC-20 tokens (the gold standard for digital assets on Ethereum), investors get seamless entry to dollar-denominated products without legacy banking friction. The ability to trade or use these assets in DeFi protocols at any time means liquidity never sleeps.

The Mechanics: How Tokenization Works

The process starts with regulated issuers acquiring U. S. Treasury bills or notes, then creating digital representations (tokens) on a blockchain network like Ethereum. Each token is backed 1: 1 by real-world securities held with custodians or trust banks, ensuring transparency and safety. This isn’t just theory; it’s already powering over $7.45 billion in tokenized U. S. securities on-chain as of September 2025, with Ethereum hosting about 70% of that activity (source).

What makes this revolutionary for fixed-income investing?

Top Benefits of Tokenized US Treasuries for Global Investors

-

24/7 Global Market Access: Tokenized US Treasuries allow investors to buy, sell, and transfer assets at any time, eliminating the restrictions of traditional market hours. This means uninterrupted access to dollar-denominated assets for users worldwide.

-

On-Chain Yield Distribution: Investors earn yield directly on-chain, with interest payments automatically distributed through mechanisms like rebasing. This provides transparent, real-time income without intermediaries.

-

Enhanced Liquidity & Fractional Ownership: Blockchain-based tokenization enables instant settlement and fractional ownership, lowering entry barriers and making it easier for smaller investors to participate in the US Treasury market.

-

Direct Integration with DeFi: Tokenized Treasuries can be used as collateral or integrated into decentralized finance protocols, expanding their utility and enabling new investment strategies within the DeFi ecosystem.

-

Lower Transaction Costs & Faster Settlement: Blockchain technology reduces reliance on intermediaries, expediting transactions and lowering associated costs compared to traditional finance infrastructure.

-

Regulatory Compliance and Transparency: Leading platforms like OpenEden and Ondo Finance issue tokenized Treasuries with robust KYC/AML processes and clear regulatory oversight, ensuring investor protection and transparency.

First off, instant settlement eliminates days-long clearing cycles, ownership changes hands in seconds rather than days. Second, fractionalization allows anyone to buy a sliver of a Treasury bond, lowering minimum investment thresholds dramatically and democratizing access.

On-Chain Yield: Transparent Returns Without Middlemen

Yield-bearing stablecoins are taking center stage in DeFi fixed-income products. With tokenized treasuries like USDY or OpenEden’s TBILL tokens (source), interest payments are distributed directly on-chain through mechanisms such as rebasing, meaning your wallet balance grows automatically as yield accrues.

This direct yield distribution is not only more efficient but also highly transparent; every transaction is visible on the blockchain ledger and auditable in real time by anyone with an internet connection.

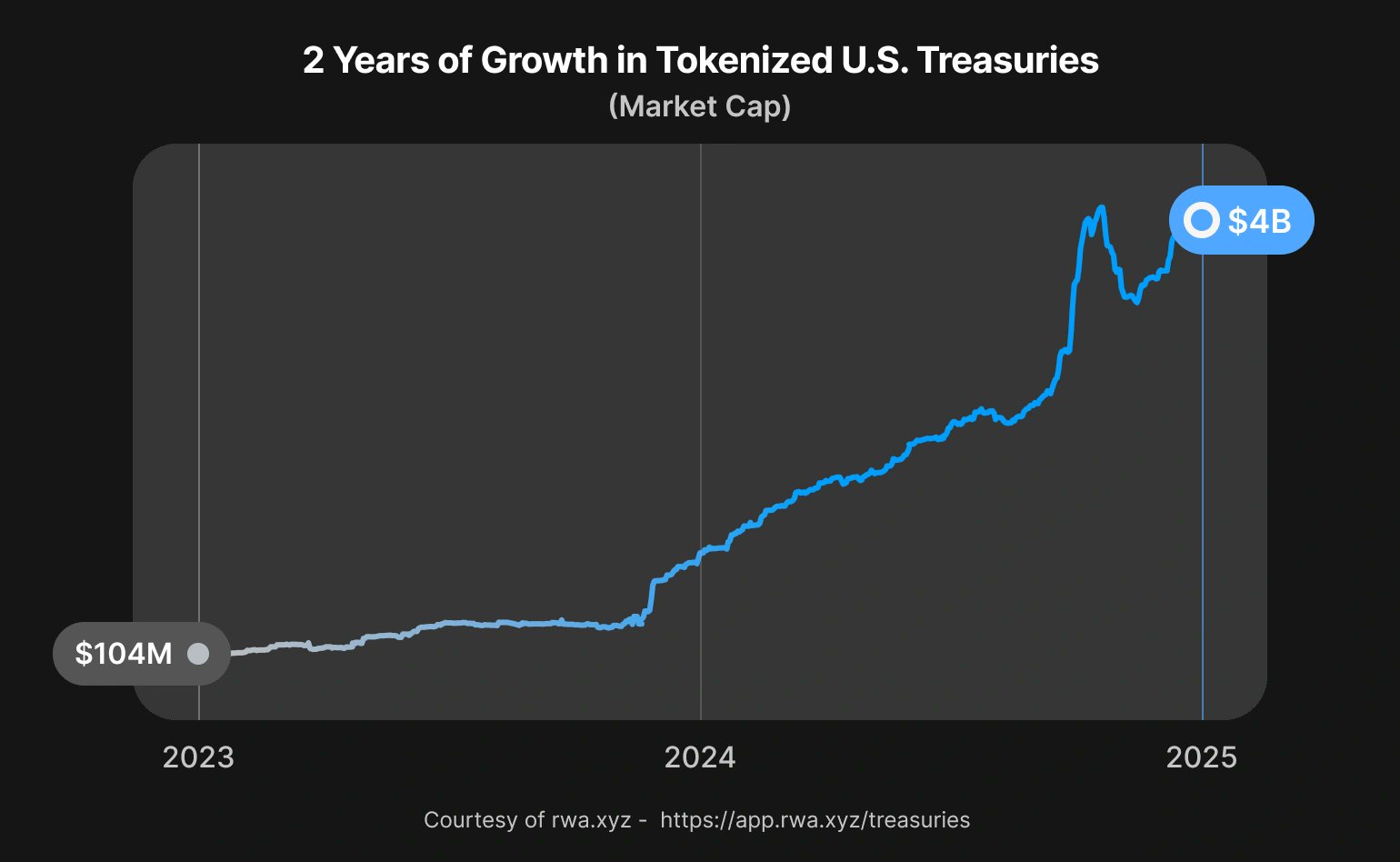

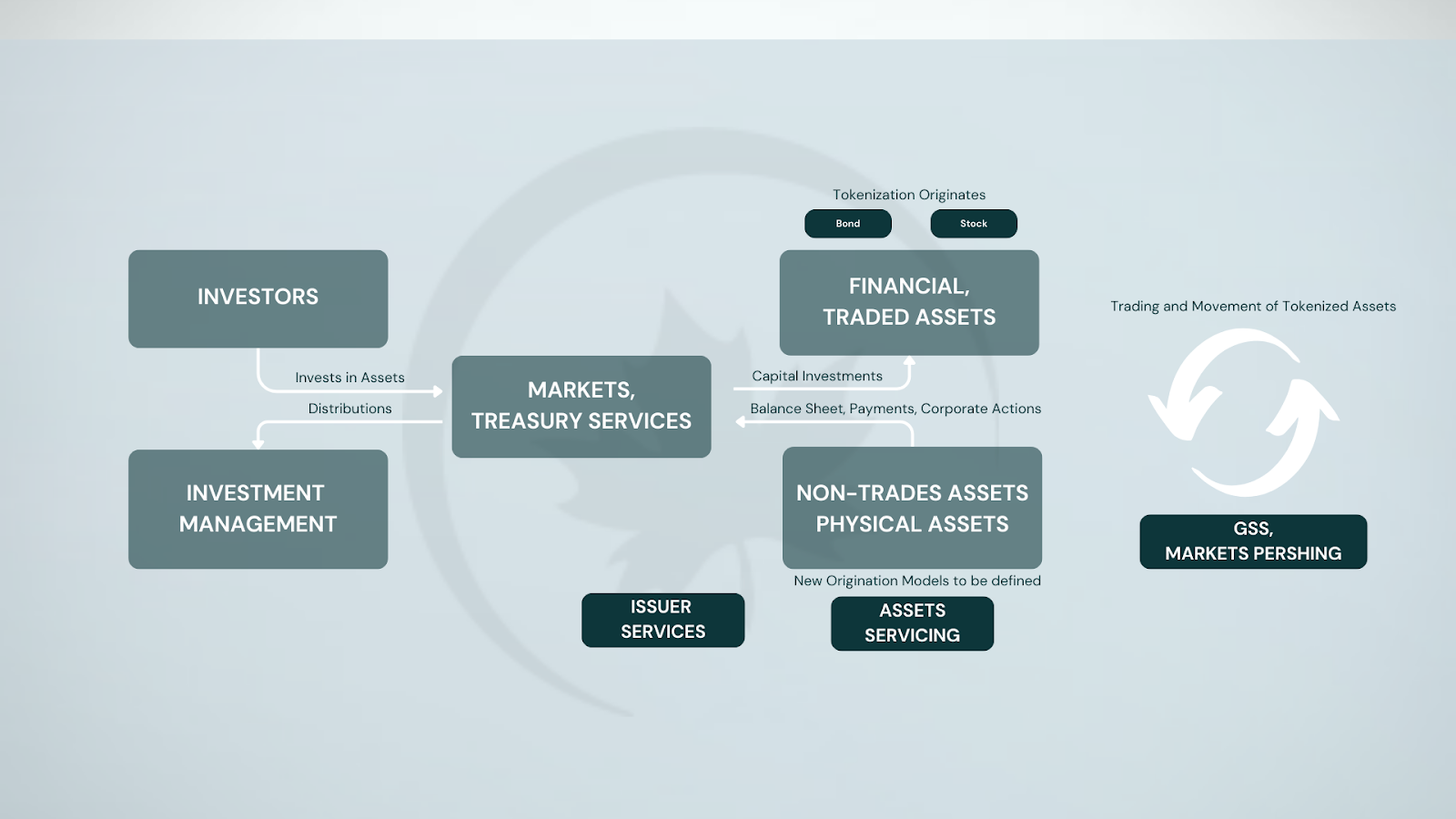

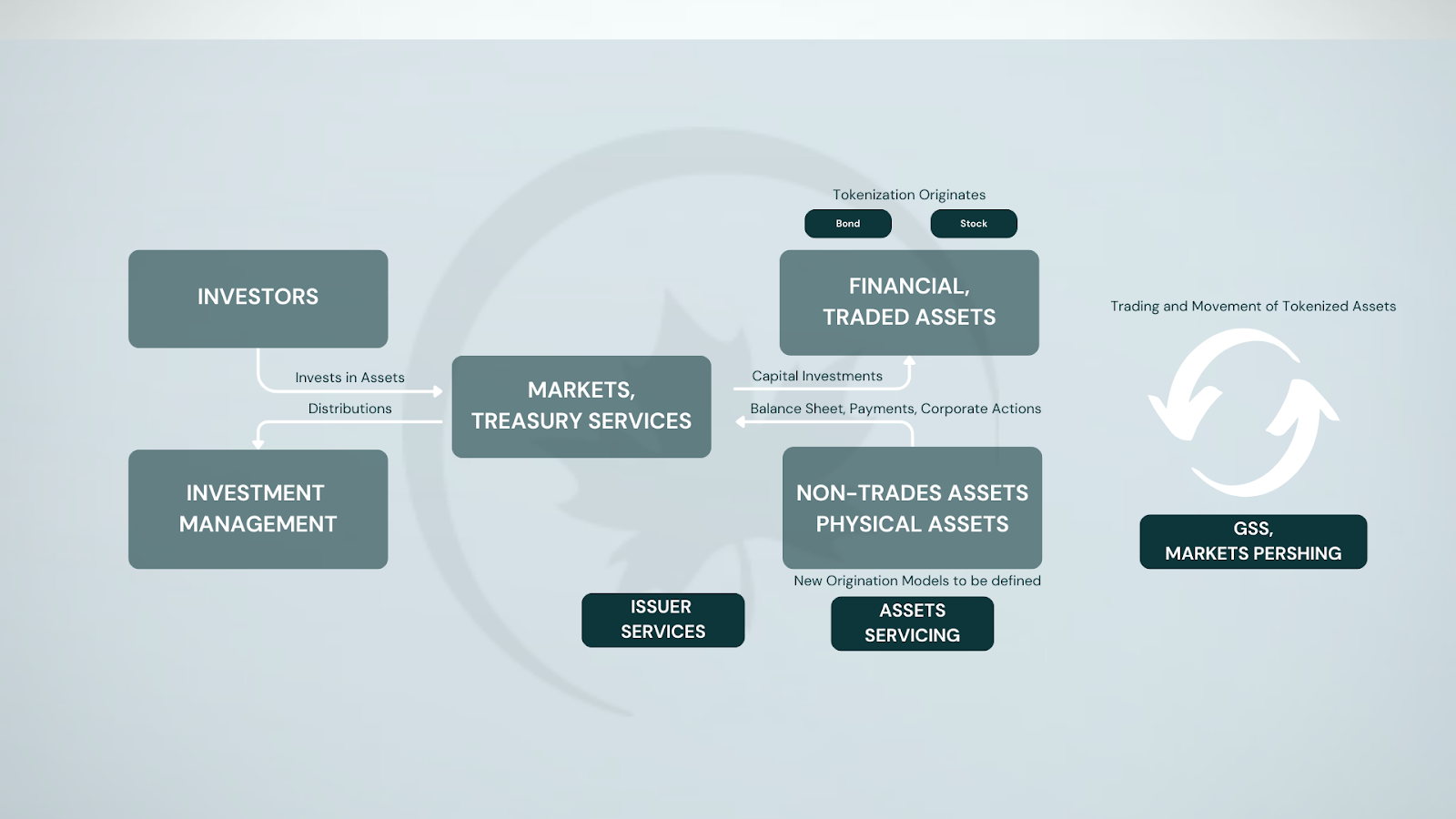

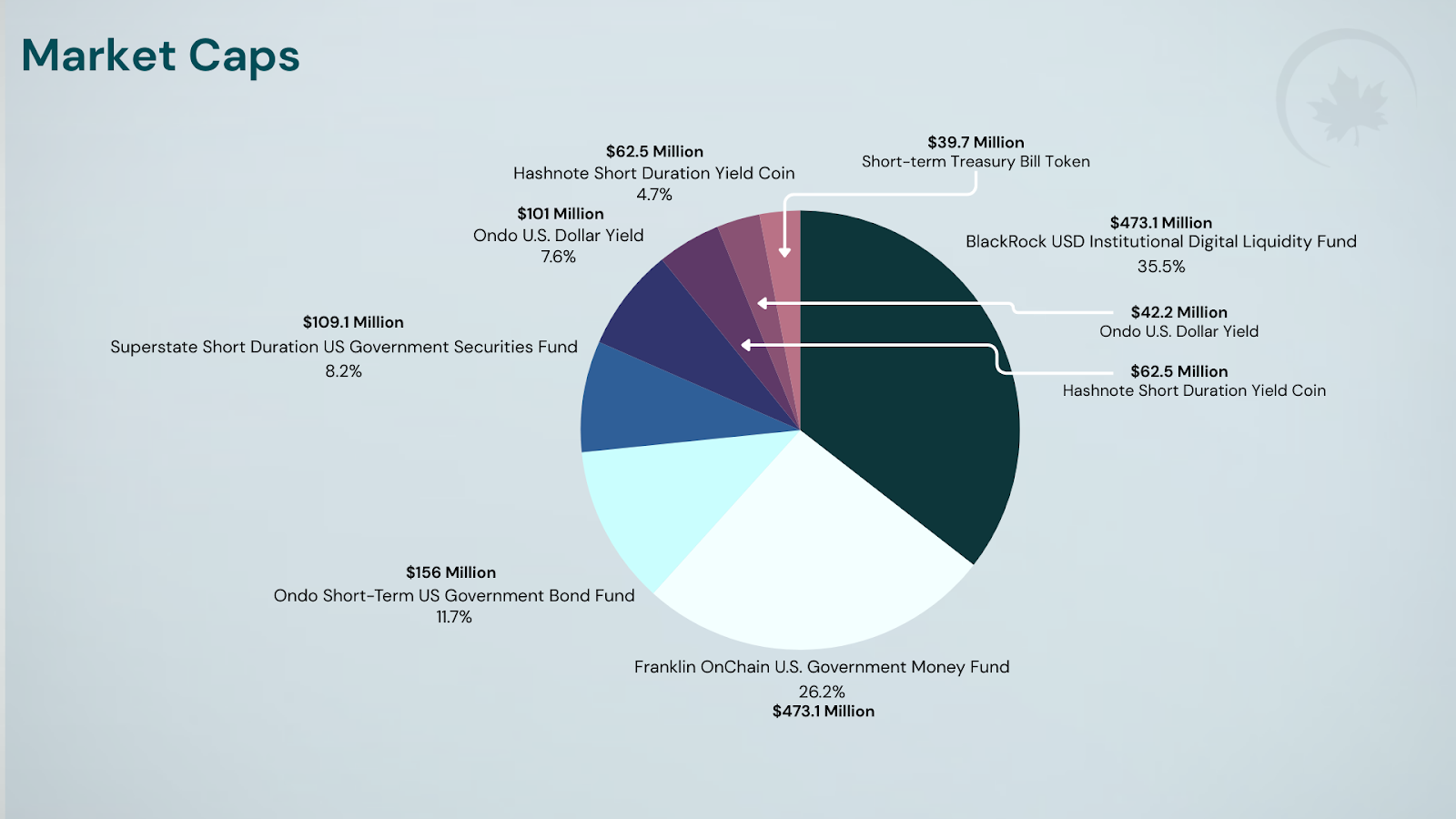

The Rise of RWA Sector TVL and Institutional Adoption

The rapid growth in total value locked (TVL) within the real-world asset (RWA) sector, especially through tokenized treasuries, signals that institutional players are paying attention, and acting fast (source). From OUSG savings rails to new DeFi integrations, these products are becoming core building blocks for diversified portfolios seeking both security and liquidity.

But the story doesn’t end with access and efficiency. The rise of tokenized US Treasuries is actively transforming how both retail and institutional investors manage risk and seek returns in a volatile global landscape. With over $7.45 billion now circulating on-chain, the RWA sector’s TVL is proving that digital rails can rival, and in some ways outperform, traditional finance infrastructure.

For institutions, tokenized Treasuries offer a compliant, transparent way to park cash or collateralize loans with real-world backing. For crypto-native investors, these tokens unlock a bridge between stable, yield-bearing assets and the fast-moving world of DeFi. The result is a new class of fixed-income products that are programmable, composable, and globally accessible, qualities that simply weren’t possible with legacy bonds.

Navigating Compliance and Global Participation

Of course, innovation doesn’t mean ignoring regulation. Modern platforms like OpenEden or Ondo Finance have prioritized robust KYC/AML processes to ensure their treasury tokens DeFi offerings remain above board (source). Many issuers work with regulated custodians and operate under international fund frameworks, such as those overseen by the British Virgin Islands Financial Services Commission, to provide confidence for both users and regulators.

This compliance-first mindset is critical as adoption spreads beyond crypto enthusiasts to banks, fintechs, and global asset managers. By making U. S. government debt programmable and globally accessible while respecting regulatory boundaries, tokenization paves the way for sustainable growth in on-chain dollar markets.

What’s Next? The Road Ahead for Tokenized Treasuries

The momentum behind tokenized US treasuries isn’t slowing down anytime soon. As more DeFi protocols integrate these assets as collateral or savings products, and as traditional players recognize the operational advantages, the ecosystem will only get deeper and more liquid.

Expect to see:

Key Trends Shaping Tokenized US Treasuries

-

Rapid Market Growth & Institutional Adoption: The tokenized US Treasuries market has surpassed $7.45 billion in on-chain assets as of September 2025, with major institutions increasingly integrating these products into their portfolios. Platforms like Ondo Finance and OpenEden are leading this expansion.

-

24/7 Global Accessibility: Blockchain-based Treasuries allow investors worldwide to access and trade US government debt around the clock, breaking free from traditional market hours. This trend is driven by ERC-20 tokenization and platforms like Ondo Finance’s USDY and OpenEden’s TBILL.

-

On-Chain Yield Distribution: Investors now receive real-time, on-chain yield through mechanisms like rebasing, where token balances automatically adjust to reflect accrued interest. This ensures transparent and efficient yield payments.

-

Fractional Ownership & Enhanced Liquidity: Tokenization enables fractional investment in US Treasuries, lowering minimums and making these assets accessible to a broader range of investors. Instant settlement and secondary market trading further boost liquidity.

-

DeFi Integration & Collateralization: Tokenized Treasuries are increasingly used as collateral in DeFi protocols, unlocking new yield strategies and lending opportunities while maintaining exposure to low-risk government debt.

-

Emphasis on Regulatory Compliance: Leading issuers like OpenEden and Ondo Finance are prioritizing KYC/AML compliance and operating under regulated jurisdictions (e.g., British Virgin Islands FSC), setting industry standards for safety and legitimacy.

The endgame? A world where anyone can tap into U. S. -grade safety and yield instantly from their phone or wallet app, no matter where they live or what time it is. This democratization of access could fundamentally reshape global finance by making dollar-denominated savings truly borderless.

The bottom line: Tokenized treasuries are already proving their worth as 24/7 gateways to on-chain yield, blending the best of TradFi security with blockchain agility. For investors seeking reliable returns without sacrificing flexibility or transparency, this new breed of digital asset might just be the smartest play in fixed income today.