How Tokenized Corporate Bonds Deliver Real Yield in DeFi: A Deep Dive into Bond Tokens

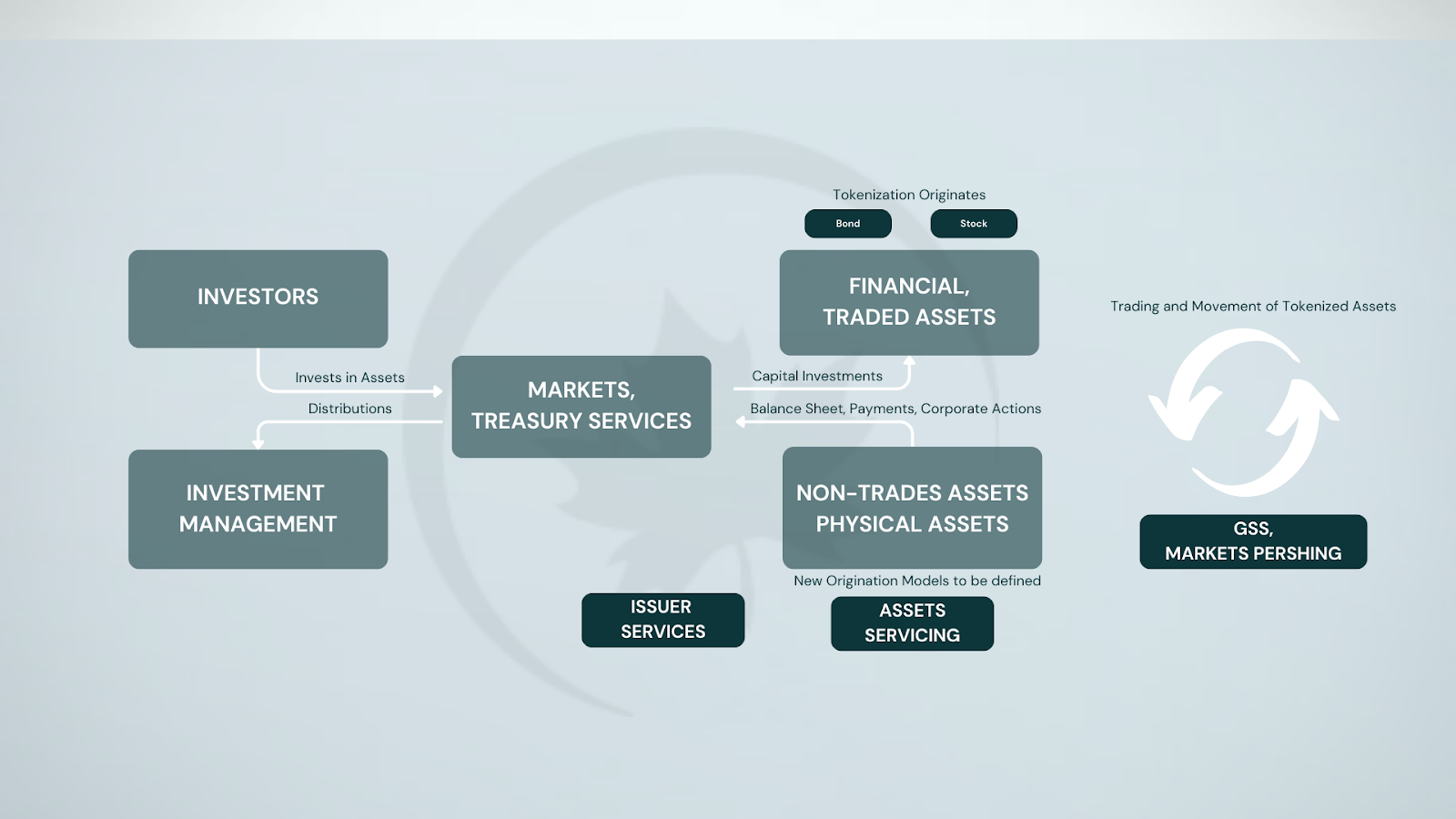

Tokenized corporate bonds are rapidly redefining yield generation in decentralized finance (DeFi), providing real-world fixed income exposure through blockchain-native instruments. By converting traditional corporate bonds into digital tokens, protocols like Bondi Finance and Ondo Finance are bridging institutional-grade assets with the composability and transparency of DeFi. This deep dive examines how bond tokens deliver genuine, regulated yield in crypto, the mechanics behind their integration, and the market’s evolving landscape.

How Tokenized Corporate Bonds Work in DeFi

Tokenization is the process of issuing digital tokens on a blockchain that represent ownership rights to a specific underlying asset, in this case, a corporate bond. Each bond token is backed 1: 1 by an actual security held in custody, ensuring that on-chain value is always collateralized by off-chain assets. This structure enables fractionalization: investors can purchase small denominations of high-value bonds, improving accessibility for retail and smaller institutional participants.

The technical implementation leverages smart contracts to automate coupon payments, record transactional history immutably, and facilitate peer-to-peer trading without intermediaries. Platforms such as Bondi Finance have focused on emerging market corporate debt, traditionally illiquid and difficult to access, while others like Ondo Finance use blue-chip funds managed by BlackRock or Pimco as underlying assets. The result: token holders receive fixed USD yields directly on-chain, with all inflows and outflows transparently auditable.

Mechanisms Delivering Real Yield: From Coupon to Crypto Wallet

The core appeal of tokenized fixed income lies in delivering real yield: a steady stream of interest payments denominated in stablecoins or fiat-pegged tokens. Here’s how it works:

- Interest Payments: Just as with traditional bonds, issuers pay periodic coupons (e. g. , quarterly or semiannual). Smart contracts automate distribution so that each bond token holder receives their pro-rata share directly to their crypto wallet.

- Lending and Borrowing: On platforms like Aave’s Horizon (launched August 2025), tokenized bonds can be used as collateral for stablecoin loans or lent out to earn additional interest. This creates layered yield opportunities beyond base coupons.

- Liquidity Provision: Investors can supply bond tokens into DeFi liquidity pools, earning a share of transaction fees, further enhancing overall returns compared with holding off-chain bonds.

This paradigm shift means that fixed USD yields once reserved for banks and large funds are now accessible in crypto-native formats, often at rates exceeding those found in legacy DeFi lending markets. For example, Ondo’s tokenized corporate bond products have consistently offered yields above 8%, directly distributed to stablecoin holders via smart contracts (see related strategies).

Market Leaders: Protocols Pushing Tokenized Bonds Mainstream

The competitive landscape is evolving quickly as protocols race to tokenize more types of real-world assets (RWAs) while meeting regulatory standards:

- Bondi Finance: Specializes in emerging market corporate bonds with full audits and compliance measures. Their protocol allows portfolio managers and DAOs to access diversified credit exposure previously unavailable on-chain.

- Ondo Finance: Pioneered on-chain funds invested in ETFs managed by BlackRock/Pimco, offering transparent fixed income products with yields exceeding 8% paid out via stablecoins.

- Aave Horizon: Enables institutions to borrow against regulated RWAs including tokenized corporate debt, bridging TradFi capital efficiency with DeFi’s composability.

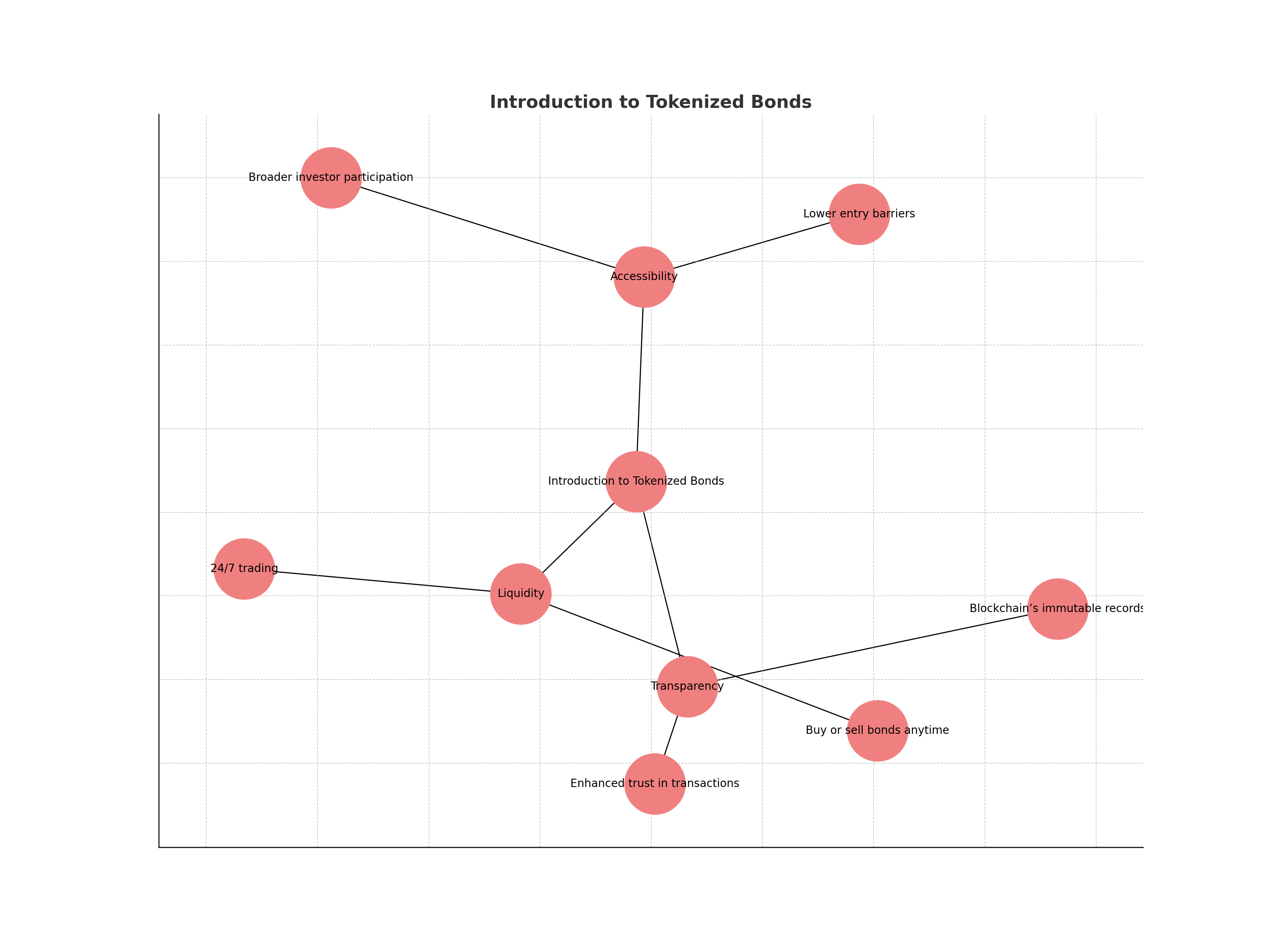

Key Advantages of Regulated DeFi Bonds Over Traditional Corporate Debt

-

Enhanced Accessibility: Tokenized corporate bonds on platforms like Bondi Finance and Ondo Finance lower entry barriers, enabling small-to-mid portfolio managers and individual investors to access emerging market corporate debt previously reserved for institutions.

-

Superior Liquidity: Unlike traditional bonds, tokenized versions can be traded 24/7 on secondary markets and DeFi protocols, offering investors immediate liquidity and exit options.

-

Transparent and Immutable Records: Blockchain-based issuance ensures all transactions and ownership records are transparent and tamper-proof, reducing settlement risk and enhancing auditability.

-

Real Yield Integration: Regulated DeFi bonds deliver direct, periodic interest payments to token holders and enable additional yield through DeFi strategies such as lending, borrowing, and liquidity provision, as seen with Ondo Finance and Aave’s Horizon.

-

Fractional Ownership: Tokenization allows corporate bonds to be divided into smaller units, making it possible for investors to purchase fractions of high-value bonds and diversify portfolios more efficiently.

-

Regulatory Compliance and Security: Leading platforms like Bondi Finance and Aave’s Horizon implement full audits, KYC/AML procedures, and smart contract security, ensuring investor protection and adherence to regulatory standards.

This new breed of digital securities is not only increasing liquidity for historically opaque markets but also enabling sophisticated strategies such as hedging with on-chain CDS markets and integrating real-time risk analytics, features previously unavailable outside institutional finance.

Despite these advancements, the transition to tokenized fixed income is not without friction. Regulatory clarity remains a moving target, especially as jurisdictions grapple with the classification of bond tokens as securities. Leading protocols have responded by instituting full KYC/AML procedures, independent audits, and transparent reporting, critical steps to attract institutional capital and ensure long-term viability. For example, Bondi Finance’s approach includes third-party custodianship and on-chain proof-of-reserves, providing investors with verifiable backing for every issued token.

Risk Management and Security: Safeguarding Tokenized Fixed Income

Security is paramount in this new asset class. Smart contract vulnerabilities have previously led to losses across DeFi, but regulated DeFi bonds are subject to rigorous code audits and often carry insurance or backstop mechanisms. Additionally, some platforms offer hedging tools such as on-chain credit default swaps (CDS), enabling users to manage credit risk dynamically, an innovation that brings traditional fixed income risk management into the programmable realm of DeFi.

- Custodial Transparency: Independent custodians hold underlying bonds off-chain, while on-chain data provides real-time verification.

- Programmable Compliance: Smart contracts enforce transfer restrictions and investor whitelisting to align with regulatory mandates.

- Risk Analytics: Platforms are integrating dashboards that model duration, credit exposure, and yield curves in real time for portfolio optimization.

This convergence of compliance and code is what differentiates regulated DeFi bonds from legacy crypto lending products. Investors gain access to fixed USD yield crypto instruments underpinned by real-world assets blockchain infrastructure, without sacrificing transparency or security.

Market Outlook: The Road Ahead for Tokenized Corporate Bonds

The market for tokenized corporate bonds is poised for exponential growth as more institutions seek yield diversification in a digital-first world. According to RWA. io, the global bond market exceeds $128 trillion; even modest adoption of tokenization could unlock trillions in on-chain liquidity. The ability to fractionalize high-value assets and provide instant settlement positions tokenized fixed income as a cornerstone of next-generation capital markets.

Protocols like Bondi Finance are already demonstrating product-market fit by onboarding DAOs, crypto treasuries, and small-to-mid portfolio managers previously excluded from traditional bond markets. As regulatory frameworks solidify and secondary markets deepen liquidity, expect further convergence between TradFi and DeFi yields, blurring the line between on-chain innovation and legacy financial products.

Binance Coin Technical Analysis Chart

Analysis by Ava Preston | Symbol: BINANCE:BNBUSDT | Interval: 1D | Drawings: 7

Technical Analysis Summary

Begin by marking the major uptrend from early August 2025 to the peak in early October 2025 with a trend_line. Draw a horizontal_line at $1124.67 to represent the current price. Use horizontal_lines to highlight key support at $1100 and resistance at $1200 and $1300. Identify the recent consolidation range from mid-October 2025 onwards with a rectangle spanning $1100 to $1150. Add arrows or callouts to emphasize the breakout above $1000 in September and the rejection near $1350 in October. For MACD and volume, add callouts below the chart to note potential bullish momentum resuming if volume increases and MACD flips positive.

Risk Assessment: medium

Analysis: Price is consolidating after a significant rally and correction, with clear defined support and resistance. Volatility has reduced, but the next major move will likely be directional.

Ava Preston’s Recommendation: Wait for a confirmed breakout above $1150 for bullish continuation, or use tight stops if entering within the current range. Maintain position sizing discipline and monitor for volume/MACD confirmation.

Key Support & Resistance Levels

📈 Support Levels:

-

$1,100 – Round number support and recent consolidation floor.

moderate -

$1,050 – Retracement low in mid-October 2025.

strong

📉 Resistance Levels:

-

$1,150 – Current consolidation ceiling; needs to be broken for bullish continuation.

moderate -

$1,200 – Previous support and resistance flip zone.

moderate -

$1,300 – Major rejection and local top from early October 2025.

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$1,110 – Potential long entry on support retest within consolidation range.

medium risk -

$1,160 – Breakout entry above consolidation and recent highs.

medium risk

🚪 Exit Zones:

-

$1,200 – Profit target for range breakout to next resistance.

💰 profit target -

$1,050 – Stop-loss below major support and recent swing low.

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Volume has likely decreased during the current consolidation, typical after a sharp rally and correction.

Watch for a volume spike to confirm breakout or breakdown from the consolidation zone.

📈 MACD Analysis:

Signal: Neutral to slightly bullish if MACD flattens or crosses up on next impulse.

MACD is likely resetting after the rally; a bullish crossover would support a new leg higher.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Ava Preston is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

For investors seeking resilient yield strategies amid volatile crypto cycles, regulated DeFi bonds offer a compelling alternative: real-world returns delivered through programmable finance rails. To understand how these strategies compare with other digital securities such as tokenized Treasuries or explore nuanced risk-return profiles across asset classes, see our detailed analysis at Comparing Tokenized Bonds vs Traditional Bonds: Risks, Returns and Accessibility.