How Tokenized U.S. Treasuries Became a Safe Haven for Institutional Crypto Investors

Amid the volatility of digital assets, institutional crypto investors have increasingly turned to tokenized U. S. Treasuries as a reliable safe haven. These blockchain-based representations of government debt blend the stability of traditional fixed income with the programmability and efficiency of digital assets, providing a compelling alternative to both stablecoins and legacy cash management solutions. The result: a market that has exploded past $7.3 billion in tokenized Treasury value by 2025, reflecting a profound shift in institutional risk management and on-chain liquidity strategies.

Why Tokenized Treasuries Appeal to Institutions

Traditional U. S. Treasuries have long been considered the bedrock of global finance, prized for their creditworthiness and deep liquidity. By tokenizing these assets, platforms are unlocking new efficiencies and access for institutional players. Tokenized Treasuries allow for 24/7 trading, instant settlement, and seamless integration with DeFi protocols, features that are largely absent from legacy financial rails.

Key advantages include:

Top 3 Reasons Institutions Choose Tokenized U.S. Treasuries

-

1. Enhanced Liquidity and 24/7 Market Access: Tokenized U.S. Treasuries can be traded around the clock on blockchain networks, enabling institutional investors to access and rebalance positions at any time—unlike traditional markets with limited trading hours. This continuous liquidity is a significant advantage for treasury management and risk mitigation.

-

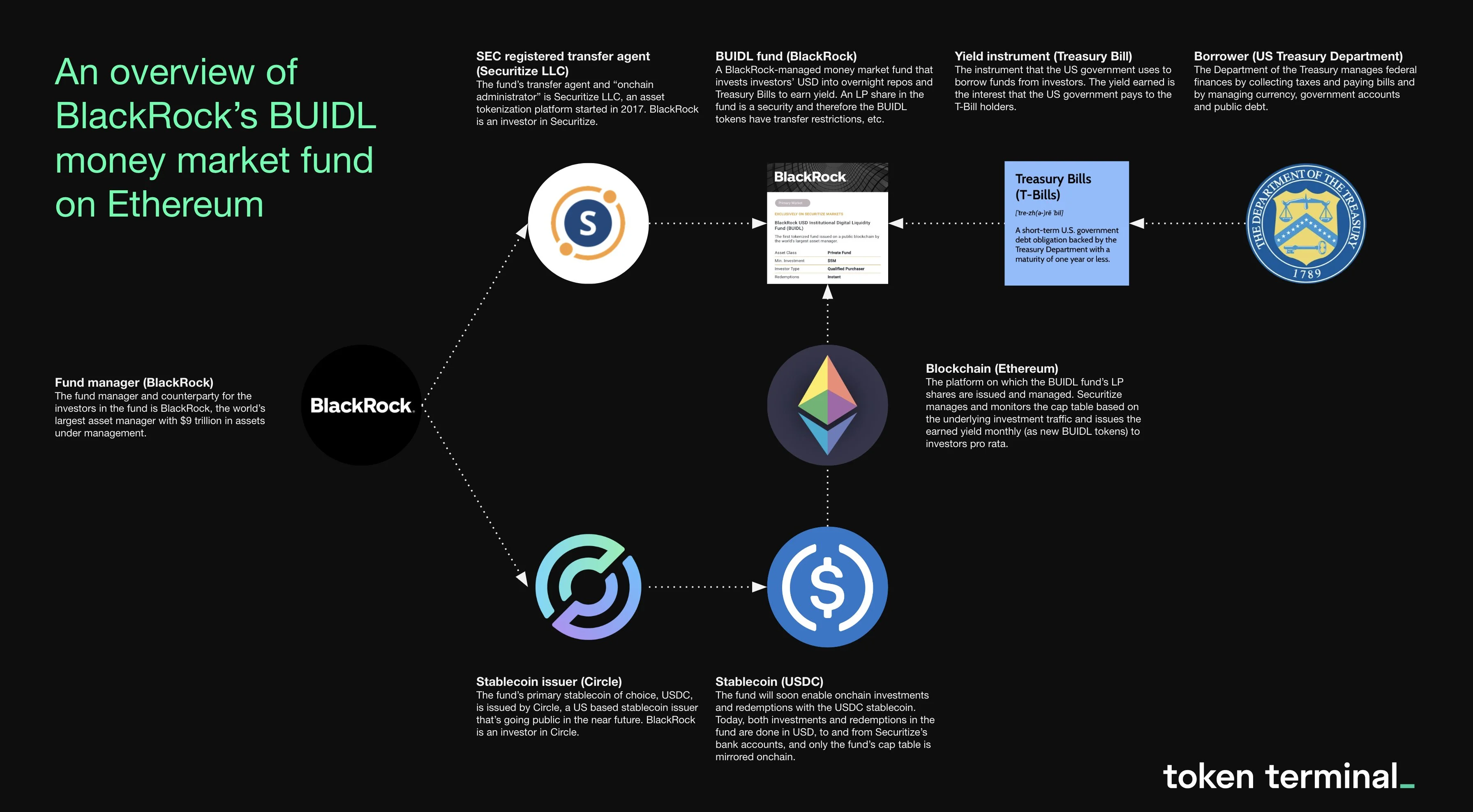

2. Stable, Yield-Generating Exposure Backed by U.S. Government: By investing in tokenized versions of U.S. Treasuries, institutions gain exposure to one of the world’s most trusted, low-risk assets while earning yield. Leading products like BlackRock’s BUIDL Fund (over $2.2 billion in assets), Fidelity’s Digital Interest Token (FDIT), and Ondo Finance’s OUSG (nearly $1 billion TVL) demonstrate robust adoption and confidence in these digital instruments.

-

3. Operational Efficiency and Fractional Ownership: Blockchain technology streamlines settlement and record-keeping, reducing transaction costs and delays. Tokenization also allows for fractional ownership, enabling institutions to allocate capital more flexibly and lower the barrier to entry for diversified treasury exposure.

This combination of yield, transparency, and accessibility positions tokenized Treasuries as an optimal solution for institutions seeking to park capital in low-volatility, yield-bearing instruments while remaining fully immersed in the digital asset ecosystem.

Market Growth: $7.3 Billion and Rising

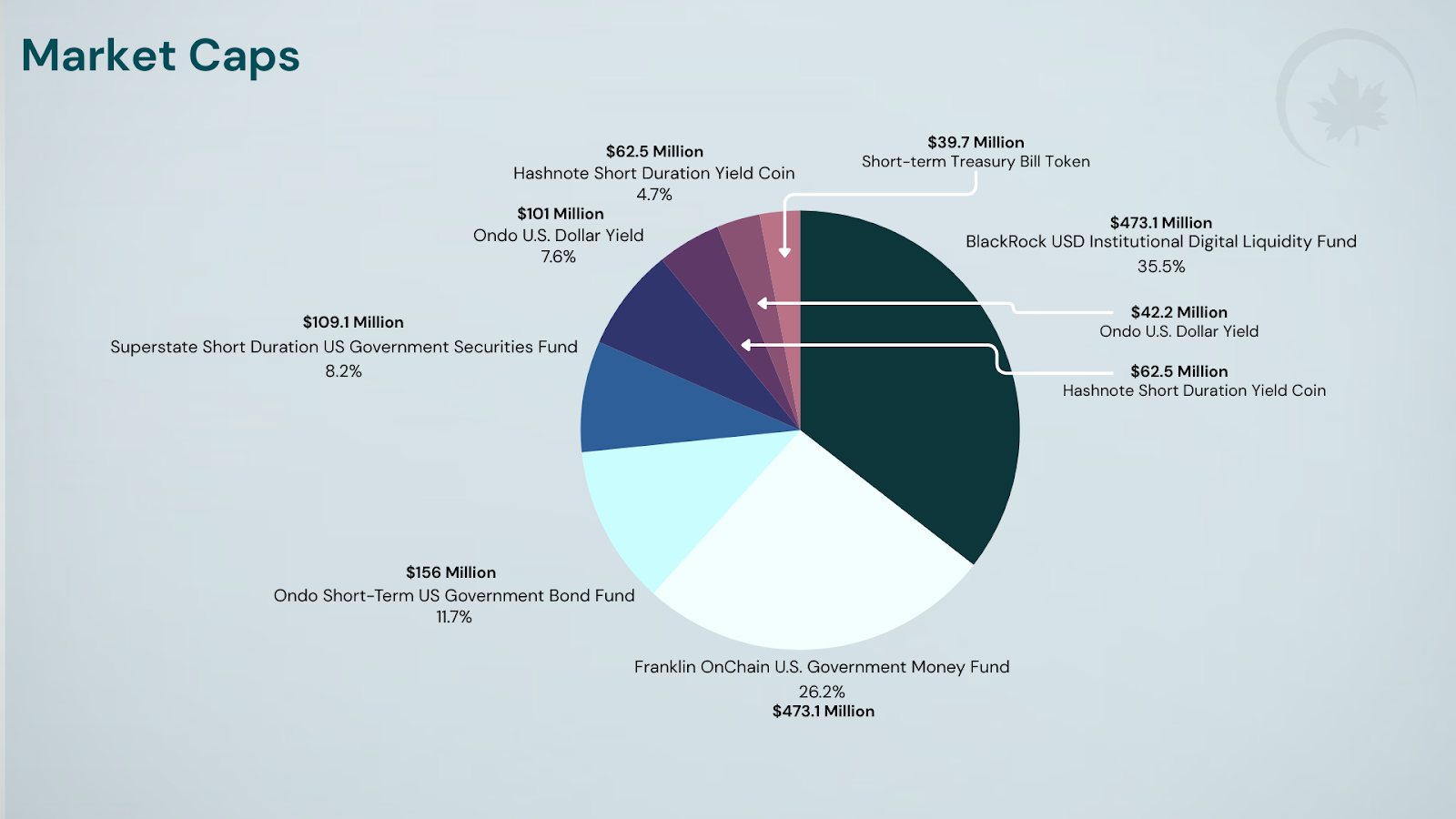

The growth trajectory of the tokenized Treasury market is striking. As of October 2025, total value locked (TVL) in these products stands at approximately $7.3 billion. This surge is driven by major institutional inflows, regulatory clarity, and the proliferation of new product offerings from both crypto-native and legacy financial giants.

Some leading examples:

- BlackRock’s BUIDL Fund: Since its March 2024 launch, BUIDL has gathered over $2.2 billion in assets by offering tokenized exposure to U. S. Treasury bills and cash equivalents.

- Fidelity’s Digital Interest Token (FDIT): Introduced in August 2025, FDIT delivers Ethereum-based access to Treasury yields, further bridging TradFi and DeFi.

- Ondo Finance’s OUSG: With nearly $1 billion in TVL, OUSG provides round-the-clock institutional access to Treasury-backed yield streams.

This robust adoption is not limited to crypto-native platforms; traditional custodians like Citigroup and State Street are actively piloting custody and payment services for these blockchain-based securities, signaling a new era of institutional-grade digital asset infrastructure.

Regulatory Developments and Risk Considerations

The rapid ascent of tokenized Treasuries has prompted both opportunity and scrutiny from regulators. The U. S. Securities and Exchange Commission (SEC) has clarified that these instruments fall under federal securities laws, ensuring that investor protections remain intact as the market evolves. This clarity has emboldened institutions to allocate larger sums to treasury-backed tokens, confident that regulatory frameworks are keeping pace with innovation.

However, challenges persist:

- Regulatory Compliance: Navigating jurisdictional requirements is complex as products scale globally.

- Security Risks: Smart contract vulnerabilities and platform risks demand rigorous due diligence.

- Market Maturity: As a nascent market, tokenized Treasuries must continue to build trust through transparency and robust infrastructure.

For a deeper dive into how these risks are managed in practice, explore our analysis of digital safe haven strategies for institutional investors.

As institutional crypto investors weigh these considerations, the value proposition of tokenized U. S. Treasuries is becoming increasingly clear. The ability to hold government-backed assets on-chain, with transparent real-time auditing and programmable compliance, is a paradigm shift in fixed income risk management. For many funds, these products now serve as the foundation for on-chain liquidity reserves, margin collateral, and treasury management, offering a stability anchor in an otherwise volatile digital landscape.

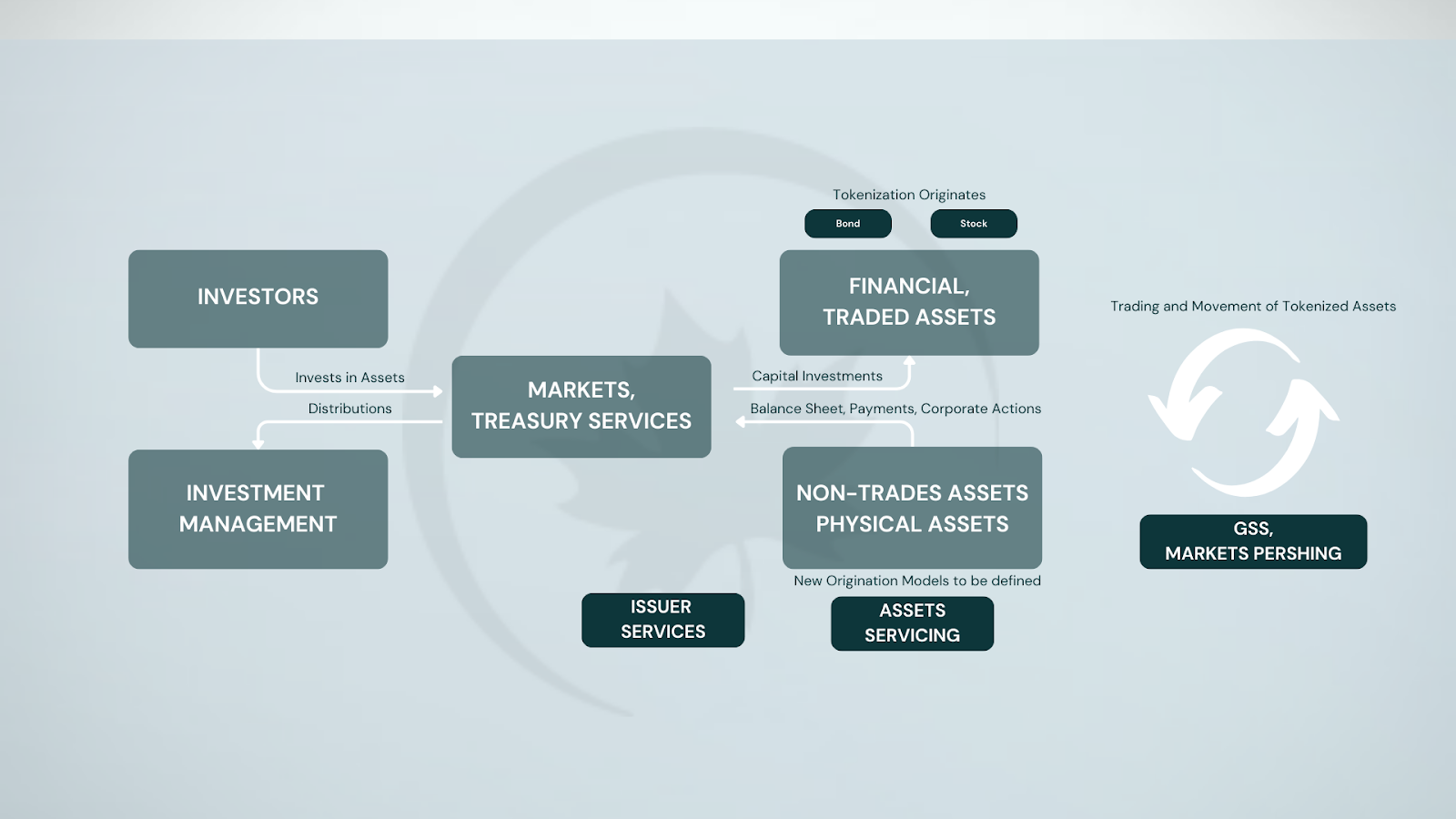

Integration with DeFi and Next-Generation Yield Strategies

The integration of tokenized Treasuries into decentralized finance (DeFi) has unlocked entirely new yield strategies for sophisticated investors. By leveraging treasury-backed tokens as collateral or liquidity in DeFi protocols, institutions can access leveraged products, structured notes, or automated rebalancing, all while maintaining exposure to the safest assets in the market. This seamless blend of traditional and digital finance is rapidly becoming a cornerstone of modern portfolio construction.

Platforms like Ondo Finance and Fidelity are leading this charge, providing institutional-grade interfaces and robust risk controls. These innovations are enabling asset managers to deploy capital more efficiently, capture incremental yield, and manage duration risk dynamically, without ever leaving the blockchain ecosystem. For a closer look at how these products are transforming fixed-income portfolios, see our guide on portfolio innovation with tokenized Treasury bills.

Key Ways Institutions Use Tokenized Treasuries in DeFi

-

Providing On-Chain Collateral for Stablecoins and Lending Protocols: Institutions use tokenized U.S. Treasuries as highly liquid, low-risk collateral in decentralized finance (DeFi) protocols, enhancing the stability and transparency of stablecoins and lending platforms.

-

Accessing 24/7 Yield Through Tokenized Treasury Funds: Products like BlackRock’s BUIDL Fund and Ondo Finance’s OUSG allow institutions to earn U.S. Treasury-backed yields around the clock, leveraging blockchain’s continuous market access.

-

Facilitating Instant Settlement and Liquidity Management: By integrating tokenized Treasuries, institutions can settle trades instantly and manage liquidity more efficiently, reducing operational costs and counterparty risks compared to traditional settlement cycles.

-

Enabling Fractional Ownership and Diversification: Tokenization allows institutions to purchase fractional shares of U.S. Treasuries, making it easier to diversify portfolios and optimize capital allocation within DeFi strategies.

-

Integrating with Regulated Digital Asset Platforms: Major custodians like State Street and Citigroup are developing services for tokenized Treasuries, allowing institutions to securely hold, trade, and use these assets within compliant digital ecosystems.

What’s Next for Tokenized Treasury Markets?

With $7.3 billion in value already secured on-chain, the momentum behind the tokenized bond market shows little sign of slowing. As regulatory frameworks continue to evolve and interoperability standards improve, expect to see even greater participation from global asset managers, banks, and sovereign wealth funds. The next phase will likely include broader cross-border settlement capabilities, real-time reporting tools, and expanded product suites that extend beyond U. S. Treasuries to other sovereign and corporate bonds.

Ultimately, the rise of blockchain safe haven assets like tokenized U. S. Treasuries signals a fundamental reimagining of how risk, yield, and liquidity are managed in the digital age. For institutions seeking to future-proof their treasury operations, these instruments offer a compelling bridge between the security of government debt and the flexibility of programmable finance.

For ongoing insights into regulatory trends, market adoption, and technical innovation in this space, explore our coverage on tokenized Treasuries on Ethereum.