How Tokenized T-Bills are Revolutionizing Institutional Fixed-Income Portfolios

Tokenized T-Bills are rapidly emerging as a game-changer for institutional fixed-income portfolios. By leveraging blockchain infrastructure, these digital treasury bills enable institutions to access, trade, and manage U. S. government debt instruments in ways that were previously impossible in traditional markets. The explosion of interest in tokenized assets for institutions is not just a passing trend, it’s a structural shift in how global capital allocators approach liquidity, transparency, and operational efficiency.

Why Institutions Are Turning to Tokenized T-Bills

Traditional T-Bills have long been the bedrock of institutional fixed-income strategies due to their low-risk profile and reliable returns. However, the legacy infrastructure underpinning these securities is riddled with friction, trading is limited to market hours, settlement can take days, and minimum investment thresholds often exclude smaller participants. Tokenization solves these pain points by converting T-Bills into blockchain-based tokens, making them instantly tradable and divisible. This opens the door for more responsive investment strategies and broader participation, as evidenced by the rapid growth in assets under management for products like BlackRock’s BUIDL fund, which reached approximately $2.9 billion by mid-2025.

Enhanced Liquidity and 24/7 Market Access

One of the most compelling benefits of tokenized T-Bills is continuous market access. Unlike traditional bond markets, which close on weekends and holidays, blockchain treasuries can be traded around the clock. Settlement is near-instantaneous, often occurring within minutes or seconds rather than days. This feature is particularly valuable for institutional investors managing global portfolios who need to rebalance positions or respond to macro events outside of standard trading hours. The ability to fractionalize ownership further enhances liquidity by lowering entry barriers and enabling more granular portfolio construction.

Key Benefits of Tokenized T-Bills for Institutions

-

Enhanced Liquidity and 24/7 Market Access: Tokenized T-Bills can be traded around the clock on blockchain platforms, providing institutional investors with continuous liquidity and immediate settlement—unlike traditional T-Bill markets limited by banking hours. Example: BlackRock’s BUIDL fund, live on Ethereum and other blockchains, reached $2.9 billion AUM by mid-2025.

-

Operational Efficiency and Cost Reduction: Blockchain-based issuance and settlement streamline processes, automate interest payments via smart contracts, and reduce administrative overhead. This leads to lower transaction costs and faster portfolio rebalancing. Example: Denote Capital’s tokenized high-yield ETFs offer 6-7% yields, outpacing traditional tokenized T-Bills at 4.1%.

-

Integration with Decentralized Finance (DeFi): Tokenized T-Bills can be used as collateral for lending, staking, and margin requirements on DeFi platforms, enabling new yield opportunities and portfolio strategies. Example: BlackRock’s BUIDL tokens are accepted as collateral on Crypto.com and Deribit.

-

Regulatory Compliance and Security: Institutional-grade tokenized T-Bills are issued under established regulatory frameworks, ensuring compliance and investor protection. Example: Realize T-BILLS Fund, regulated in Abu Dhabi Global Market, issues tokens backed by U.S. Treasury ETFs on IOTA and Ethereum.

Operational Efficiency and Yield Enhancement

Blockchain technology doesn’t just make T-Bills more accessible, it also streamlines back-office operations. Smart contracts automate interest payments and redemptions, reducing manual intervention and minimizing error risks. Platforms like Denote Capital now offer tokenized high-yield ETFs with yields of 6-7%, providing a notable 280-basis point advantage over traditional tokenized T-Bills yielding around 4.1%. This efficiency translates directly into higher net returns for institutions managing stablecoin reserves and other cash-equivalent holdings.

For a deeper dive into how tokenized T-Bills are transforming liquidity management and on-chain yield strategies, see our analysis at How Tokenized T-Bills Are Revolutionizing Institutional Liquidity Management.

Integration with DeFi and Collateral Use Cases

The integration of tokenized T-Bills into decentralized finance (DeFi) is unlocking new opportunities for portfolio optimization. Institutions can now use digital treasury bills as collateral on platforms like Crypto. com and Deribit, earning short-term Treasury yields while covering trading margin requirements or participating in lending protocols. This dual use, yield generation and collateralization, marks a significant evolution in crypto fixed income and expands the utility of tokenized bonds within the broader digital asset ecosystem.

Regulatory clarity is another major driver of institutional adoption. Recent developments, such as the launch of the Realize T-BILLS Fund in the Abu Dhabi Global Market, highlight how regulatory frameworks are adapting to support the growth of blockchain treasuries. By ensuring compliance with international standards and investor protections, these structures are giving institutions the confidence to allocate significant capital to digital treasury bills. Funds are now able to tokenize underlying U. S. Treasury-focused ETFs from established issuers like BlackRock and State Street, then issue compliant digital tokens tradable on networks such as Ethereum and IOTA. This regulatory momentum is crucial for mainstream adoption, especially as large asset managers and sovereign wealth funds explore tokenized assets for institutions.

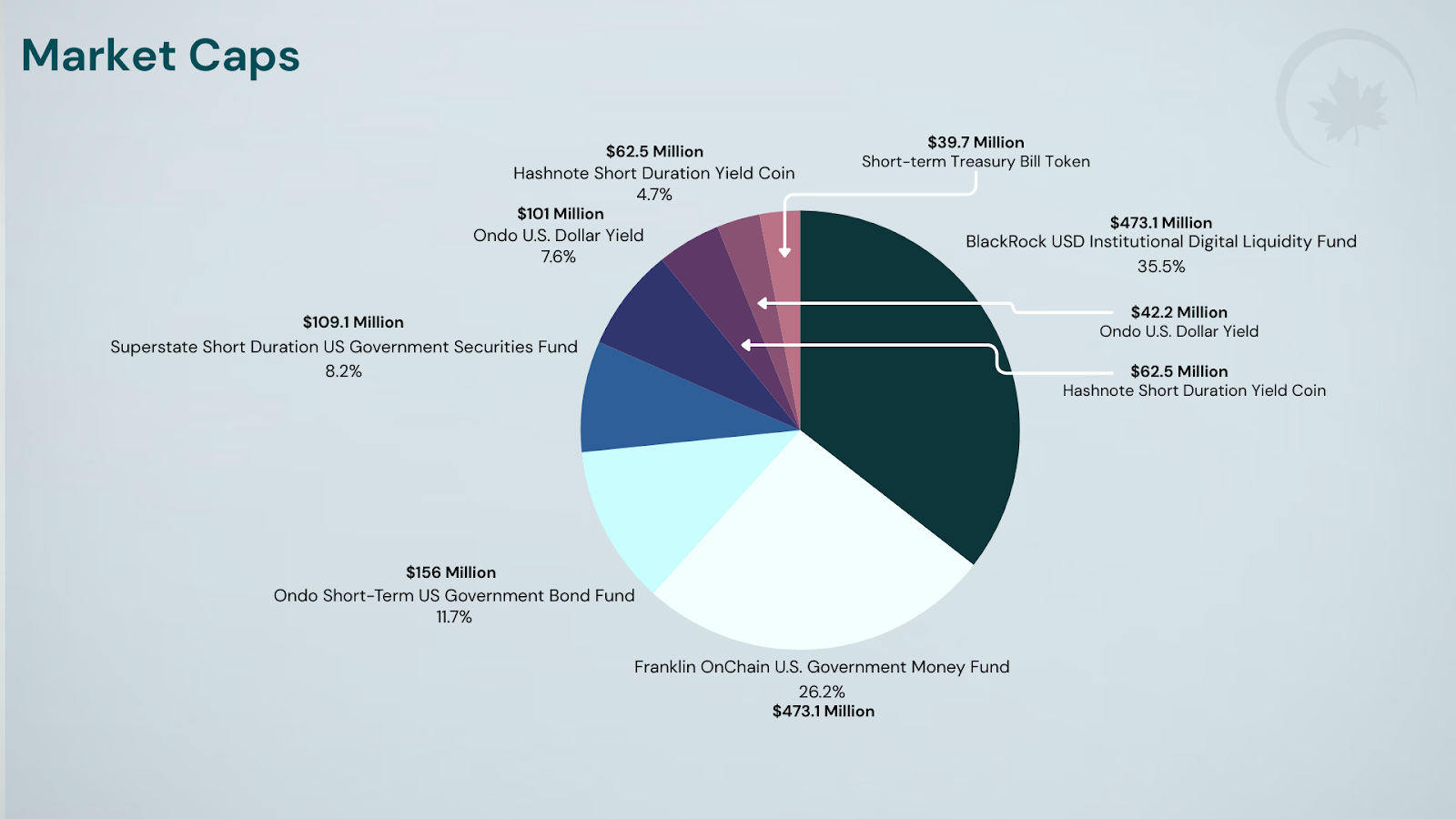

Scaling Up: Market Growth and Institutional Participation

The numbers underscore the seismic shift underway. As of 2025, the market for tokenized Treasuries has swelled to $7.4 billion in assets under management, according to recent data. This surge is fueled by both innovation and necessity: 76% of institutional investors surveyed by EY plan to invest in tokenized assets by 2026, citing diversification and operational efficiency as top priorities. The ability to trade, settle, and manage fixed-income products in a programmable, digital format is simply too compelling for forward-thinking institutions to ignore.

Market leaders are building on this momentum by expanding tokenized T-Bill offerings across multiple blockchains, including Ethereum, Arbitrum, Avalanche, and Polygon. This multi-chain approach not only improves accessibility but also provides redundancy and resilience, reducing single-point-of-failure risks. As a result, tokenized bonds and digital treasury bills are quickly becoming core components of institutional fixed-income portfolios, rather than niche experiments.

Major Platforms and Blockchains Supporting Tokenized T-Bills in 2025

-

BlackRock BUIDL Fund — Launched in March 2024, BlackRock’s BUIDL is a pioneering tokenized U.S. Treasury fund. It operates across multiple blockchains, including Ethereum, Aptos, Arbitrum, Avalanche, Optimism, and Polygon, and reached approximately $2.9 billion in assets under management by mid-2025. BUIDL is also accepted as collateral on platforms like Crypto.com and Deribit.

-

Ondo Finance — Ondo’s OUSG token represents tokenized U.S. Treasuries and is available on Ethereum. Ondo is recognized for its institutional-grade compliance and integration with DeFi protocols, making it a leading choice for on-chain fixed-income exposure.

-

Franklin Templeton’s Franklin OnChain U.S. Government Money Fund (FOBXX) — This SEC-registered fund issues tokenized shares on the Stellar and Polygon blockchains, allowing investors to access U.S. government money market funds in a digital format.

-

Realize T-BILLS Fund — Domiciled in the Abu Dhabi Global Market and approved by its regulatory authority, this fund tokenizes U.S. Treasury-focused ETFs from BlackRock and State Street. Its tokens are tradable on the IOTA and Ethereum networks, providing regulated, cross-border access to tokenized Treasuries.

-

Matrixdock — Matrixdock offers STBT (Short-Term Treasury Bill Token) on Ethereum, providing 24/7 access to tokenized U.S. Treasury bill yields for institutional and accredited investors. Matrixdock is known for its transparency and regular on-chain attestations.

-

OpenEden — OpenEden’s TBill Vault issues tokenized U.S. Treasury bills on Ethereum, enabling instant settlement and composability with DeFi protocols. It is widely used by institutions seeking on-chain fixed-income solutions.

What’s Next for Tokenized Fixed-Income?

The rapid adoption of tokenized T-Bills is just the beginning. As blockchain infrastructure matures and regulatory frameworks solidify, expect to see even more sophisticated products emerge, from tokenized money market funds to fully programmable fixed-income strategies. The convergence of traditional finance and DeFi will further blur the lines between on-chain and off-chain assets, unlocking new yield opportunities and risk management tools for global investors.

For asset managers, treasury teams, and crypto-native institutions alike, the message is clear: tokenized T-Bills are no longer a theoretical innovation, they are a practical solution reshaping the future of institutional fixed-income. Those who move early will be best positioned to capitalize on enhanced liquidity, operational efficiency, and the expanding universe of digital yield strategies.

Explore real-world case studies and adoption stories in our feature on how asset managers are deploying tokenized Treasuries.